Traders love their long-term positive aspects, however short-term traders cannot stand volatility. And that very concern on the a part of shorter-term-minded traders, significantly individuals nearing retirement, can doubtlessly provide large alternatives for traders with a long-term mindset.

The most effective-performing sector out there over the previous 10 years presents such a chance. Whereas many traders usually keep away from this sector on account of its excessive booms and busts, over the long run, it has truly offered superior long-term positive aspects.

Do not let the fearmongers and naysayers preserve you out. The sector stays a long-term winner.

Throw your chips in with the chips

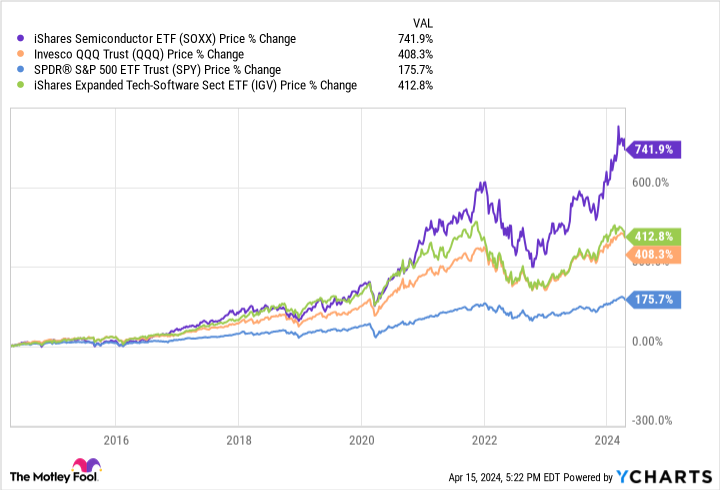

The sector in query is the semiconductor sector. Wanting on the efficiency of 1 low-cost exchange-traded fund (ETF) monitoring the chip sector, the iShares Semiconductor ETF (NASDAQ: SOXX), one can plainly see how chip shares, in combination, have crushed the broader market, even outperforming the final know-how and software program sectors over the previous 10 years.

The broader S&P 500 has appreciated 176% over the previous decade, giving long-term shareholders a pleasant return effectively above the speed of inflation. In fact, with sturdy improvements in cloud computing, e-commerce, smartphone functions, and now synthetic intelligence (AI), the know-how sector has rallied way more.

The tech-heavy Invesco QQQ Belief (NASDAQ: QQQ), meant to carefully mirror the Nasdaq 100, has appreciated 408% over that point. Throughout the tech sector, the super-high-growth cloud software program sector has pushed the iShares Expanded Tech-Software program Sector ETF (NYSEMKT: IGV) a good larger 413%.

However that every one pales compared to the semiconductor sector, which has rallied a whopping 742%! That is almost double the returns of the general know-how sector and over 4.2 occasions the return of the broader market over the previous decade.

Why many draw back from the chip sector

In mild of the semiconductor sector’s long-term outperformance, it could be stunning that many traders draw back from it. In any case, Warren Buffett had by no means as soon as purchased a semiconductor inventory till he bought Taiwan Semiconductor Manufacturing (NYSE: TSM) in late 2022, solely to promote all of it inside two quarters over geopolitical fears.

The chorus by many Buffett acolytes and worth traders, basically, is that the chip sector strikes too shortly, with fast-changing know-how making long-term aggressive benefits considerably laborious to determine or extra breach-able by the competitors.

There’s some reality to this; in spite of everything, simply have a look at how Nvidia (NASDAQ: NVDA) and foundry associate TSMC have overtaken Intel (NASDAQ: INTC), which was once thought to be the sector’s undisputed champion a mere decade in the past. Now, Intel has all of a sudden fallen far behind in a comparatively brief period of time and is trying an bold turnaround for its very survival.

However that is the fantastic thing about shopping for an ETF. With an ETF, you might be betting on the trade’s long-term progress with a diversified mixture of winners and losers. Finally, the winners rise to a top-weighting, buoying outcome.

How have semiconductors completed it? It is extra than simply AI

As you may see within the chart above, the chip sector had mainly appreciated according to the broader software program sector for the primary six years or so of the previous decade and solely started to do a bit higher than the Nasdaq round late 2020, when the chips began to separate from the pack.

Sure, the know-how sector started to take off in earnest throughout the pandemic, as corporations ran to cloud computing to maintain their companies going, and shoppers bought new laptops and smartphones with stimulus checks for the stay-at-home financial system. That benefited software program, the web, and semiconductors alike.

Nevertheless, late in 2020 and into 2021, separation started to occur — even earlier than the thunderous debut of ChatGPT in late 2022. Why was that?

I believe it was on account of a renewed investor deal with inventory valuations as inflation and rates of interest started to choose up from rock-bottom ranges. In that interval, software program valuations tended to be a lot larger than these of chip shares, as software program is regarded as extra of a secure “recurring” subscription enterprise, and chip gross sales can fluctuate 12 months to 12 months.

Nevertheless, rising rates of interest decrease the current worth of earnings far out sooner or later. That tends to depress the valuations of high-multiple shares equivalent to software program.

Alternatively, semiconductor shares tended to commerce at decrease valuations, particularly again then. Many chip leaders are additionally dividend payers and share repurchasers on prime of their tech-powered progress. These shareholder returns solely add to the sector’s long-term numbers.

And whereas semiconductors general might not develop as quick as, say, cloud software program, semiconductors are nonetheless holding their very own by way of long-term progress. Whereas the sector might increase and bust in any single 12 months, the general sector is projected to develop at an 11.6% annualized progress charge over the 2023 to 2030 time interval, based on DataHorizzon Analysis.

So, ranging from a decrease valuation with a decrease hurdle to clear might have been a key issue behind the sector’s outperformance as rates of interest normalized.

It isn’t simply Nvidia

In fact, many might scoff on the sector’s rise because the work of Nvidia alone. Because the first-mover in graphics processing items (GPUs) wanted for generative AI functions, Nvidia’s inventory has taken off over the previous two years. And with AI being a doubtlessly transformative know-how to society and humanity, Nvidia has grow to be the poster little one of success.

Nevertheless it’s truly not simply Nvidia driving the positive aspects within the sector. The truth is, seven of the ten best-performing S&P 500 shares over the previous decade are all within the semiconductor sector, encompassing 4 of the highest 5.

Producing modern chips with billions of tiny transistors is tough, and previous cycles have allowed the chip sector to consolidate right into a handful of outstanding corporations with these distinctive technological capabilities. As such, it is maybe no shock that not one however a handful of shares all taking part in AI chip design and manufacturing ecosystem would reap the rewards.

Whereas the chip sector might not obtain the positive aspects within the subsequent 10 years that it did over the previous 10, owing to larger beginning valuations, our world solely seems to be getting extra automated, clever, and linked. All of that’s powered by semiconductors. And that also makes this ETF a must have for any ETF investor with a time horizon past 10 years.

Do you have to make investments $1,000 in iShares Belief – iShares Semiconductor ETF proper now?

Before you purchase inventory in iShares Belief – iShares Semiconductor ETF, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and iShares Belief – iShares Semiconductor ETF wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $540,321!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 15, 2024

Billy Duberstein has positions in Taiwan Semiconductor Manufacturing. His purchasers might personal shares of the businesses talked about. The Motley Idiot has positions in and recommends Nvidia, Taiwan Semiconductor Manufacturing, and iShares Belief-iShares Semiconductor ETF. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

This ETF Has Crushed the Markets and Even the Tech Sector: Do not Let Fearmongers Hold You Out was initially revealed by The Motley Idiot