4kodiak/E+ through Getty Pictures

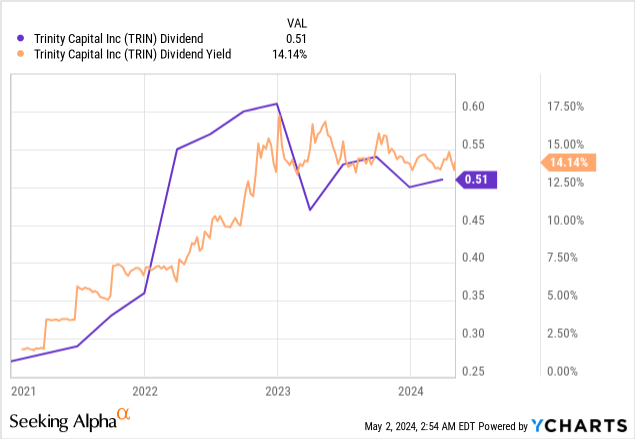

I have been shopping for extra Trinity Capital (NASDAQ:TRIN) for the reason that internally managed enterprise debt BDC final declared a quarterly money dividend of $0.51 per share, this was a 2% enhance from its prior quarter and $2.04 annualized for a 13.8% dividend yield. This hike got here because the Fed gears to maintain base rates of interest at their 22-year excessive of 5.25% to five.50% for many of 2024, in opposition to prior expectations of at the very least three charge cuts ranging from the June assembly. The CME FedWatch Software is now pricing within the likelihood of no charge cuts to exit 2024 at 27.16%, its highest stage in over a yr.

Trinity Capital Fiscal 2024 First Quarter Presentation

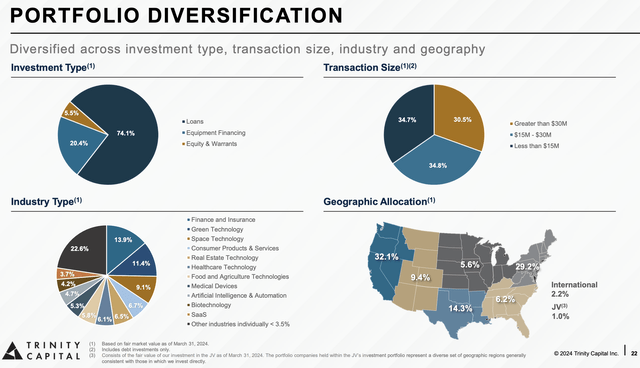

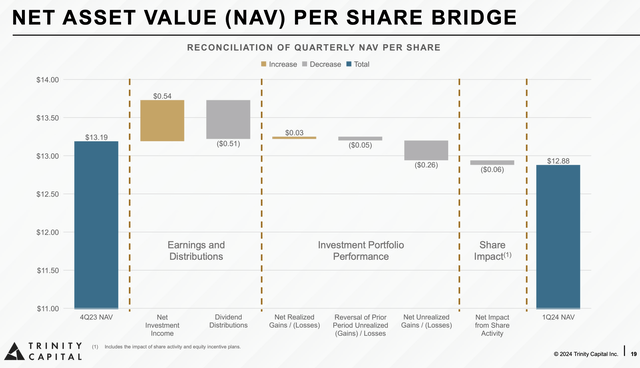

TRIN’s funding portfolio on the finish of its latest fiscal 2024 first quarter had an combination honest worth of $1.4 billion, comprised of $1 billion in secured loans, $277.6 million in gear financings, and $75.5 million in fairness and warrants. Internet asset worth is what’s vital and this got here in at $626.3 million, round $12.88 per share on the finish of the primary quarter. This sadly dipped by 31 cents sequentially following a $0.06 hit from an enlargement of its excellent share rely and $0.26 from unrealized losses on its funding portfolio.

Trinity Capital Fiscal 2024 First Quarter Presentation

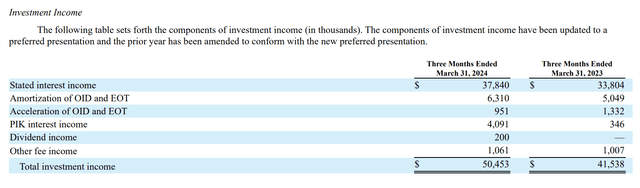

Critically, TRIN has hiked its base dividend for 13 consecutive quarters, primarily each quarter because it went public with the present dividend wrapped inside a report web funding revenue of $25.2 million within the first quarter, round $0.54 per share. This implies 106% dividend protection or a 94.4% payout ratio. Bears can be proper to flag that this payout ratio, above the 90% BDC watermark, doesn’t present a ton of depth for TRIN to take care of near-term base dividend hikes. Nevertheless, the Fed seems to be set to protect charges larger for longer and the US financial system continues to defy the chances with an employment growth. The BDC additionally held undistributed revenue of $55 million, roughly $1.33 per share, on the finish of the primary quarter.

Underwriting High quality, Debt-To-Fairness Ratio, And The 2025 Bonds

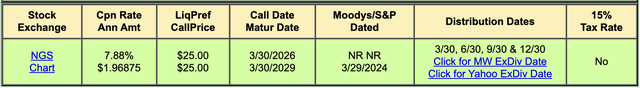

TRIN’s 7.00% Notes due 2025 (NASDAQ:TRINL) and the 7.875% Notes Due 2029 (NASDAQ:TRINZ) are public buying and selling TRIN securities. Each are at present swapping palms a number of cents above their $25 liquidation worth per be aware with TRINL at $25.32 per be aware and TRINZ at $25.37 per be aware. Nevertheless, with TRINL maturing on 1/16/2023, TRINZ varieties the higher purchase with its 3/30/2026 maturity set to see its holders earn an revenue for longer. To be clear, TRINZ is just 5 cents costlier than TRINL regardless of a markedly larger annual coupon that is 87.5 foundation factors forward.

QuantumOnline

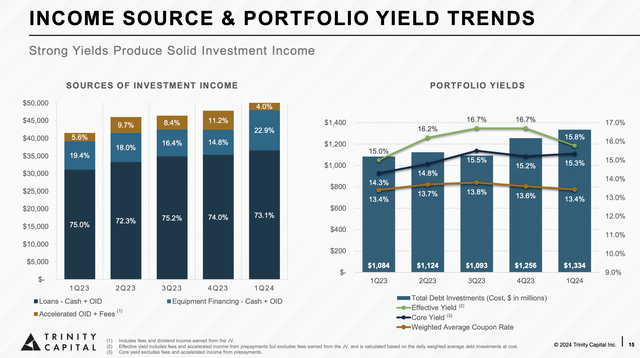

TRIN originated $286.8 million of complete new commitments and funded $242.7 million through the first quarter with $182.9 million of funded investments in eight new portfolio corporations and $57.4 million of investments in 12 present portfolio corporations. This was set in opposition to principal repayments of $148.5 million however got here with a 110 foundation level dip in TRIN’s efficient yield to fifteen.8% from 16.7% within the prior fourth quarter.

Trinity Capital Fiscal 2024 First Quarter Presentation

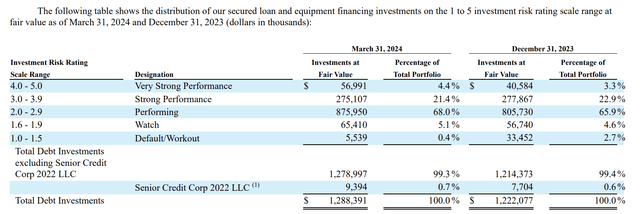

The BDC had secured loans to 4 portfolio corporations and gear financings to at least one portfolio firm on non-accrual standing on the finish of the primary quarter. These had a good worth of $30.4 million, round 2.4% of the BDC’s debt funding portfolio at honest worth. This got here as complete debt funding with an funding danger score of three.0 to five.0 at 25.8% on the finish of the primary quarter dipped sequentially from 26.2% within the prior fourth quarter.

Trinity Capital Fiscal 2024 First Quarter Type 10-Q

Nevertheless, investments in default at 0.4% of TRIN’s funding portfolio on the finish of the primary quarter materially improved sequentially from 2.7% following the January exit of crypto miner Core Scientific (CORZ) from chapter. General, TRIN’s underwriting high quality stays wholesome with loans on non-accrual standing remaining low and the broader danger score of its portfolio nonetheless overwhelmingly throughout the realm of prudence.

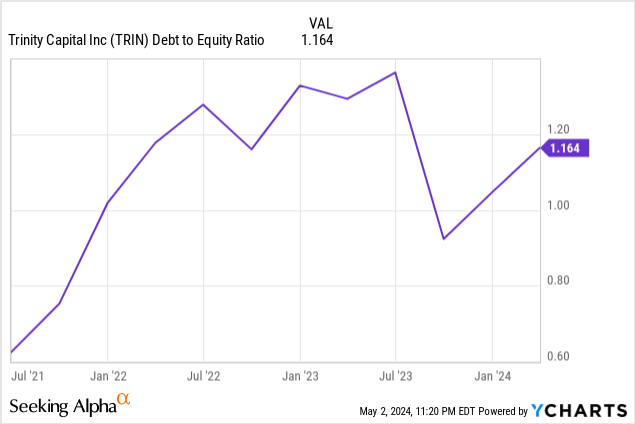

That is because the BDC’s debt-to-equity ratio at 1.16x as of the top of the primary quarter additionally sat beneath its summer season 2023 peak and likewise nicely inside a broadly prudent vary. TRIN is up round 7% on a complete return foundation since my final protection in November with BDCs experiencing continued energy on the Fed’s higher-for-longer rhetoric. TRIN has seen its PIK curiosity revenue spike to $4.1 million from $346,000 within the year-ago comp.

Trinity Capital Fiscal 2024 First Quarter

This leap may suggest extra near-term headwinds with the NAV dip a possible trigger for bulls to pause. Nevertheless, I like the security of the big dividend yield and wholesome leverage ratio and have been including to my TRIN place to seize extra of this yield.