Manuka Sources Restricted (“Manuka” or the “Firm”) is happy to announce it has obtained agency commitments from institutional and different exempt buyers for as much as $8 million value of latest Manuka shares (every, a New Share) through a Share Placement (“Placement”) to begin bringing the Mt Boppy Gold Mine into manufacturing inside 2024.

Highlights

- Agency commitments obtained for $8 million to be utilized in the direction of bringing the Mt Boppy Gold Mine into manufacturing.

- Mt Boppy has an preliminary 5-year Mine Plan producing a forecast EBITDA of as much as roughly $19 million every year1.

- The $8 million raised will permit for the institution of an on-site processing facility to recuperate gold from oxidised ore. The steadiness of capital required for a flotation circuit for processing of sulphide ore is to be funded from undertaking money flows.

- Manuka tenements within the area, together with the Mt Boppy mining licenses, maintain important exploration upside. As soon as in manufacturing at Mt Boppy, the Firm intends to aggressively discover with the intention of accelerating annual gold manufacturing and increasing the lifetime of mine.

- Money flows from Mt Boppy will help the potential restart of the Wonawinta Silver Mine, positioned 150km south of Mt Boppy, as a devoted silver operation in 2025.

- The Firm is concentrating on the discharge of an up to date Reserve Assertion for the Wonawinta Silver Mine within the present June quarter.

The Firm is pursuing a staged development technique that’s initially targeted on gold and silver manufacturing and free money circulation technology from its property within the Cobar Basin.

The Firm has just lately accomplished a sonic drilling program to agency up confidence within the Mt Boppy Useful resource2 and developed an preliminary 5-year Mine Plan that’s forecast to generate a mean $19 million EBITDA every year3. The capital elevating will fund the institution and ramp up of a fit-for-purpose gold processing facility on-site on the My Boppy Gold Mine with first doré manufacturing scheduled for This autumn 2024. Beforehand, ore mined at Mt Boppy had been transported, to and processed at, the Wonawinta Silver Mine positioned 150km south of Mt Boppy.

Dennis Karp, Manuka’s Government Chairman, commented:

“We’re delighted to announce this important capital elevating for the Firm and look ahead to launching instantly into the execution of our technique to ascertain on-site processing capability at Mt Boppy and probably commencing gold doré manufacturing later this 12 months.

Bringing a brand new processing plant at Mt Boppy on-line represents Stage 1 of the Firm’s staged self-sustaining development plan, that’s targeted initially on manufacturing and free money technology from our Cobar Basin gold and silver tasks, and subsequently improvement of our world-class VTM Sands Venture in New Zealand.

With agency commitments towards this capital elevating obtained and continued energy within the gold and silver markets, it’s an thrilling time to be a Manuka shareholder.”

Following the ramp-up of the Mt Boppy Gold Mine, the Firm will look to recommence silver manufacturing at Wonawinta in 2025 with the help of money circulation generated from Mt Boppy. Beforehand Australia’s largest major silver producer, the Wonawinta Silver Mine includes an current mine and course of plant and a Useful resource of 38.3Mt at 41.3g/t Ag for 51Moz4 together with a higher-grade part of 4.5Mt at 97 g/t Ag for 14Moz.

Wonawinta, which as just lately as December 2023 was used to course of ore from Mt Boppy, is at the moment on care and upkeep. The Firm is concentrating on the discharge of an up to date Reserve Assertion for the Wonawinta Silver Mine within the present quarter.

Use of Placement Proceeds

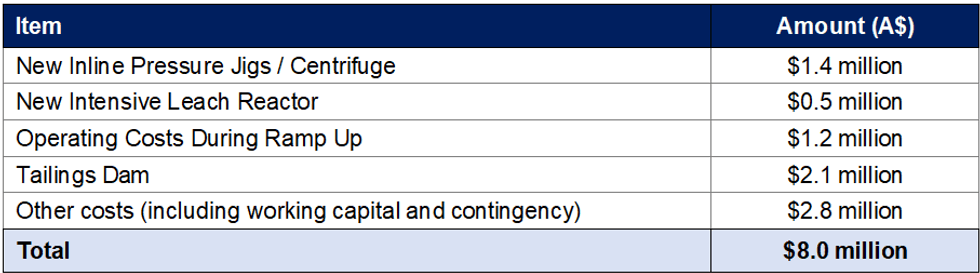

The proceeds of the Placement are proposed for use as follows:

Desk 1: Use of Placement Proceeds

Desk 1: Use of Placement Proceeds

Placement Particulars

The Placement includes the difficulty of roughly 133.3 million New Shares which can rank equally with the Firm’s current abnormal shares. The Placement worth of $0.06 per share represents:

- a 13.0% low cost to the closing worth of the Firm’s shares on 6 Could 2024; and

- a 18.1% low cost to the 5-day quantity weighted common worth (“VWAP”);

Every New Share issued beneath the Placement will include one free accompanying choice exercisable into an abnormal share within the Firm at a strike worth of $0.06 per share and an expiry date of 15 Could 2026 (every, an “Possibility”). The Choices are being issued for nil more money consideration. It’s the intention for the Choices to be quoted on ASX, topic to the receipt of shareholder approval, the satisfaction of all relevant ASX necessities and following the preparation and issuance of a transaction-specific prospectus.

Click on right here for the complete ASX Launch

This text consists of content material from Manuka Sources Restricted, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your duty to carry out correct due diligence earlier than appearing upon any info supplied right here. Please check with our full disclaimer right here.