Architectural Visualization

Jardine Matheson Holdings Restricted (OTCPK:JMHLY, OTCPK:JARLF) (we’ll name it JM or simply Jardine for brief), along with its listed subsidiary Jardine Cycle & Carriage Restricted (OTCPK:JCYCF) (C&C for brief), symbolize main companies in Hong Kong and China’s mainland. Collectively, they’ve traits that will sometimes invite a excessive a number of: clear tangible worth, revenue development because of the top of COVID-zero, relative resilience and monitor report. Certainly, Jardine Matheson, a storied conglomerate with a protracted historical past in Hong Kong, only a few years in the past used to command fairly a premium valuation.

Now, nonetheless, JM’s complete P/B has plummeted, and the valuation of belongings outdoors its well-performing Indonesian and SE Asian companies in C&C has plummeted even additional than that. We expect there’s an angle the place allocators change into comfy once more with Chinese language allocations, with JM being a really operationally strong decide with huge quantities of worth to realize on it returning to its extra premium standing.

Alternatively, we’ve got been bearish on China for years over the foundational subject of how safe Chinese language securities truly are, and the way that concern articulates with geopolitical battle. We see it as a really compelling headline revenue and worth play, however acknowledge the dangers and can by no means transcend a really speculative allocation to the inventory.

Earnings FY

Since that is our first protection, we need to be complete, additionally for our personal reference sooner or later, and take a look at efficiency phase by phase, since its presence is sort of sprawling.

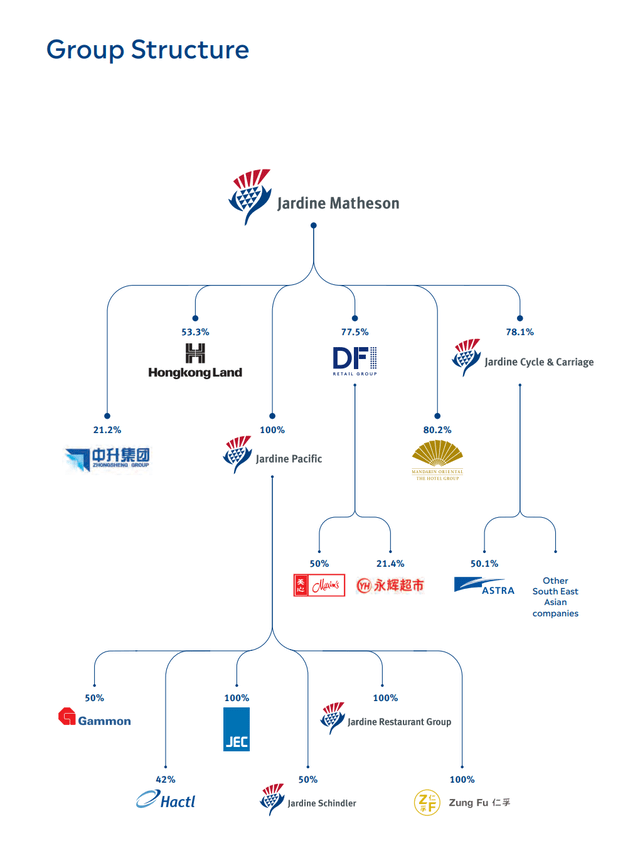

Construction (AR 2023)

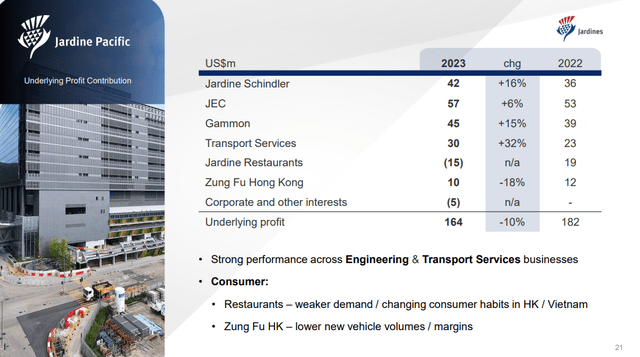

Jardine Pacific (9% of underlying working income)

Jardine Pacific is composed of a number of companies. These embrace a few heavy engineering companies (Gammon and JEC). One other is Hactl, which is a serious warehouse the place cargo from air freight is dealt with in Hong Kong; that is apparently the world’s largest of such amenities. Then there’s the Schindler (OTC:SHLRF) and Jardine three way partnership that’s centered on escalators, elevators, and many others., for the Asian markets ex-China. Additionally, a restaurant group, which is a serious franchisee of Yum! (YUM) centered on the foremost Southeast Asian markets, and at last Zung Fu, which is an automotive group, working as an unique Mercedes-Benz (OTCPK:MBGAF) retailer (each industrial and passenger autos).

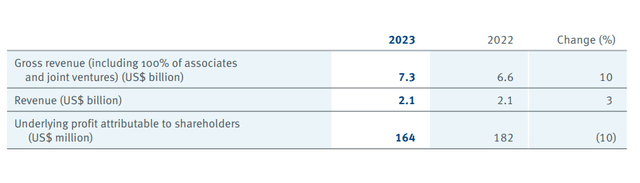

Jardine Pacific Highlights (AR 2023)

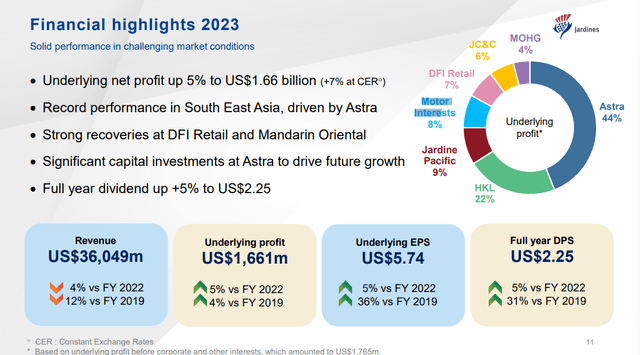

Earnings declined round 10%, however would have risen absent the federal government subsidies supporting income in 2022 of $28 million.

Jardine Pacific Companies (FY Pres)

Jardine Schindler carried out properly, with larger gross sales consistent with efficiency anticipated of its razor-and-blades enterprise mannequin. New set up was unsurprisingly weak, with the area’s China-connected economies struggling a bit, however upkeep did properly.

Gammon had larger gross sales, however tasks phasing and timings hit margins. They nonetheless contributed to development, YoY. Operational enchancment applications have been serving to. Even JEC had respectable performances YoY. Very similar to the top of the subsidies coincided with the top of COVID-zero in China, a few of this restoration owes to a little bit of a resumption in these economies, though issues across the Chinese language property markets stay excessive.

Zung Fu reported decrease income regardless of stronger after-sales efficiency, which tends to be a larger margin enterprise. There have been quantity points right here, additionally as a result of provide chain impacts from Hyundai. However typically weak client sentiment is an element, notably in Hong Kong finish markets, by which Zung Fu is targeted. Jardine Eating places did not do properly, coming in at a web loss. Low-ish visitors concurrently missing authorities subsidies are an issue right here for now. Apparently, numerous outbound visitors from HK today is to Shenzhen.

Jardine Pacific is round 5% of revenues and round 9% of underlying income.

Working Revenue Breakdown (FY Pres)

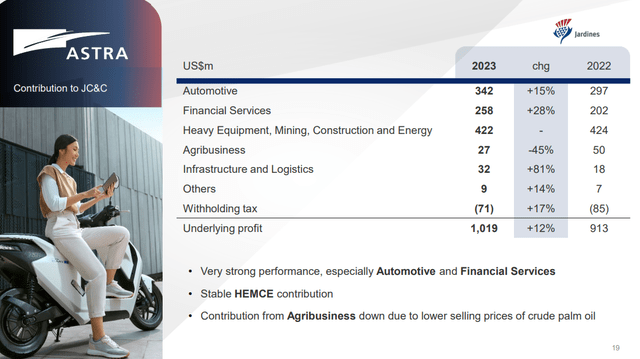

Astra (44% of underlying working income)

Astra, fundamental C&C enterprise (FY Pres)

The main companies in Astra are automotive, monetary providers and heavy trade together with mining and vitality. There was modest development in underlying income. These companies are centered totally on Indonesia, and there is not actually any Chinese language publicity.

The automotive enterprise assembles and distributes sure Japanese and French automobile manufacturers for the Southeast Asian market. Motorbike gross sales rose significantly, whereas automobile gross sales shrunk barely, however the web results, because of the prevalence of two-wheeled autos in Southeast Asia, have been very constructive. The 80% owned auto components enterprise additionally grew as a result of main margin features on pricing hikes for auto components.

Monetary providers noticed appreciable enhance in web revenue because of its rising client finance companies at 15%. Heavy gear financing additionally grew 8%. The insurance coverage enterprise additionally grew as a result of development in insurance policies underwritten.

For the heavy industries, they’ve their United Tractors enterprise which purchased a stake in a nickel mine, regardless that nickel has been taking place on over-mining, notably in Indonesia. United tractors total noticed steady efficiency because of aftermarket gross sales offsetting new gear declines. Their contract mining companies are doing respectable, in addition to their building equipment enterprise, offsetting a number of the stress in coal mining and in addition the consequences of a decrease price of gold mining. The general phase is operating stably and has flat working revenue evolutions.

Palm oil worth stress hit the agribusiness, whereas web revenue virtually doubled for infrastructure and logistics, primarily as a result of their toll street and logistics companies. They’ve the concession for some roads in Java and the outer Jakarta ring street. It is a small contribution, although.

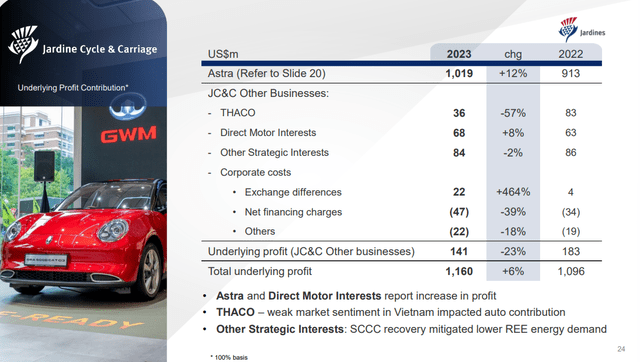

Jardine Cycle & Carriage (6% of underlying working income ex-Astra)

C&C ex-Astra (FY Pres)

Astra is technically inside this phase, which can be a publicly listed firm in its personal proper, with near 90% possession by Jardine Matheson. However right here we deal with the ex-Astra companies. The residual working revenue of companies outdoors of Astra is small, at round $40 million solely.

Direct Motor Pursuits, which embrace the Myanmar, Singapore and Bintang companies in addition to Tunas Ridean. Most of those are automobile distributing companies. THACO is a Vietnamese automotive manufacturing enterprise. Pressures on the Vietnamese financial system made issues right here, with revenue halving. The remaining companies have been comparatively steady, concerned in dairy manufacturing, cement manufacturing and engineering. The commonly robust finish markets in Indonesia and Southeast Asian infrastructure improvement saved issues flat right here.

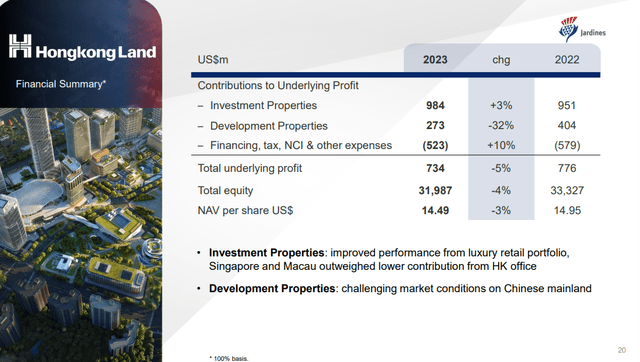

Hongkong Land (22% of underlying working income)

HKL (FY Pres)

The Chinese language mainland is the place unsurprisingly the corporate noticed challenges in creating properties with offsets in a robust Singaporean market, regardless that the revenue properties continued to carry out properly with modest development. Underlying revenue shrunk by 5% when excluding some portfolio re-evaluation results. The underside line is that improvement suffered on worse mainland property costs, which is the place the developments have been principally taking place. HK property markets are additionally struggling, nevertheless it appears this isn’t the place the corporate had been making its investments.

There have been some pressures within the funding property phase from HK workplaces, which whereas sporting emptiness charges which are lots decrease than within the West the place do business from home has taken extra maintain, has seen some rising. Singapore workplaces did high-quality, and the general development is from a restoration in retail and luxurious properties pushed by the return to regular following the COVID-19 restrictions in 2022, which made for a simple comp.

The event enterprise had some residential belongings in Wuhan that did not carry out, and the overall deleveraging occurring within the Chinese language financial system is the opposite concern that possible retains a lid on this phase’s outcomes for some time longer. Nevertheless, curiosity in contracted gross sales, the metrics to observe the gross sales of developed properties, is a little bit bit on the up.

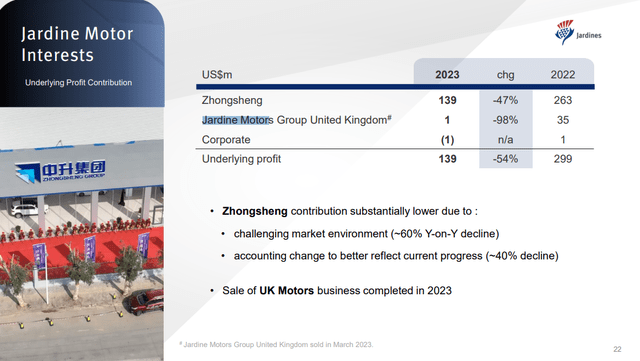

Jardine Motor Pursuits (8% of underlying working income)

Motor Pursuits is a equally sized enterprise to Pacific. Round 40% of the decline is because of accounting adjustments in Zhongsheng (OTCPK:ZSHGY) (publicly listed, by which Jardine Matheson has a 21% stake). However the market atmosphere has additionally been difficult as a result of EV shift and common stress on client sentiment. Zhongsheng is a dealership enterprise centered on the standard suspects of premium manufacturers, all of which have not made a significant EV shift. The UK enterprise was bought utterly early in 2023.

JMI (FY Pres)

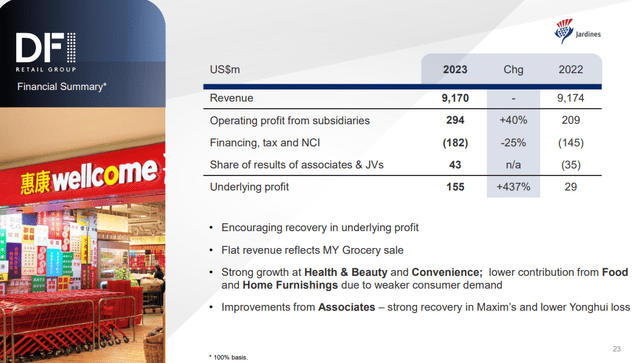

DFI Retail Group (7% of underlying working revenue)

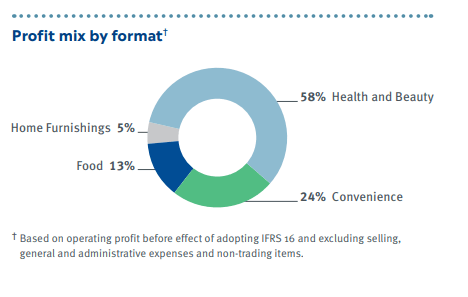

Breakdown of DFI (AR 2023)

Efficiency was virtually completely pushed by improved operational profitability. Within the Meals phase throughout the retail group, revenues have been down round 5% excluding the consequences from a divestment of a Malaysian enterprise. The problem was more durable comps from pantry stocking conduct in 2022 as a result of pandemic-era conduct. In Southeast Asia, there was common stress from larger prices of dwelling and common financial pressures. Underlying working revenue fell by round 50%.

In Comfort gross sales grew by 8%, primarily pushed by the primary half of the 12 months when the second half was extra flat as a result of quantity of outbound journey from Hong Kong, notably throughout weekends. A strategic focus to maneuver away from taxed gross sales of cigarettes and into different merchandise additionally lifted margins. DFI has the 7-Eleven model to be used in Chinese language markets and Singapore. Typically, there are normally extra levers to tug for efficiency in comfort, as there’s extra pricing energy and the inventory tends to be larger margin. However the common reopening and elevated foot visitors in key markets has been crucial. Working revenue for the Comfort phase is up 74%.

Well being and Magnificence grew by 20% like-for-like because of Mannings specifically, and the overall profile of the Well being and Magnificence retail mannequin which depends on foot visitors that has recovered. Operational enhancements have been additionally essential for driving an total 127% enhance in underlying working revenue.

Dwelling Furnishings suffered a bit on the weakening property market sentiment, falling 7% on an LFL foundation when it comes to gross sales. Underlying working revenue right here dropped by a few third. Would not matter an excessive amount of as it is a small ingredient of the DFI retail combine.

DFI Headlines (FY Pres)

The Associates phase is ownerships in varied different companies like Maxim’s centered on restaurant exercise in China and different components of Southeast Asia which had a robust restoration as a result of finish of COVID-zero and the return to eating out. Yonghui is a grocery store group, the place losses thinned because of operational enchancment however have been nonetheless challenged by native competitors, which is not very bullish. Robinsons Retail Holdings, which is a Philippines retailing enterprise, primarily centered on groceries, has been doing properly operationally with robust gross sales and working revenue development, however the affiliate contribution has been poor as a result of FX and in addition as a result of larger curiosity prices.

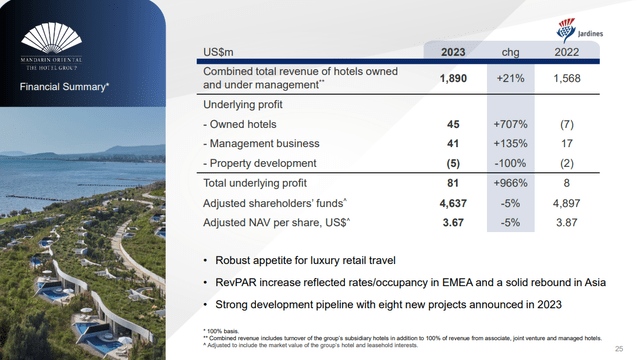

Mandarin Oriental (4% of underlying working revenue)

Headline Outcomes (FY Pres)

Right here, the reopening of the markets induced a large reversal in working income that had been detrimental or near detrimental for some years. Two new motels have been opened in 2023 elevating total portfolio to 38 motels and 9 residences. 28 extra motels and one other 2 residences are within the pipeline to be opened over the following 5 years, so it is a rising group.

Backside Line

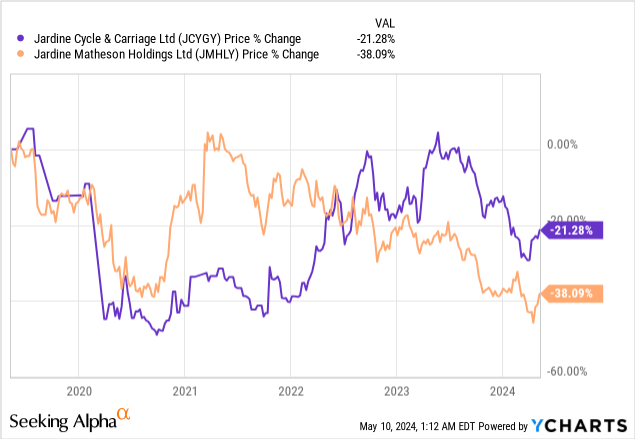

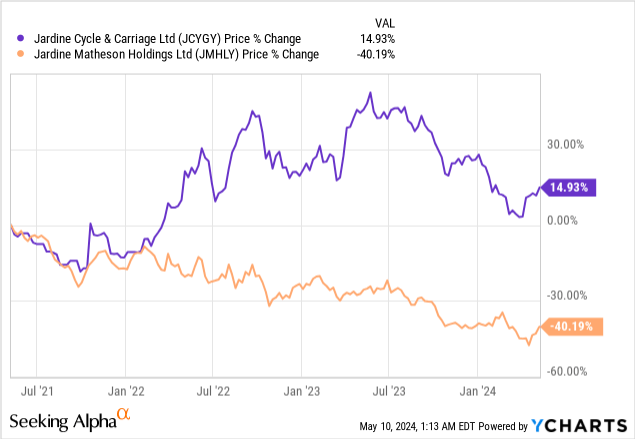

Let’s begin attending to the worth case. We be aware the buying and selling worth of Jardine Matheson in comparison with Jardine Cycle & Carriage Restricted, which is the publicly listed managed holding containing Astra that focuses on the Indonesian market, mentioned above. C&C has carried out lots higher than Jardine Matheson on the 5Y and 3Y horizons. C&C’s worth accounts for about half of JM’s market cap.

The divergence might be defined by one main factor, which is the China issue. Each the Chinese language segments, as mentioned above, and C&C segments are reaching total revenue development, notably segments levered to China inside JM as a result of reopening, which simply means the uninvestability of China has been the first issue driving very completely different returns within the shares notably because the onset of geopolitical questions on China in 2022. Certainly, JM used to commerce as a premium inventory with P/Bs at round 0.7x in 2020, now at lower than 0.4x, whereas C&C is above its 202 stage of 0.85x at 0.98x now.

Clearly, Jardine Matheson Holdings Restricted inventory is extraordinarily low cost, buying and selling at lower than a 7x P/E, with a robust, virtually 5% dividend yield as properly, undergirded by strong and worthwhile companies and an elite actual property portfolio in Hong Kong. Its revenue is even solidly rising on the again of the reopening in China, and the top of COVID-zero, which has been the first earnings driver for the corporate. The issue at play is not operational, it is right this moment with the foundational drawback of whether or not Chinese language, now absolutely together with Hong Kong, belongings are literally securities or not.

We expect that there are attainable upsides at this level in Chinese language equities, which have come near all-time 2005 nadirs in P/B. China’s financial nationalism can solely go to this point earlier than being suicidal, evidenced by the results of retaliatory financial nationalism by the West with issues just like the CHIPS Act, and that the road that the CCP appears very unwilling to cross is appropriation. Sentiment is near lows at this level, and we expect that folks will change into extra comfy with the dangers that tangible, revenue producing, however Chinese language linked belongings have to supply over time.

Jardine Matheson’s P/B has shrunk as its fundamental non-Chinese language enterprise P/B has stayed comparatively strong. It additionally has a historical past of being valued with a premium P/B. C&C is round 50% of JM’s total underlying working revenue. That implies that considering when it comes to crudely blended common P/Bs, the Chinese language (that’s to say ex-C&C) belongings inside JM have fallen to extraordinarily low ranges, a lot decrease than the general 0.4x which is already extraordinarily low.

You possibly can say that the Chinese language belongings have acquired a 75% low cost to their P/Bs, whereas the denominators develop on continued profitability. The CSI 300 hasn’t even declined greater than 50% from 2021 highs. Which might be one of many harshest reductions in Chinese language markets. Any restoration in confidence by the foremost allocators in China would have a large influence on JM, because it additionally continues to generate development and revenue.

There are, in fact, dangers. An intensification of the market rifts may include China invading Taiwan, which could simply be an inevitability, because the West tries to re-station Taiwanese strategic belongings nearer to house. There are different methods by which the rising multipolarity of the world order may set off strikes that might intensify fears in regards to the safety of belongings finally held in China. No less than a lot of JM’s companies are outdoors of China, and its shares are listed in Singapore.

One other mind-set about valuation is that outdoors of C&C, the belongings are primarily properties via Hongkong Land and retail/automotive. Roughly 50% of the worth of JM’s inventory might be accounted for by C&C, which can be round 50% of underlying revenue. That implies that property and retail belongings, lessons of belongings that sometimes have honest yield of round 5-7%, are yielding at nearer to twenty%, which the JM’s earnings yield (reciprocal of P/E). Nevertheless, whereas it’s only a directional case, that C&C, a serious a part of the JM enterprise, is performing properly whereas the JM inventory is performing badly simply implies that the belongings underlying JM outdoors of C&C would possibly deserve some extra consideration, particularly because the C&C enterprise itself can be good to personal.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.