U.S. shares hit a recent all-time excessive on Might 15, powered partially by a softer-than-expected April inflation report that has reignited bets on a fall Federal Reserve price reduce and triggered some large adjustments in Wall Road forecasts.

The S&P 500 has clawed again all of its April decline, whereas powering to a year-to-date achieve of round 10%. The transfer got here regardless of a number of warnings from Fed officers, together with Chairman Jerome Powell, that rates of interest are more likely to stay elevated till inflation is seen shifting definitively towards the central financial institution’s 2% goal.

The Commerce Division’s April CPI report offered the primary actual piece of proof that worth pressures on the earth’s greatest financial system might see their closing leg of easing into the summer time months and past.

Headline inflation fell for the primary time this 12 months, easing to a year-on-year price of three.4%, whereas so-called core costs slowed to three.8%, the bottom in practically three years.

“Wanting forward, the case for anticipating an additional slowdown in core CPI inflation stays compelling,” mentioned Ian Shepherdson of Pantheon Macroeconomics. “Provide chains have normalized, wage progress is weakening, and company margins are flat however nonetheless massively elevated, indicating clear scope to fall forward.”

Charge-cut foundations ‘are in place’

“The foundations, subsequently, are in place for an additional deceleration within the core CPI this summer time, enabling the Fed to start out easing in September,” he added.

Following the information report, price merchants instantly repriced bets on a September Fed price reduce, whereas nonetheless anticipating no change within the present price of 5.25% and 5.5% over the subsequent two coverage conferences, in June and July.

CME Group’s FedWatch now pegs the percentages of 1 / 4 level reduce in September at 52.1%, with the general probability of any transfer now buying and selling at 68.8%.

Associated: S&P 500 goals for greatest achieve in Fed rate of interest pause historical past

In between, in fact, comes the Fed’s June coverage assembly, which is able to embody recent progress and inflation projections — and a brand new set of dot plots, the Fed officers’ price projections — for the again half of the 12 months.

That mentioned, the prospect of decrease Fed charges, alongside better-than-expected company income and a resilient home financial system, has not solely lifted shares to the latest all-time peaks. It has additionally compelled some Wall Road analysts to overtake their end-of-year worth targets for the broadest benchmark of U.S. shares.

BMO's Brian Belski boosted his $SPX worth goal to five,600 this morning. Now the excessive on the Road!

Value strikes sentiment!$SPY $QQQ $DIA h/t @_JoshSchafer pic.twitter.com/pWhaK4dCt4

— Seth Golden (@SethCL) Might 15, 2024

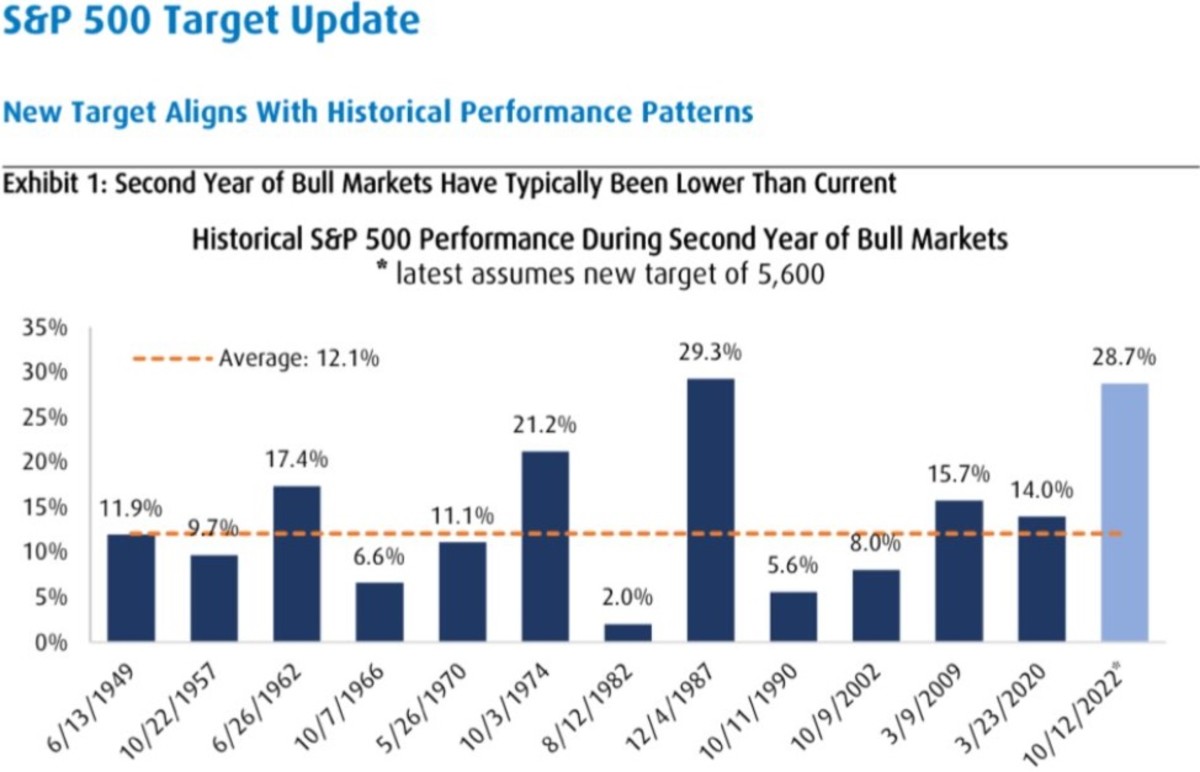

“It has change into clear to us that we underestimated the energy of the market momentum,” mentioned BMO Capital Markets’ chief funding strategist, Brian Belski, in a observe that lifted the financial institution’s S&P 500 worth goal to five,600 factors, the very best on Wall Road.

Market momentum is robust

“The market is behaving similarly to 2021 and 2023, years the place we didn’t give sufficient credit score to the energy of market momentum, one thing we are attempting to keep away from this time round,” Belski and his workforce mentioned.

Earlier this week, knowledge from two intently tracked Wall Road surveys additionally advised buyers are seeing a transparent path to new all-time highs, even when the Fed retains to its phrase and holds charges regular till year-end.

S&P World’s Funding Supervisor Index, revealed Might 14, confirmed equity-risk urge for food surged to a two-and-a-half-year excessive this month, citing S&P 500 earnings potential over rate-cut optimism.

Associated: Shares on inflation watch as S&P 500 exams document

The Atlanta Fed’s GDPNow forecasting device, a real-time tracker of the U.S. financial system, suggests a current-quarter GDP progress price of 4.2%, greater than twice the 1.6% tempo the Commerce Division revealed for its latest first-quarter estimate.

LSEG knowledge, in the meantime, estimate collective first-quarter income for the S&P 500 rose 7.4% from a 12 months earlier to $467.9 billion, a $5 billion enchancment for the reason that begin of the reporting season.

Wanting into the three months ending in June, LSEG sees that year-on-year progress price bettering to 10.6%, with income rising to a share-weighted $495 billion.

Huge fund managers are bullish

Financial institution of America’s month-to-month survey of world fund managers, in the meantime, suggests buyers are essentially the most bullish they have been since November 2021. However it notes that 80% of respondents anticipate a minimum of two price cuts as a way to assist that optimism.

Bret Kenwell, U.S. funding analyst at eToro, additionally notes that the Commerce Division’s April retail gross sales report, which confirmed a marked slowdown in spending, additionally aligns with the modest downtick in inflation pressures.

Extra Financial Evaluation:

- Be careful for 8% mortgage charges

- Sizzling inflation report batters shares; here is what occurs subsequent

- Inflation report will disappoint markets (and the Fed)

“April’s retail gross sales and CPI experiences might have simply threaded the needle for what inventory market bulls and the Fed wanted to see,” Kenwell mentioned. “Client spending is the lifeblood of the U.S. financial system, so nobody desires to see it fall off a cliff.

“Nevertheless, some weak point on the financial entrance might nudge the Fed towards its first price reduce, particularly if it comes alongside progress on inflation.”

Associated: Single Greatest Commerce: Wall Road veteran picks Palantir inventory