Cybersecurity is a large business that has by no means been extra vital. Hackers are more proficient at breaching methods and inflicting havoc for firms. Precautions should be taken to guard inner and buyer information.

This requires implementing one (or a number of) cybersecurity options, and, in consequence, buyers ought to contemplate including cybersecurity shares to their portfolio, as demand for his or her merchandise is huge.

Two of the most well-liked are Palo Alto Networks (NASDAQ: PANW) and CrowdStrike (NASDAQ: CRWD). However which one is the higher purchase? Let’s discover out.

Palo Alto and CrowdStrike compete closely

First, let’s talk about every firm’s main enterprise throughout the cybersecurity realm.

Palo Alto divides its enterprise into three segments: community safety, cloud safety, and safety operations. Its community safety enterprise contains firewalls and a zero-trust platform that forestalls outsiders from accessing a community. Its cloud safety platform protects cloud workloads, and the safety operations platform has merchandise like endpoint safety (endpoints are community entry units like laptops) and menace detection response.

CrowdStrike has an analogous product lineup, though its preliminary enterprise wasn’t firewalls like Palo Alto. It acquired its begin with a cloud-first safety strategy that began with endpoint protections after which expanded into different areas like id safety, cloud safety, menace intelligence, and endpoint detection response. So Palo Alto and CrowdStrike are direct rivals in lots of their choices.

However once you dig into their financials, a frontrunner begins to emerge.

CrowdStrike’s progress is projected to stay sturdy this yr

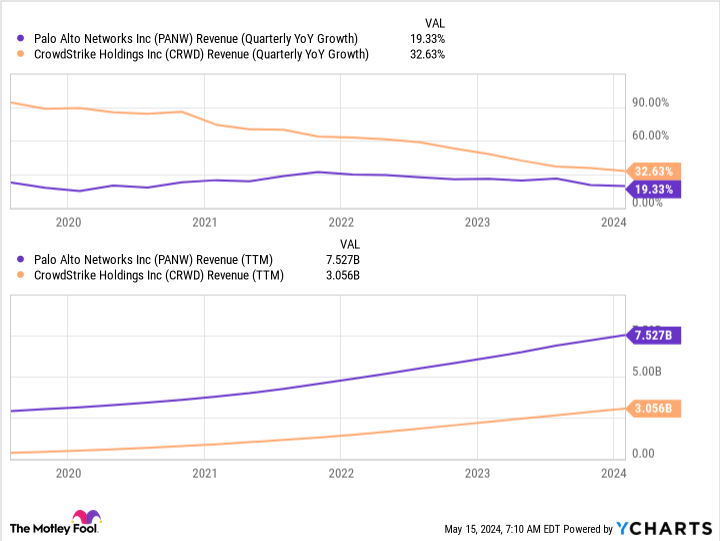

Should you look solely at income progress, CrowdStrike appears to have an edge. Nonetheless, it is a facet impact of being a smaller enterprise. That is on full show with CrowdStrike’s progress trajectory, as its year-over-year income progress is slowing down the bigger it will get.

Whereas CrowdStrike is rising quicker than Palo Alto, the roles is likely to be flipped if Palo Alto had been the scale of CrowdStrike. Nonetheless, forward-looking indications aren’t as vibrant for Palo Alto.

Within the quarter that ended April 30, Palo Alto is anticipating income progress of solely 3%. (It is scheduled to report earnings outcomes Monday.) This can be a huge pink flag, particularly when in comparison with CrowdStrike, in addition to different cybersecurity firms.

For the quarter that ended April 30, CrowdStrike expects income of round $904 million, indicating 31% progress. (It is scheduled to report earnings outcomes on June 4.) That is fairly the distinction, and it exhibits that Palo Alto is struggling.

Or is it?

Palo Alto’s administration mentioned in the course of the February convention name with analysts that its steerage was “a consequence of us driving a shift in our technique in desirous to speed up each our platformization and consolidation and activating our AI management.” Synthetic intelligence (AI) can play an enormous function in highly effective cybersecurity merchandise, so this shift is smart.

Nonetheless, CrowdStrike has been utilizing AI since its inception to robotically detect and take care of threats with out human intervention. This has given CrowdStrike an edge over Palo Alto networks within the endpoint safety sport.

Which inventory?

To me, that is all I have to declare CrowdStrike the winner. It already has important AI expertise, whereas Palo Alto is late to the sport.

CrowdStrike is by far the higher purchase right here, and I would not be shocked to see it beginning to take some Palo Alto prospects sooner or later.

Do you have to make investments $1,000 in Palo Alto Networks proper now?

Before you purchase inventory in Palo Alto Networks, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Palo Alto Networks wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $566,624!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

Keithen Drury has positions in CrowdStrike. The Motley Idiot has positions in and recommends CrowdStrike and Palo Alto Networks. The Motley Idiot has a disclosure coverage.

Higher Cybersecurity Inventory: Palo Alto Networks vs. CrowdStrike was initially revealed by The Motley Idiot