Matteo Colombo

It has been what I prefer to name a “purchase all the things” market within the final month. I, together with many different market watchers, anticipated a steeper pullback in US giant caps following the excessive hit on March 28. Alas, it was a mere 6.1% retreat, utilizing intraday costs, on the S&P 500. What’s extra, equities often function volatility heading into the Memorial Day weekend throughout election years. However the bulls have been sturdy, with earnings numbers supporting larger inventory costs.

Thus, I’m upgrading the Vanguard S&P 500 ETF (NYSEARCA:VOO) from a maintain to a purchase. It is a bit of a capitulation name, as I used to be impartial on the SPX in the course of the center of March, which turned out to be prematurely of the late-Q1 interim peak.

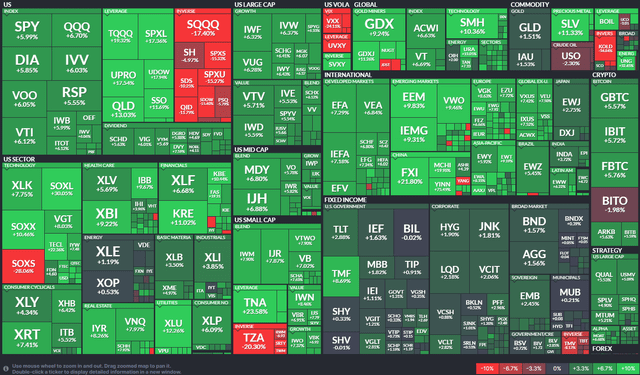

1-Month ETF Efficiency Warmth Map: Broad-Based mostly Positive aspects, VOO +6%

Finviz

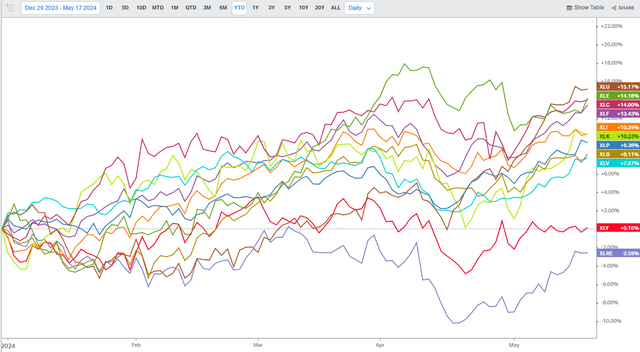

Whereas the previous month has been a boon for practically all belongings, from shares to bonds to commodities to cryptocurrencies, the sector view of the S&P 500 reveals a brand new chief. Utilities (XLU) holds the pole place, up by greater than 15% because the begin of the yr.

Vitality (XLE) and Communication Providers (XLC) are scorching on the facility sector’s heels, however it actually has been a broad set of positive aspects. Only recently, the Data Know-how sector (XLK) has reasserted itself because the place to be obese. General, this participation profile is an encouraging signal as we make our manner past the Q1 reporting interval.

Yr-to-Date S&P 500 Sector Returns

Koyfin Charts

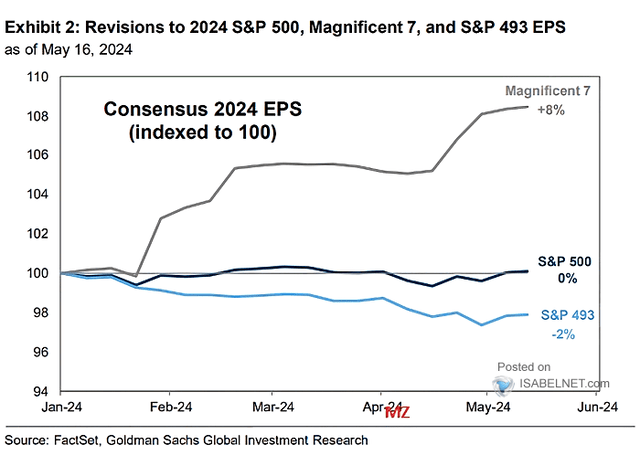

Talking of earnings, the trailing view is all about large tech. The Magnificent 7 shares proceed to be the darlings of the sellside. Charted under, that group of equities has loved an 8% EPS upward revision to FY 2024 numbers whereas the so-called “S&P 493” has really seen its earnings estimates trimmed.

The result’s an unchanged calendar-year working EPS sum anticipated for the SPX – at the moment at $244 in line with the most recent numbers from Factset. The excellent news for worth and cyclical buyers is that the S&P 493, in addition to small- and mid-cap shares, are forecast to see a lot stronger year-on-year bottom-line progress over the again half of 2024.

Upward EPS Revisions to the Magazine 7

Goldman Sachs

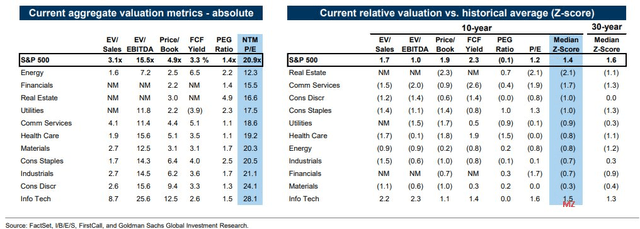

Because it stands, the S&P 500 trades at practically 21 instances ahead EPS estimates, in line with David Kostin’s US Weekly Kickstart report put out final Friday afternoon. Utilities’ earnings a number of has climbed to 17.5 and Vitality is the most cost effective sector with only a 12.3x a number of and a major buyback yield.

S&P 500 Sector Valuation Metrics

Goldman Sachs

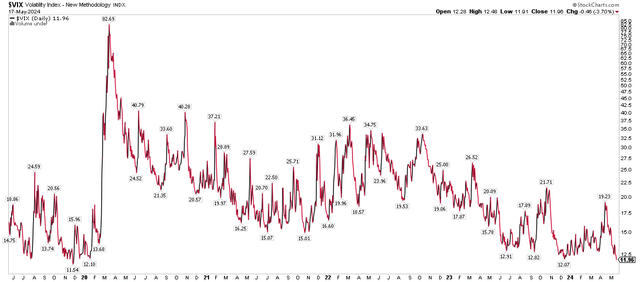

Amid fixed motion of sectors vying for the highest YTD place, what’s absent is volatility. The VIX settled final week at its lowest mark since November 2019, suggesting that VOO will seemingly see muted each day swings searching the following 30 days.

However inside that window would be the April PCE report on Could 31, the Could employment report on June 7, and Could CPI hitting the wires in the course of the subsequent FOMC assembly. Past that, may volatility kick up across the proposed late-June presidential debate? It’s one thing buyers ought to mark on their calendars.

VIX Falls to Recent Multi-Yr Lows

Stockcharts.com

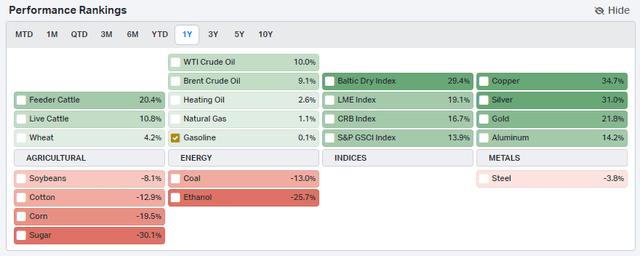

What’s serving to VOO proper now isn’t just the AI commerce. Economically delicate commodities are in full-blown bull-market mode. That is additionally aiding Vitality and Supplies, in addition to some Industrials-sector equities, although the XLI ETF has been a notable laggard recently.

So, whereas I’ve a purchase ranking on VOO, I encourage buyers to think about worth energy in lots of resource-rich markets like a bunch of rising markets and different non-US developed markets.

1-Yr Commodity Returns

Koyfin Charts

However a key tailwind serving to all risk-on areas is the latest drop in US Treasury yields. The speed on the benchmark 10-year Treasury observe sank from above 4.7% late final month to a fraction above 4.3% following the April CPI report final week.

Nonetheless, the yield appeared to search out help at 4.3%, and you’ll see within the under graph that 4.3% is certainly an vital spot on the chart. It is a doubtlessly bearish function – if we see a rebound in inflation fears, that may seemingly lead to decrease bond costs and a troublesome tape for VOO.

Decrease Charges Present a Enhance to VOO

TradingView

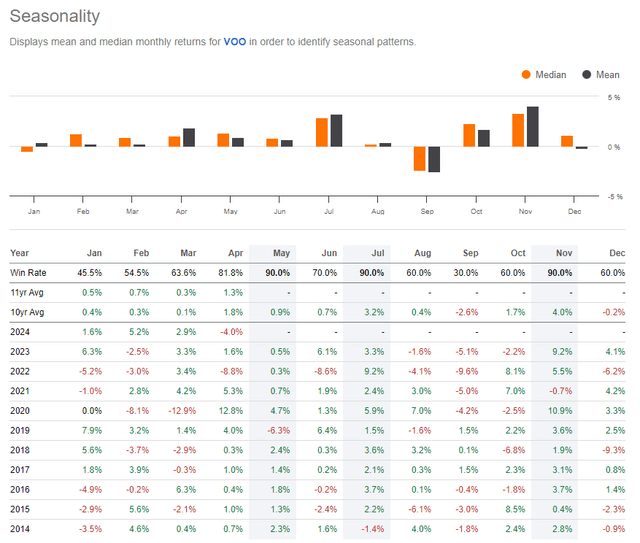

Seasonally, nonetheless, now could be a bullish time for US giant caps. Over the previous 10 years, VOO has returns considerably optimistic by way of July, and I discussed earlier that in election years, a bullish run has, on common, taken flight beginning proper after the lengthy Memorial Day weekend.

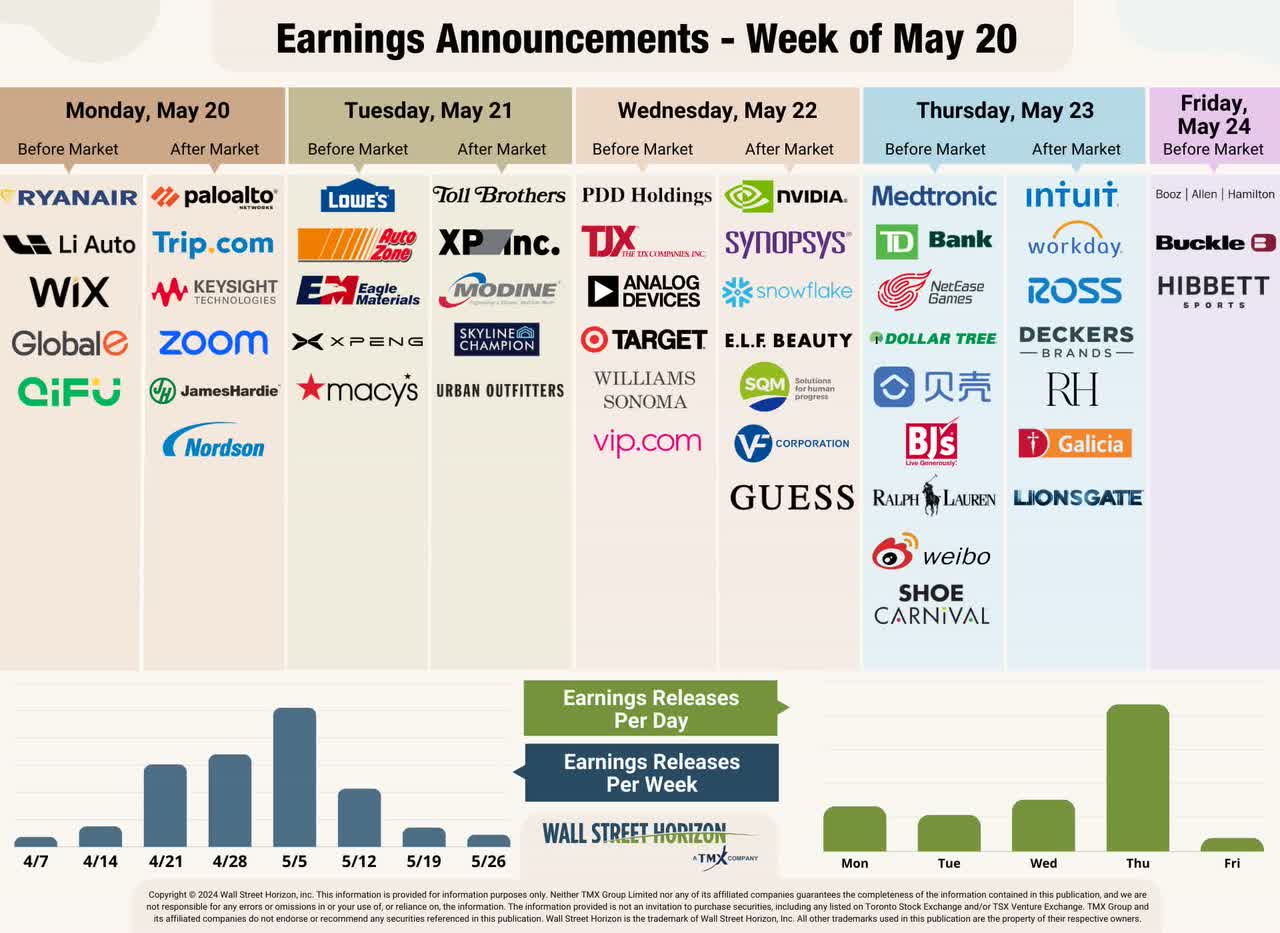

Wanting forward, the main target this week might be on NVIDIA’s (NVDA) Q1 earnings report together with revenue stories from main US retailers.

Earnings Reviews This Week

Wall Road Horizon

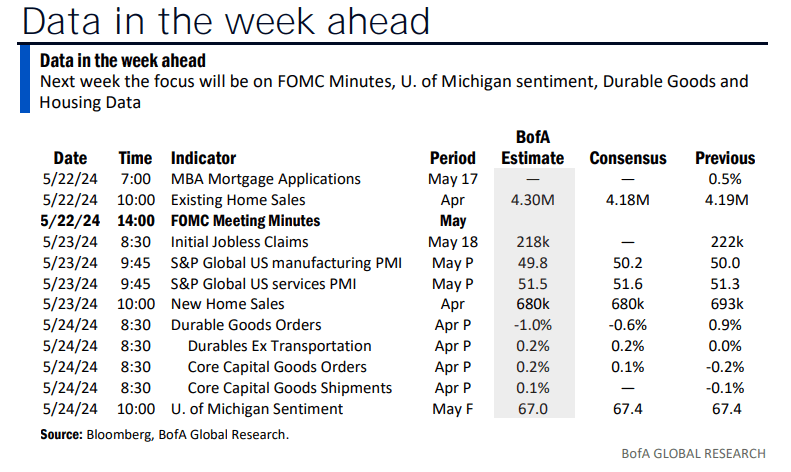

This Week’s Knowledge Deck

BofA World Analysis

VOO: Bullish Seasonal Stretch By way of July

Looking for Alpha

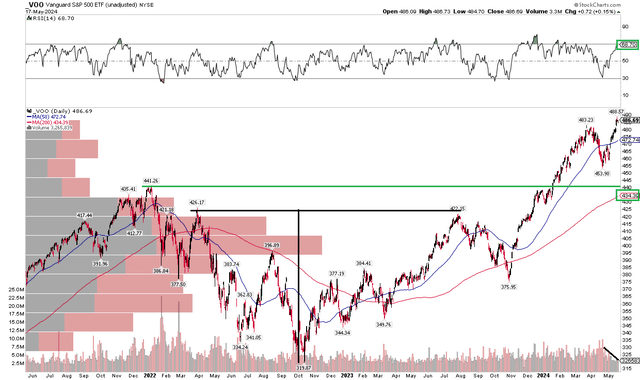

The Technical Take

With an admittedly excessive earnings a number of, above 20, respectable breadth, and optimistic seasonals, VOO’s technical chart seems sturdy for my part. Discover within the graph under that shares rose to report ranges on the shut of final week. The late-March by way of mid-April decline did not even threaten to check help on the earlier high-water mark from late 2021 and early 2022, nor did it take a run at any of the important thing Fibonacci retracement ranges. Moreover, in a uncommon feat, all 11 S&P 500 sectors commerce above each their respective 50-day and 200-day transferring averages.

Additionally check out the rising 200-day transferring common. It stays firmly upward-sloping, suggesting that the bulls are in charge of the first development. What’s extra, the RSI momentum gauge on the high of the chart has recovered to multi-week highs, simply shy of technically “overbought” situations. A threat, although, is that the most recent upward thrust in VOO’s worth comes amid remarkably low quantity. I wish to see bigger quantity upward strikes within the ETF worth and pullbacks on low quantity, so that is an indicator to watch over the approaching weeks.

By way of upside targets, if we take the $105 peak of the April 2022 to December 2023 vary and add that onto the breakout level of $425, then maybe $530 or so is doable over the months. For help, $454 and $441 are your draw back bogeys on VOO.

General, the technical view on VOO is wholesome as US giant caps march to new report highs.

VOO: Bullish Upside Breakout and Profitable Maintain of Assist, Stronger RSI

Stockcharts.com

The Backside Line

I’m upgrading VOO from a maintain to a purchase. The April dip was not a lot, however worth motion has been dominated by the bulls recently. Whereas the fund’s P/E ratio is lofty, the rally this yr has been broad-based and the technicals seem sturdy heading into the summer season.