Nvidia (NASDAQ: NVDA) has risen to grow to be an almost $1,000 inventory once more, which is normally a threshold the place buyers begin to anticipate a inventory cut up. Whereas there is not any laborious and quick rule about when to anticipate a cut up (some firms by no means do), historical past tells us that Nvidia might be contemplating one now.

Moreover, Might 22 would be the day that one is introduced, which is correct across the nook. The final time Nvidia introduced a inventory cut up, the inventory went wild and rose considerably. So, must you purchase forward of this potential announcement?

The final inventory cut up was introduced at an analogous time in 2021

The final time Nvidia enacted a inventory cut up was on July 20, 2021. That four-for-one cut up broke every Nvidia share into 4 separate items, thus rising the share depend fourfold and chopping the inventory value to 25% of its authentic worth. With out this cut up, Nvidia’s inventory could be round $3,600 right now.

Nonetheless, the timing of this final cut up announcement units the stage for a possible announcement on Might 22 throughout its first-quarter fiscal 12 months 2025 earnings launch. In its Q1 fiscal 12 months 2022 earnings launch (which occurred on Might 26, 2021), Nvidia introduced to shareholders that the board of administrators agreed to separate the inventory. That is excellent timing, because the annual assembly of stockholders was set to happen only some weeks later in order that shareholders may approve the vote. At the moment, Nvidia was buying and selling at round $600, so the inventory is much dearer right now than when it determined to separate its inventory.

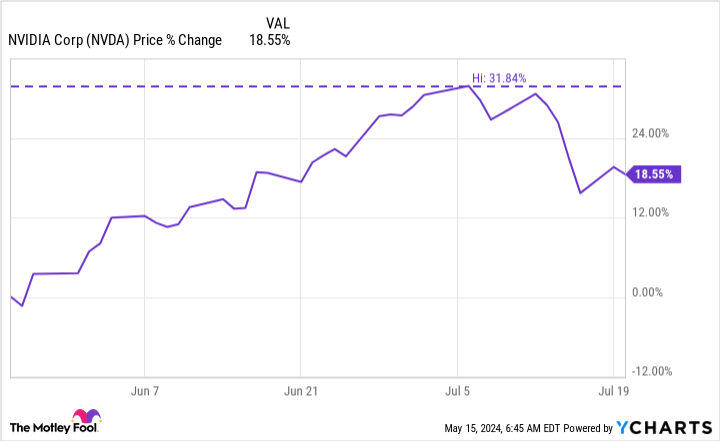

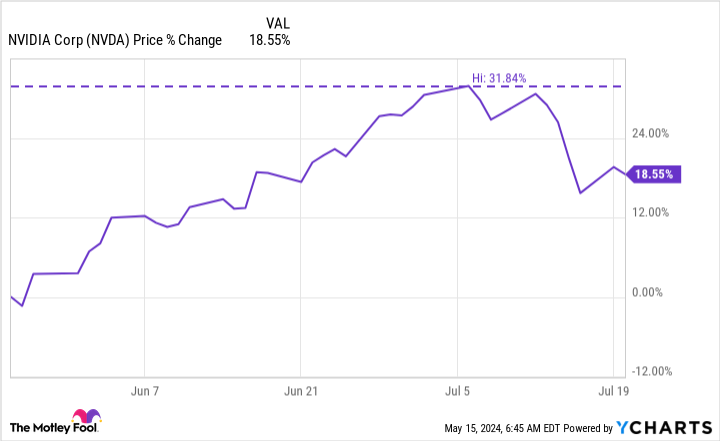

With the stage set for almost the identical situation three years later, I’d not be stunned if Nvidia introduced a inventory cut up on Might 22. The query is, will it ignite a run-up prefer it did final time? After Nvidia’s Q1 outcomes have been introduced, up till the inventory cut up date, the inventory went on a formidable tear.

With the inventory rising 30% within the days after the stock-split announcement, who would not need to get forward of that motion? Nonetheless, buyers mustn’t anticipate that sort of response once more.

Ought to Nvidia’s inventory improve by 30% from present ranges, its market cap would improve from $2.3 trillion to roughly $3 trillion. That may permit Nvidia to surpass Apple because the second-largest firm on the planet and put it inside placing distance of Microsoft as the most important firm on the planet.

I doubt {that a} stock-split announcement will create almost $700 billion in worth. Fortuitously, there are different causes to purchase the inventory.

Nvidia’s rising enterprise is driving the inventory value larger

Whereas the edge the place firms cut up their shares differs for every enterprise, the rationale stays the identical: Their inventory value has gotten too costly. This happens as a result of the enterprise is succeeding — an excellent downside to have.

Nvidia’s enterprise has been on hearth recently, with its graphics processing models (GPUs) promoting at an unbelievable tempo to fulfill the demand for information facilities constructed to energy the unreal intelligence (AI) arms race.

Any inventory motion from a possible stock-split announcement must be attributed to its GPU enterprise, as it is the driving drive behind the inventory. With administration guiding buyers for Q1 income of about $24 billion (indicating 234% development), we’re slated to see a monster quarter reported once more.

Whereas a stock-split announcement could also be coming, buyers ought to look past that to find out if Nvidia is a possible purchase (or not).

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $566,624!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Historical past Says an Nvidia Inventory-Break up Announcement Would possibly Be Approaching Might 22 was initially printed by The Motley Idiot