Klaus Vedfelt

ETF Overview

iShares Worldwide Dividend Progress ETF (BATS:IGRO) owns a portfolio of worldwide dividend development shares. About half of the fund’s portfolio are concentrated in Canada, Japan, and Switzerland. IGRO’s fund worth has an inverse correlation to the U.S. treasury charge. Its fund worth can be impacted by foreign money alternate charges of various international locations and might trigger extra volatility. IGRO additionally has a decrease publicity to know-how sector than its U.S. fund peer. This will restrict its long-term return. Therefore, we expect traders might wish to search options elsewhere.

YCharts

Fund Evaluation

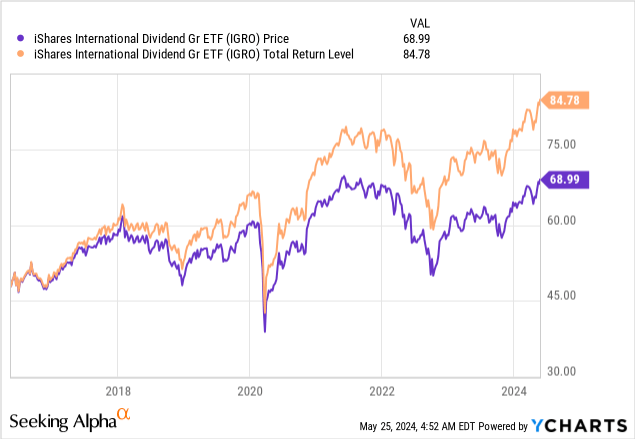

IGRO has lastly close to the height of late 2021 once more

Like many different funds, IGRO had a tough experience within the first 10 months of 2022. The fund has declined by about 26.5% throughout this time interval, barely larger than the S&P 500 index’s 24.8%. Luckily, the fund has since recovered practically all of its loss, and registered a return of 38.5% as of Might 24, 2024. This return was good, however nonetheless decrease than the S&P 500 index’s 48.1%.

Portfolio building methodology

Allow us to now go to IGRO’s portfolio building methodology. The portfolio is constructed by choosing shares from the Morningstar World Markets ex-US Index that meets the next standards: (1) a minimum of 5-years of uninterrupted annual dividend development, and (2) a payout ratio of lower than 75%. The choice methodology is sound in 3 ways. First, it focuses on dividend development. Though the methodology of choosing shares which have grown their dividends up to now 5-years doesn’t essentially guarantee future development, it ensures some degree of consistency. Second, limiting the choice of shares to those who have lower than 75% of the payout ratio reduces the prospect of any dividend reduce. Third, this payout ratio beneath 75% additionally leaves some room for future dividend development, particularly in an financial recession.

YCharts

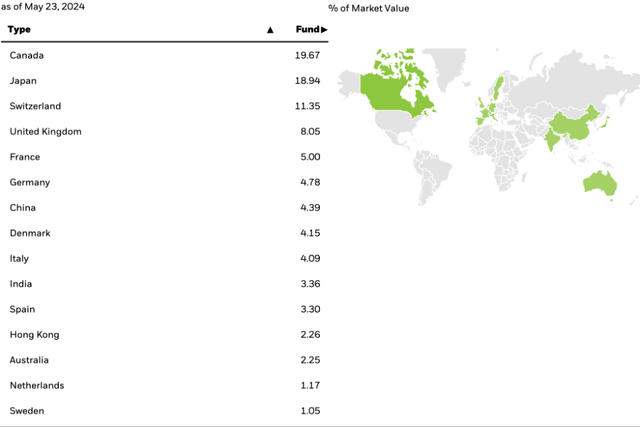

A portfolio of worldwide dividend development shares

IGRO’s choice methodology has resulted in a portfolio of about 440 shares from about 15 international locations/areas. As might be seen from the chart, shares from Canada, Japan and Switzerland represents about half of its portfolio.

iShares

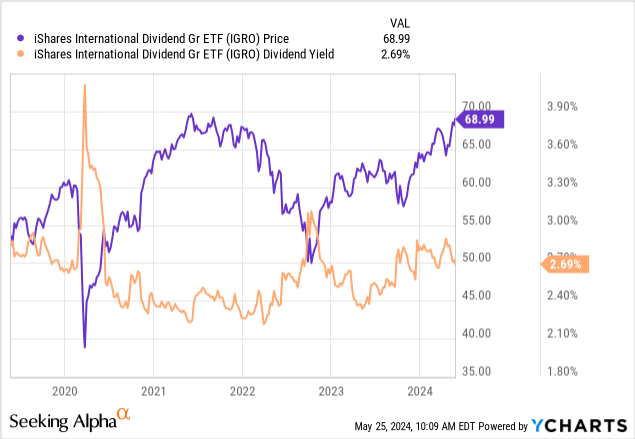

On condition that these shares are dividend development shares, not excessive dividend shares, IGRO’s dividend yield has not been very spectacular up to now. In reality, its dividend yield up to now 5 years has often been within the vary of two.2% and three.0% besides within the preliminary breakout of the COVID-19 in 2020. Its present yield of two.7% is barely larger than its U.S. peer fund, iShares Core Dividend Progress ETF (DGRO), whose yield was about 2.4%.

YCharts

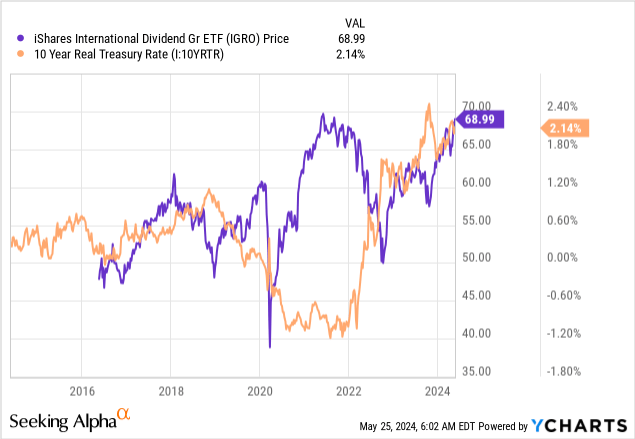

IGRO’s worth efficiency might be impacted by Federal Reserve’s charge coverage

On condition that IGRO’s portfolio embody solely worldwide shares, its fund worth might be impacted by foreign money charges of various international locations. Generally, a powerful U.S. greenback will usually compress its fund worth and vice versa. The energy of the U.S. greenback is often impacted by the U.S. treasury charge. As might be seen from the chart beneath, IGRO’s fund worth usually has an inverse correlation to the U.S. treasury charge. When the Federal Reserve reduce the speed in 2020, it impacted the treasury charge and IGRO’s fund worth skilled a powerful rally. However, when the Federal Reserve aggressively hiked the speed in 2022, IGRO’s fund worth declined sharply.

YCharts

Wanting ahead, we’re doubtless already on the peak or close to the height of this charge hike cycle. Nonetheless, given the truth that the battle towards inflation is way from over, and inflation has the tendency to change into a self-fulfilling prophecy, the Federal Reserve might must maintain the speed elevated for a prolonged time period. Subsequently, in our opinion, it’s unlikely that the Federal Reserve will decrease the speed any time quickly. Therefore, we don’t anticipate any tailwind from the Federal Reserve to occur within the near-term.

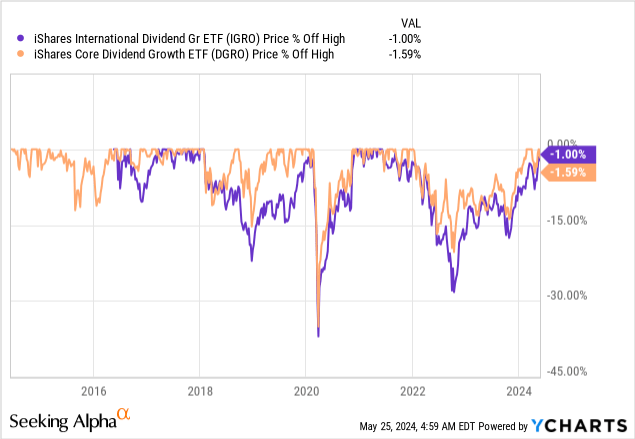

IGRO can decline greater than its U.S. friends

Since IGRO’s fund worth might be impacted by foreign money alternate charge, its fund worth might be extra unstable than its U.S. peer fund, DGRO. In reality, IGRO’s 5-year common beta of 0.92 is larger than DGRO’s 0.83. For reader’s data, beta is a measure of the fund’s volatility in relation to the general market. Not solely does IGRO have larger volatility, it tends to say no way more than DGRO in a bear market. As might be seen from the chart beneath, IGRO’s fund worth has a a lot larger diploma of decline within the preliminary outbreak of COVID-19 in 2020, and in the course of the bear’s market in 2022 than DGRO.

YCharts

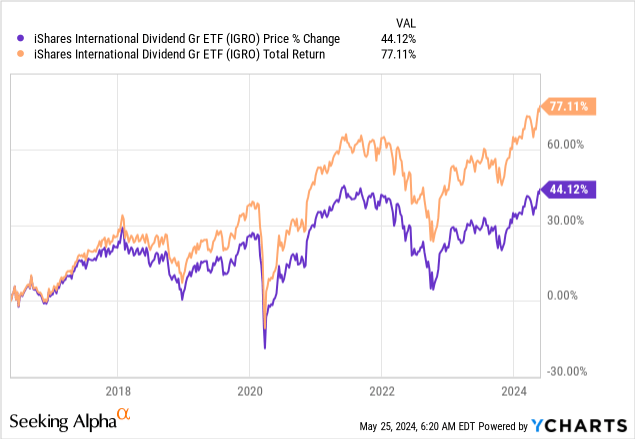

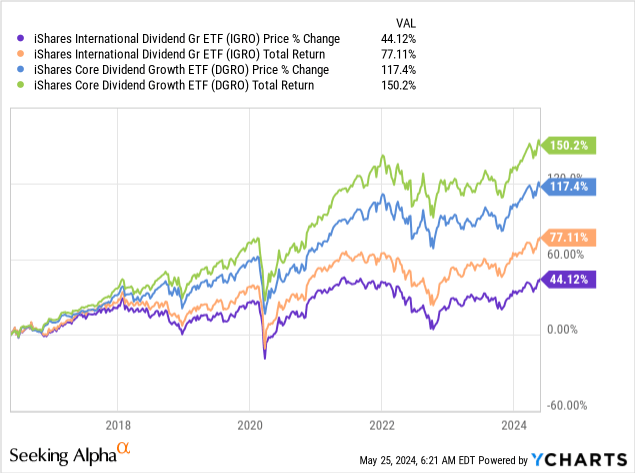

Not engaging relative to its U.S. peer

In addition to larger declines up to now, it has a a lot decrease return than DGRO up to now. As might be seen from the chart beneath, it has delivered a complete return and worth return of 77.1% and 44.1% respectively since its inception in Might 2016. That is a lot decrease than DGRO’s complete return and worth return of 150.2% and 117.4% respectively.

YCharts

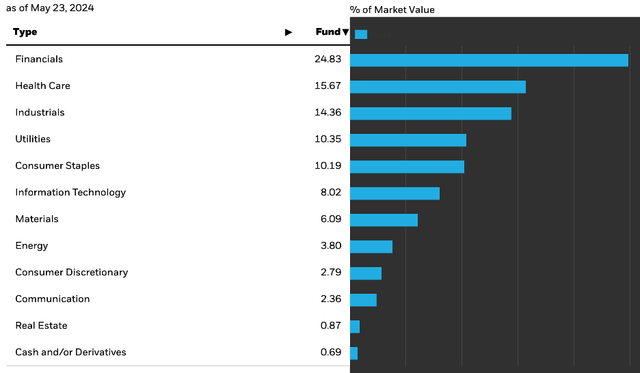

There are two the reason why we expect IGRO underperformed DGRO. First, IGRO’s publicity to development sectors equivalent to know-how sector is sort of restricted. As might be seen from the chart beneath, know-how sector solely represents about 8.0% of its complete portfolio. In distinction, this sector represents about 17.0% of DGRO’s portfolio.

iShares

One more reason we expect IGRO trailed its U.S. peer fund, DGRO, is as a result of most shares in IGRO’s portfolio are usually not multinational enterprises. Nearly all of them solely focus in a single or a number of markets. That is fairly totally different than DGRO’s portfolio. Though shares in DGRO’s portfolio are U.S. shares, the vast majority of them are multinational enterprises. In different phrases, these U.S. shares have companies in most main markets on the earth. That is evident within the high holdings of DGRO’s portfolio. For instance, Microsoft (MSFT) and Apple (AAPL), DGRO’s high two holdings, are way more “worldwide” than most, if not the entire shares in IGRO’s portfolio. Therefore, these U.S. dividend development shares have higher development potential than IGRO’s worldwide dividend development shares.

Investor Takeaway

Our evaluation reveals that IGRO might not be one of the best place to take a position because it doesn’t present higher return than its U.S. peer fund, and it may possibly decline extra in a bear market too. Subsequently, we expect traders ought to search different funds as an alternative.

Extra Disclosure: This isn’t monetary recommendation and that every one monetary investments carry dangers. Buyers are anticipated to hunt monetary recommendation from professionals earlier than making any funding.