bankrx/iStock by way of Getty Photographs

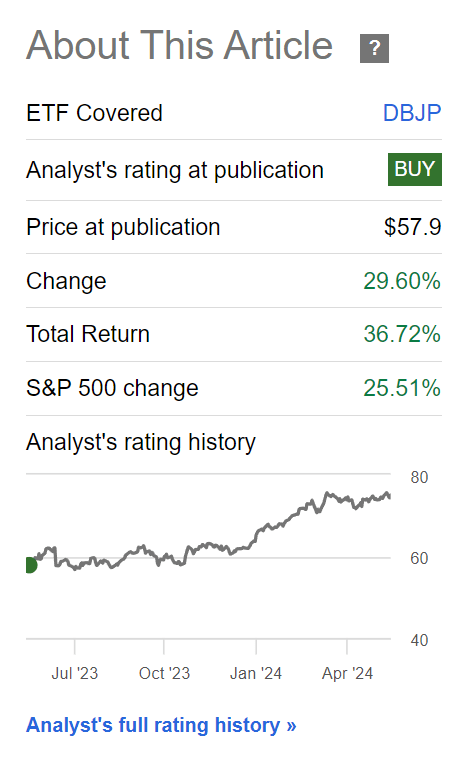

A 12 months in the past, I wrote a bullish article on the Xtrackers MSCI Japan Hedged Fairness ETF (NYSEARCA:DBJP), suggesting buyers accumulate Japanese equities on any pullbacks because the nation’s shares had been low-cost in comparison with the remainder of the world. Up to now, my advice has proved right, because the DBJP ETF has outperformed the mighty S&P 500 Index, returning 37% in comparison with the S&P 500’s 26% (Determine 1).

Determine 1 – DBJP has outperformed the S&P 500 Index (Searching for Alpha)

Nonetheless, after an extra 37% rally, we should always evaluation the basics of the Japanese inventory markets to see if the DBJP ETF stays a purchase.

With the BOJ now targeted on stopping extra forex weak point, the depreciating Yen tailwind that has turbocharged DBJP returns could recede within the coming months. Moreover, Japanese fairness valuations are actually extra normalized, so additional positive factors could also be tougher to return by.

I consider a interval of consolidation is so as, so I’m downgrading DBJP to a maintain.

Transient Fund Overview

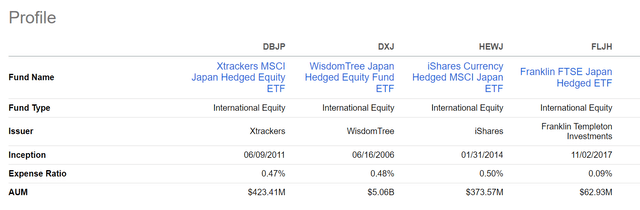

The Xtrackers MSCI Japan Hedged Fairness ETF is one in every of a handful of currency-hedged ETFs specializing in Japanese equities (Determine 2). Along with DBJP, the most important currency-hedged Japanese ETFs are the WisdomTree Japan Hedged Fairness Fund ETF (DXJ), the iShare Foreign money Hedged MSCI Japan ETF (HEWJ), and the Franklin FSE Japan Hedged ETF (FLJH).

Determine 2 – DBJP vs. peer hedged JPY funds (Searching for Alpha)

The DBJP ETF absolutely replicates the underlying MSCI Japan Index whereas utilizing spinoff contracts to hedge the fund’s forex publicity for US Greenback-based buyers.

The DBJP ETF has grown to $423 million in property whereas charging a 0.47% expense ratio.

Weak Foreign money + Sturdy Shares A Highly effective Combo

For the DBJP ETF, returns up to now 12 months have been pushed by robust returns within the MSCI Japan Index in native forex (Japanese Yen) phrases and a plummeting Yen in opposition to the US Greenback. For instance, the Nikkei 225 Index, a proxy for the MSCI Japan Index tracked by the DBJP ETF, returned 24.7% up to now 12 months, practically equal to the S&P 500 Index (Determine 3).

Determine 3 – Nikkei 225 Index vs. S&P 500 Index in previous 12 months (Searching for Alpha)

Moreover, the Japanese Yen weakened by 11.7% in opposition to the US Greenback up to now 12 months (Determine 4).

Determine 4 – JPY/USD weakened by 11.7% up to now 12 months (Searching for Alpha)

For the reason that DBJP ETF shorts the Yen in opposition to the US Greenback to hedge away the forex influence for American buyers, this interprets into a further 11.7% tailwind to the fund’s native forex returns (Determine 5).

Determine 5 – DBJP hedges away forex danger for American buyers (etf.dws.com)

When Will Yen Weak spot Come To An Finish?

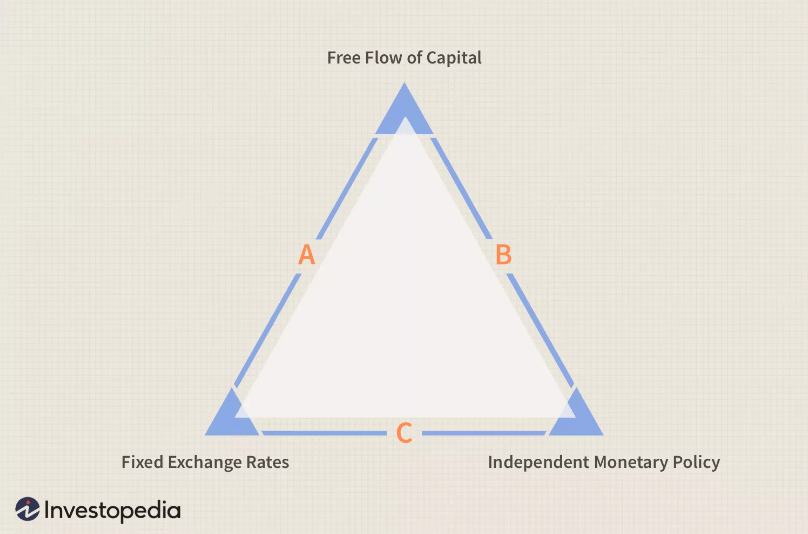

As I detailed in my prior article, the Japanese Yen is basically weak as a result of Mundell-Fleming trilemma, as Japanese policymakers have saved Japanese rates of interest on the zero sure whereas permitting the free stream of capital. Due to this fact, the Yen needed to weaken to stability the system (Determine 6).

Determine 6 – Illustrative Mundell-Fleming Trilemma (investopedia)

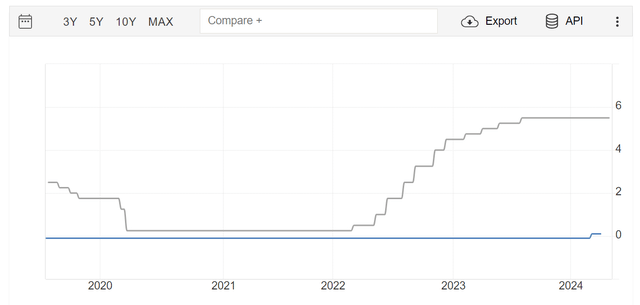

In actual fact, though the U.S. Federal Reserve had begun elevating rates of interest in March 2022, its Japanese counterpart, the Financial institution of Japan (“BOJ”), had solely not too long ago moved off of detrimental coverage charges in March 2024 (Determine 7).

Determine 7 – US Fed Funds vs BOJ coverage charges (tradingeconomics.com)

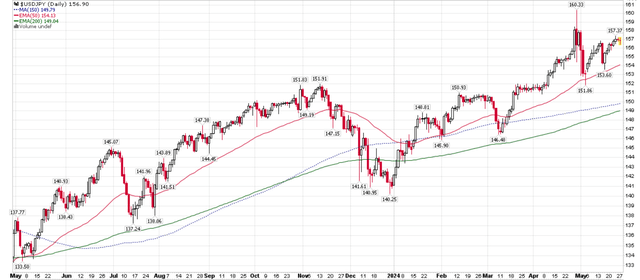

Due to this fact, the Yen has collapsed up to now 12 months, from ~140 JPY/USD once I wrote my final article in Might 2023 to a latest low of 160 JPY/USD (Determine 8).

Determine 8 – JPY/USD has collapsed to a low of 160 JPY/USD (stockcharts.com)

In latest weeks, we’ve got lastly seen Japanese central bankers intervene within the forex markets, as they had been rumored to have defended the important thing psychological 160 JPY/USD stage on Might 2nd with probably greater than $23 billion in money.

Going ahead, I consider the 160 JPY/USD stage is a key ‘line within the sand’ for Japanese policymakers as they attempt to reintroduce two-way volatility to the forex markets which were on a one-way depreciation freight practice for the previous few years.

With a weaker Yen tougher to return by, I consider the depreciating Yen tailwind for the DJBP ETF will flip impartial and will even flip right into a headwind within the coming months.

Japanese Markets No Longer ‘Low-cost’ On Absolute Foundation

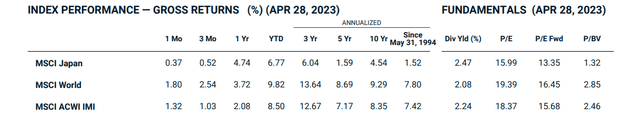

The opposite key driver behind my bullish stance on Japanese equities a 12 months in the past was due to their valuations. On a ahead foundation, the MSCI Japan Index was buying and selling at a Fwd P/E ratio of 13.4x, in comparison with 16.5x for the MSCI World Index and 18.4x for the S&P 500 in April 2023 (Determine 9).

Determine 9 – MSCI Japan valuations, April 2023 (msci.com)

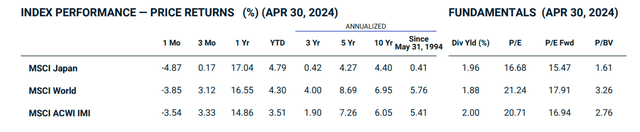

At the moment, the identical index valuations have risen to fifteen.5x Fwd P/E for MSCI Japan, 17.9x for MSCI World, and 21.5x for the S&P 500 Index (Determine 10).

Determine 10 – MSCI Japan valuations, April 2024 (msci.com)

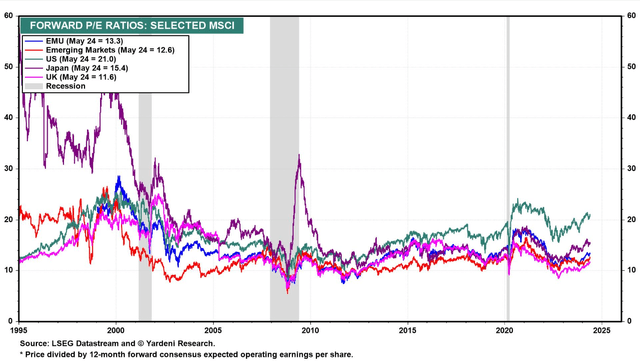

Whereas the MSCI Japan Index continues to be ‘cheaper’ than the MSCI World Index and the S&P 500 Index, it’s not low-cost on an absolute foundation. Traditionally, 15.5x Fwd P/E for MSCI Japan is in direction of the excessive finish of its vary since Nice Monetary Disaster (Determine 11).

Determine 11 – Historic Fwd P/E suggests MSCI Japan is not ‘low-cost’ (yardeni.com)

Technicals Counsel A Interval Of Consolidation

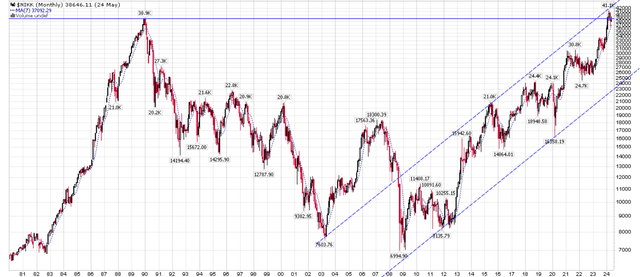

Technically, the Nikkei Index not too long ago surpassed its 1990 highs and pushed to the psychological 40,000 stage earlier than pulling again in latest weeks (Determine 12). Whereas the pattern stays technically robust and optimistic, one ought to assume a interval of consolidation is required to ‘digest’ the present 40k stage.

Determine 12 – Nikkei has returned to 1990 peak (Writer created utilizing stockcharts.com)

The index can also be on the higher finish of a rising uptrend for the reason that 2008 lows, which suggests a interval of consolidation is so as.

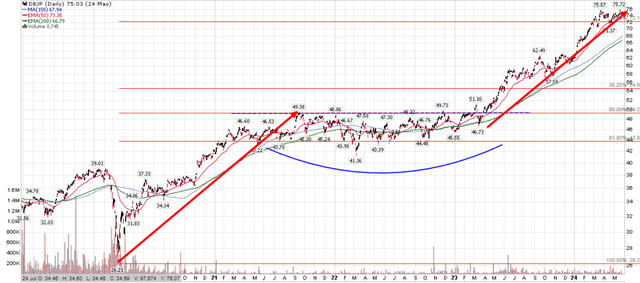

For the DBJP ETF, its 2023 breakout from the ~$50 stage has now accomplished a ‘measured transfer’ of ~$25, roughly equal to a swift rally from the COVID-19 pandemic lows to 2021 highs (Determine 13). I’d not be stunned if DBJP spends a number of quarters backing and filling across the $75 stage because it digests the explosive breakout transfer from 2023.

Determine 13 – DBJP has accomplished a ‘measured transfer’ (Writer created with stockcharts.com)

Conclusion

With the Financial institution of Japan now squarely targeted on stopping extra Yen weak point and Japanese fairness valuations extra normalized in comparison with the remainder of the world, I consider it might be time for the DBJP ETF to take a breather and spend a number of quarters consolidating close to the present $75 / share stage. Due to this fact, I’m downgrading DBJP to a maintain.