Walter Bibikow

Introduction

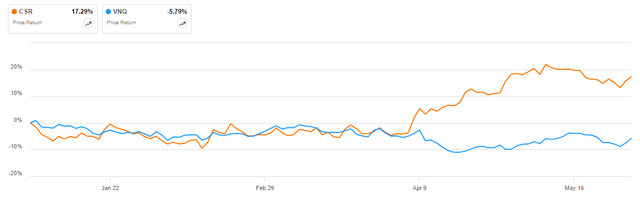

Centerspace (NYSE:CSR) has considerably outperformed the Vanguard Actual Property Index Fund ETF (VNQ) to this point in 2024, with the REIT’s shares delivering a double-digit acquire, considerably above the mid-single-digit decline of VNQ:

CSR vs VNQ in 2024 (Looking for Alpha)

Trying forward, I feel the corporate will proceed to outperform, with a 7.5% market-implied cap charge, rising internet working earnings and a well-structured debt maturity profile, however the considerably elevated leverage and declining occupancy. I feel administration overhead seems fairly bloated, and as such Centerspace could possibly be an acquisition goal in mild of its engaging valuation however excessive administrative bills.

Firm Overview

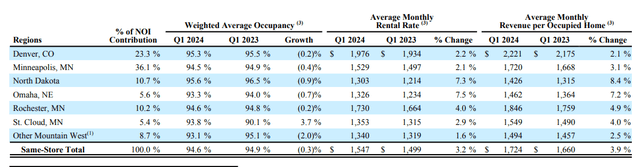

You may entry all firm outcomes right here. Centerspace is a Residential REIT that has pursuits in 70 house communities consisting of 12,883 house houses. The REIT is closely concentrated in a couple of states, specifically Minnesota (52% of complete internet working earnings, or NOI), Colorado (23%), and North Dakota (11% of NOI):

Similar-store portfolio overview (Centerspace Q1 2024 Monetary Complement)

Operational Overview

Centerspace reported occupancy of 94.6%, down 0.3% Y/Y, indicating some misery within the REIT’s portfolio, however total a strong degree for a residential REIT.

NOI developments had been markedly transfer constructive, with rising rents and decrease bills leading to a really strong 7.5% NOI improve year-over-year. This drove Core FFO to 1.23/share in Q1 2024, 15% greater Y/Y. The sturdy Core FFO per share was additionally helped by a decrease share rely, with the corporate spending $4.7 million on share repurchases within the quarter.

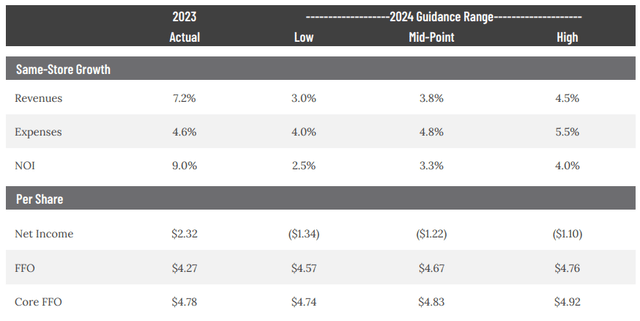

Up to date 2024 Outlook

The sturdy begin of the yr prompted Centerspace to spice up its low-end Core FFO steering, with Core FFO now anticipated in a spread of $4.74-4.92/share, up 1% Y/Y:

Up to date 2024 Outlook (Centerspace June 2024 Investor Presentation)

The NOI outlook was additionally upgraded, pushed primarily by decrease expense progress. Consequently, NOI is anticipated to extend by 2.5-4% in 2024.

Debt Place

The corporate ended Q1 2024 with a internet debt of $916 million, implying that internet debt accounts for 44% of the corporate’s enterprise worth. It also needs to be famous that the corporate has most popular shares which account for five% of enterprise worth.

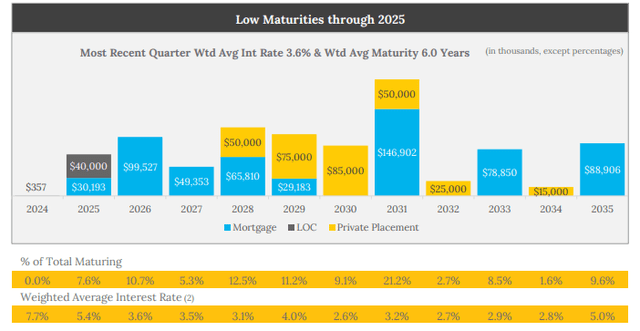

The common value of debt is 3.6%, with a weighted common maturity of 6 years. What’s extra, the corporate has simply 7.6% of all debt maturing by way of 2025, with 42% of all debt locked at charges round 3% and expiring in 2030-2034:

Debt maturity overview (Centerspace June 2024 Investor Presentation)

Consequently, the corporate will profit from its tiered debt maturity construction for no less than 6 extra years earlier than refinancing at greater charges kicks in.

Market-implied cap charge

Centerspace is anticipated to generate internet working earnings of about $157 million in 2024, which in opposition to an enterprise worth of about $2.1 billion represented a really engaging market cap charge of seven.5%. Normal and administrative bills are forecast at about $27.75 million, implying a 1.3% burden from administration overhead, which is sort of excessive.

Bigger REITs may doubtlessly carry the administration overhead all the way down to about 0.8% of enterprise worth, indicating a takeover of Centerspace by a extra environment friendly competitor may create important worth.

Synergies from a possible takeover

As highlighted within the above paragraph, I imagine Centerspace is overspending on normal and administrative bills. AvalonBay Communities (AVB), the most important residential REIT in the US by market capitalization, presently has an enterprise worth of about $35.2 billion, and spent solely $76 million on normal and administrative bills in 2023, as per its annual report. This represents simply 0.2% of enterprise worth spent on normal and administrative bills.

For comparability, Centerspace spent $20 million on normal and administrative bills in 2023, as per its annual report, representing virtually 1% of its enterprise worth. The distinction to the 1.3% administration overhead burden outlined above is made up by property administration bills which aren’t deducted from internet working earnings.

All in all, I imagine it’s affordable to imagine a bigger peer may materially reduce down on normal and administrative bills, leading to a circa $10 million financial savings relative to enterprise worth, or about $0.67/share enhance to earnings on a typical shareholder degree, bearing in mind the present share rely of 14.9 million.

Contemplating that the most important shareholders in Centerspace are Blackrock and Vanguard, every holding about 17% and 16% respectively, an opportunistic purchaser is unlikely to face opposition from shareholders.

I ought to notice there is no such thing as a concrete proof {that a} third get together is planning to take over Centerspace, however the monetary rationale is actually there in my view.

Dangers

The principle threat going through Centerspace is its barely elevated leverage, at 44% of its capital construction. That is offset by a beneficial maturity profile and restricted near-term maturities. That stated, the corporate is actively shopping for again shares which boosts leverage even additional.

One other factor to notice is that occupancy is reducing as the corporate is elevating rents, indicating tenants are struggling to maintain up with greater funds. If this pattern continues, it could put the corporate’s sturdy NOI progress in query. This threat is considerably mitigated by the low unemployment within the states the place the corporate’s portfolio is concentrated, with Minnesota (2.7% unemployment charge) and Colorado (3.7%) each under the U.S. common of three.9%.

Conclusion

Centerspace had a really sturdy begin to 2024, with NOI rising 7.5% Y/Y, pushed by greater rents and decrease bills. For the complete yr, the NOI improve is ready to be extra muted, by round 3.25%, as the corporate catches up with its expense spending.

The market-implied cap charge of seven.5% could be very engaging for a residential REIT, though the excessive quantity of administrative bills doesn’t enable the complete quantity to succeed in shareholders. As such I feel the complete worth of Centerspace will solely be unlocked by an acquisition by a bigger participant.

Thanks for studying.