trenchcoates

Nothing has precipitated extra points than the progress or lack thereof of each EBITDA (because the acquisition) and its place within the coming development for Warner Bros Discovery (NASDAQ:WBD) because the final article. Administration has since completed a bunch of displays to attempt to clean out the method of going from “slicing like mad” as a result of the acquisition actually had no money move (or positively nothing near sufficient) to rising the enterprise. Mr. Market is upset that development has not occurred from the beginning whereas fretting about that lack of development on the impact of EBITDA and money move. Put Mr. Market down as lower than happy with the entire state of affairs. But in addition notice that if administration follows by with the plan, and extra goes proper than improper, Mr. Market might nicely turn into a fan.

Inventory Value Historical past

All of this confusion has, after all affected the inventory worth.

Warner Bros Discovery Widespread Inventory Value Historical past And Key Valuation Measures (In search of Alpha Web site June 10, 2024) Warner Bros Discovery Widespread Inventory Value Historical past And Key Valuation Measures (In search of Alpha Web site Might 31, 2024)

By no means thoughts that board member John Malone gave an interview stating that this might take some time to work out as a result of issues have been worse than administration anticipated. He additionally famous that he offered places to assist administration.

Mr. Market has clearly been dissatisfied from the beginning (as proven above). Generally, a big acquisition is extra like constructing a home aside from the truth that you obtain a price report from the market every single day. That worth report can lead you astray as to the progress administration is making. This has led administration to the newest “street present”.

EBITDA Progress And Free Money Stream

The final article talked about administration’s frustration over the market impatience with reconstructing the company in a method that improves profitability and results in development.

The market responded by shifting the dialog to income development and EBITDA.

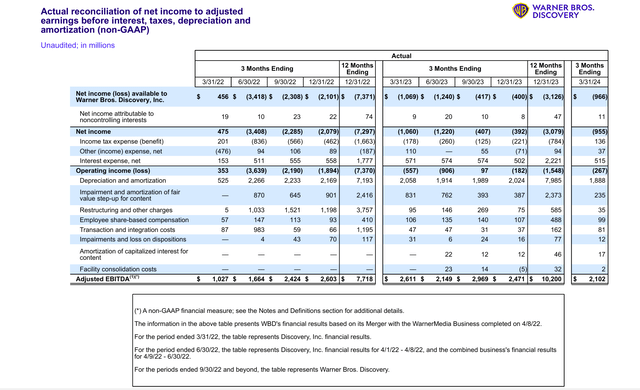

Warner Bros Discovery Adjusted EBITDA Progress (Warner Bros Discovery First Quarter 2024, Earnings Supplemental Calculations)

Word that EBITDA positively grew 12 months over 12 months. However there was some concern that the quarterly comparability turned adverse starting with the fourth quarter.

This can be a firm the place earnings can be closely influenced by film (or video games for instance) hits. Final 12 months there was a really profitable recreation that was not replicated for the fiscal first quarter. Earlier than that there was the double strike (amongst different points). Subsequently, quarterly comparisons can positively swing wildly, and it actually won’t imply a lot.

One of many issues that impacted EBITDA within the earlier fiscal 12 months was that DTC moved from shedding billions to almost breakeven (as lined all year long in earlier articles.

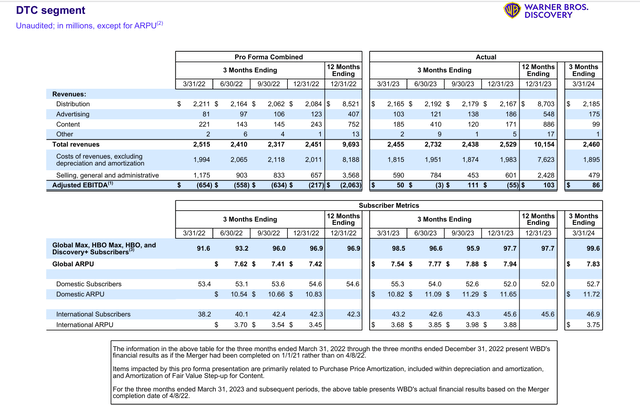

Warner Bros Discovery DTC Pattern Outcomes (Warner Bros Discovery First Quarter 2024, Earnings Supplemental Calculations)

One of many issues to recollect about that is that the development in DTC that’s proven above got here a 12 months forward of schedule. The comparisons may nicely be flat or range barely both method as a result of the expansion plan is on schedule. However it’s simply now being offered within the newest convention presentation.

Now the market pretends to be bored with listening to “the identical outdated factor” when the actual purpose is there isn’t a dramatic enchancment to match the earlier fiscal 12 months. But the absence of these large losses was an element within the debt reimbursement being far forward of the unique schedule.

Administration seemingly raised some targets the place it may when one thing like this occurs. However to count on the “full subsequent step” which is probably going a development technique a 12 months early as a result of the monetary enchancment occurred forward of time is probably going not affordable. As an alternative, it’s affordable to count on some flat outcomes till the following step will get underway as deliberate.

Free Money Stream

Additionally, you will need to be aware that “you can’t spend EBITDA”. Subsequently, EBITDA progress must be in contrast with money move and free money move progress. Subsequently, you, the investor want resolve when you agree how the GAAP quantity was spent and when you agree with the non-GAAP free money move calculation as a spendable quantity.

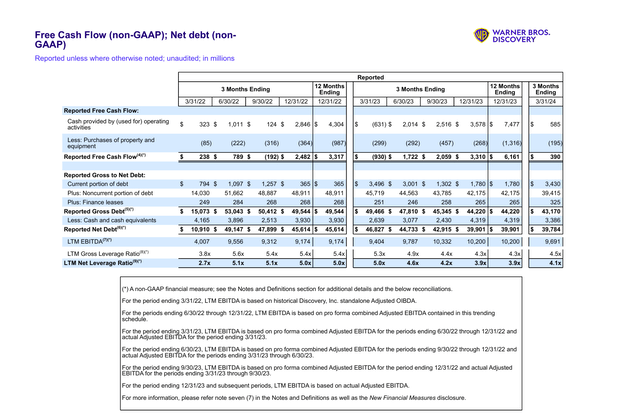

Warner Bros Discovery Free Money Stream And Associated Traits (Warner Bros Discovery First Quarter 2024, Earnings Supplemental Calculations)

Ever because the first quarter of fiscal 12 months 2023, the free money move comparability with the earlier quarter has been enhancing. For an acquisition the dimensions of the one made right here, that could be a large enchancment in a time interval that few managements can match. This has funded an sudden strong debt discount plan that has given the corporate appreciable monetary flexibility sooner than a few of us anticipated.

Word particularly that the primary quarter confirmed a greater than $1 billion money move enchancment over the earlier fiscal 12 months. Many have been targeted on EBITDA. However the money move enchancment proven above is spendable whereas EBITDA is just not.

Additionally be aware that the corporate has paid down roughly $10 billion of long-term debt because the acquisition in 2022. For the reason that shut of the quarter, administration has referred to as nonetheless extra debt. This led to a remark within the newest convention name about repaying roughly $13 billion in debt because the acquisition.

Deleveraging Technique

Most likely the only most essential goal must be to generate money to deleverage. Administration has talked about in a number of convention calls and displays that money was not essential earlier than the acquisition. In consequence, they found gadgets that wanted to be billed mixed with different gadgets that wanted to be collected. This has likewise helped the deleveraging course of.

Mr. Market might not care about this as it’s a “one-time” or “not repeating” merchandise. Nonetheless, the reimbursement of debt provides administration a whole lot of flexibility. It was talked about within the newest presentation that administration will take a look at acquisitions. The leverage ratio under 4 seemingly provides administration the choice to just do that. Administration will seemingly have the debt ratio under 4 with the following quarterly report.

As soon as that occurs then different enterprise methods will rise in significance.

Enterprise Technique

The most recent convention centered upon the concept administration will now develop the enterprise. That has been talked about ever because the acquisition was made.

Clouding the problem was an absence of money move of the acquired property. That needed to be fastened first. Administration subsequently redirected efforts in direction of profitability with value controls and correct accounting. Clearly techniques needed to first be constructed for that. This has led to administration frustration with the market greater than as soon as.

However what’s rising now’s a market perspective that the corporate didn’t develop, subsequently, it can not develop. But it is vitally essential to have the correct methods with assist techniques in place earlier than worthwhile development can happen.

To this finish there was a convention dialogue about bundling as this firm has lengthy been within the forefront of discussing that idea. It additionally took a while to give you a rational development technique after the assist techniques got here into existence. With a giant firm this takes extra time than the market had endurance for.

Now administration laid out these development plans in the course of the convention presentation. To a sure diploma, these plans have additionally been mentioned in convention calls and different displays. What’s totally different is that after two lengthy years of ready, a few of these plans are launching.

Mr. Market was yawning like this was too late. However leisure is a really fractured market with nobody actually controlling a big a part of the market. Subsequently, good product is required, or the expansion would fail. It additionally signifies that there is probably not consolidation as a result of fractured nature of the market. This might change because the streaming market ages. Mainly, anybody with a aggressive product can “jump-in” at any time proper now. Boundaries to entry are low to non-existent in some circumstances. The buyer has a whole lot of decisions consequently.

Regardless of the market response, there’s each probability that the corporate now has the monetary flexibility to regulate its technique as soon as that technique is launched. Cash can do wonders. The truth that the debt has been paid far forward of time now provides administration flexibility to execute the approaching development methods that leveraged purchases usually wouldn’t have.

So far as when these methods will take-over to steer the corporate to extra profitability as the results of the preliminary deleveraging effort (and constructing assist buildings) fades, that may range. Almost certainly it would catch the market without warning.

The market has been fed up to this point with the preliminary steps. But when these steps are completed accurately, the market will seemingly adore what comes subsequent.

Sports activities

The market has been involved with the NBA contract negotiations for a while. However administration has introduced up that their sports activities protection (or supply) has been a worldwide group for a while. Subsequently, the lack of anybody perceived main merchandise, just like the NBA contract, is unlikely to show to be a long-term difficulty.

A contract for the French Open Tennis match was simply introduced. That is exactly the sort of announcement that might result in a obligatory rebuild (or substitute of the loss) of the sports activities protection ought to the NBA contract be misplaced. It will after all take a number of of those because the NBA contract is way extra vital. However as a worldwide enterprise, there are various issues that may finally offset the lack of the NBA contract.

After all, that loss has not occurred regardless of market worries. However the existence of a worldwide group is one more profit that will assist in the course of the negotiations. There may nicely be economies of scale that opponents wouldn’t have and different advantages as nicely.

Abstract

The preliminary steps of the acquisition have been a painful course of with a whole lot of adverse outcomes catching the eye of Mr. Market. This even has Mr. Market fretting concerning the free money move progress as a result of he thinks the enterprise won’t develop (largely as a result of it has not).

However it’s laborious to measure the expansion of the remaining companies as a result of a whole lot of pointless “duties” have been reduce. This led to a shrinkage by eliminating nonessential and unprofitable components of the company whereas enhancing the core operations which can be the way forward for the corporate. This type of progress the market doesn’t see at present and definitely can not measure whereas the losses and errors gave the impression to be very actual.

This can be a robust purchase based mostly upon the concept administration has completed what it needed to, and it was completed to accurately assist the approaching development that the market will very very like. Misplaced in the entire fear is the very improved debt ratio at a charge that was fully sudden.

Whereas the market clearly doubts a whole lot of the newest administration convention presentation, the market will keep in mind what was mentioned ought to administration carry out in keeping with the steerage set. That would result in a significantly larger inventory worth later.

Dangers

The most recent methods, like launching “MAX” and bundling may fail or run into sudden issues. They likewise may fail to fulfill administration expectations. Because the CEO and others famous, they intend to maintain working with the brand new concepts till passable returns are obtained. That will likewise take longer than the market has endurance for. It’s potential, however unlikely that it by no means occurs, and the inventory worth by no means recovers or exceeds the value earlier than the acquisition.

The potential lack of success in renewing the enterprise relationship with the NBA can be weighing on the way forward for the inventory worth. There could be no assurance {that a} lack of the contract could be offset by sufficient enterprise elsewhere.

The flicks are at present working forward of expectations. There may be completely no assurance that can result in a great 12 months or a great subsequent 12 months((s)). Equally, there’s a danger that video games won’t ever have one other “hit” recreation.

Administration claims to have discovered the fabric “skeletons within the closet” that wanted some main actions. There is no such thing as a assurance that there won’t be one more materials discovery sooner or later.

The lack of key personnel may set again firm plans materially.