Small enterprise exercise was up once more in Could, because the variety of staff working (+1%) and hours labored (+1.9%) elevated and carried out barely higher than the final 12 months

With secure development throughout Predominant Avenue, hourly staff are feeling extra content material, with 4 out of 5 saying they’re proud of their jobs. Considerations round inflation and non-work stresses declined by 6% and 5%, respectively.

Noteworthy tendencies this month:

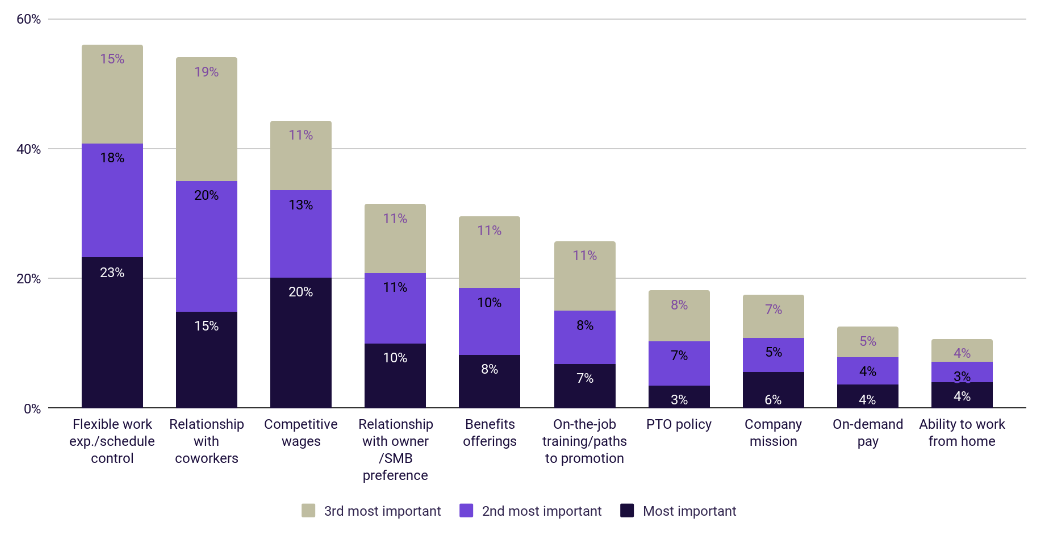

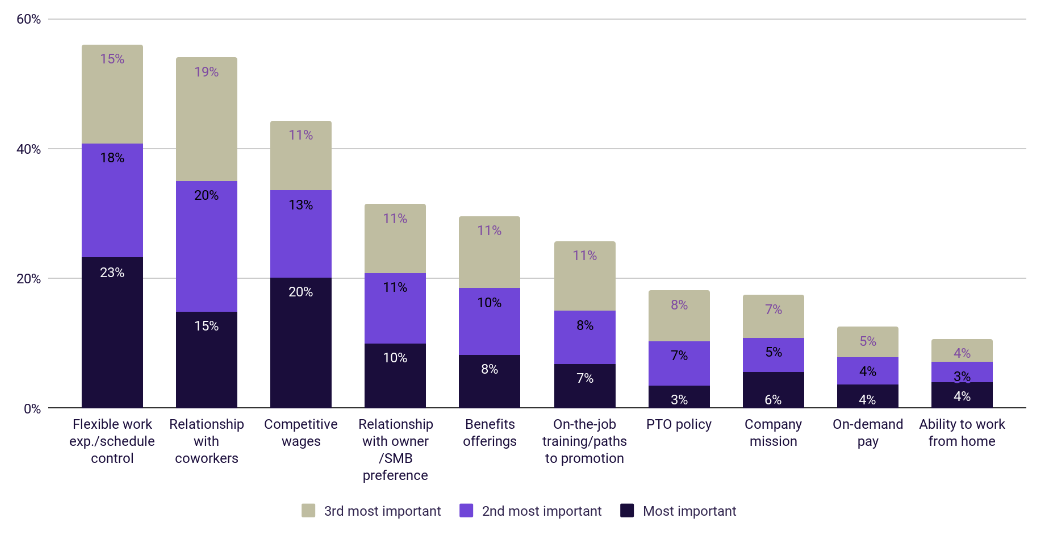

- Whereas wages are nonetheless vital to hourly staff, non-monetary standards like versatile work environments and relationships with coworkers are key elements in figuring out the place they work.

- As turnover ticked up 11.7% in Could m/m, so did hiring exercise (+6.0%), with small companies hiring extra staff probably anticipating a rise in demand

- Summer time is right here! Out of doors companies are rising. The Northern area is rising.

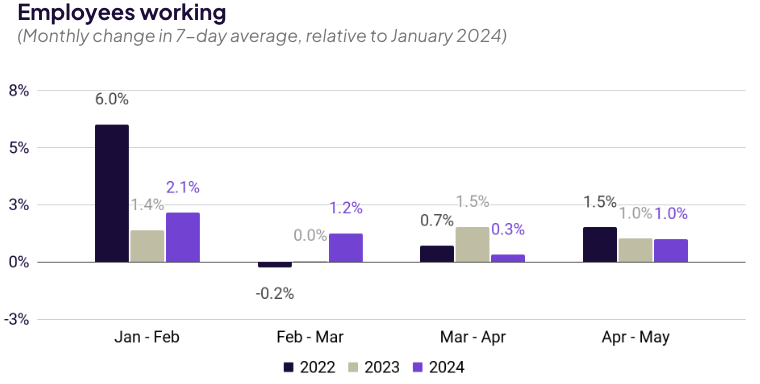

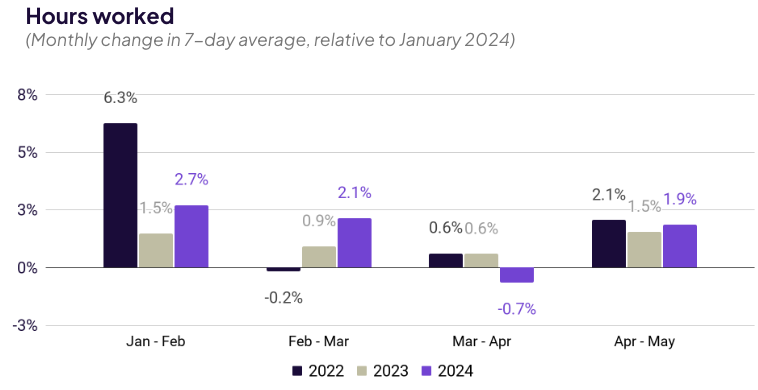

2024 enterprise exercise exhibits indicators of restoration in development

Subhead: The onset of summer season appears to attract barely increased positive aspects in employment exercise than final 12 months.

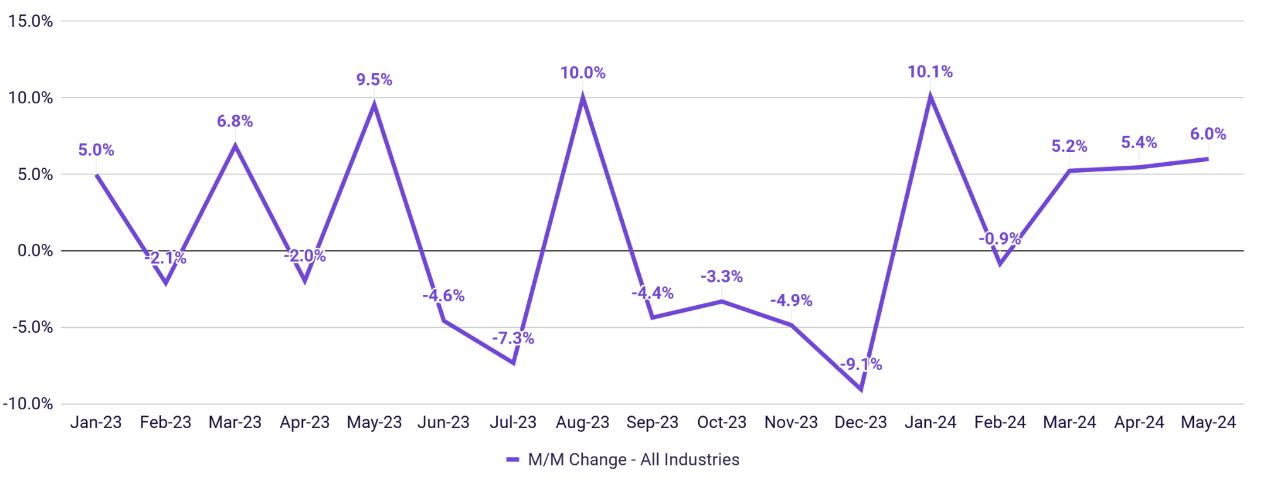

Workers working

(Month-to-month change in 7-day common, relative to January 2024)

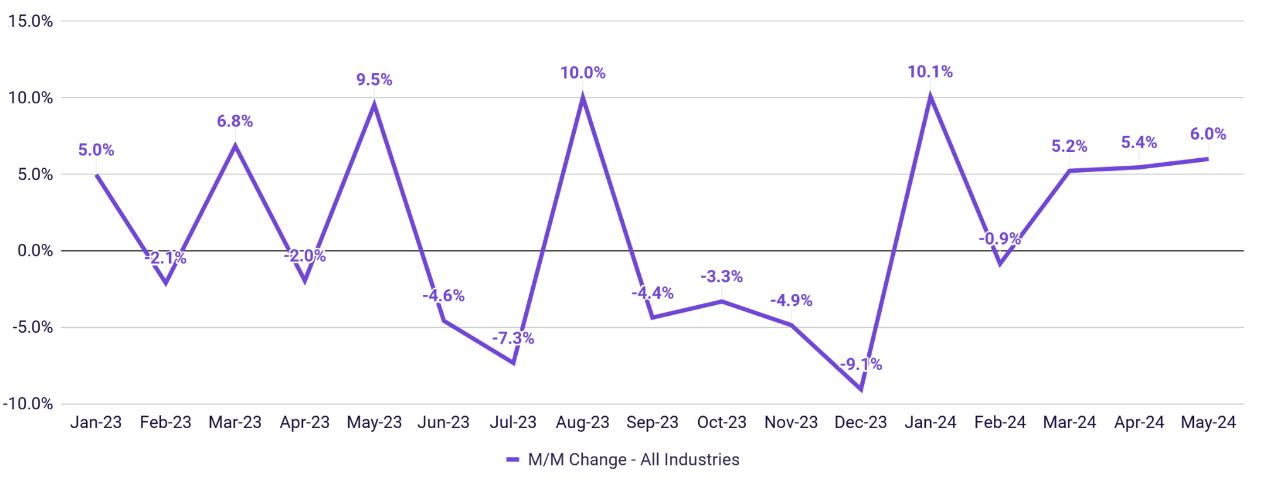

Hours labored

(Month-to-month change in 7-day common, relative to January 2024)

Be aware: Knowledge compares rolling 7-day averages for weeks encompassing the twelfth of every month.April 2023 knowledge encompasses subsequent week to account for Easter vacation. Supply: Homebase knowledge.

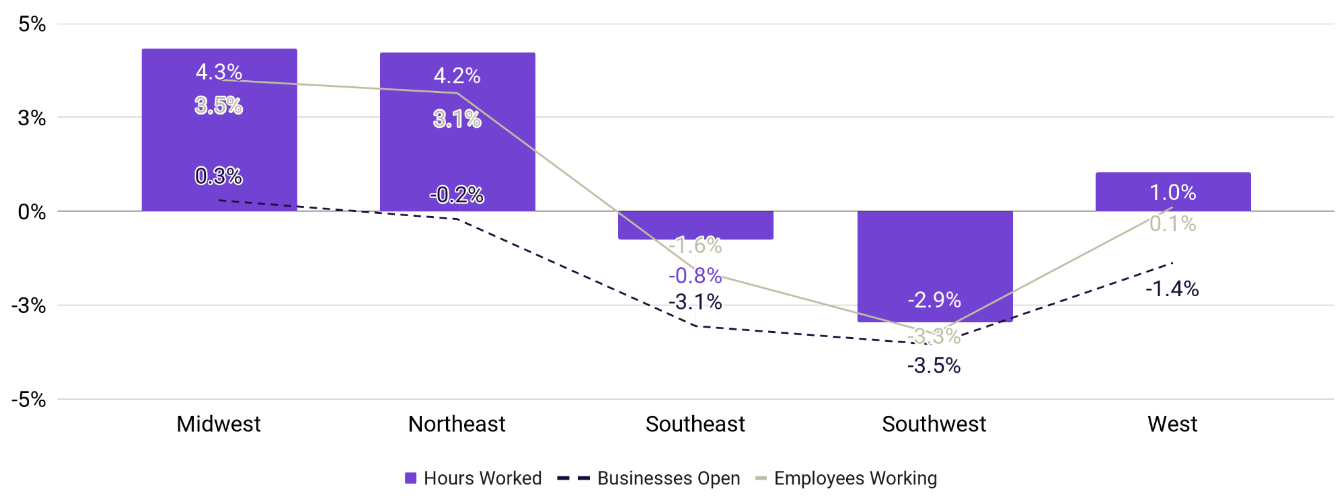

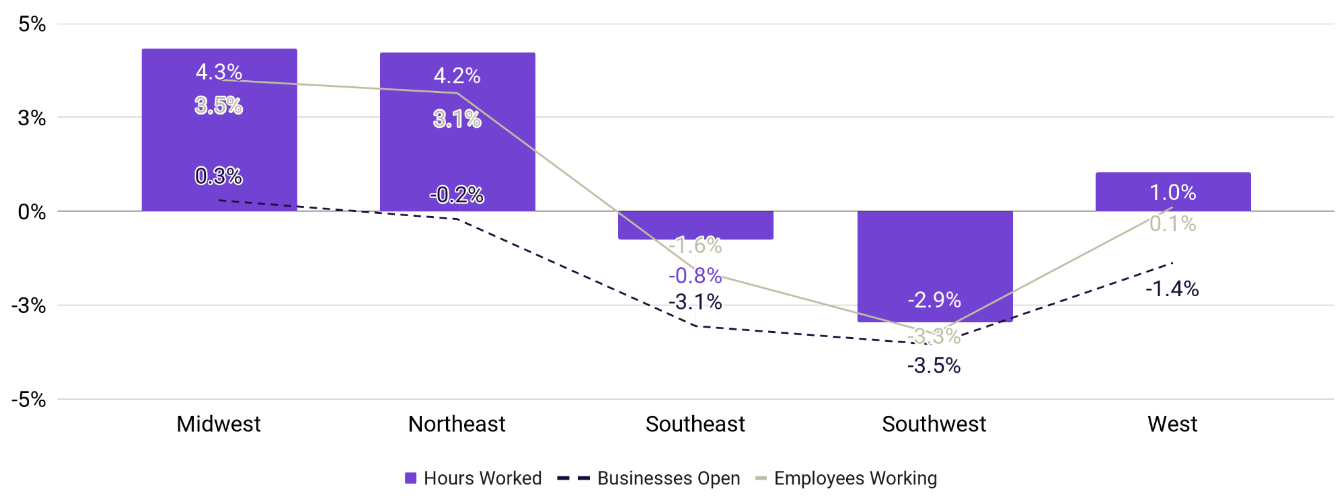

Midwest, Northeast, and Western states driving development

Southern states appear to have slowed down, which is according to sample seen this time final 12 months

Output by Area

Month-over-month change in core financial indicators, by Census area

Be aware: April 7-13 vs. Could 12-18. Area classification – Midwest: ND, SD, NE, KS, MN, IA, MO, WI, IL, IN, OH, MI; West: NV, UT, AZ, NM, CO, WY, MT, ID, OR, WA, CA, HI, AK; Northeast: NY, PA, NJ, CT, RI, MA, NH, VT, ME; Southeast: MS, AL, TN, KY, NC, SC, GA, FL; Southwest: TX, OK, AR, LA. Supply: Homebase knowledge

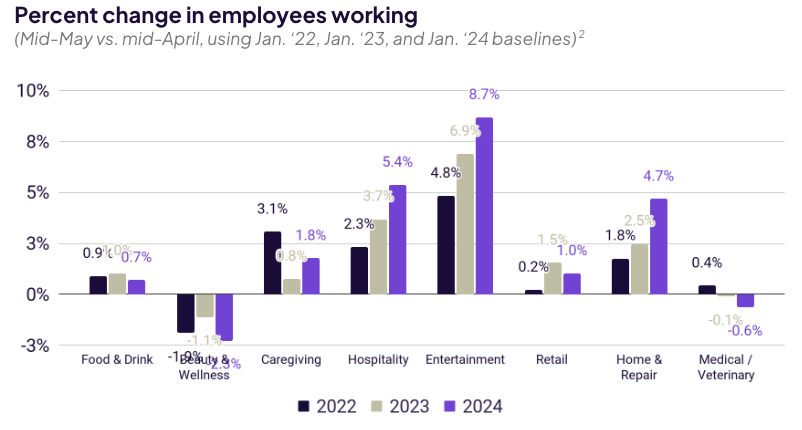

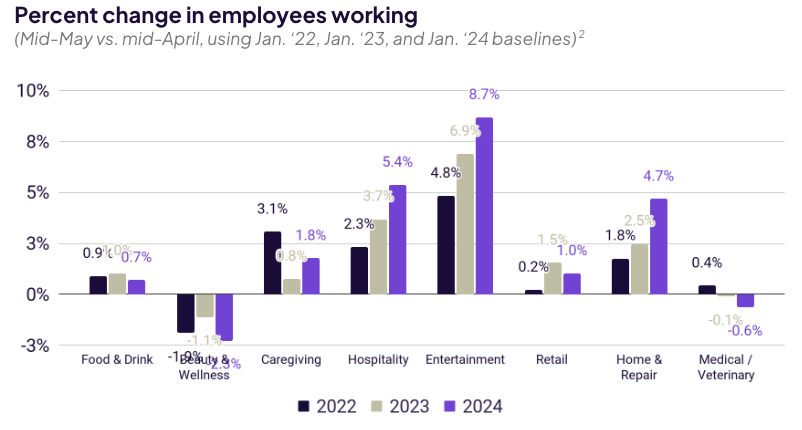

Out of doors companies are booming, much like final 12 months

Foot visitors is driving a very scorching interval for Leisure, Hospitality, and House & Restore companies

Small companies within the Hospitality (+5.4%), Leisure1 (+8.7%), and House & Restore (+4.7%) sectors outperformed seasonal expectations in Could, persevering with current pattern

The Retail and Meals & Drink industries additionally noticed elevated work exercise, however not fairly on the degree of prior years.

P.c change in staff working

(Mid-Could vs. mid-April, utilizing Jan. ‘22, Jan. ‘23, and Jan. ‘24 baselines)

- Leisure contains occasions/festivals, sports activities/recreation, parks, film theaters, and different classes.

- April 10-16 vs. Could 8-14 (2022); April 16-22 vs. Could 7-13 (2023); April 7-13 vs. Could 12-18 (2024). April 2023 knowledge encompasses subsequent week to account for Easter vacation. Supply: Homebase knowledge

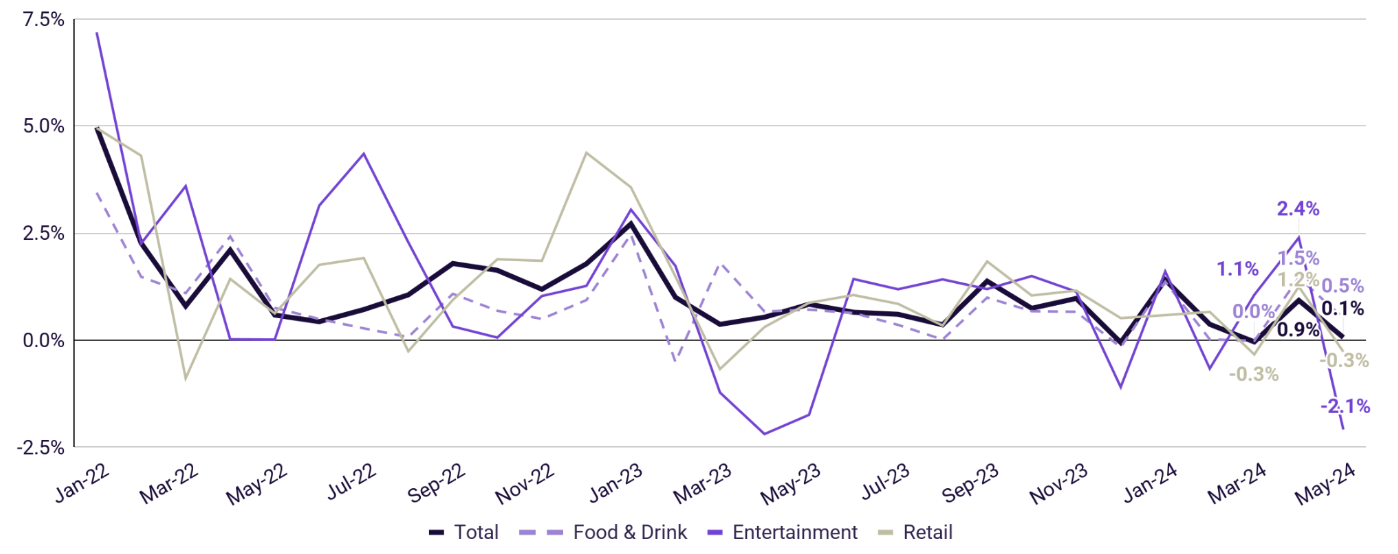

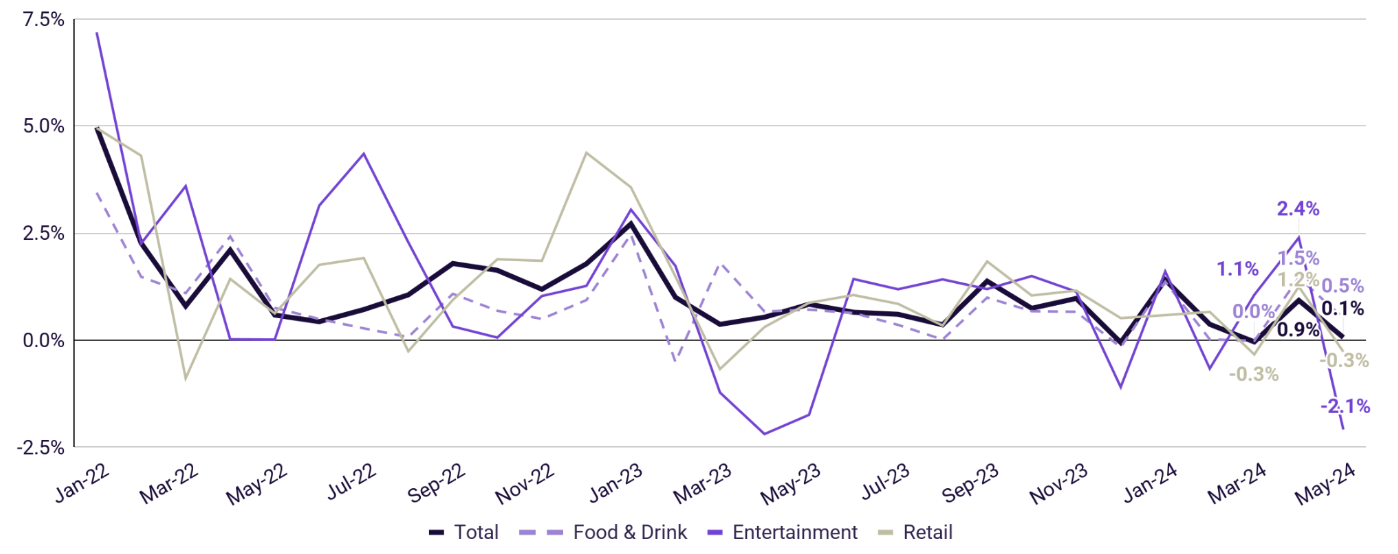

No wage development in Could

Leisure has seen the steepest decline, nevertheless, it aligned with final 12 months’s sample

Avg. wage adjustments, m/m

Month-to-month change in common hourly wages throughout all jobs

Be aware: Knowledge measures common hourly wages for areas that utilized Homebase to pay staff in each Could 2024 and Could 2023. Whole contains industries not depicted right here. Supply: Homebase Payroll knowledge.

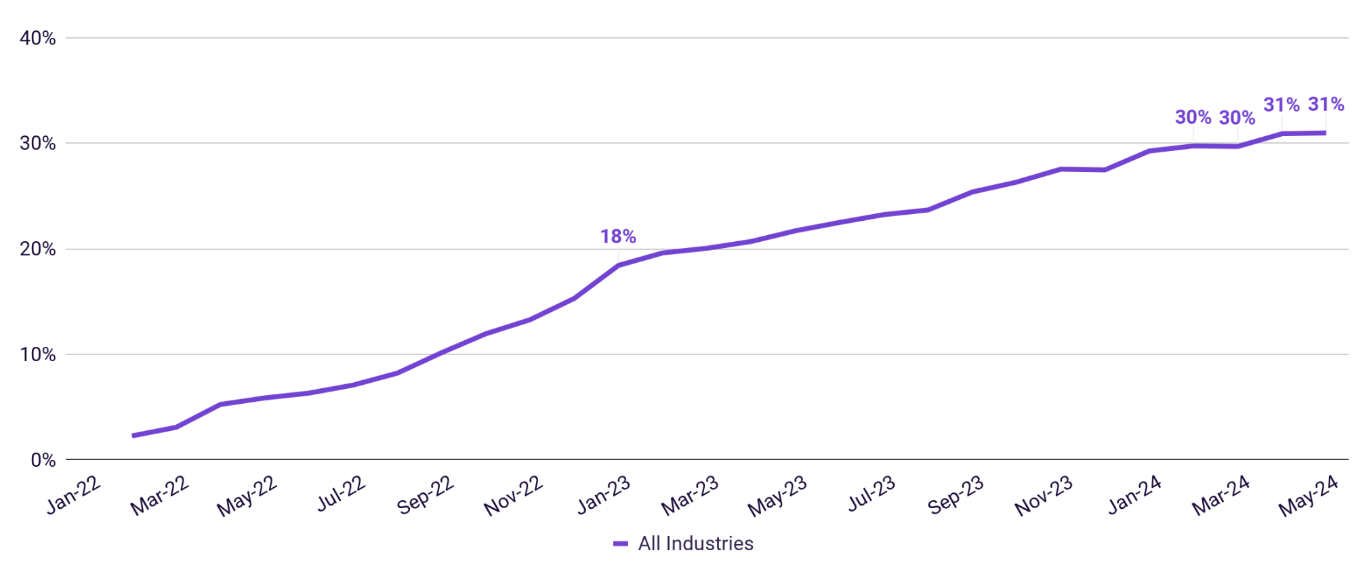

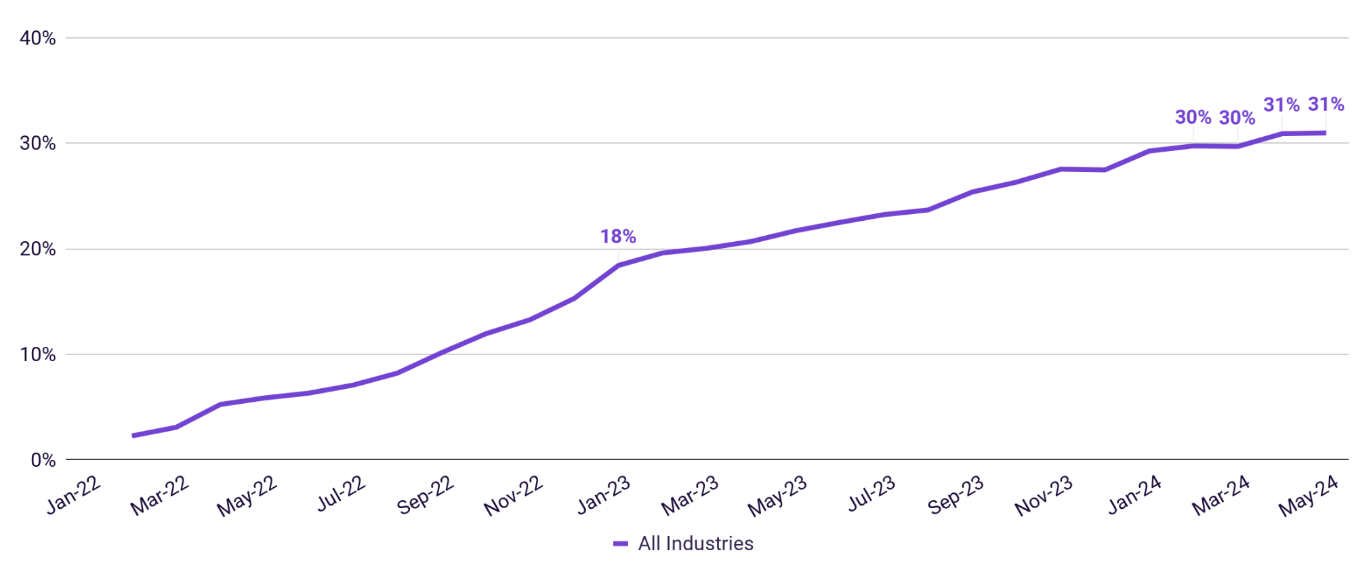

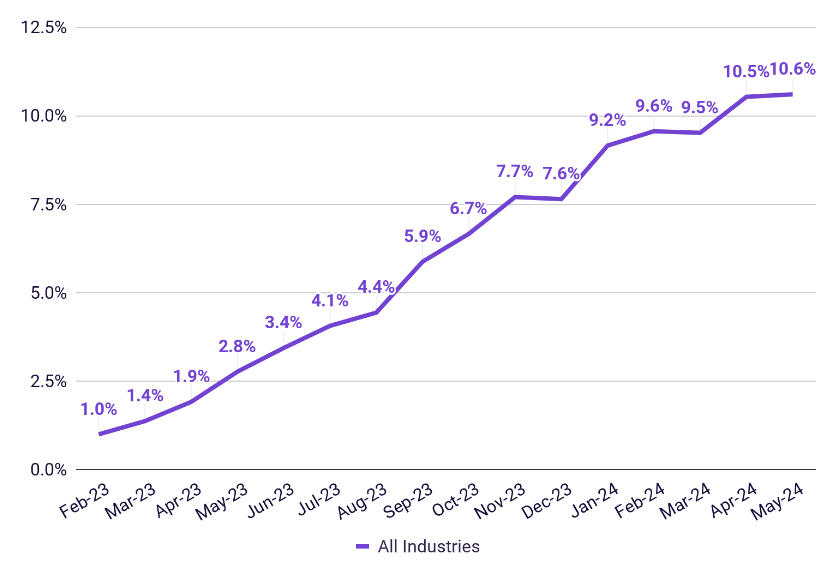

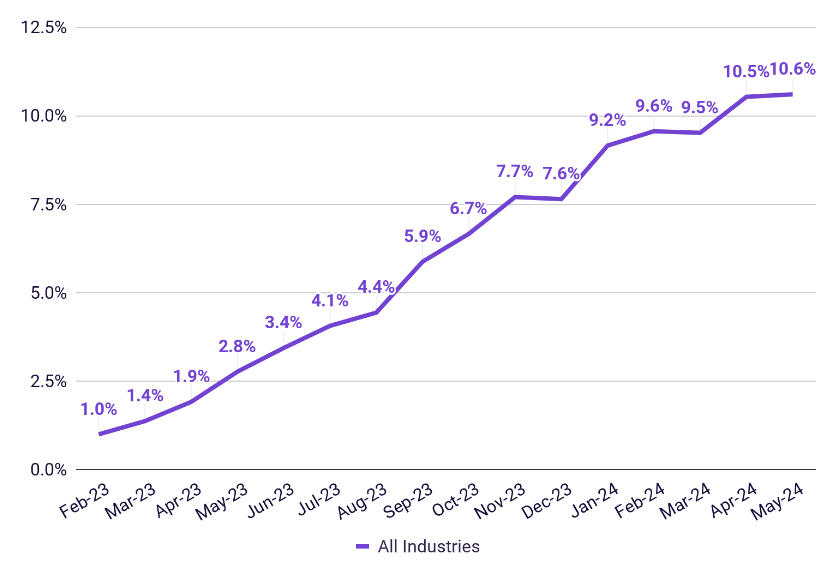

Labor prices are slowing, stay 30% above 2022 ranges

Progress in hiring exercise led to a marginal enhance in wages in Could

Avg. hourly wages

P.c change in common hourly wages throughout all jobs, relative to January 2022

Be aware: Knowledge measures common hourly wages for areas that utilized Homebase to pay staff in each Could 2024 and March 2023. Supply: Homebase Payroll knowledge.

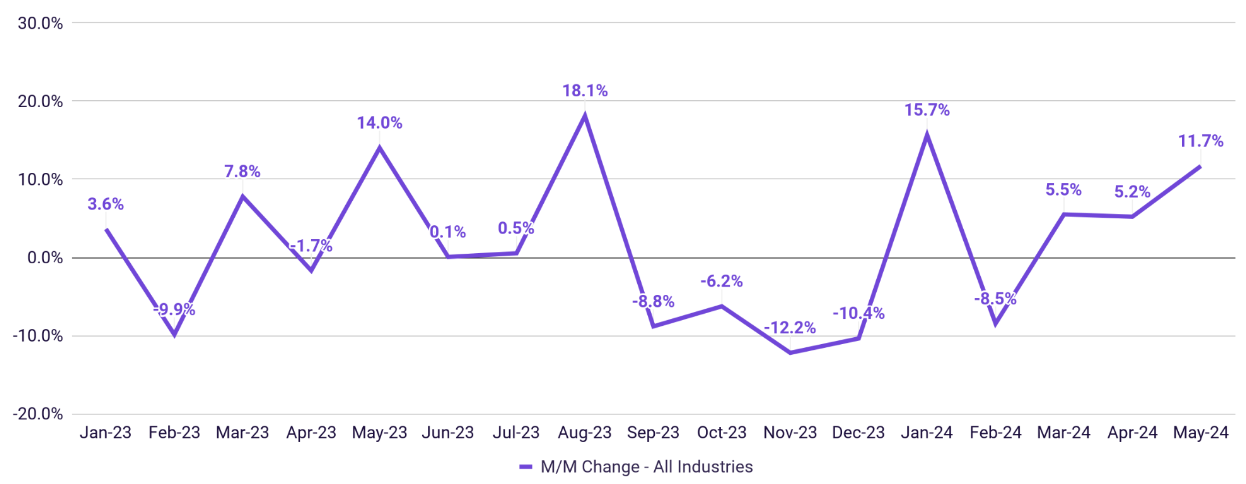

Hiring continues to develop m/m, since March 2024

Homeowners proceed to rent extra staff to maintain up with development, albeit at a decrease fee than seen traditionally

m/m adjustments in common jobs created

Month-to-month change in common variety of jobs added throughout all jobs

Be aware: Knowledge measures common month-to-month change in whole variety of jobs created in official worker rosters for corporations lively in any given month. Supply: Homebase knowledge.

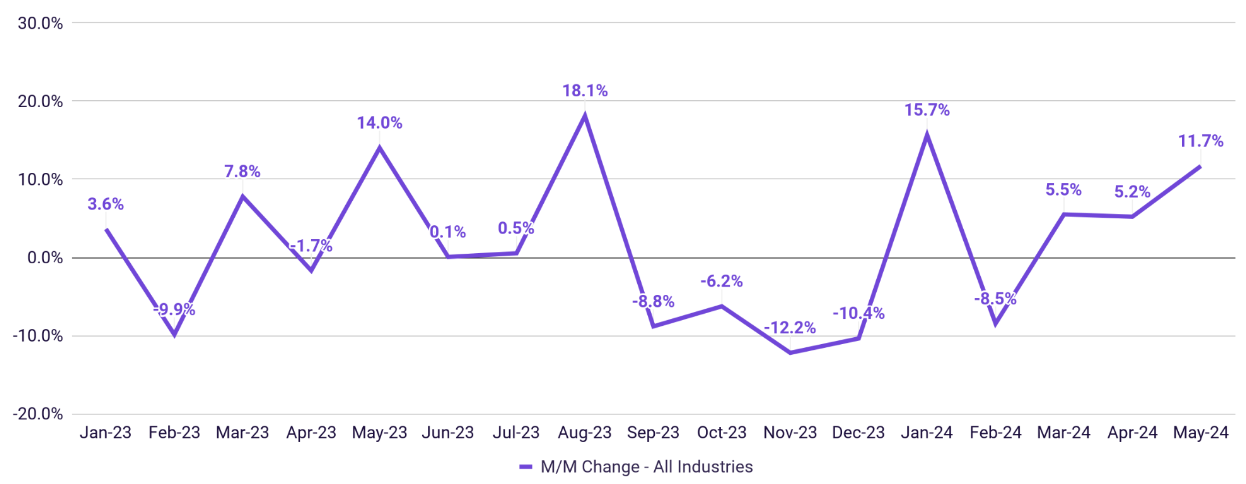

Turnover for Could got here in decrease than seasonally anticipated in comparison with the final 12 months

m/m adjustments in common variety of jobs eliminated

Month-to-month change in common jobs archived throughout all jobs

Be aware: Knowledge measures common month-to-month change in whole variety of jobs eliminated, whether or not by voluntary or involuntary exit, from official worker rosters for corporations lively in any given month. Supply: Homebase knowledge.

Hourly worker pulse examine

Could 2024

Worker optimism holds regular

36% of staff surveyed reported optimism about their job prospects in a 12 months, as regular wage will increase and enterprise at present employers buoys expectations in regards to the coming months.

Constantly optimistic outlook within the workforce amid wholesome financial exercise on Predominant Avenue bodes effectively for small companies this summer season.

Do you suppose your job choices can be higher, about the identical, or worse in 12 months in comparison with as we speak?

Supply: Homebase Worker Pulse Survey

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23);

N = 575 (Jan. ‘24); N = 652 (Mar. ‘24); N = 3214 (Could ‘24)

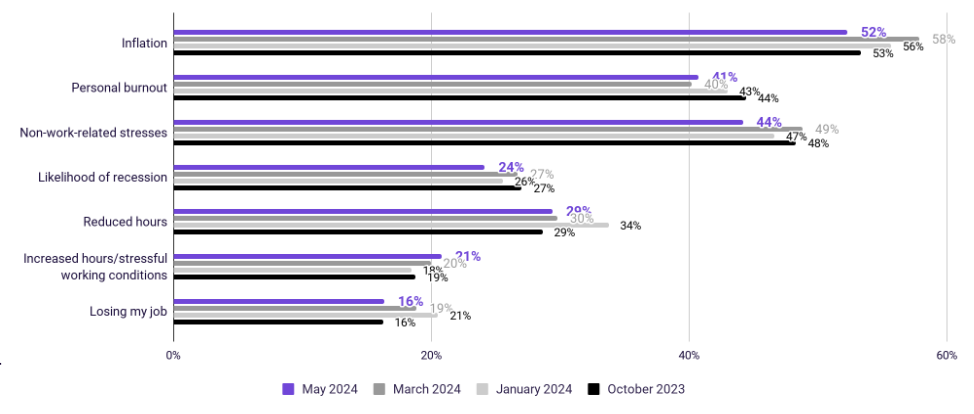

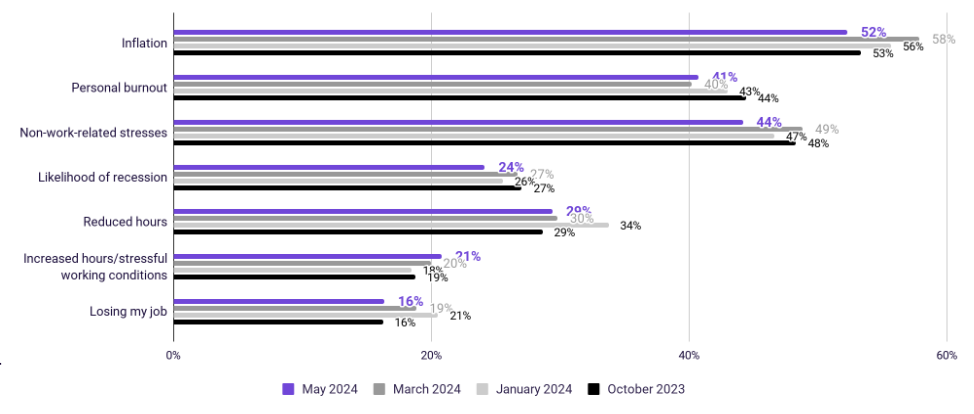

On Predominant Avenue, staff are feeling much less anxiousness

Worries are nonetheless current for workers of small companies, however they’re typically beginning to wane. In Could, concern about inflation and about non-work stresses decreased by 6% and 5%, respectively.

The specter of financial hardship (recession, job loss) is taking on much less mindshare for hourly staff throughout a time of elevated client demand.

Trying forward, which of the next elements are you involved about?

Supply: Homebase Worker Pulse Survey.

N = 427 (Aug. ‘23); N = 437 (Oct. ‘23); N = 575 (Jan. ‘24); N = 652 (Mar. ‘24); N = 3214 (Could ‘24)

Versatile work and office relations are the highest drivers for worker retention

Whereas wages are vital, making a optimistic work atmosphere in non-monetary methods is the deciding issue for workers on the place they select to work

Rank the highest 3 most vital elements in your determination on the place you’re employed

Supply: Homebase Worker Pulse Survey. N = 3214 (Could ‘24)

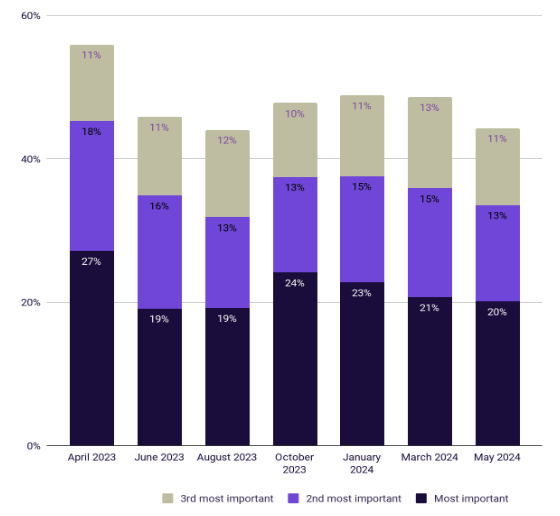

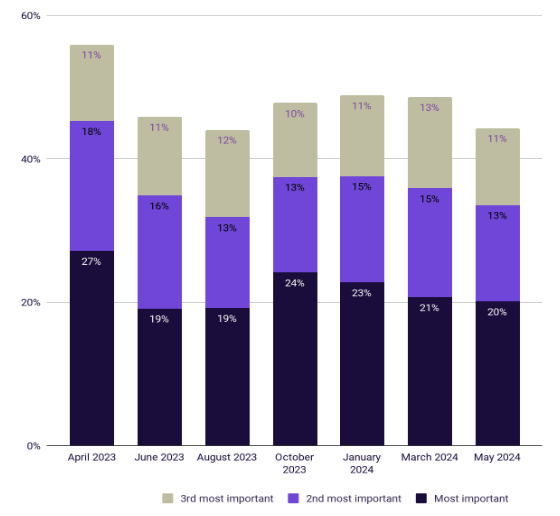

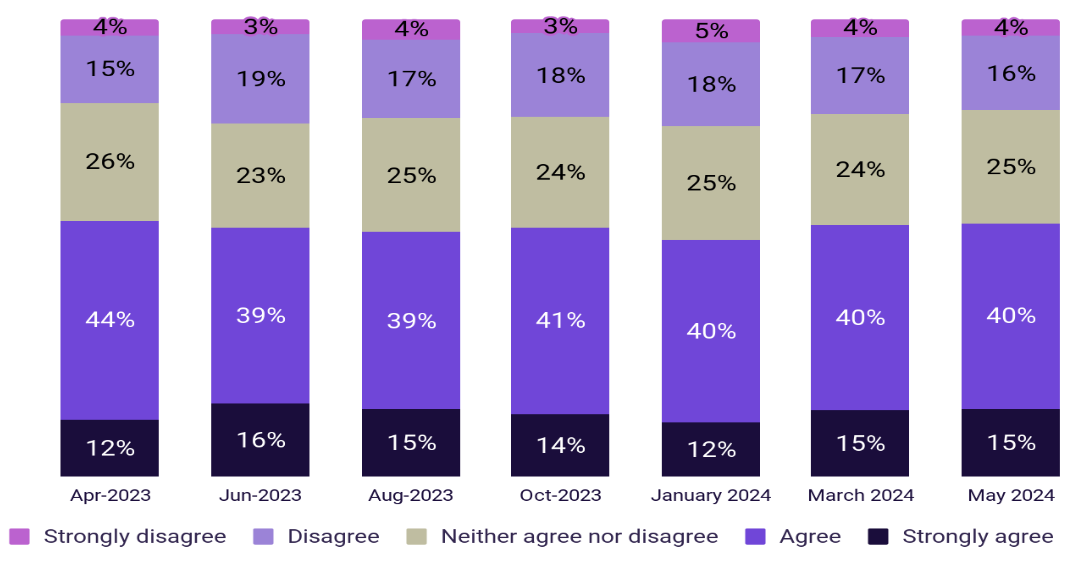

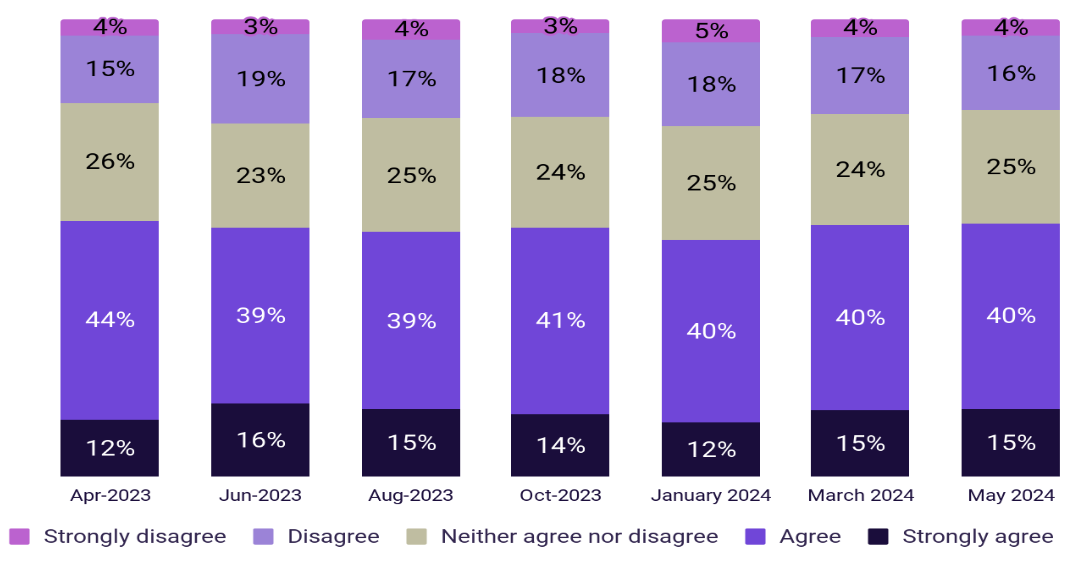

To staff, wages have gotten extra of a given

Rank the highest 3 most vital elements in your determination on the place you’re employed (“Aggressive wages”)

Avg. hourly wages

P.c change in common hourly wages throughout all jobs, relative to January 2023

Supply: Homebase Payroll Knowledge/Homebase Worker Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23); N = 575 (Jan. ‘24); N = 652 (Mar. ‘24); N = 3214 (Could ‘24).

Be aware: Knowledge measures common hourly wages for areas that utilized Homebase to pay staff in each Could 2024 and Could 2023.

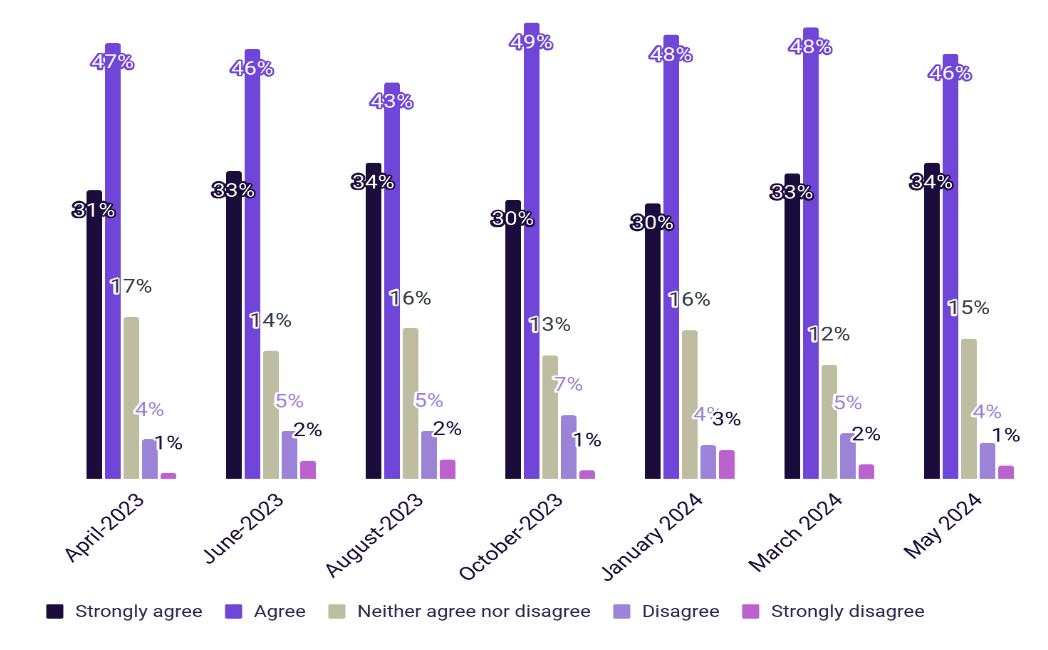

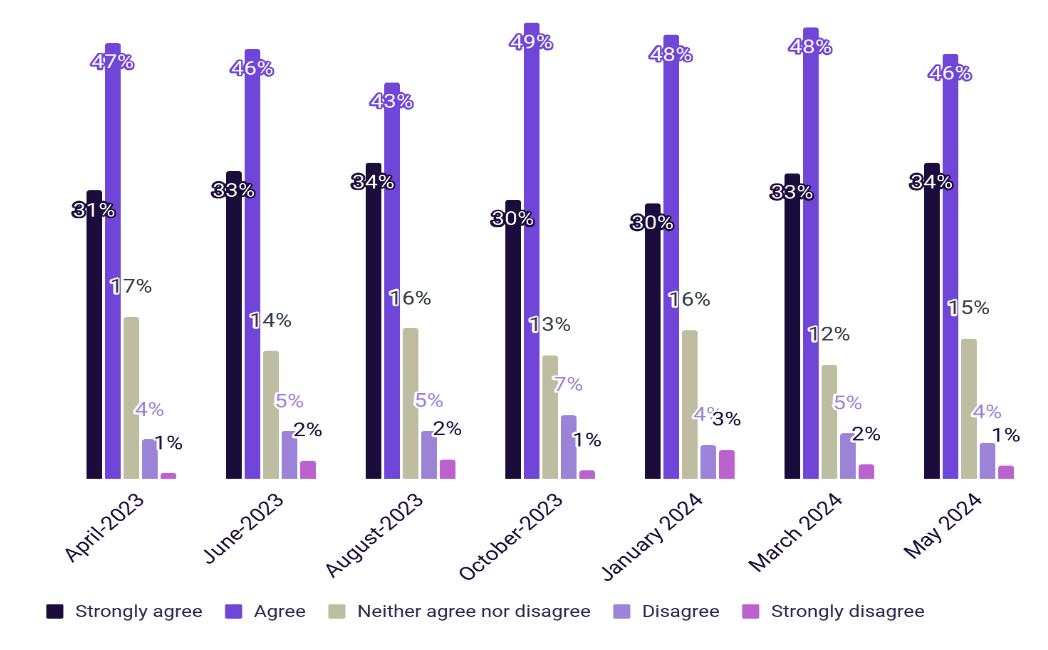

Worker sentiment round job satisfaction continues to be positives and secure

Roughly 4 in 5 hourly staff agree they’re proud of their jobs total.

With normal considerations in regards to the future abating, nearly all of surveyed staff report feeling happy with their jobs and degree of compensation.

To what extent do you agree with the next sentence: “Total, I’m proud of my job.”

To what extent do you agree with the next sentence: “Total, I’m happy with my degree of compensation.”

Supply: Homebase Worker Pulse Survey

N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23);

N = 575 (Jan. ‘24); N = 652 (Mar. ‘24); N = 3214 (Could ‘24)

View a PDF of our full Could 2024 Predominant Avenue Well being Report. Should you select to make use of this knowledge for analysis or reporting functions, please cite Homebase.

Could 2024 Homebase Predominant Avenue Well being Report