Erik Isakson

Funding Thesis

GDS Holdings (NASDAQ:GDS) providers as a number one excessive efficiency knowledge developer and supplier headquartered in China. With its distinctive cloud computing platform and historic observe of outperformance, the corporate has efficiently happy the wants of main firms in knowledge providers, serving as its core competence. Our evaluation signifies that GDS is at present undervalued with a goal value of $11.78 the place the present buying and selling value is $8.30 as of 6/04/2024, representing a 41.74% upside.

Firm Background

GDS began as an IT supplier in 2001 and moved to knowledge middle enterprise with its first self-developed knowledge service middle which opened in 2010. Based in 2001 in China, the corporate is a number one developer and operator of excessive efficiency knowledge facilities in each China and Southeast Asia. The corporate is famend for its knowledge facilities which have a big internet ground space, excessive energy capability, density, effectivity, and a number of redundancies throughout all essential methods, which made the corporate the most important PRC and international public clouds service. The corporate’s fundamental shopper base consists predominantly of hyperscale cloud suppliers, massive web firms, monetary establishments, telecommunication facilities, IT service suppliers, and multinational companies.

The corporate has demonstrated important development and enlargement of their useful resource pushed stage within the early 2010s. With the aim of increasing the client base to excessive quantity customers and upselling providers, GDS opened new facilities in key places in China throughout Beijing, Shanghai, Shenzhen, and extra. This facilitated the third and present stage of the corporate. It was efficiently listed on Nasdaq in 2016 and HKEX in 2020 whereas increasing its knowledge facilities overseas in Malaysia and inside China. This constant observe of excellence positioned the corporate on the frontier of the trade with a sturdy administration interface.

Qualitative Evaluation

To higher perceive and assess the corporate’s standings throughout the trade, we’ve performed an evaluation of the aggressive forces:

Menace of New Entrants:

The IT providers trade has excessive obstacles to entry because of the important quantity of funding required. GDS advantages from a steady shopper profile of 864 main firms primarily based mostly in Southeast Asia, making it tough for brand new entrants from economies of scale. Furthermore, GDS has constructed a robust model repute and belief amongst its shoppers, the place new entrants would wish appreciable time to determine related credibility.

The corporate’s strategic enterprise plans additionally embrace offering providers in much less developed areas and cities, equivalent to organising knowledge facilities in smaller cities. As of now, the corporate has established a number of core financial cities domestically: Yangtze River Delta in Shanghai, Better Bay Space in Canto, City Agglomeration in Beijing, and Southwestern China in Chengdu. These core areas assist the corporate to cater its totally different providers based mostly on numerous wants throughout key financial areas.

Bargaining Energy of Patrons:

Shoppers inside this trade have reasonably excessive bargaining energy because of the quite a few alternate options obtainable. Giant company shoppers could also be extra value delicate and are extra susceptible to barter higher phrases given the numerous enterprise quantity. GDS mitigates this with distinctive providers equivalent to CloudMIX, an modern service platform that gives a sturdy administration interface enabling shoppers to combine and management their hybrid cloud computing environments throughout sectors.

Bargaining Energy of Suppliers:

Given the rising reputation of IT internationally, the bargaining energy of suppliers is average. Nevertheless, suppliers offering specialised tools and know-how for knowledge facilities maintain appreciable energy because of the essential nature of their merchandise. Therefore, suppliers providing area of interest merchandise might have extra affect, however GDS’s robust market place may help negotiate favorable phrases.

Menace of Substitutes:

Inside the IT providers trade, there’s an growing stress from substitutes. Firms might select different IT options equivalent to on-premises knowledge facilities or hybrid cloud options. Nevertheless, the present pattern in direction of outsourcing knowledge middle must specialised suppliers like GDS reduces this menace. The corporate can also be the primary IT supplier in China to obtain all 4 certifications of ISO, proving their excellence and professionalism. Furthermore, it’s the solely supplier in China to earn an Uptime Institute award for Administration, Operations & Website Approval for a number of places. Their enterprise technique of increasing into area of interest geographic markets reduces the chance of substitution.

Competitors Amongst Current Opponents:

The worldwide IT providers trade is extraordinarily fragmented and aggressive. Regardless of being fairly diluted, competitors solely intensifies amongst present opponents. For GDS particularly, its concentrate on excessive efficiency knowledge facilities and specialised providers helps keep a aggressive edge. Some opponents in related markets embrace: Inspur Group (SHA: 600756), Core Scientific (CORZ), and Taiji Computer systems (SHE: 002368).

Major Driving Factors

Robust Demand for Oversea Information Facilities

As GDS continues to buy and construct fundamental knowledge facilities round Tier 1 cities in China, the corporate has just lately elevated the dimensions of its non-public capital raised for its worldwide knowledge facilities from $672M to $750M. Additional fairness raises can be required if robust worldwide demand continues. Along with abroad calls for, administration expects demand in China to get better starting in 2025. As synthetic intelligence in China has not but obtained the identical quantity of consideration and demand as in America, steady high-end chip provide will drastically profit home demand and increase potential enlargement to North Asia and Europe.

Promotion of Digital Growth in China

In 2023, China unveiled a plan to advertise digital improvement with a concentrate on interconnectivity in digital infrastructure. The state goals to develop a thriving our on-line world tradition with broadly accessible digital public providers and ecological digital governance by 2035.

The development of Digital China might be specified by accordance with the general framework of “2522” which incorporates:

Utilizing the “two foundations” of digital infrastructure and knowledge useful resource methods. Selling the deep fusion of the “5 integrations” of digital know-how with the financial system, politics, tradition, society, and ecological civilization. Strengthening the “two capacities” of the digital know-how innovation system and digital safety protect. Optimizing the “two environments” of home and worldwide digital improvement.

The brand new NDRC (Nationwide Growth and Reform Fee) pointers promote the development of large-scale knowledge facilities in strategically necessary areas. As GDS is already energetic in these necessary areas, this guideline can additional strengthen its model presence and facilitate the acquisition of permits for land with preferential phrases. By aligning the corporate’s development technique with nationwide insurance policies, GDS can capitalize on incentives and profit from knowledge community enlargement, price discount, and elevated effectivity.

Valuation

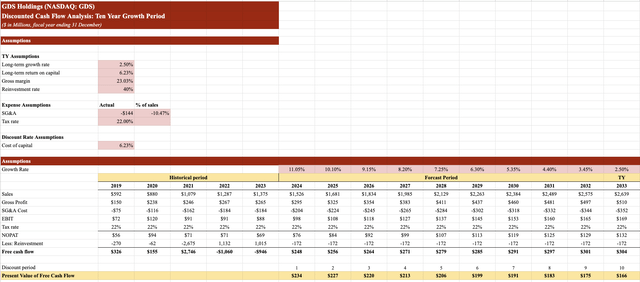

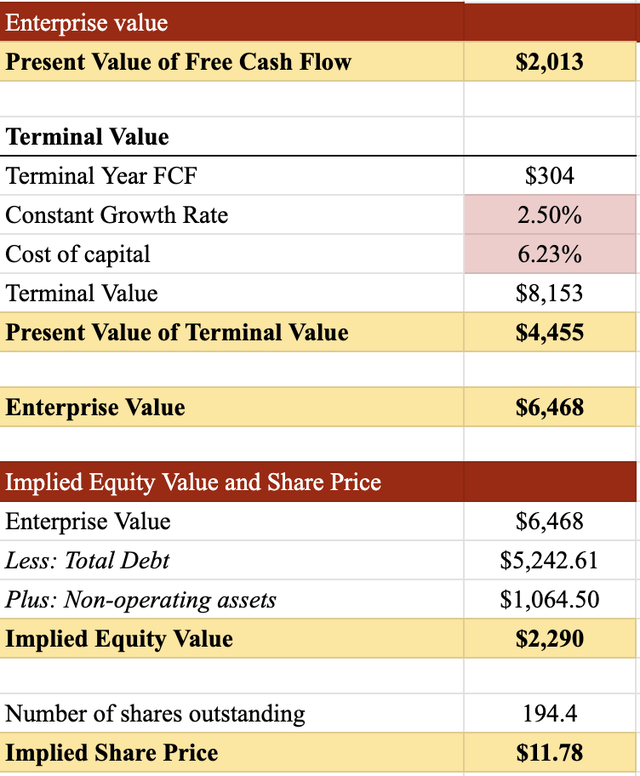

The DCF mannequin thought of a historic interval of the earlier 5 years from 2019 – 2023 and forecasted ten years from 2024 – 2033. We began with an preliminary development price of 11.05% for 2024, which was calculated based mostly on historic reinvestment price and return on capital by way of NOPAT and return on invested capital. We assumed a terminal development price of two.5% based mostly on the principle driving factors talked about above.

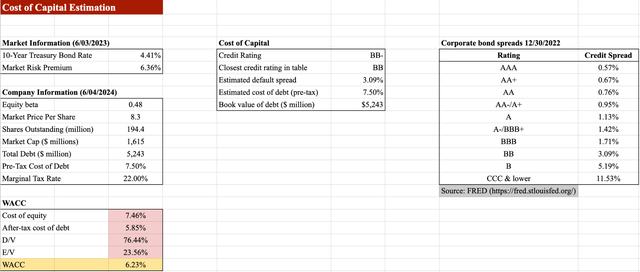

We ran a regression evaluation from Dec. 2018 – Nov. 2023 buying and selling days to get a beta of 0.48, which is used within the WACC. We additionally referred to the 10-12 months Treasury Bond Fee and the credit standing for the price of fairness and price of debt for a remaining WACC of 6.23%.

QOE Capital – Analyst Sally Ma

By means of a DCF mannequin, we arrived at a remaining goal value of $11.78, which is a 44.74% upside from the buying and selling value as of 6/04/2024.

QOE Capital – Analyst Sally Ma

QOE Capital – Analyst Sally Ma

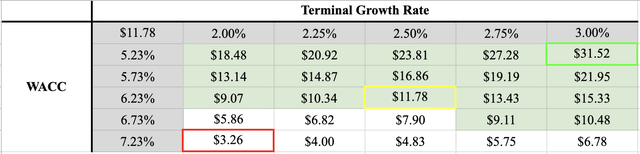

To research the connection between the impact of terminal development price and WACC on the goal share value, a sensitivity evaluation was carried out.

QOE Capital – Analyst Sally Ma

On the whole desk, we highlighted in inexperienced all of the circumstances the place we received a remaining goal value that’s larger than the present value. Particularly, we will see that the goal value by way of DCF is within the center boxed in yellow, with the best value boxed in inexperienced and lowest boxed in yellow.

From the sensitivity evaluation, we see an total optimistic pattern for GDS, as we’ve been fairly conservative within the development price and WACC within the DCF evaluation. We will see that for all of the terminal development charges listed above within the desk, we’re capable of see costs that exceed the present buying and selling value for no less than three low cost charges. Subsequently, we deem the goal value of $11.78 to be truthful worth. The evaluation takes into consideration the corporate’s present efficiency, future development prospects, and related macro developments.

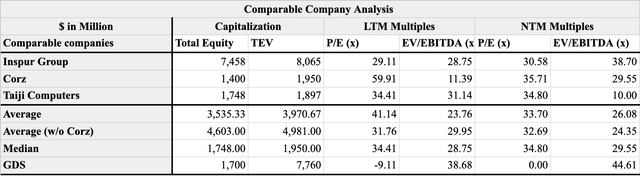

When evaluating with related industries, Taiji Computer systems and Inspur, we see an trade common ahead P/E and EV/EBITDA to be 32.69 and 24.35 respectively. These are extraordinarily excessive ratios in comparison with the present ratio of GDS, however this precisely displays the trade development potential that buyers have set on related industries. Each Inspur and Taiji Computer systems ship digital providers and knowledge know-how based mostly in China provide comparability for GDS’s standing throughout the trade. From the comparable evaluation, we see that GDS can also be at present undervalued with an excessive quantity of potential.

QOE Capital – Analyst Sally Ma

To additional analyze the expansion prospects of GDS, we determined to match it with an analogous American Firm – Core Scientific. Equally, this firm gives software improvement providers with synthetic intelligence internet hosting and extra. As talked about above, we will see even larger ahead P/E and EV/EBITDA ratios with the inclusion of CORZ, which additional helps the concept of robust development. Furthermore, if GDS plans to increase abroad and probably into North America and Europe areas, we’ve an estimate of the trade developments in goal areas.

General, the takeaway is that GDS is priced to be below truthful value. As the whole know-how sector is on an increase, the goal market of GDS nonetheless has plenty of potential and alternatives for additional enlargement. Thus, we stay optimistic on this valuation.

Dialogue of Dangers

Unstable Efficiency

As we’re seeing from the valuation, the corporate is seeing nice development over the previous few years. On the identical time, the monetary efficiency might be fairly unstable. On common, GDS has a income development price of 24.32% over the past 5 years. Nevertheless, in the latest fiscal yr report, the corporate solely skilled a income development price of 6.76%, which is lots lower than the common. In working earnings, we’re even seeing a minor decline from 2022 to 2023 fiscal years. The general excessive leverage place that the corporate is in is essentially because of its reliance on capital. The enterprise mannequin requires intensive funding in knowledge facilities, which considerably led to a considerable amount of debt mirrored within the monetary knowledge. This will increase the vulnerability uncovered to risky rates of interest and refinancing dangers. With the instability embedded within the total trade and the corporate itself, we should be cautious by way of intently monitoring the corporate key efficiency indicators.

Though a danger, a mitigation is included throughout the valuation itself. When calculating the anticipated development price of the corporate, we eradicated some outliers in reinvestment price to account for the large fluctuations in efficiency. With this elimination, the calculations can higher replicate a extra steady situation of the corporate. Furthermore, the forecast development price additionally stays conservative to a terminal development price of two.5%. Though issues have already been mirrored within the valuation, it’s onerous to precisely predict the trade efficiency as it’s continually evolving. Going ahead, we consider that GDS will have the ability to seize nice alternatives as we’re at present seeing the increase in capital with growing abroad demand and macroeconomic headwinds in China.

Market Slowdown and Competitors

Because the die down of the pandemic internationally, China has been experiencing slower than anticipated development economically. Though GDS additionally has many long-term customers in Southeast Asia and surrounding areas, nearly all of its enterprise nonetheless stays inside China. With this present financial downturn, the corporate might face discount in demand for knowledge facilities. Financial instability can result in diminished capital availability, which is able to impression the corporate’s potential plan of increasing abroad. As talked about above, the corporate did efficiently increase its non-public fairness to $750M. As we anticipate the financial system to slowly get better in 2025, it’s important for the corporate to make sure ample capital for its operations within the upcoming fiscal years to mitigate this danger.

As well as, the IT providers and knowledge middle trade is extremely aggressive throughout the globe. The corporate at present faces opponents each domestically and internationally, posing a danger of eroding GDS’s technological edge. At the moment, GDS retains an awesome aggressive benefit with its enterprise technique in capturing key financial hub cities inside China, which may hedge away potential dangers in lowering demand. Along with the brand new authorities coverage of transitioning right into a digital age, GDS should keep its trade positioning to seize upcoming alternatives.

Conclusion

GDS Holdings operates in a dynamic and quickly evolving trade with important development alternatives, which additionally comes with surprising challenges. Weighing these dangers towards the corporate’s strengths, we arrived at a remaining advice of ‘purchase’. Buyers ought to stay vigilant with a well-informed method. All in all, GDS represents a robust but younger, rising firm that may hopefully seize nice market potential.