peshkov

The largest digital forex information up to now few months has been the fairly disappointing value of Bitcoin for the reason that a lot anticipated ‘halving’ occasion. Because the April nineteenth halving, Bitcoin has been flat, resulting in disappointing returns for Bitcoin-related investments just like the 2X Bitcoin Technique ETF (BATS:BITX). Ought to long-term BITX traders purchase the lull in Bitcoin costs in anticipation of one other leg within the Bitcoin rally?

For my part, the BITX ETF is just not appropriate for long-term buy-and-hold methods due to its important contango and volatility decays. Moreover, with no fast catalysts to drive Bitcoin costs increased, the BITX ETF might proceed to decay over the approaching weeks and months, as Bitcoin digests its robust transfer since final 12 months. I provoke on BITX with an keep away from (maintain) suggestion.

Fund Overview

The 2x Bitcoin Technique ETF seeks to supply every day returns which are twice the return of the S&P CME Bitcoin Futures Each day Roll Index (“SPBTFDUE Index”). The SPBTFDUE Index measures the every day efficiency of a rolling place in front-month Bitcoin futures and is rebalanced each day between the entrance contract and the following month’s contract.

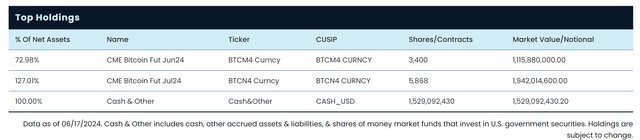

The BITX ETF’s present holdings are proven in Determine 1.

Determine 1 – BITX holdings (volatilityshares.com)

Buyers ought to word that BITX’s 2x returns are achieved by holding 200% of the notional worth of the fund’s belongings within the type of Bitcoin futures contracts. For instance, the fund at the moment holds $3.06 billion in notional Bitcoin futures towards $1.53 billion in AUM.

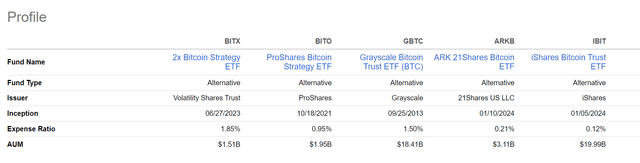

BITX is mainly a 200% leveraged model of the extremely profitable Bitcoin Technique ETF (BITO), however BITX fees a peer-leading 1.85% expense ratio (Determine 2).

Determine 2 – BITX fees a 1.85% expense ratio (Looking for Alpha)

Beware Contango & Volatility Decay

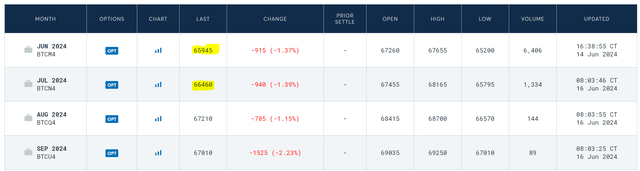

As I’ve written in a number of articles on leveraged ETFs, the primary drawback with the BITX ETF, and all futures-based ETFs, is that futures costs are usually in contango, the place costs farther out in maturity are costlier (Determine 3).

Determine 3 – Illustrative Bitcoin futures contango (cmegroup.com)

So day by day, the BITX ETF should promote expiring front-month futures and reallocate to the next-month future contract in a mechanical ‘roll’ course of. For instance, within the determine above, the BITX ETF should promote June futures at $65,945 and purchase July futures at $66,460. This fixed ‘sell-low/buy-high’ results in a gradual decay in worth for the BITX ETF.

Compounding the problem is BITX’s leverage, with 200% publicity to Bitcoin futures costs. Levered ETFs have ‘constructive convexity’ within the course of their exposures. For instance, assuming an investor purchased $100 of BITX. If Bitcoin returns 5% in a single day and Bitcoin futures are 100% correlated to Bitcoin costs, then the BITX place will develop to $110 (2 occasions 5% return). If Bitcoin futures return 5% on day 2, the place will develop to $121. That is greater than twice the theoretical 2-day compounded return of 10.25% or $120.50.

Nonetheless, if the return expertise is +5% adopted by -5%, traders will find yourself with $99.00, considerably lower than twice the 2-day compounded lack of 0.25% or $99.50. This loss in worth is because of ‘volatility decay’.

Whereas ‘volatility decay’ could appear insignificant each day, over the long-run, volatility decay can flip into very important slippage, particularly for very unstable belongings like Bitcoin futures.

The mix of ‘contango’ and ‘volatility decay’ implies that since its inception in June 2023, the BITX ETF has solely returned 162.3%, in comparison with 94.9% for BITO and 119.8% for Bitcoins themselves (Determine 4).

Determine 4 – BITX vs. BITO and Bitcoin costs (Looking for Alpha)

The distinction between BITO and Bitcoin returns is ‘contango decay’ (24.9%) whereas the distinction between BITX and twice Bitcoin returns is the mixture of contango and volatility decay (77.3%).

Merchants contemplating the BITX ETF ought to guarantee they absolutely perceive the monitoring error dangers concerned with levered and futures-based ETFs by consulting these FINRA and SEC warnings.

What Occurred To The Halving Rally?

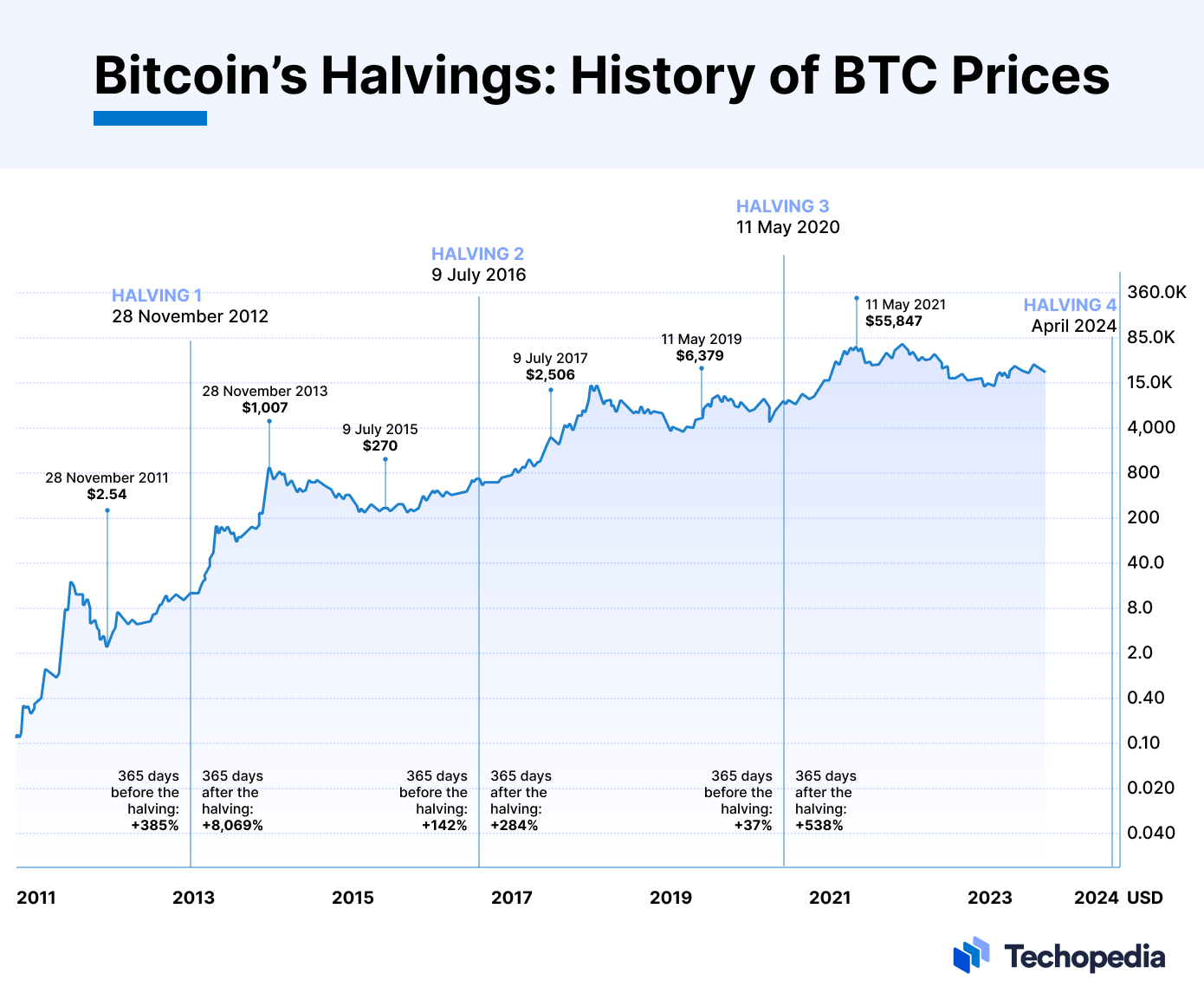

In February, I wrote a bullish article on the ARK 21Shares Bitcoin ETF (ARKB), noting that the upcoming ‘halving’ occasion may very well be a serious catalyst for Bitcoin. For these not acquainted, having refers to the truth that the reward of mining Bitcoins decreases because the variety of Bitcoins mined will increase.

Authentic Bitcoin miners have been paid 50 BTC per block when Bitcoin was first established in 2009. Nonetheless, the reward price is halved for each 210,000 blocks mined, and the ‘fourth’ halving occasion occurred lately on April nineteenth. Traditionally, Bitcoin costs are inclined to rally considerably round halving occasions (Determine 5).

Determine 5 – Bitcoin costs are inclined to rally round halving occasions (techopedia.com)

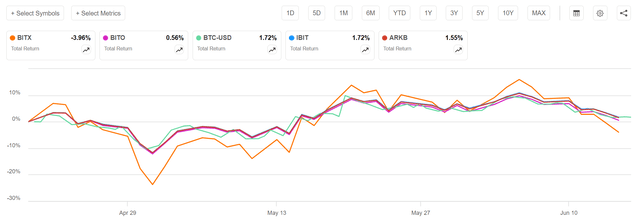

Nonetheless, the present halving has been a dud to date. Because the halving occasion on April nineteenth, Bitcoin costs have been flat, and BITX and different Bitcoin-related investments like BITX and ARKB have carried out little up to now two months (Determine 6).

Determine 6 – Bitcoin and associated investments have carried out littel up to now few months (Looking for Alpha)

Bitcoin Costs Entrance-Ran The Halving

In fact, two months is a comparatively brief time period and the rally should happen within the coming months and quarters. Nonetheless, one cause for the weak efficiency to date may very well be that the current halving occasion was effectively anticipated by traders, and Bitcoin costs might have front-run the occasion.

For instance, Determine 5 above exhibits that within the 12 months previous to the earlier halving in 2020, Bitcoin costs solely rallied 37%, which arrange a robust 538% rally within the 12 months after the occasion. Nonetheless, this time, Bitcoin costs rallied 134% within the 12 months to April 19, 2024, pushed by hypothesis concerning the introduction of Spot Bitcoin ETFs and the upcoming halving (Determine 7).

Determine 7 – Bitcoin costs rallied strongly into halving (Looking for Alpha)

So lots of the everyday post-halving rally might have been pulled ahead to the months earlier than the halving.

Bitcoin Additionally Pushed By Free Monetary Circumstances

Moreover, whereas Bitcoin’s perceived shortage (i.e. halving occasions will increase Bitcoin’s shortage) is a big driver of its valuation, I imagine there are different components in play as effectively. For instance, I imagine Bitcoin can also be closely depending on monetary market circumstances and liquidity.

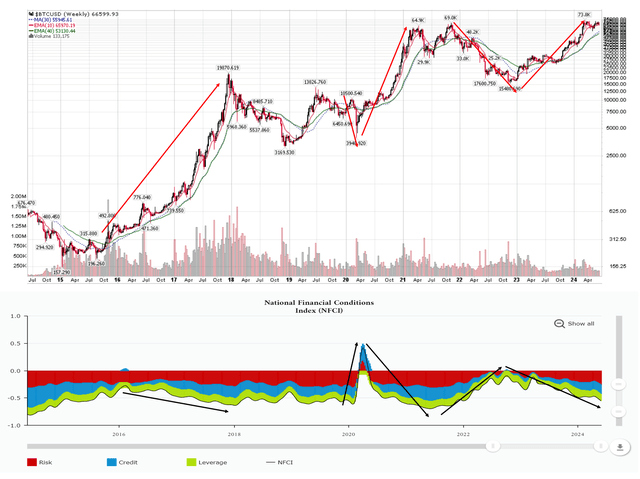

Traditionally, there’s a robust destructive correlation between Bitcoin costs and the Chicago Fed’s Monetary Circumstances Index (Determine 8). When monetary circumstances tighten, like they did sharply in 2020 and 2022, Bitcoin costs are inclined to weaken.

Determine 8 – Bitcoin costs negatively correlated to monetary circumstances (Writer created with knowledge from stockcharts.com and Chicago Fed)

The newest up impulse in Bitcoin costs coincided with the Federal Reserves’s dovish pivot on the finish of 2023, once they hinted of a number of ‘insurance coverage’ price cuts in 2024. This led to a wild rally in all threat belongings, culminating with traders anticipating the Fed to chop rates of interest 7 occasions in 2024.

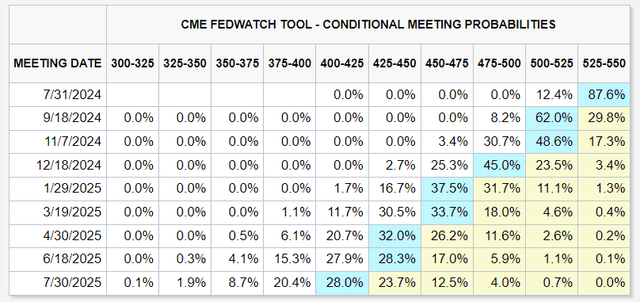

Nonetheless, with inflation readings staying elevated, the Federal Reserve has been pushing again on price minimize expectations in the previous few months, such that the market is at the moment solely pricing in 1 or 2 price cuts for the remainder of this 12 months (Determine 9).

Determine 9 – Markets solely anticipating 1 to 2 price cuts (CME)

This modest discount in threat appetites and ‘animal spirits’ may very well be another excuse why Bitcoin has not been capable of proceed its rally. Wanting ahead, I imagine the Fed is probably going on maintain for the foreseeable future, which implies Bitcoin is probably going ‘caught’ round present ranges as effectively.

Technicals Counsel Warning Warranted

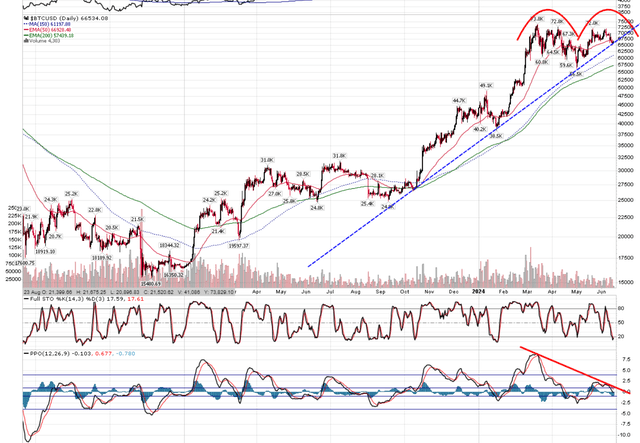

Technically, Bitcoin spot costs have a destructive divergence on the PPO Indicator (a measure of momentum), suggesting warning is warranted (Determine 10). Bitcoin costs are additionally near breaking a steep uptrend, in place since October 2023, with a possible double-top sample forming.

Determine 10 – Technical image recommend warning warranted (Writer created with stockcharts.com)

Conclusion

The 2X Bitcoin Technique ETF is a levered guess on Bitcoin Futures costs that endure from robust contango and volatility decays. As a result of decays talked about, the BITX ETF is just not advisable for long-term traders.

Again in February, I famous that the outlook for Bitcoin seemed vibrant, as an anticipated halving occasion would improve Bitcoin’s shortage worth. Nonetheless, the precise halving occasion has come and gone with little motion within the value of Bitcoins. The problem may very well be that the present halving occasion was broadly anticipated and costs have already front-run the occasion.

Moreover, Bitcoin costs are very delicate to monetary circumstances and market liquidity. With inflation nonetheless elevated, the Federal Reserve has been reluctant to chop rates of interest and additional ease already free monetary circumstances.

With the Fed possible on maintain for the foreseeable future and the main halving catalyst come and gone, I’m turning extra cautious on Bitcoin and its associated investments. I price the BITX ETF an keep away from (maintain) for now.