Regardless of how a lot most of us would love them too, shares can’t go straight up without end.

Social media has turn into a breeding floor for retail investor sentiment, and with it comes a fair proportion of emotional outbursts. When a inventory value dips after a major run-up, accusations of brief promoting and darkish pool exercise are widespread. That mentioned, it’s essential to think about an easier clarification: a wholesome pullback.

Think about this: You purchase a inventory at $10, and inside a month, it skyrockets to $20. Then the inventory value dips to $18. Panic units in, and social media chatter will get louder about potential causes.

Subsequent factor you realize, shares are at $14. It’s not the tip of the world.

In reality, a pullback after a robust surge is a pure market phenomenon. Listed here are three the reason why pullbacks occur.

- Revenue-taking: Those that purchased early at decrease costs may see this as a chance to money in some income, resulting in a brief dip in share value.

- Valuation Reset: Fast value will increase can typically outpace the corporate’s precise fundamentals. Wall Avenue typically prefers a slow-and-steady share appreciation as the corporate continues to strengthen.

- Regular Market Fluctuation: The inventory market doesn’t transfer in a straight line. Pullbacks are a traditional a part of the market cycle, and a wholesome correction can truly be a very good factor for a inventory’s long-term well being.

Word that none are something nefarious. So, earlier than you be part of the web refrain of conspiracy theories, take a deep breath and contemplate these information:

- Brief sellers are a professional a part of the market, offering liquidity and doubtlessly figuring out overvalued shares. Their presence doesn’t routinely imply a inventory is doomed.

- Darkish swimming pools exist to facilitate giant institutional trades with out inflicting market disruptions. Suspect typically, however they’re not inherently adverse.

- Pullbacks create shopping for alternatives

GMGI: Case in Level

Golden Matrix Group (NASDAQ: GMGI) is a number one B2B and B2C gaming expertise firm using proprietary expertise and working globally throughout 17 regulated markets. GMGI’s B2B division develops and licenses branded gaming platforms for its intensive checklist of purchasers. RKings, its B2C division, operates a high-volume eCommerce website enabling finish customers to enter paid-for competitions on its proprietary platform in approved markets.

In Mexico, GMGI owns and operates MEXPLAY, a regulated on-line on line casino. The corporate’s international footprint expanded earlier this 12 months with the acquisition of Meridianbet, a well-established B2B and B2C sports activities betting and gaming platform working in regulated markets throughout Europe, Africa and Latin America.

The Meridianbet acquisition has been a catalyst for GMGI’s books and inventory value. As detailed in a Kind 8-Ok/A filed with the SEC, in fiscal 12 months 2023, the mixed entity achieved complete professional forma gross sales of $137.17 millionand a gross margin of 57%. For the primary quarter of 2024, complete mixed income was $36.69 million, with mixed gross margin of 57.4%. Mixed web revenue of for Q1 2024 was $2.06 million.

GMGI Chart Responds

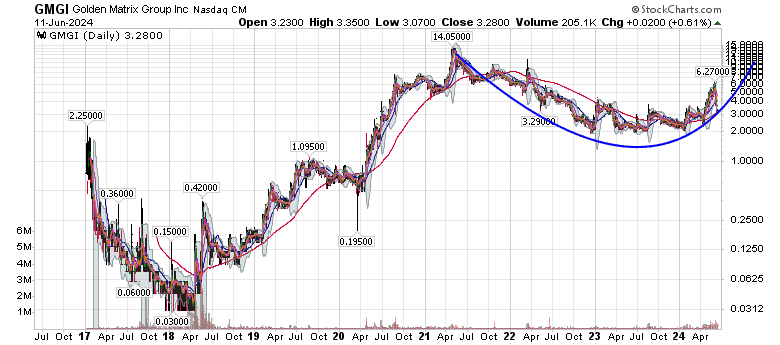

The optimistic developments had been on full show within the GMGI chart as to the optimistic market response. Discover the pronounced surge in cumulative quantity as shares bounced off $2.22 on April 15 to hit a 52-week excessive at $6.27 on Might 31 (+182.4% in six weeks).

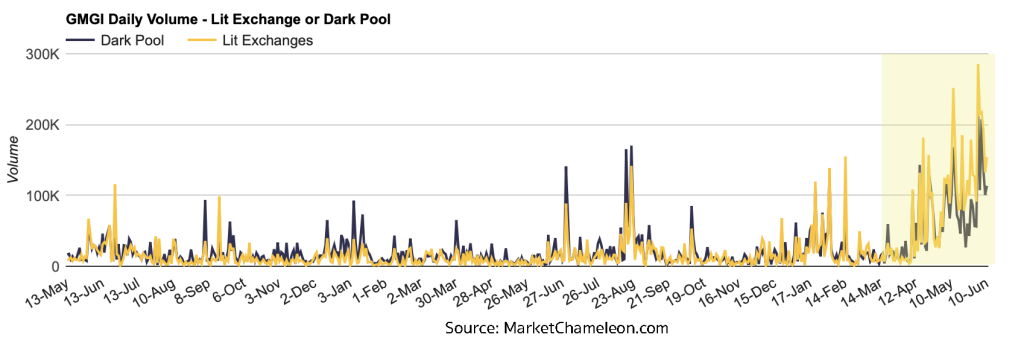

Not surprisingly, a sell-off ensued. However was it pushed by one thing larger than pure buying and selling? A take a look at GMGI darkish pool buying and selling on MarketChameleon.com exhibits no discernible soar in darkish pool versus lit buying and selling during the last couple months.

Because it occurs, darkish pool buying and selling is a playground for giant cash (e.g. hedge funds, establishments). Market Chameleon’s charts present that almost all buying and selling for GMGI is small and retail merchants. This may increasingly quickly change, as Golden Matrix Group was simply added to the Russell 3000 on June 5, which might command the eye of much more funds that put money into the favored index.

Then, it should be shorts, proper? No. Knowledge on Fintel.io, which pulls its information from NASDAQ, exhibits GMGI as simply 96,868 shares, or lower than a day’s value of buying and selling, brief.

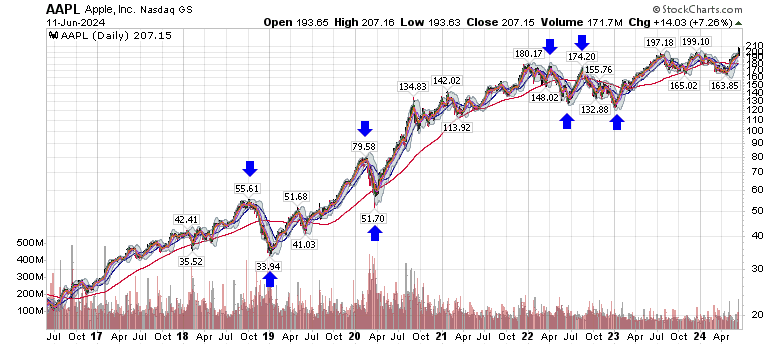

The brief reply is that folks took the possibility to financial institution some income as GMGI hit a multi-year excessive. It occurs to each firm. Even the mighty Apple (NASDAQ: AAPL) has been chopped considerably throughout its unimaginable worth creation (and halved many instances while you return to its early years).

Savvy merchants use strikes up and all the way down to evaluate funding theses, asking if the corporate’s fundamentals nonetheless assist the preliminary funding determination and if the pullback is an opportunity for dollar-cost averaging.

Give attention to the long run: Don’t get caught up in short-term value fluctuations. When you consider within the firm’s long-term prospects, a pullback could be a golden alternative to purchase at a reduction.

For GMGI, a greater query than what was the perpetrator within the pullback could also be if the chart is forming a big cup and deal with, a bullish continuation sample. Technical merchants certainly seen within the chart above that shares rebounded off a assist degree and the 200 day shifting common. That is making a 3rd new larger low if it holds.

A easy climb from right here to maintain making larger lows and better highs is what builds a robust chart and reflection of a inventory worthy of being a part of the Russell 3000.

Profitable investing requires self-discipline and a transparent head, not being swayed by noise. Analyze the scenario rationally, and keep in mind, typically a pullback is only a pullback.

This content material is supplied by J Ramsdell Consulting (“JRC”), an investor relations consultancy agency specialised in social media administration and company communications options for private and non-private firms globally. JRC shouldn’t be a registered dealer/vendor or monetary advisor and encourages all readers to seek the advice of with a certified skilled advisor earlier than making any funding selections. JRC assumes no accountability for the funding actions executed by the reader. All content material is generated from publicly accessible data and believed to be correct. Nonetheless, the accuracy or completeness of the knowledge is barely as dependable because the sources they had been obtained from. All supplies created by JRC and launched to the general public through distribution companies, social media, web site, or some other technique of transmission are to not be thought to be funding recommendation or a solicitation to purchase or promote securities and are solely for informative functions solely. JRC has been compensated by GMGI for investor relations companies, together with often creating and managing content material, which inherently creates a battle of curiosity in JRC’s potential to stay goal in communication concerning the consumer firm. Moreover, this text comprises forward-looking statements, notably as associated to the enterprise plans of the consumer firm, throughout the that means of Part 27A of the Securities Act of 1933 and Sections 21E of the Securities Change Act of 1934 and are topic to the secure harbor created by these sections.