Small companies are experiencing a cool-down interval as a result of early summer time warmth. Heatwaves have dampened the tempo of enterprise restoration, with each companies and staff feeling the affect.

Noteworthy developments this month:

- Small enterprise homeowners noticed the lowest variety of staff working in June over the previous three years. This knowledge relies on the distinct variety of hourly employees with not less than one clock-in.

- Southern and Western states had been hit the toughest, however Northern and Midwest states additionally skilled a slowdown due to the irregular temperatures.

- All industries are feeling the labor affect, with fewer staff working in comparison with earlier years. The leisure & hospitality industries proceed to outpace different industries by way of progress, even with temperatures rising.

Worker exercise

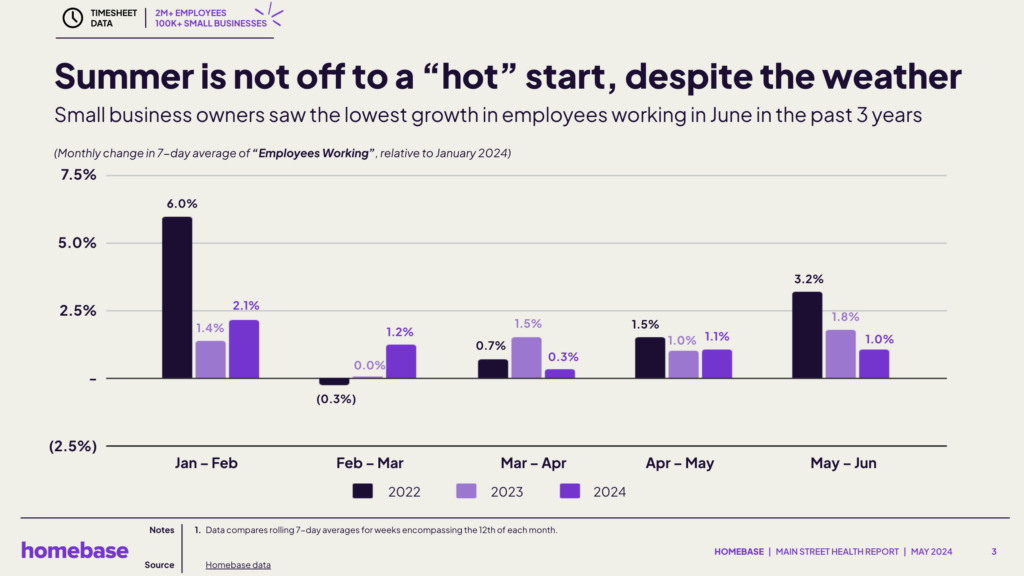

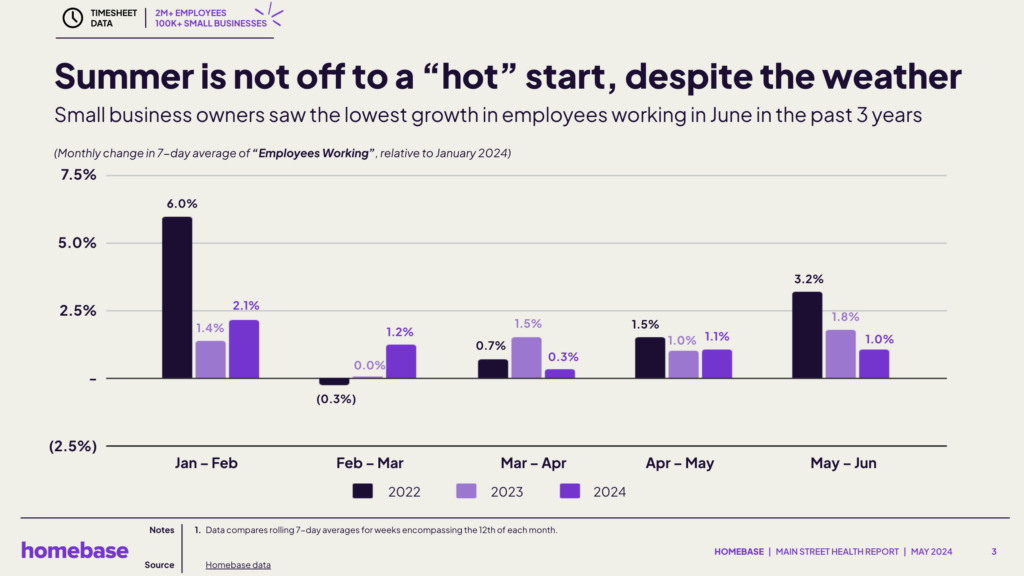

Small enterprise homeowners noticed the bottom progress in variety of staff working in June up to now three years.

In 2024, progress has slowed by mid-year, reflecting the broader affect of heatwaves on small companies. Could-June of this 12 months noticed progress of 1.0%, a noteable drop in comparison with earlier years (1.8% in 2023 and three.2% in 2022).

Key statistics:

- January – February: 2.1% progress, down vs. 2022 however the highest of 2024.

- February – March: A 12 months over 12 months enchancment of 1.2%.

- March – April: A drop in progress to 0.3%.

- April – Could: Noticed a 1.1% improve, indicating some restoration and regular YOY.

- Could – June: Progress of 1.0%, regular vs. Apr-Could however down from 1.8% in 2023 and three.2% in 2022.

Hours labored

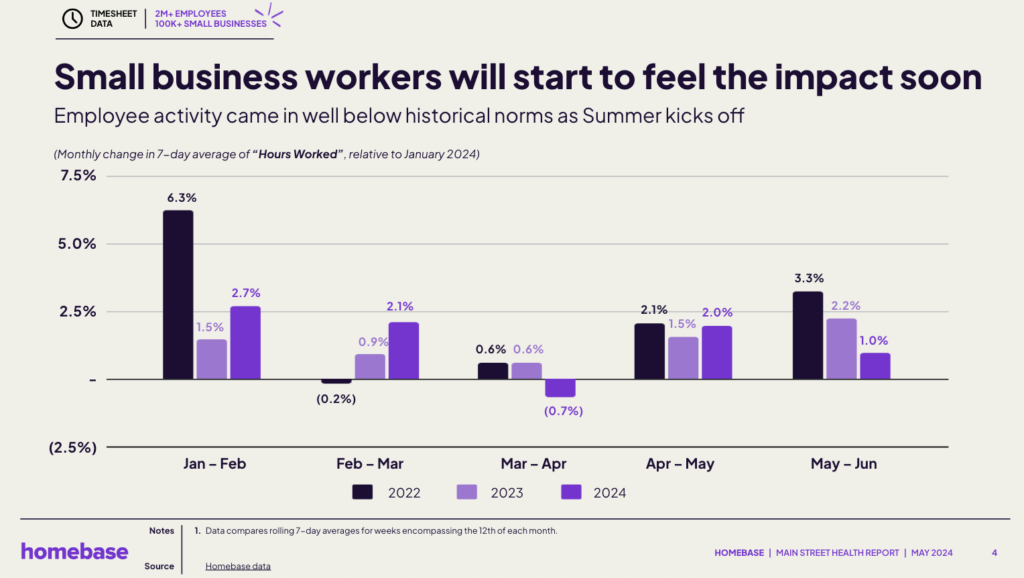

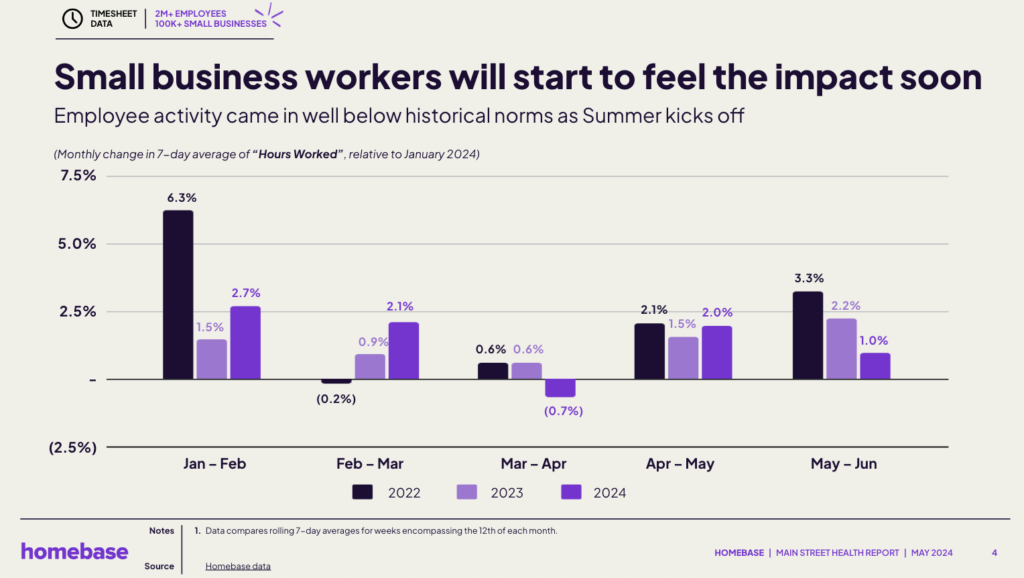

Worker exercise got here in properly under historic norms as summer time kicks off. The month-to-month change within the 7-day common of “Hours Labored,” relative to January 2024, highlights this development. Hours labored is calculated from hours recorded in Homebase timecards.

Regardless of a robust begin, 2024 noticed fluctuations in hours labored with a major drop in early spring (-0.7%) and one other slowdown by the beginning of summer time (1.0%).

Key statistics:

- January – February: Small enterprise worker exercise noticed a 2.7% rise, indicating a constructive begin to the 12 months vs. 2021.

- February – March: Exercise held comparatively regular with a 2.1% improve, out-performing earlier years.

- March – April: A drop to -0.7% suggests challenges throughout this era, though earlier years confirmed slowed progress.

- April – Could: A wholesome rebound to 2.0% displays some restoration.

- Could – June: One other drop to 1.0%, exhibiting minimal progress versus earlier years and the second lowest interval of 2024.

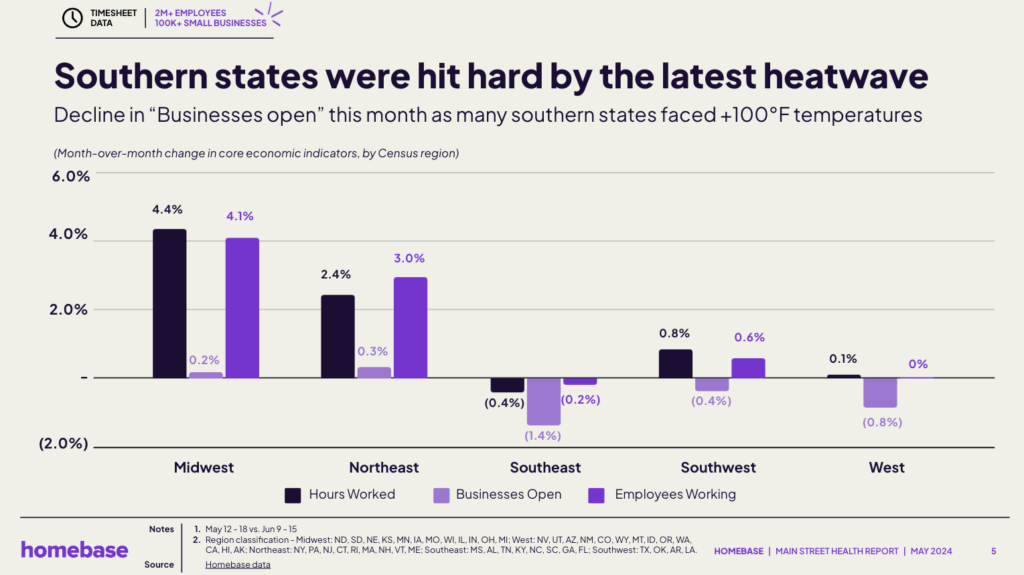

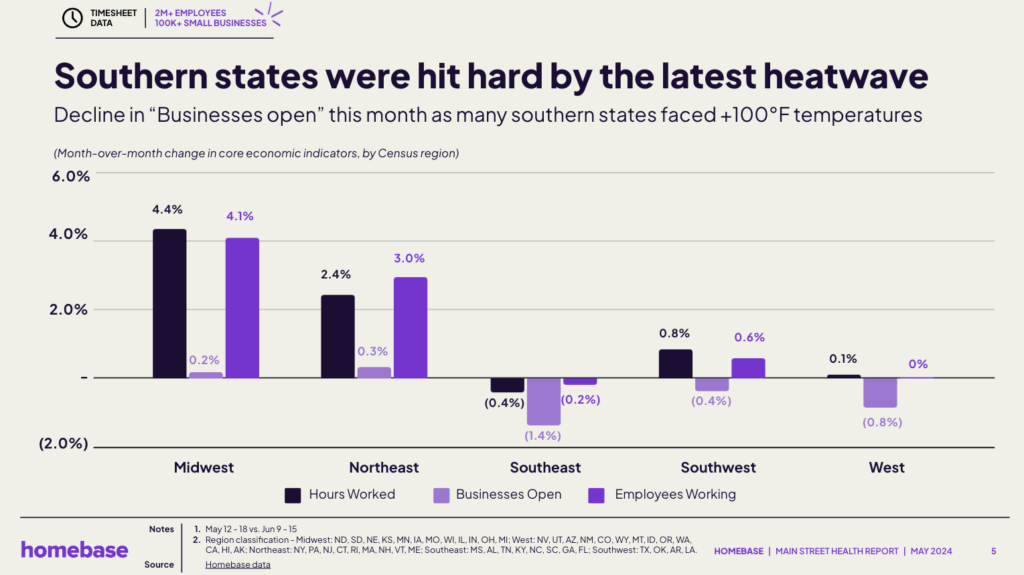

Regional affect

Southern States had been hit arduous by the newest heatwave. “Companies open” is down this month as many Southern States confronted +100°F temperatures, with different core financial indicators trending downwards (hours labored, staff working) within the Southeast.

Whereas the Midwest and Northeast confirmed some constructive core financial indicator developments, the Southeast, Southwest, and West areas confronted some notable declines throughout companies open and worker exercise, highlighting regional disparities resulting from climate circumstances.

Key statistics:

- Midwest: A notable 4% improve in hours labored and staff working, with sluggish progress in companies open.

- Northeast: Slight upwards development in companies open and a 3% rise in staff working.

- Southeast: Skilled vital declines, exhibiting a -1.0% drop in companies open and -0.2% in staff working.

- Southwest: Slight improve in hours labored and staff working, with a slight decline of -0.4% in companies open.

- West: Damaging development of -0.8% in companies open and flat progress in staff working.

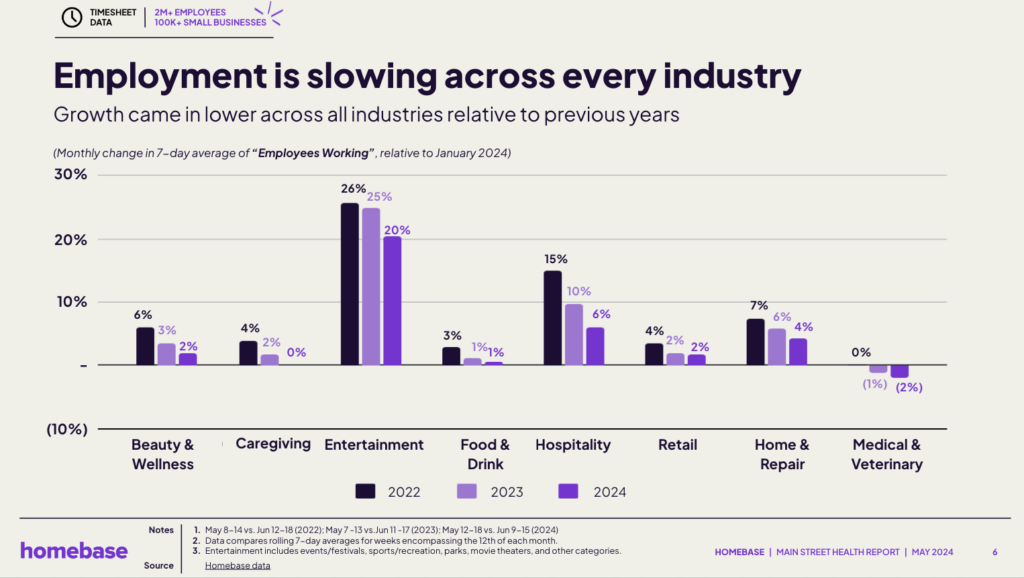

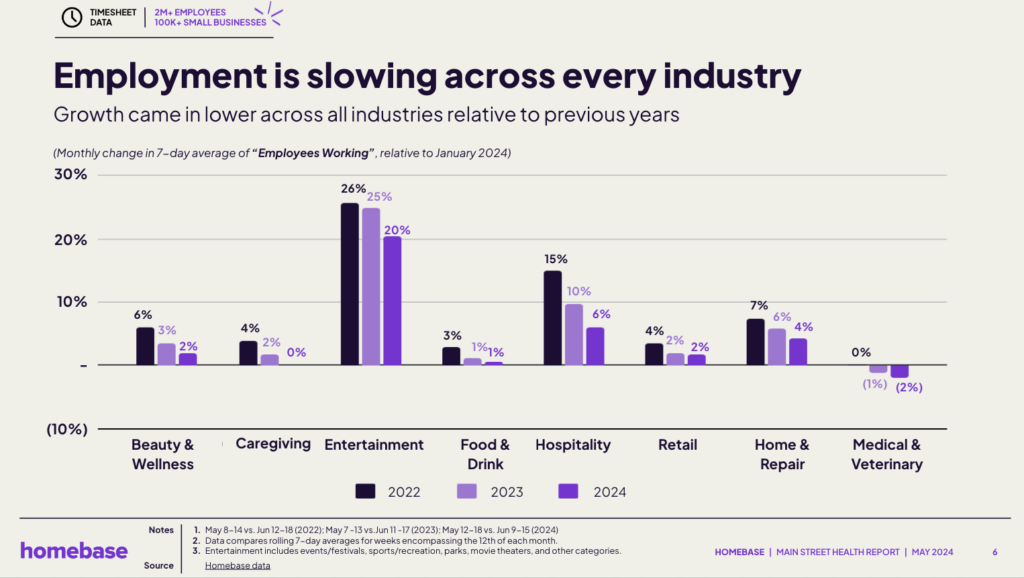

Business-specific insights

Each {industry} is feeling the labor affect these days, with progress coming in decrease throughout all industries relative to earlier years.

Whereas some industries like Leisure and Hospitality noticed progress in 2024, many sectors skilled both minimal progress or declines, highlighting ongoing challenges in varied elements of the small enterprise panorama.

Key statistics:

- Magnificence & Wellness: 2024 noticed a 2% improve, in comparison with 3% in 2023 and 6% in 2022.

- Caregiving: Got here in flat at 0.1%, nonetheless down YOY.

- Leisure: Elevated by 20% in 2024, however nonetheless down from 26% in 2022.

- Meals & Drink: Matching 2023’s progress of 1%.

- Hospitality: Grew by 6% in 2024, a major drop from 15% in 2022.

- Retail: Just like final 12 months, grew by 2%.

- Dwelling & Restore: Grew by 3%, down versus earlier years.

- Medical & Veterinary: Declined by -2%, escalating the decline seen in 2023.

This June report reveals that the acute climate has impacted small enterprise operations, with notable declines in worker exercise and hours labored. Regional and industry-specific knowledge reveal the widespread results, underscoring the necessity for methods to mitigate weather-related disruptions and assist enterprise restoration.

View a PDF under of our full June 2024 Essential Avenue Well being Report. For those who select to make use of this knowledge for analysis or reporting functions, please cite Homebase.

June 2024 Homebase Essential Avenue Well being Report

Our knowledge is publicly obtainable in order that coverage makers and teachers can higher perceive small companies. For those who’re fascinated about extra granular knowledge, or have questions concerning the dataset, e-mail us at knowledge@joinhomebase.com