Up to date at 9:05 AM EDT

Nvidia shares moved greater once more Thursday, extending the inventory’s astonishing run to a contemporary file, because the clear market chief in AI-chip manufacturing continues to dominate its megacap tech rivals.

Nvidia (NVDA) , which took solely 74 buying and selling days so as to add one other trillion in worth and prime the $3 trillion mark, is now set to open because the world’s most useful firm, having overtaken Microsoft (MSFT) late Tuesday and Apple (AAPL) earlier within the month.

The inventory is ready to open Thursday with a price of $3.46 trillion, extending its 2024 achieve by round $2.1 trillion.

Associated: Analyst resets Nvidia inventory value goal as CEO unveils new AI platform

The tech big’s current surge started in spring 2023 with a revenue-growth forecast that shocked Wall Road and cemented the group’s place because the artificial-intelligence-market benchmark.

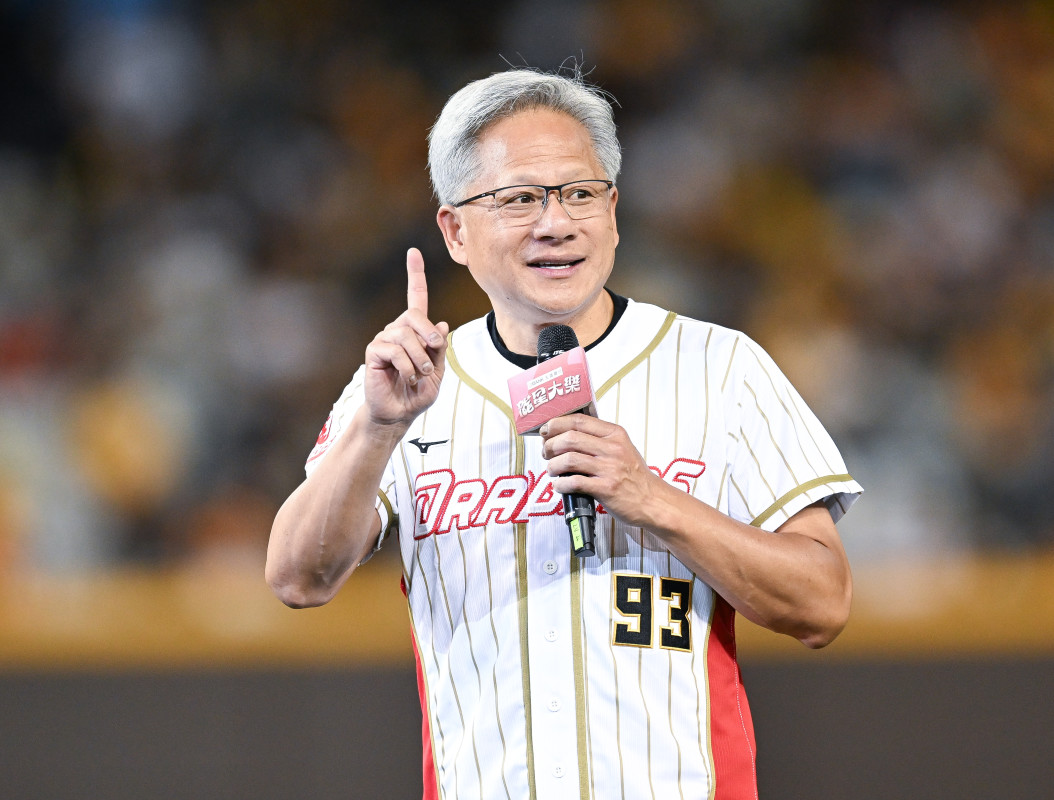

Since then, beneath the management of Co-Founder Jensen Huang, Nvidia has tightened its grip in the marketplace for the superior chips and processors that energy the brand new wave of AI techniques beneath development from tech giants akin to Amazon (AMZN) , Google (GOOGL) and Meta Platforms (META) .

These so-called hyperscalers the truth is are poised to spend round $92 billion this yr alone constructing out their large computing infrastructure. The trouble displays their purchasers’ transfer to leverage their large datasets to reinforce gross sales of the whole lot from drive-through eating to probably the most sophisticated pharmaceutical testing.

Nvidia will get increase from Blackwell processor launch

That is serving to Nvidia, which earlier this spring launched a line of Blackwell computing processors, which can doubtless substitute the corporate’s benchmark H100 chips and drive constant income good points.

“Proper now, we’re in an preliminary funding or analysis section of AI, the place corporations, governments, cloud service suppliers, and many others. are investing in AI and making an attempt to determine what it could actually do for them,” stated John Belton, portfolio supervisor at Gabelli Funds.

“The {hardware} suppliers akin to Nvidia are benefiting, and I believe there’s nonetheless some room for this preliminary section to run.”

Associated: Analysts overhaul Nvidia inventory value targets as earnings handle key drawback

Nvidia stated final month that current-quarter income would rise to round $28 billion, with a 2% margin for error, even because it stated the Blackwell system of processors and software program would not begin delivery till the again half of the yr.

Analysts had fearful {that a} hole between the present H100 chips and the brand new Blackwell providing would create a type of air pocket in income as clients dumped orders for the older chips and waited for the newer system.

“GPUS akin to Blackwell are way more environment friendly than CPUs, just like the H100. So the entire price of possession for working an information middle with Nvidia’s GPUs is decrease than that of working an information middle with CPU servers, stated Belton at Gabelli Funds.

“There’s a case to be made that the put in base of CPU servers and knowledge facilities will must be changed by GPUs within the coming years, and there needs to be ongoing tailwinds for Nvidia from data-center upgrades and data-center modernization,” he added.

Subsequent cease for Nvidia inventory: $4 trillion?

Dan Ives of Wedbush, a longtime Nvidia bull, likens its GPUs to “the brand new gold or oil within the tech sector,” which can energy a “fourth Industrial Revolution.” That revolution, he argues, is already properly underway.

“Its all concerning the tempo of data-center AI-driven spending, as the one sport on the town for GPUs to run generative-AI purposes all undergo Nvidia,” Ives stated. “We imagine over the following yr the race to $4 trillion market cap in tech will likely be entrance and middle between Nvidia, Apple and Microsoft.”

Extra AI Shares:

- Analysts retool C3.ai inventory value goal after earnings

- Analysts revamp Salesforce inventory value targets after earnings

- Veteran fund supervisor points blunt warning on Nvidia inventory

Nvidia shares have been marked 3.63% greater in premarket buying and selling to point a gap bell value of $140.50 every, a transfer would prolong the inventory’s 2024 achieve previous 210%.

The group’s 10-for-1 inventory break up, which was accomplished earlier this month, has additionally added to hypothesis that Nvidia might be added to the Dow Jones Industrial Common, with chipmaker Intel (INTC) , valued at $130 billion, is seen because the probably candidate for alternative.

Associated: Single Greatest Commerce: Wall Road veteran picks Palantir inventory