brunocoelhopt/iStock Editorial by way of Getty Photos

Nike (NYSE:NKE), the athletic attire and footwear big whose inventory has fallen about 50% from its late November 2021 highs of $179, experiences their fiscal This fall ’24 earnings subsequent Thursday evening, June twenty seventh, after the market shut.

The inventory has been basing within the excessive $80s, low $90s because the third week of April.

Promote-side consensus is anticipating $0.84 in earnings per share, and $1.54 billion in working revenue on $12.85 billion in income, for anticipated year-over-year (YoY) progress of 27%, 26% and 0% or flat income progress. (Nike has a simple comp for working revenue vs. fiscal This fall ’23.)

The anticipated 26% working revenue progress is barely the 2nd time within the final 11 quarters that Nike has generated YoY progress in working revenue, which is fairly shocking. Quite a lot of that working revenue drag might have been the stock glut, however that’s now historical past and mentioned decrease within the preview.

No query the sports activities big has struggled since Covid struck. Right here’s Nike’s common income, working revenue and EPS progress because the inventory peaked in November ’21 (10 quarters):

- Income progress: +5%

- Working revenue progress: -8%

- EPS progress: -1%

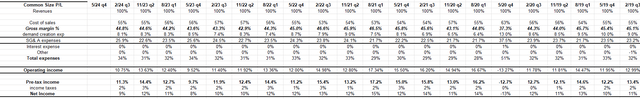

Right here’s the difficulty from modeling Nike’s spreadsheet:

This “widespread dimension” revenue assertion from Nike exhibits that SG&A bills have risen modestly since late 2019, whereas working revenue has slowly eroded since late 2019.

It’s not the tip of the world, however it could possibly be indicative of the “stale model” and the stale footwear that Nike CEO John Donahoe desires to invigorate.

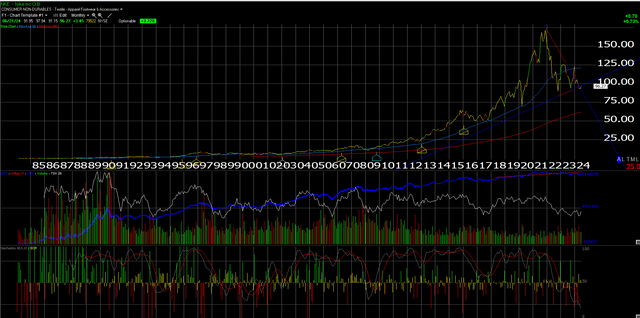

Technical take a look at the inventory

What’s intriguing with Nike’s month-to-month chart is that the inventory will clear congestion if it could actually commerce up and thru $100, after which has room to run till the 50-month transferring common or roughly $120-121 per share.

Possibly extra importantly, if you happen to take a look at the underside 1/third panel, Nike is now extra oversold on the month-to-month chart than it was in 2008.

The issue from the elemental perspective is that the model really could possibly be stale and worn out, i.e. drained. If that’s the case, it is going to possible stay bouncing round at these ranges.

The late September, ’22-early October ’22 lows for the inventory have been within the $80-$82 worth stage.

That’s your exit worth or loss restrict, since a commerce by means of that stage on heavy quantity means a lot deeper issues on the “Swoosh”.

Valuation

The problem with Nike, each with fiscal ’24 and monetary ’25 is that Nike expects simply 1% income progress for each years, and whereas there’s simply 1 quarter left in fiscal ’24, the truth that fiscal ’25 consensus (began on June 1, ’24) expects 1% income progress to generate 4% EPS progress, (down from an anticipated 16% EPS progress this 12 months) continues to inform us that analysts are loath to raise numbers and don’t anticipate a lot to alter.

Nike’s fiscal ’25 information will likely be important on subsequent Thursday evening’s convention name. For fiscal ’25, the present consensus is anticipating $3.88 in EPS on $52.1 billion in income. Once more, Nike ought to be producing higher than 1% income progress.

At $95 per share, Nike is buying and selling at 24x anticipated EPS of $3.88 on anticipated income progress of 1%. That actually will not be a lot to excite buyers. Nike can be buying and selling about 2.5x income and 18x and 21x money circulate and free money circulate (ex money).

As a valuation optimistic, Morningstar has a $129 honest worth estimate on the inventory, which – in keeping with Morningstar’s mannequin – leaves the inventory buying and selling at a 25-26% low cost to honest worth.

Abstract/conclusion

If fiscal ’25 seems like the present sell-side consensus expects, then Nike can have generated 2 consecutive years of 1% income progress. That’s not good. This weblog’s monetary mannequin goes all the best way again to 1992, and Nike has skilled single years with 1% income progress, however by no means 2 years in a row. Fiscal ’25 steerage will likely be important on the decision.

The stock glut, which many retailers skilled in late ’21 and thru ’22, Nike has now fastened. So within the final 4 quarters, Nike’s YoY income progress has exceeded YoY stock progress properly. A listing glut like that’s in the end a drag on money circulate.

China is roughly 17% of Nike’s complete income, and 53% of EBIT (which is how Nike discloses their working revenue) however it’s deceptive because the World Model Divisions and Company are huge unfavourable numbers inside EBIT disclosure. The US and China EBIT sum as much as 157% of complete EBIT because of how Nike discloses it, so its analytical worth is questionable.

Nonetheless, China is essential to Nike. Maintaining a tally of China’s financial information, I don’t assume that a lot has modified for China progress prospects in the previous couple of years. There’s nothing compelling but to trigger buyers to leap aggressively into accumulating the inventory. Be affected person and watch the numbers.

One motive I fear about Nike, as many appear to be from an “obsolescence” perspective, is Nike’s reporting of earnings. Nike is likely one of the few main manufacturers, retailers and iconic corporations that doesn’t report the money circulate assertion with earnings.

It feels like one thing that isn’t even value mentioning, however because the Nineties and the passing of Reg FD (Full Disclosure), corporations have been more and more reporting the money circulate assertion with the earnings launch.

All of the mega-cap tech corporations report the assertion of money circulate with the quarterly earnings launch. Nike remains to be caught at midnight ages when thought of from that perspective. Traders nonetheless want to attend 3-4 weeks for the 10-Q to be launched to see the precise numbers.

Earlier articles on Nike (right here, right here and right here).

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.