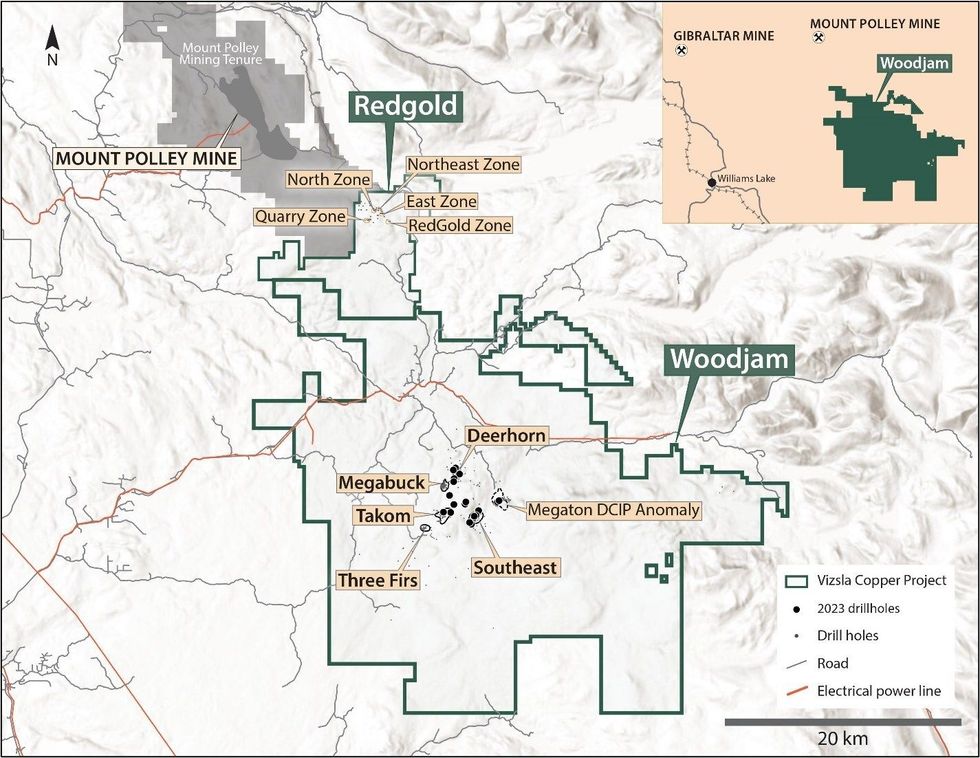

Vizsla Copper Corp. (TSXV: VCU) (OTCQB: VCUFF) (FRANKFURT: 97E0) (“Vizsla Copper” or the “Firm“) is happy to announce the beginning of the summer season core drilling program on the Woodjam copper-gold undertaking (the “Woodjam Venture” or “Woodjam“) in south-central BC (Determine 1).

HIGHLIGHTS

- The Targets: Core drilling will consider the potential for: (1) extensions of high-grade gold mineralization on the Deerhorn deposit, (2) extensions of gold-rich copper mineralization on the Three Firs zone, and (3) extensions of upper gold mineralization on the Southeast deposit.

- The Program: Roughly 3,600m of core drilling in 9 drill holes is deliberate, a few of which might be on the contiguous Redgold property.

“With our financing freshly closed, I am excited in regards to the begin of drilling at Woodjam,” commented Craig Parry, Govt Chairman. “Robust copper costs are anticipated to proceed over the long run and Vizsla Copper is executing on its technique of buying undervalued copper belongings and finishing selective, high-impact exploration applications on our greatest targets.“

“Nicely mineralized and extremely potential for exploration success, Woodjam stays our highest precedence undertaking,” commented Steve Blower, Vice President of Exploration. “I am wanting ahead to evaluating the entire goal areas, particularly Three Firs, as that is our first alternative to increase the wide-open mineralization there.”

The Program

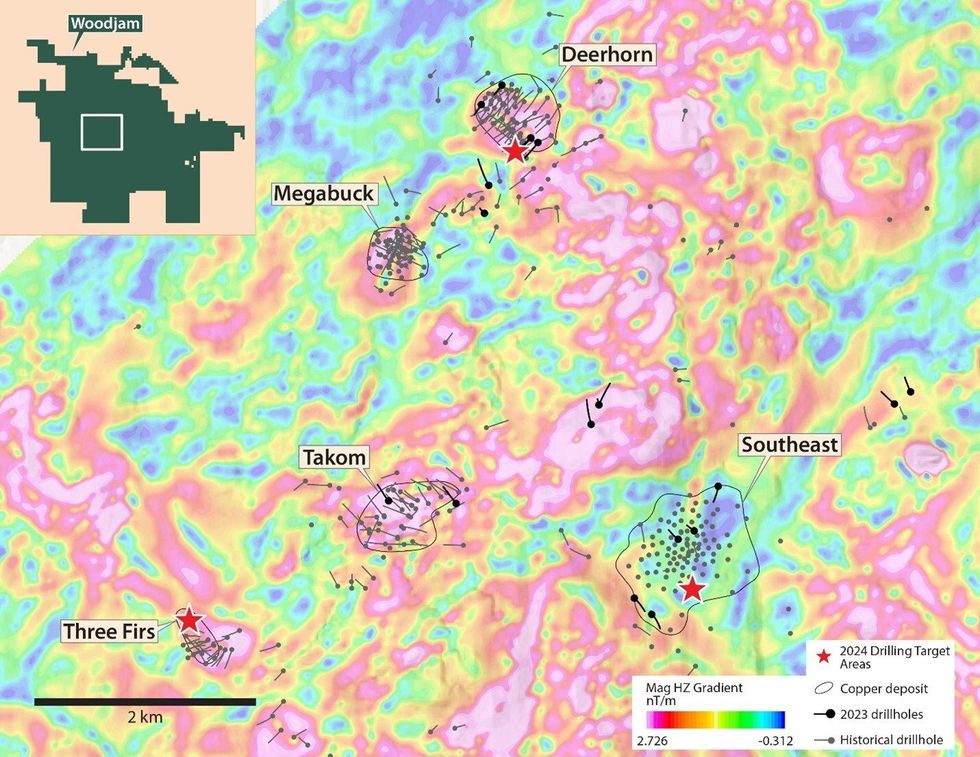

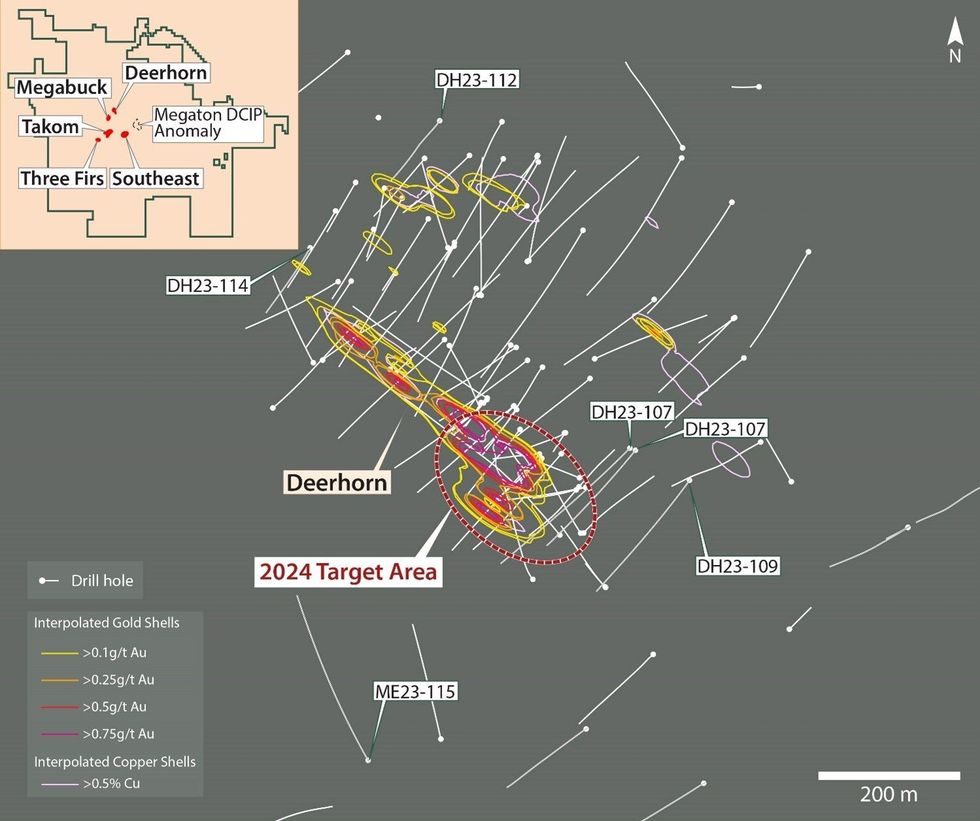

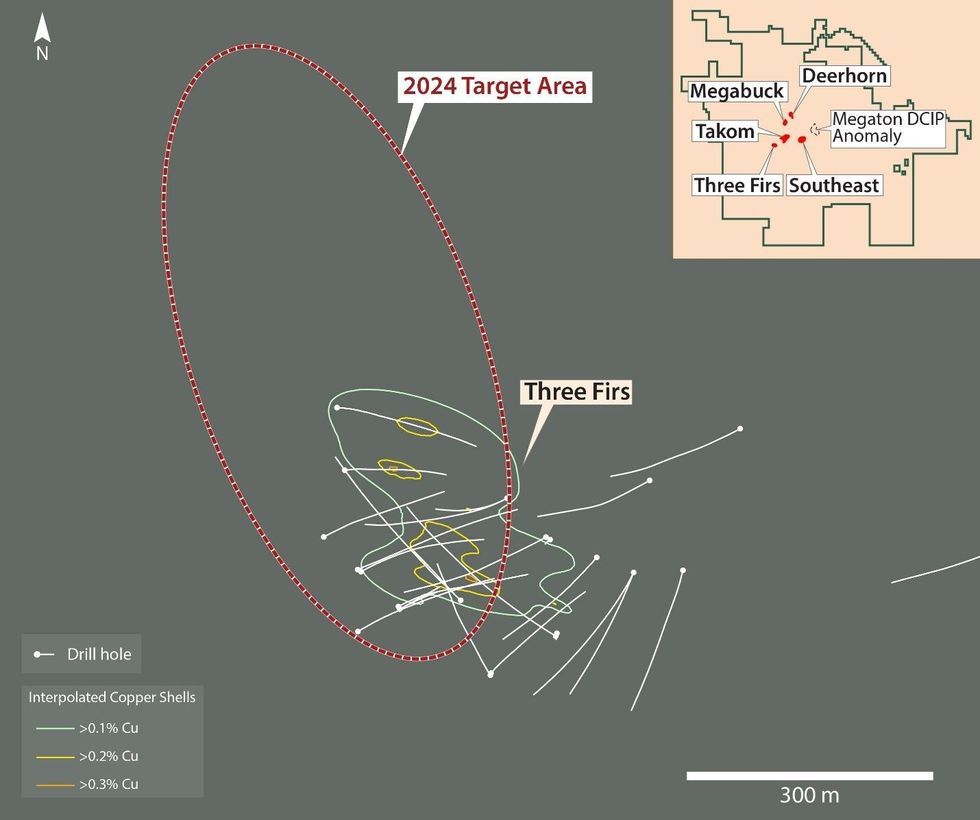

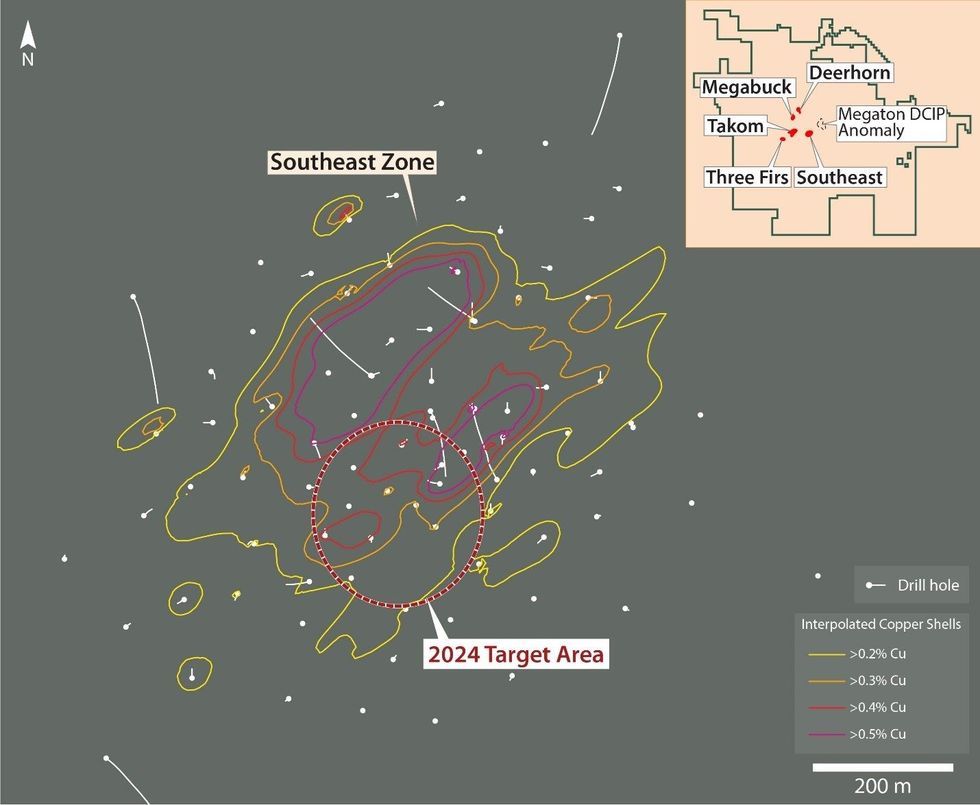

Excessive precedence targets might be evaluated in 3 areas – the Deerhorn deposit, the Three Firs zone and the Southeast deposit (Determine 2). On the Deerhorn copper-gold deposit, at the least two drill holes will consider the potential to increase the higher-grade southern gold-rich portion of the deposit (Determine 3). On the copper-gold Three Firs zone, one drill gap will consider potential extensions to the southwest of the zone and one other will consider a big round magnetic anomaly northwest of the zone (Determine 4). Lastly, drilling on the massive Southeast copper deposit will try and increase the world of higher-grade gold mineralization alongside the south finish of the deposit (Determine 5).

Roughly 3,600m of drilling is deliberate in 9 drill holes – a few of which might be accomplished on the contiguous Redgold property. Extra info on the Redgold portion of the drilling program will observe as targets are finalized. This system will take roughly 6 to eight weeks to finish. Samples might be submitted for assay commonly by way of this system, and analytical outcomes might be disclosed in the end.

Determine 2 – Goal Space Areas

Determine 2 – Goal Space Areas

Determine 3 – Deerhorn Deposit Goal Space (Grade Shells at 810masl)

Determine 3 – Deerhorn Deposit Goal Space (Grade Shells at 810masl)

Determine 4 – Three Firs Zone Goal Space (Grade Shells at 800masl)

Determine 4 – Three Firs Zone Goal Space (Grade Shells at 800masl)

Determine 5 – Southeast Deposit Goal Space (Grade Shells at 790masl)

Determine 5 – Southeast Deposit Goal Space (Grade Shells at 790masl)

About Vizsla Copper

Vizsla Copper is a Cu-Au-Mo centered mineral exploration and growth firm headquartered in Vancouver, Canada. The Firm is primarily centered on its flagship Woodjam undertaking, positioned inside the prolific Quesnel Terrane, 55 kilometers east of the group of Williams Lake, British Columbia. It has three further copper properties: Poplar, Copperview, and Redgold, all effectively located amongst vital infrastructure in British Columbia. The Firm’s development technique is concentrated on the exploration and growth of its copper properties inside its portfolio along with worth accretive acquisitions. Vizsla Copper’s imaginative and prescient is to be a accountable copper explorer and developer within the steady mining jurisdiction of British Columbia, Canada and it’s dedicated to socially accountable exploration and growth, working safely, ethically and with integrity.

Vizsla Copper is a spin-out of Vizsla Silver (TSX.V: VZLA) (NYSE: VZLA) and is backed by Inventa Capital Corp., a premier funding group based in 2017 with the purpose of discovering and funding alternatives within the useful resource sector. Further details about the Firm is accessible on SEDAR+ (www.sedarplus.ca) and the Firm’s web site (www.vizslacopper.com).

Certified Particular person

The Firm’s disclosure of technical or scientific info on this press launch has been reviewed and accredited by Ian Borg, P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Certified Particular person as outlined below the phrases of Nationwide Instrument 43-101.

Neither the TSX Enterprise Trade nor its Regulation Companies Supplier (as that time period is outlined within the insurance policies of the TSX Enterprise Trade) accepts accountability for the adequacy or accuracy of this launch.

FORWARD LOOKING STATEMENTS

The data contained herein incorporates “forward-looking statements” inside the which means of america Personal Securities Litigation Reform Act of 1995 and “forward-looking info” inside the which means of relevant Canadian securities laws. “Ahead-looking info” consists of, however shouldn’t be restricted to, statements with respect to the actions, occasions or developments that the Firm expects or anticipates will or could happen sooner or later, together with, with out limitation, deliberate exploration actions. Typically, however not all the time, forward-looking info and statements could be recognized by way of phrases similar to “plans”, “expects”, “is predicted”, “price range”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the damaging connotation thereof or variations of such phrases and phrases or state that sure actions, occasions or outcomes “could”, “might”, “would”, “may” or “might be taken”, “happen” or “be achieved” or the damaging connotation thereof. Ahead-looking statements on this information launch embrace, amongst others, statements regarding: acquiring required regulator approvals for the Copperview Acquisition and the RG Copper Acquisition; satisfying the necessities of the Underlying Choice Settlement; the exploration and growth of the Woodjam Venture, Redgold Venture and Copperview Venture; and the Firm’s development and enterprise methods.

Such forward-looking info and statements are primarily based on quite a few assumptions, together with amongst others, that the outcomes of deliberate exploration actions are as anticipated, the anticipated value of deliberate exploration actions, that basic enterprise and financial situations is not going to change in a fabric hostile method, that financing might be out there if and when wanted and on cheap phrases, that third celebration contractors, tools and provides and governmental and different approvals required to conduct the Firm’s deliberate exploration actions might be out there on cheap phrases and in a well timed method. Though the assumptions made by the Firm in offering forward-looking info or making forward-looking statements are thought of cheap by administration on the time, there could be no assurance that such assumptions will show to be correct.

Ahead-looking info and statements additionally contain identified and unknown dangers and uncertainties and different components, which can trigger precise occasions or leads to future durations to vary materially from any projections of future occasions or outcomes expressed or implied by such forward-looking info or statements, together with, amongst others: damaging working money move and dependence on third celebration financing, uncertainty of further financing, no identified mineral reserves or sources, the restricted working historical past of the Firm, the affect of a big shareholder, aboriginal title and session points, reliance on key administration and different personnel, precise outcomes of exploration actions being totally different than anticipated, adjustments in exploration applications primarily based upon outcomes, availability of third celebration contractors, availability of kit and provides, failure of kit to function as anticipated; accidents, results of climate and different pure phenomena and different dangers related to the mineral exploration business, environmental dangers, adjustments in legal guidelines and rules, group relations and delays in acquiring governmental or different approvals.

Though the Firm has tried to establish vital components that would trigger precise outcomes to vary materially from these contained within the forward-looking info or implied by forward-looking info, there could also be different components that trigger outcomes to not be as anticipated, estimated or meant. There could be no assurance that forward-looking info and statements will show to be correct, as precise outcomes and future occasions might differ materially from these anticipated, estimated or meant. Accordingly, readers shouldn’t place undue reliance on forward-looking statements or info. The Firm undertakes no obligation to replace or reissue forward-looking info on account of new info or occasions besides as required by relevant securities legal guidelines.