Khanchit Khirisutchalual

AI appeared to steal the present from bitcoin throughout a lot of the primary half of the 12 months. Crypto was within the information in January when the US Securities and Change Fee authorized 11 spot bitcoin ETFs. Then, only in the near past, information unfolded that spot ether ETFs have been on the horizon, although the approval course of is taking a bit longer than some crypto specialists anticipated.

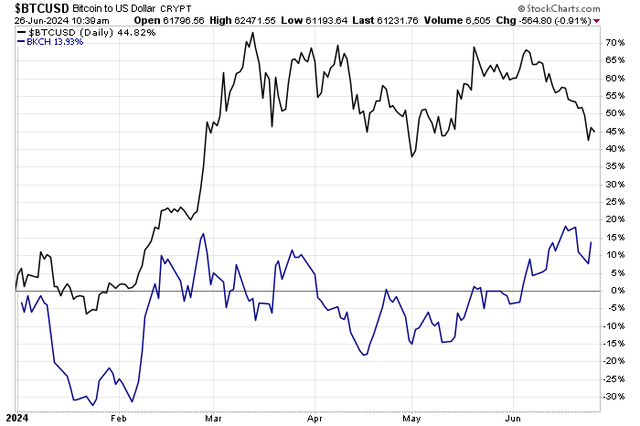

However crypto- and blockchain-related shares proceed to be among the many extra extremely traded equities by way of day by day quantity. Some critics level out, nevertheless, that with the comfort of spot bitcoin ETFs, the shine may come off extremely risky blockchain shares. To wit, the International X Blockchain ETF (NASDAQ:BKCH) is up simply 14% in whole return up to now in 2024 whereas spot bitcoin is greater by 45%.

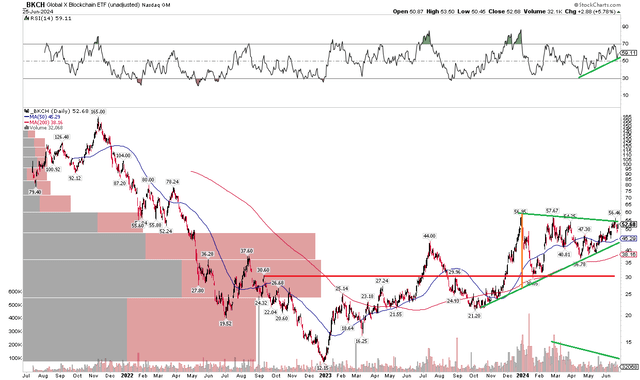

I reiterate a maintain score on BKCH. Shares surged into the shut of 2023, and my maintain score on December 7 was untimely. As hypothesis grew round spot bitcoin ETFs, BKCH rose huge, however has actually simply churned sideways since mid-February. Immediately, I see blended dangers, together with bearish summer time seasonality for bitcoin that would forestall BKCH from gaining a lot steam within the months to come back.

Blockchain Shares Underperforming Bitcoin YTD

Stockcharts.com

In keeping with the issuer, BKCH seeks to spend money on corporations positioned to learn from the elevated adoption of blockchain know-how, together with corporations in digital asset mining, blockchain & digital asset transactions, blockchain purposes, blockchain & digital asset {hardware}, and blockchain & digital asset integration, in keeping with International X. The issuer states that the theme is greater than simply cryptocurrency and that BKCH invests accordingly, with international publicity throughout a number of sectors and industries.

BKCH has grown considerably since I final analyzed the fund. Whole property beneath administration have swelled to $165 million, up from $104 million. With an annual expense ratio of 0.50%, it’s not all that costly and the ETF yields 2.05% on a trailing 12-month foundation. Share-price momentum reveals an ideal A+ ETF Grade by Looking for Alpha, however I’ll make the case later within the article that the technicals are usually not that sanguine.

BKCH isn’t for the risk-averse. Its threat score is kind of poor given a concentrated allocation and excessive annualized normal deviation developments. Potential traders also needs to be aware of the ETF’s liquidity scenario – common day by day quantity is lower than 50,000 shares and its 30-day median bid/ask unfold is excessive at 0.5%, in keeping with International X.

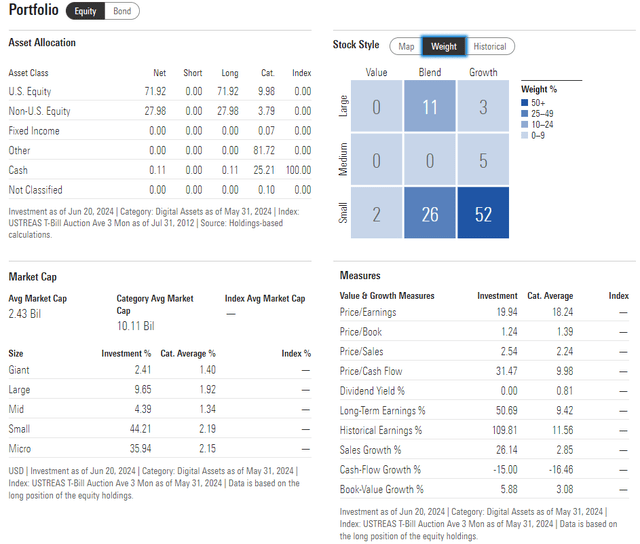

Wanting nearer on the present portfolio, BKCH is risky resulting from its excessive weight to the small-cap-growth part of the fashion field. What’s encouraging, nevertheless, is that the fund’s price-to-earnings ratio has dropped a full 10 handles from above 30 in late December to beneath 20 immediately. I like that cheaper flip whereas long-term EPS development is excessive (after all, the earnings path will possible be risky). Nonetheless, I used to be involved in regards to the P/E final 12 months, so this can be a constructive improvement.

BKCH: Portfolio Metrics

Morningstar

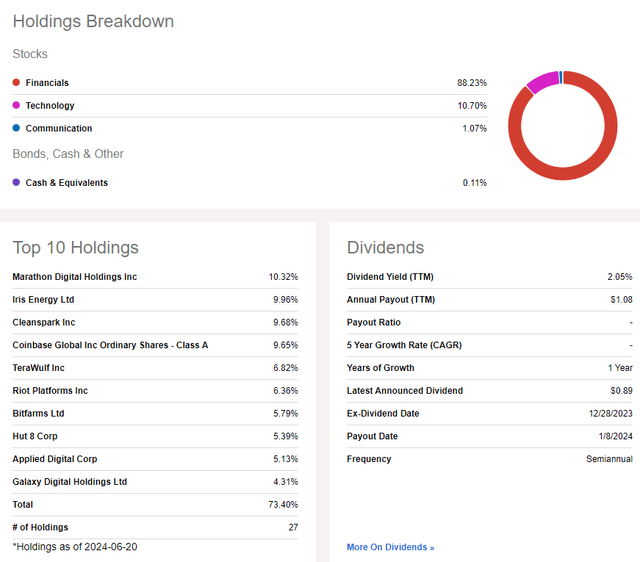

BKCH is very concentrated in only a pair of sectors. The portfolio is ‘fintech’ in nature, with 88% in Financials and 11% within the Info Know-how sector. As talked about earlier than, greater than 70% of the fund’s property are invested within the prime 10 securities, which is a key threat to contemplate.

BKCH: Holdings & Dividend Info

Looking for Alpha

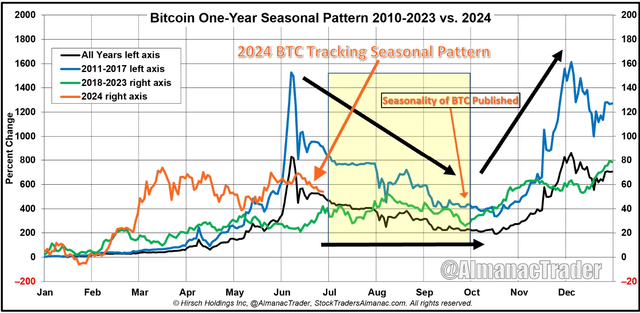

Frightening me to revisit BKCH was this seasonal chart from Jeffrey Hirsch. The famed technician notes that the July via September interval has been tender for bitcoin in its historical past. With 14 years of buying and selling historical past, this can be a materials seasonal threat because the world’s most beneficial cryptocurrency fails to achieve new highs, at present buying and selling within the low $60,000s.

Bitcoin: Bearish Seasonal Traits in Q3

Jeffrey Hirsch

The Technical Take

Up huge on the 12 months and with a decrease valuation, BKCH’s worth chart is encouraging for my part. Discover within the graph under that shares are at present consolidating in a bullish symmetrical triangle. That is thought of a continuation sample, and with the broader pattern being greater off the $12 low from late 22, we are able to even make an upside worth outlook.

If we take the $30 vary top that started in early 2024 and add that on prime of a possible breakout level above $58, then that might set off a bullish upside measured transfer worth goal to $88. After all, that’s nonetheless nicely under BKCH’s all-time excessive of $165 from late 2021.

I see draw back help within the $27 to $30 vary. We’ve additionally seen sellers come about within the $56 to $58 zone a number of instances, so that is still a attainable bother spot for the bulls.

General, the chart is encouraging with rising momentum in the previous couple of months.

BKCH: Bullish Consolidation Amid Falling Quantity

Stockcharts.com

The Backside Line

I just like the valuation and the technicals, however with bearish seasonality within the offing, I imagine it should pay to be choosy on when to enter BKCH. I reiterate a maintain score.