Bychykhin_Olexandr/iStock Editorial through Getty Pictures

I’ve been masking airport names since for properly over a yr now. Popping out of the pandemic, demand for air journey has surged, however I’m considerably reluctant to spend money on airways. Some airways present compelling funding alternatives, however the unbridled value and capability progress doesn’t assist investor sentiment. That’s the reason I began taking a look at different methods to capitalize on sturdy journey demand, and one of many methods is airport infrastructure.

TAV Havalimanlari Holding A.S. (OTCPK:TAVHY) (“TAV Airports”) is among the airport shares I’ve been masking, and the inventory has carried out extraordinarily properly with an 85.3% return since March 2023 and since March this yr once I final coated TAV Airports inventory, we noticed a 53.25% return in comparison with a 5.25% return for the S&P 500 (SP500).

The inventory has now climbed above my value goal of $28.94 and that makes it a very good second to revisit the corporate’s most up-to-date outcomes and assess whether or not the inventory has any upside left for this yr or whether or not it ran forward of its valuation.

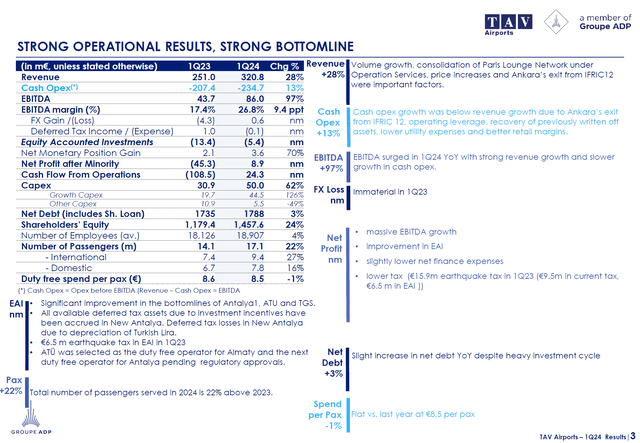

TAV Airports Income Development Outpaces PAX and Value Development

TAV Airport Holding

In my earlier evaluation I famous that top-line progress fell wanting value progress and I had additionally highlighted the chance a weakening Turkish lira poses. Nevertheless, it must be famous that the top-line revenues are largely in US {dollars} or Euros, and it’s largely the fee facet of the enterprise that’s in Turkish lira. Prices are for roughly 34% in liras, whereas revenues are solely 12% in liras. The result’s {that a} weakening Lira is definitely a very good factor for TAV Airports, as with the identical Euro or US Greenback within the top-line, it may pay extra prices. Clearly, if the Turkish Lira strengthens, that very same greenback or euro pays fewer payments.

Specializing in the outcomes, income grew 28% on 22% passenger, which is powerful. Worldwide passenger site visitors grew 27% whereas home passenger progress was 16% and responsibility free spend per passenger dropped modestly. Aviation and floor dealing with revenues grew 23 and 26% with an 84% progress in lounge revenues. Throughout the board in all areas of the enterprise, we noticed revenues develop. The one components the place income progress fell wanting the entire income progress was in subleasing and promoting and catering companies. Popping out of the pandemic, promoting revenues have been below strain, however I consider that time beyond regulation that might enhance once more.

Revenues had been boosted by a two-year extension of the power majeure interval for Ankara Esenboga Airport, the place the accounting construction has modified. Beneath the earlier accounting technique used till Might 2023, the corporate might solely report low cost earnings relatively than complete assured revenues and below the present construction till Might 2025 attributable to an extension of the power majeure. As a part of this extension, the accounting technique has been modified. The brand new accounting technique has been in impact since Might 2023, which means that it’s going to present a useful comp for Q1 and Q2 2024. What will likely be fascinating is to see how income progress will maintain up towards value progress in a extra comparable interval, which will likely be from Q3 onwards.

Moreover, below the brand new concession that may take impact in 2025 there will likely be no minimum-guaranteed revenues and no IFRIC 12 adjustment for Ankara Esenboga, which ought to unlock extra revenues as a part of the revenues which might usually be above the minimal assured income will now not be collected by DHMI, which is the Basic Directorate of State Airports Authority.

Money working bills grew 13% pushed by a 22% progress in personnel prices and a 26% improve in service prices in addition to a 23% improve in hire prices and a 20% improve in upkeep. Most prices are pushed by a mixture of quantity in addition to inflation, and there was some offset as utility prices had been 40% decrease and decrease concession hire in Macedonia.

Total, we noticed EBITDA develop 97% to €86 million pushed by larger passenger site visitors, larger lounge revenues in addition to the exit of Ankara from IFRIC 12 whereas on the fee facet we noticed continued value inflation partially offset by a decrease power invoice and a reversal of beforehand written off property.

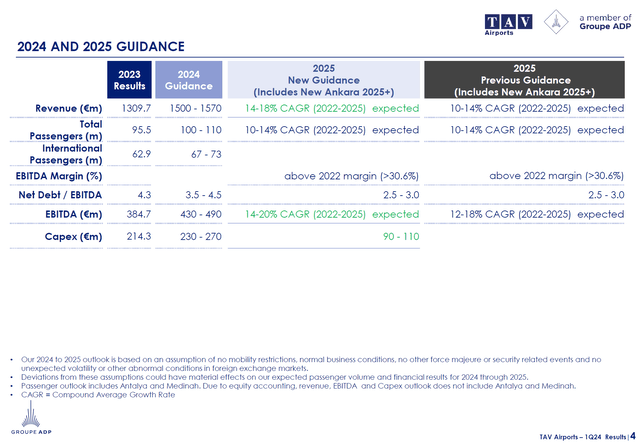

TAV Havalimanlari Maintains Sturdy Steering

TAV Airport Holding

For 2024, the corporate has maintained its earlier steerage aiming for €1.5 billion to €1.57 billion in revenues for 2024 indicating 17% progress on the midpoint on 10% site visitors progress with an growth of worldwide passenger progress. Moreover, the corporate expects its web debt to stay steady within the worst case whereas EBITDA is predicted to develop 20% on the midpoint outpacing income progress and pointing on the potential for larger margins partially pushed by the accounting change.

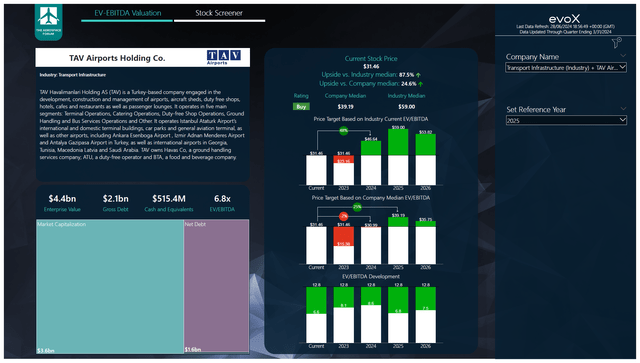

Is TAV Inventory Nonetheless A Purchase?

The Aerospace Discussion board

I’ve entered the newest earnings, steadiness sheet knowledge, and ahead projections into the evoX Inventory Screener and based mostly on that I’m rising my value goal to $39.19 based mostly on 2025 earnings valuing the inventory one yr forward of earnings. If we had been to worth the inventory based mostly on 2024 anticipated earnings, all upside would have materialized, and I might doubtless downgrade the inventory from purchase to carry. Nevertheless, I do consider that at this level it’s acceptable to worth the inventory one yr forward and likewise word that TAV Airport Holding nonetheless trades discounted to friends.

Conclusion: TAV Airports Holding Is Nonetheless A Purchase

TAV Airports has seen a powerful improve in its inventory costs and if the 2024 valuation is an indicator, that may recommend that at this level we must be downgrading the inventory to carry. Nevertheless, I do consider that the corporate nonetheless has numerous progress forward that may drive the inventory costs past 2024. Subsequent to that, the corporate continues to commerce discounted to friends. So, I’m sustaining my purchase score with the word that after the sturdy uptick within the inventory value, any slight signal of weak point would put strain on the inventory value as 2024 upside in direction of the corporate median EV/EBITDA has already materialized.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.