Monty Rakusen

Abstract

I’m optimistic on Similarweb (NYSE:SMWB). My summarized thesis is that SMWB is a number one participant within the business, which permits it to learn from the rising digitalization of companies. Its aggressive benefit stems from its capacity to supply and synthesize knowledge and from its historic datasets, which have been created a number of years in the past. Wanting forward, as development has reaccelerated in latest quarters, with numerous working metrics turning optimistic, I anticipate SMWB to proceed seeing development recuperate.

Firm overview

SMWB

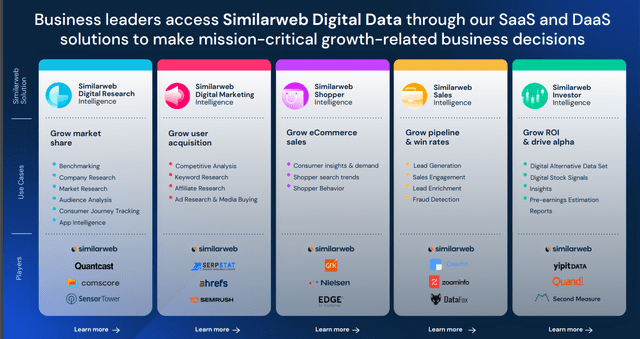

Most readers can be acquainted with what SMWB does, because it seems every now and then throughout an funding analysis course of. SMWB is a digital analytics platform that focuses on offering net site visitors knowledge and evaluation to companies throughout a number of industries. There are 5 key product traces: digital analysis, digital advertising, consumers, gross sales, and investor intelligence (as proven above), and so they principally assist customers purchase the proper market intelligence. As of FY23, SMWB generated $218 million in income, $171 million in gross revenue, and was not worthwhile (adj EBIT margin of -2%). Nevertheless, on a quarterly foundation, since 3Q23, SMWB has reported a optimistic adj. EBIT margin of two% (8.4% in 4Q23 and 4.7% in 1Q24).

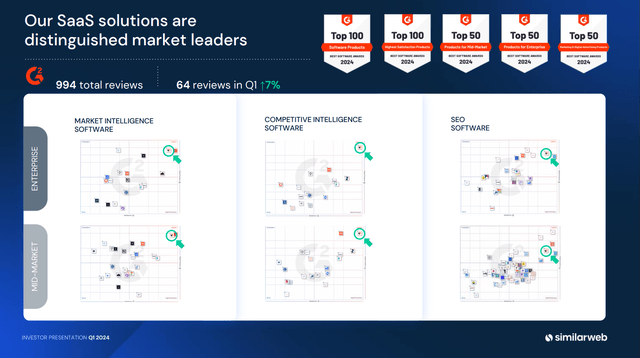

Main participant for market intelligence

SMWB

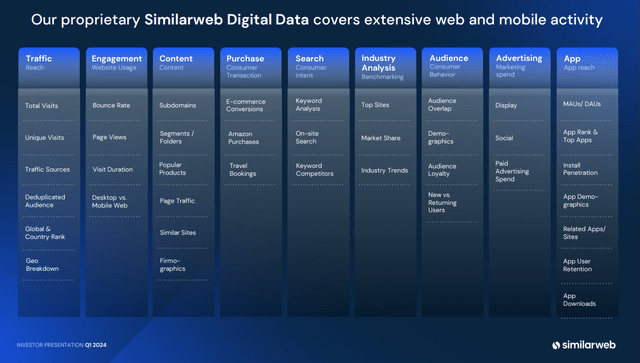

As a number one participant on this business, SMWB ought to proceed to learn from the secular tailwind of digitalization. Within the bodily world, firms and buyers depend on point-of-sale knowledge and a spread of conventional market analysis. However as extra firms are shifting to buying income by means of digital channels (e.g., e-commerce, subscriptions, digital adverts, and so on.), conventional strategies merely don’t work as successfully anymore. Within the digital world, knowledge is rather more modular, which suggests there’s much more knowledge and analytics that may be performed to achieve insights. As an example, it’s a lot simpler to achieve a way of market share, determine site visitors sources so that companies can tweak their advertising messaging, know customers; gadget preferences in order to raised regulate webpage or app format, and so on.

SMWB

SMWB

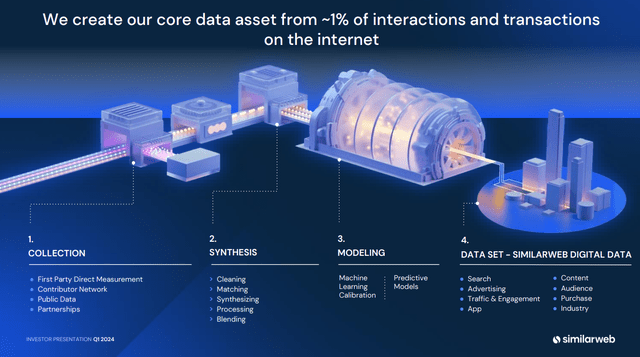

This is the reason I consider SMWB goes to proceed rising for the long run, as it’s a main participant and has a powerful aggressive edge stemming from its underlying knowledge and the best way it synthesizes it. SMWB collects knowledge from a number of totally different sources (together with first-party knowledge, its contributor community, public knowledge, and its companions), and in keeping with SMWB, they accumulate round 1% of the web knowledge each day, which is insanely large. A vital distinguishing issue is that SMWB doesn’t use cookies or accumulate personally identifiable data [PII], and it’s compliant with Id for Advertisers [IDFA] rules within the U.S. and Normal Knowledge Safety Regulation [GDPR] in Europe. Being compliant is more and more vital as underlying customers need extra knowledge privateness safety as we speak, and as such, SMWB enterprise is future-proof.

I see that the best way SMWB collects knowledge is an enormous aggressive benefit that can’t be simply replicated. Firstly, to even obtain the dimensions at which SMWB collects knowledge is a tough factor to do (take into consideration all of the computing energy and storage required, the trouble to put in writing the codes, and so on.). Secondly, it’s not straightforward to accumulate first-party knowledge and purchase partnerships which might be prepared to share knowledge. Thirdly, the diversified strategy of gathering knowledge not solely helps with amassing a really giant dataset, however it is usually essential for SMWB accuracy as extra knowledge factors used to validate the identical piece of data means extra correct outcomes.

Moreover, even when a brand new participant can considerably replicate SMWB’s capacity to accumulate 1% of the web knowledge a day, they’re nonetheless lagging behind when it comes to the full quantity of underlying knowledge SMWB has. Keep in mind that SMWB was based in 2007 (17 years in the past), and that implies that a lot of the datasets for SMWB return years, and within the instances the place these are first-party aggregated knowledge, it might be tough for potential rivals to have something significant as they want a few years earlier than they’ll come out with insights similar to SMWB.

SMWB

The largest differentiation, and likewise an enormous aggressive benefit, is the best way SMWB processes its uncooked knowledge to ship a clear finish product to prospects. After gathering knowledge, SMWB cleans it to take away bot exercise and different anomalies, prepares the datasets, blends knowledge from a number of sources for redundancy, and matches occasion sequences. This course of permits the corporate to supply datasets damaged out into thousands and thousands of insights. Because of this, a consumer can view not simply the full variety of visits to a web site but in addition the origin of these guests (direct search, promoting hyperlink, and so on.), the length of their keep on web site, and the particular order during which every consumer navigated between pages.

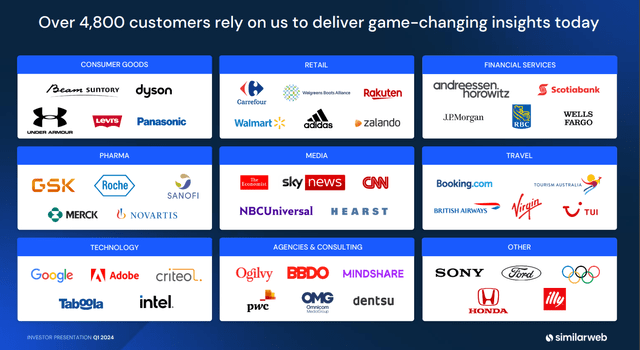

One fascinating factor to spotlight is that even Google, which itself has very robust knowledge assortment and analytics capabilities, is a buyer of SMWB. Main advertising businesses and consulting corporations additionally depend on SMWB for knowledge.

SMWB

Development has circled

SMWB

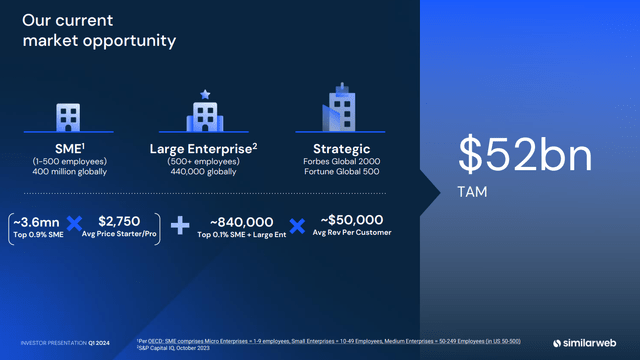

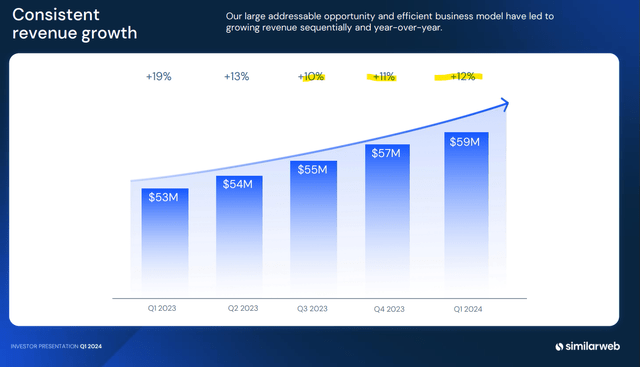

The market measurement is definitely large and is estimated to be round $52 billion as per the SMWB 1Q24 earnings presentation. Utilizing that determine, SMWB is now solely lower than 1% penetrated (utilizing LTM income). If we take a step again and have a look at pre-2023 numbers, SMWB was a high-growth firm, rising revenues by 30 to 40+% yearly, and the market rewarded it with excessive valuation multiples. Nevertheless, ever since development slowed consecutively for six straight quarters (from 1Q22 to 3Q23), the inventory took a dive.

SMWB

That stated, issues have circled, and I see a optimistic pathway for development to proceed accelerating from right here. After six quarters of development slowdown, SMWB reported development acceleration in 4Q23 (10.5%) and 1Q24 (11.8%) vs. 9.6% in 3Q23. This was effectively acquired by the market, as may be seen from the share worth leaping by virtually 100% between December 23 and March 24.

Varied working metrics are additionally pointing to the truth that the worst is over. For instance: (1) internet income retention fee has stabilized in 1Q24 (at 98%, identical as 4Q23); (2) buyer development accelerated to 16.4% in 4Q23 and was fairly steady in 1Q24 at 15.9%; (3) the variety of prospects with >$100 annual recurring income noticed its first y/y development acceleration since 7 quarters to 9.9% (vs. 8.3% in 4Q23); and lastly, (4) backlogs are lastly being transformed to precise orders, which is a really encouraging signal that demand is coming again. Specifically, the big deal pipeline stays intact, as SMWB received 4 offers price greater than $1 million in 1Q24 (the final quarter noticed 10 of such offers).

A few of these offers have been within the pipeline for some time, and simply took a very long time to shut, we’re very excited to see that these offers did in the end convert and are offering us good momentum as we enter 2024. Talked about in 4Q23 name

Subsequently, my view forward is that development will proceed to speed up, and if the economic system turns for the higher, development might see a stronger than anticipated acceleration.

Valuation

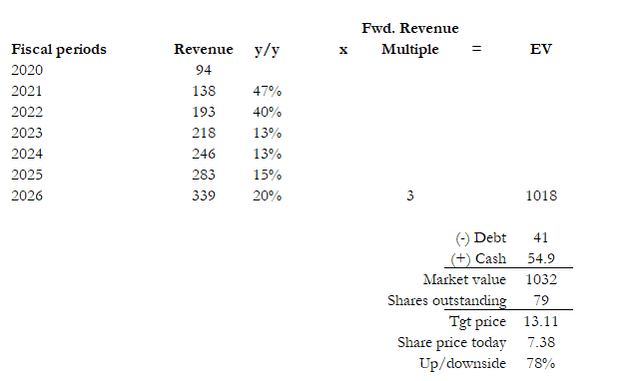

Supply: Creator’s calculation

I consider SMWB is price much more than the present share worth. My goal worth is predicated on FY26 $339 million income and a ahead income a number of of 3x.

Income bridge: As all working metrics and up to date income development have demonstrated, the trough seems to be over, and I anticipate development to proceed recovering to twenty% by FY26. I don’t suppose 20% is an aggressive assumption, because the enterprise was experiencing 40% development simply earlier than the present poor macroeconomic scenario began. The structural development driver stays unchanged, and so I’m nonetheless optimistic on the long-term development potential (do not forget that the TAM is $52 billion).

Valuation justification: Just some months in the past, SMWB was buying and selling at 3x ahead income, and I believe that may be a good start line to consider what a number of SMWB might commerce at when development accelerates again to twenty%. Utilizing 3x, I received to a share worth goal of ~$13.

Funding Threat

If there was a significant breach in being compliant with knowledge privateness legal guidelines (SMWB collects knowledge from lots of sources, so there’s a danger that they missed out) that compromised consumer capacity to make use of these knowledge, it might instantly influence gross sales and buyer development, which might put strain on the inventory. Moreover, I must also embody that additional macro-slowdowns will influence SMWB development as prospects reduce on advertising spend.

Conclusion

My optimistic view on SMWB is due to its main place on this business, which permits it to raised profit from the continued digitalization pattern. SMWB aggressive edge stems from its large historic datasets and its distinctive knowledge assortment and processing strategies. Current quarters have proven a optimistic development trajectory, with key working metrics enhancing. I consider SMWB is undervalued, and the upside could possibly be large if development accelerates as I anticipate.