hapabapa

Every week in the past, Rivian Automotive, Inc. (NASDAQ:RIVN) shocked traders positively by asserting that it was partnering with automaker Volkswagen AG (OTCPK:VLKAF) and that the German auto big would make investments billions of {dollars} right into a joint enterprise with the American electrical automobile firm.

The brand new alliance is clearly directed at countering Tesla, Inc. (TSLA) and goals to decrease growth prices for each firms.

Although Rivian Automotive nonetheless has appreciable gross sales (and estimated correction dangers) in a market that’s seeing a slowdown in EV shipments, I believe that the deal is smart and makes strategic sense for each firms.

My Score Historical past

My final article on Rivian Automotive entitled Rivian: 80% Of Market Worth Is Now Money was a ‘Maintain’, primarily as a result of the electrical automobile firm’s market valuation consisted of 80% out of money. This money cushion created a considerable margin of security for traders.

I’m modifying my inventory classification for Rivian Automotive to ‘Purchase’ after the electrical automobile firm stunned traders with a strategic funding from German automaker Volkswagen on the finish of June.

With Volkswagen placing billions of {dollars} right into a 50:50 three way partnership, I believe that the danger/reward relationship is wanting significantly better for Rivian Automotive.

Deal Implications Of Volkswagen, Rivian Partnership

On the finish of June, Volkswagen and Rivian introduced that they will enter right into a partnership that may see the German automaker make investments $1.0 billion this yr and an extra $4.0 billion by 2026 right into a 50:50 three way partnership. This three way partnership will develop next-gen electrical structure for EVs in addition to software program.

It must be famous, nonetheless, that the settlement doesn’t imply that each firms will collectively develop new electrical autos. The three way partnership will use Rivian Automotive’s {hardware} and know-how platform and each firms will develop their very own electrical automobile manufacturers shifting ahead. In brief, Rivian Automotive is contributing its EV tech whereas Volkswagen is financing the three way partnership as a way to velocity up its personal electrical automobile growth.

The settlement is nonetheless vital, notably for Rivian Automotive, whose pure-play positioning within the electrical automobile market has led to some investor considerations in current quarters, notably as they relate to the corporate’s revenue trajectory. With gross sales falling behind earlier expectations because the electrical automobile market reveals indicators of saturation, traders are apprehensive about Rivian Automotive’s sky-high losses. The blockbuster take care of Volkswagen may assist trim these losses.

The blockbuster take care of Volkswagen may assist trim these losses, notably as a result of the $5.0 billion funding to be made by the German automaker may take strain off of Rivian Automotive’s money move. Sharing growth prices and bills is a good way for Rivian Automotive to alleviate its challenges with money move, which sadly continues to be very a lot adverse.

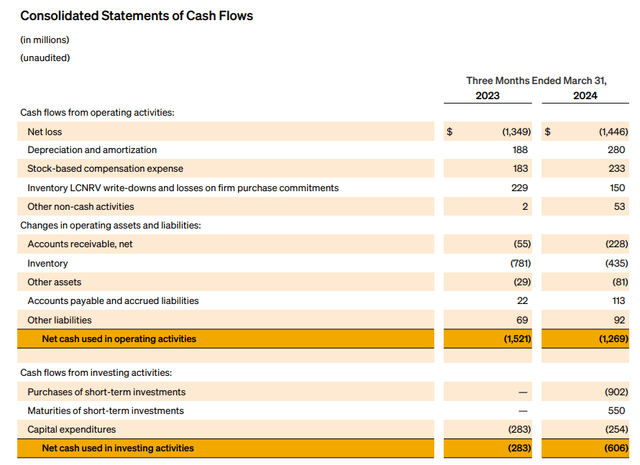

In the latest monetary quarter, Rivian Automotive had a adverse working money move of $1.3 billion and the corporate has been persistently unprofitable on a free money move foundation as effectively, primarily due to rising capital expenditures associated to the ramp of its varied EVs.

Consolidated Statements Of Money Flows (Rivian Automotive Inc)

The sharing of growth prices may very well be a boon for Rivian Automotive, clearly, as a result of the electrical automobile firm must urgently tackle considerations about its lack of profitability. The settlement with Volkswagen ought to enable Rivian Automotive to do exactly that and doubtlessly even speed up its revenue timeline.

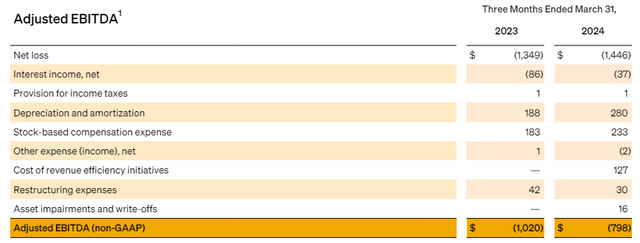

As of proper now, Rivian Automotive continues to be shedding a whole lot of money on its operations and the electrical automobile firm reported an adjusted EBITDA lack of virtually $800 million within the final quarter. Although EBITDA losses narrowed $222 million YoY, traders right now are a lot much less prepared to finance ongoing working losses for electrical automobile firms just because threat attitudes have modified in a market that should take in regular information of slowing electrical automobile gross sales development.

If Rivian Automotive will get to reign in its adverse EBITDA with the assistance of Volkswagen, I believe the EV firm has an ideal probability to develop into the next valuation shifting ahead.

Adjusted EBITDA (Rivian Automotive Inc)

Rivian Automotive Is A Steal Primarily based On Money Worth

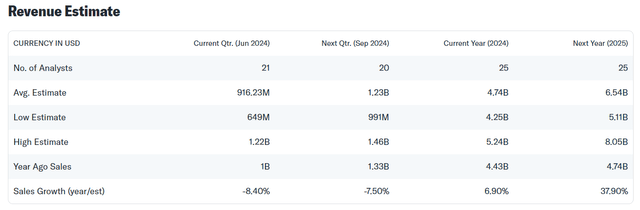

Rivian Automotive’s consensus gross sales estimates are falling and have carried out so for fairly some time because the market got here to phrases with the notion of slowing development out there.

The consequence has been a gradual move of estimate revisions for Rivian Automotive’s gross sales: Presently, the market fashions $6.54 billion in gross sales for the EV firm in 2025 which is down about 1% since my final piece on the corporate was revealed in Might.

Income Estimate (Yahoo Finance)

Electrical automobile firms have suffered a reset of their gross sales estimates within the final yr as demand points started to be broadly reported. Tesla’s makes an attempt to spice up electrical automobile shipments, beginning final yr, by means of aggressive promotions have additional amplified the issue for giant EV firms: They’re competing for lower-than-anticipated gross sales within the electrical automobile trade, pushing firms like Fisker over the cliff and into chapter 11.

If consensus estimates for 2025 are appropriate, Rivian Automotive’s inventory is valued at 2.04x main gross sales, although the electrical automobile firm has offered for considerably greater gross sales multiples previously. Making an allowance for the downtrend in gross sales estimates, an alternate strategy to valuing Rivian Automotive may be based mostly on Rivan Automotive’s substantial money and funding stability.

Rivian Automotive presently has a market worth of $13.4 billion. As of March 31, 2024, the EV firm had $7.86 billion in money stashed on its stability sheet which incorporates the worth of its short-term investments. Rivian Automotive’s complete money stability (together with short-term investments and restricted money) dwindled by $3.9 billion during the last twelve months, which means the corporate had a money burn of about $1.0 billion per quarter.

Primarily based on final quarter’s stability sheet, which means that 59% of Rivian Automotive’s valuation now consists of money. The scaling up of manufacturing goes to value Rivian Automotive a considerable sum of money shifting ahead, however with Volkswagen stepping up and serving to fund the three way partnership, the EV firm may see much less money burn within the subsequent two years, which in flip may speed up Rivian Automotive’s revenue schedule.

Although Rivian Automotive’s cash-to-market-value proportion is down from 80% in Might, it nonetheless displays a excessive margin of security for traders which can be involved about Rivian Automotive’s dangers in a softening market, notably with the EV firm now probably sharing growth prices and dangers with Volkswagen. Rivian Automotive will in all probability proceed to lose cash on its EV manufacturing shifting ahead, however the cash-to-market-value proportion continues to be fairly extreme and limits dangers for traders, for my part.

Rivian Automotive will probably proceed to see adverse money move because it ramps up R2/R3 manufacturing, however with Volkswagen throwing $5.0 billion at a three way partnership with Rivian Automotive, I anticipate that money will proceed to make up about 50% of the corporate’s stability sheet.

With such an extreme money stability and a extra favorable money move outlook, I see a considerable margin of security for Rivian Automotive.

Why The Funding Thesis Nonetheless Has Appreciable Dangers

Rivian Automotive has gross sales and gross sales estimate correction dangers in a market that’s seeing slowing demand for electrical autos. The chapter of Fisker is one other instance of the heightened dangers that traders in electrical automobile firms are going through.

Although Rivian Automotive isn’t vulnerable to chapter given its appreciable money energy, I believe that we’re going to see extra bankruptcies within the sector shifting ahead with solely the biggest EV firms capable of survive.

My Conclusion

Rivian Automotive has carried out a blockbuster take care of VW right here and I believe that the electrical automobile firm is about to revenue by means of an accelerated revenue timeline and assuaging strain on its prices.

As Volkswagen is primarily financing the three way partnership, Rivian Automotive may lastly be put right into a place that enables it to handle its weak level: excessive EBITDA losses in a low-demand surroundings.

Moreover, Rivian Automotive’s valuation nonetheless comprises a really huge margin of security as the corporate’s money accounts for nearly 60% of its market valuation.

Although gross sales estimates will be anticipated to stay underneath strain within the quick time period, Rivian Automotive’s threat/reward relationship seems to be significantly better to me. Purchase.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.