Jerome Powell is more likely to inform lawmakers that Federal Reserve officers want additional affirmation inflation is slowing earlier than they’re able to chop rates of interest, even with proof constructing of softer development and employment.

Article content

(Bloomberg) — Jerome Powell is likely to tell lawmakers that Federal Reserve officials need further confirmation inflation is slowing before they’re in a position to cut interest rates, even with evidence building of softer growth and employment.

June consumer price index data are projected to be another step toward that goal, but the figures are only set for release on Thursday — after the Fed chair wraps up two days of Congressional testimony. Powell speaks Tuesday to the Senate Banking Committee, followed by a House panel appearance on Wednesday.

Advertisement 2

Article content material

With contemporary knowledge displaying the best unemployment price since late 2021, and different figures illustrating weaker financial development, Powell will probably be pressed tougher by some lawmakers on why the Fed is hesitant to decrease borrowing prices.

On Tuesday, Powell stated latest knowledge recommend inflation is getting again on a downward path, however that he and his colleagues want to see that progress proceed.

The so-called core CPI, which excludes meals and power prices and is seen as a greater measure of underlying inflation, is predicted to rise 0.2% in June for a second month. That will mark the smallest back-to-back features since August, a tempo extra palatable for Fed officers.

The inflation report can also be forecast to point out a modest 0.1% improve within the general CPI from a month earlier. In contrast with June of final yr, the worth metric is projected to rise 3.1%, the smallest annual advance in 5 months.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

In the meantime, Friday’s month-to-month payrolls report confirmed that the jobless price, whereas nonetheless traditionally low at 4.1%, is creeping larger. Minutes from the Fed’s June coverage assembly revealed that a number of officers flagged the chance {that a} additional slowing in demand might result in larger unemployment.

Commercial 3

Article content material

Economists on Friday will parse the federal government’s report on producer costs to evaluate the affect of sure classes — like portfolio administration and well being care — that feed into the Fed’s most popular inflation gauge, the non-public consumption expenditures value index.

What Bloomberg Economics Says:

“We anticipate that comfortable inflation prints for June, July and August will give the Fed sufficient confidence to start out slicing charges by the point of the September FOMC assembly.”

—Estelle Ou, Stuart Paul, Eliza Winger, Chris G. Collins, and Anna Wong, economists. For full evaluation, click on right here

Additional north it’s a lightweight knowledge week, however June dwelling gross sales on Friday will make clear whether or not the Financial institution of Canada’s price lower that month jolted the market out of a slumber.

Elsewhere, inflation numbers from China to Sweden and the aftermath of France’s parliamentary election runoff will likely be amongst highlights.

Click on right here for what occurred up to now week, and beneath is our wrap of what’s developing within the world economic system.

Asia

China might get some mildly optimistic information on costs, with knowledge Wednesday anticipated to point out shopper inflation ticked larger in June and factory-gate deflation eased to the slowest tempo since January 2023. Whether or not that helps buoy manufacturing stays to be seen.

Article content material

Commercial 4

Article content material

In different knowledge, Japanese figures for employees’ pay on Monday might present actual wages sliding for a twenty sixth month in Might, casting doubts on the prospects of attaining the virtuous cycle lengthy sought by the Financial institution of Japan.

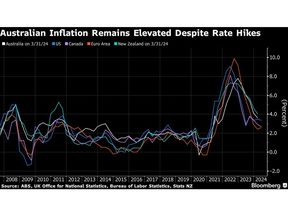

Shopper value development in India might have nudged larger in June, and Australia unveils shopper inflation expectations on Thursday.

Commerce statistics are due from China, the Philippines and Taiwan, whereas Singapore is about to launch second-quarter gross home product knowledge through the week.

On the coverage entrance, a few regional central banks are anticipated to face pat, with traders looking forward to prospects for price cuts within the second half.

The Reserve Financial institution of New Zealand meets after a weak studying for the composite buying managers index pointed to slackening financial development, probably opening to door to a lower within the fourth quarter.

The Financial institution of Korea gathers per week after inflation slowed greater than anticipated, boosting the prospects for pivoting to a discount in borrowing prices as early as August, in response to Bloomberg Economics.

On Friday, Kazakhstan’s central financial institution will determine whether or not to comply with its price lower in Might with one other.

Commercial 5

Article content material

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

A spotlight for traders on Monday would be the aftermath of the French election. Whereas financial-market considerations have eased, the prospect of a hung parliament resulting in a minority authorities that lacks resolve to restore the general public funds stays a possible final result.

Within the UK, whose personal election led to a landslide victory for Keir Starmer’s Labour Get together, traders will likely be looking out for any preliminary selections impacting the economic system and its personal strained fiscal place. Information on Thursday, in the meantime, might present a pickup in development in Might after stagnation the earlier month.

European Central Financial institution policymakers have till the shut of play on Wednesday to talk publicly in regards to the upcoming July 18 price choice earlier than a blackout interval kicks in. Amid a sparse calendar, Bundesbank President Joachim Nagel and Government Board member Piero Cipollone are scheduled to make appearances.

It’s additionally a quiet week for knowledge within the euro area. German exports on Monday and Italian industrial manufacturing numbers on Wednesday are among the many highlights.

Commercial 6

Article content material

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

There’s extra on the calendar outdoors the one foreign money space, with a number of June inflation releases scheduled.

- Hungary on Tuesday, then Norway and the Czech Republic on Wednesday, are all tipped to disclose slowing shopper value development, albeit nonetheless with noticeable margins above 2%.

- The identical day, Russian knowledge might present inflation reached a brand new 2024 excessive, underlining the problem for the central financial institution. After holding its key price at 16% thus far this yr, the Financial institution of Russia will almost definitely contemplate a hike of 100 to 200 foundation factors at its July assembly, Deputy Governor Alexey Zabotkin stated lately.

- In Egypt on Wednesday, officers will hope inflation slowed for a fourth straight month from its peak of 36% in February, which was simply earlier than the central financial institution raised charges as a part of an enormous bailout from the Worldwide Financial Fund, the UAE, and others.

- Additionally on Wednesday, Ghana’s inflation is forecast to sluggish for a 3rd straight month – from 23% in Might – on favorable base results. The central financial institution will nonetheless be involved by a month-to-month improve in costs that’s anticipated to quicken due to a hunch within the cedi.

- And on Friday in Sweden, the CPIF gauge of inflation that the Riksbank targets is predicted to drop beneath 2% for the primary time in nearly three years.

Commercial 7

Article content material

Two central financial institution selections of notice are due throughout the wider area:

- Israel’s financial coverage committee on Monday will probably look previous rising inflation pressures and maintain the important thing price at 4.5% for a fourth straight assembly to help an economic system strained by the struggle in Gaza and escalating tensions with Hezbollah in Lebanon.

- On Thursday, Serbia’s central financial institution makes its month-to-month choice, the place officers might give clues on their subsequent step for the important thing price after June’s price lower, the primary in additional than three years.

Latin America

Information out on Monday might present shopper costs in Chile accelerated for a 3rd month to push additional above goal — whereas greater than a yr of regular disinflation seems to have stalled in Colombia.

In Mexico, inflation probably pushed larger for a fourth straight month, on no account the “benign CPI knowledge” central financial institution Deputy Governor Jonathan Heath says the board desires to see earlier than easing once more.

Banxico, which subsequent meets in August and has paused at 11% for the final two conferences, posts the minutes of its June 27 choice on Thursday.

Inflation is heating up in Brazil, together with President Luiz Inacio Lula da Silva’s mood. Brazil’s chief is fuming over “exaggerated” double-digit rates of interest and the central financial institution’s “nominated by Bolsonaro” president, Roberto Campos Neto. Lula’s verbal broadsides make it tougher to regulate inflation, Campos Neto instructed Brazil’s Valor newspaper.

Commercial 8

Article content material

A string of single-digit month-to-month readings in Argentina has the annual inflation price lastly slowing after hitting 289.4% in April. Analysts surveyed by the central financial institution anticipate the month-to-month print on Friday to come back in over Might’s 4.2% studying.

Peru’s central financial institution meets Thursday after maintaining its key price at 5.75%. A pick-up within the June headline and core inflation prints might sideline the financial institution for a second assembly.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Robert Jameson, Laura Dhillon Kane, Tony Halpin, Monique Vanek, Brian Fowler, Paul Wallace and Zoe Schneeweiss.

Article content material