“Most analysts are modeling rising deficits within the copper market stability by 2027-2028, with a near-term forecast (2024-2026) hinting at surpluses till then; nonetheless, latest developments counsel a shift towards deficits by late 2024 resulting from manufacturing shortfalls by massive producers,” Joe Mazumdar of Exploration Insights mentioned through electronic mail.

These issues have pushed copper to highs a number of instances lately. A copper provide/demand imbalance sparked a record-breaking rally in 2021, pushing costs to a then all-time excessive of US$10,724.50 per metric ton (MT) — a file that the steel broke in March 2022, when it hit US$10,730.

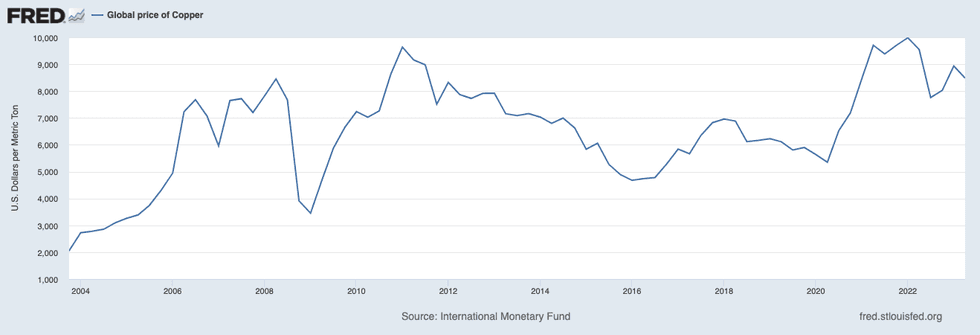

20 yr copper worth chart.

Chart through Federal Reserve Financial Information.

Copper had pulled again to about US$8,000 by mid-August 2022 on rising fears of a worldwide recession. In early 2023, costs mounted a marketing campaign to breach the US$9,300 stage, as soon as once more giving market watchers a cause to imagine highs for the steel would quickly to be retested. Nevertheless, that cause quickly pale as rising rates of interest dampened the outlook for copper-dependent industries globally. China’s ongoing actual property disaster additionally hit copper demand arduous in 2023.

With the demand image unclear, copper could not maintain above the US$9,000 stage. Consequently, it went on a slide, reaching US$7,910 as of early October 2023. Copper managed to shut the yr near the US$8,500 mark.

This trajectory continued into the primary quarter of 2024, retaining copper buying and selling in a spread of US$8,000 to US$8,500. Current manufacturing curbs out of high Chinese language copper smelters are additionally serving to to help costs.

The closure of First Quantum Minerals’ (TSX:FM,OTC Pink:FQVLF) Cobre Panama copper mine final yr and Anglo American (LSE:AAL,OTCQX:AAUKF) revised 2024 copper manufacturing goal have been additionally important components behind copper’s worth momentum.

It started climbing in earnest in Q2 on constructing anticipation that the Federal Reserve might quickly launch its charge lower cycle alongside a worsening provide aspect image. On Might 20, 2024, the value of copper reached its highest recorded worth of US$5.20 per pound, or US$11,464 per MT.

Nevertheless, the value of the bottom steel moved again beneath US$10,000 by the top of the month.

Is the optimism of an impending bull marketplace for the crimson steel nonetheless warranted? Let’s take a look at the present provide and demand components that would affect copper costs to the upside.

Inexperienced vitality in driver’s seat for copper demand

Copper’s many helpful properties have translated into demand from various industries. Building and electronics have lengthy been the principle drivers for copper demand, and with a conductivity score that is second solely to silver, it’s no surprise copper can also be a great steel to be used in vitality storage, electrical autos (EVs) and EV charging infrastructure.

Power storage might show to be probably the most copper-intensive markets within the twenty first century. In keeping with a 2022 report on the way forward for copper by S&P International Market Intelligence, “The fast, large-scale deployment of those applied sciences globally, EV fleets notably, will generate an enormous surge in copper demand.”

The agency is projecting that international refined copper demand will practically double from 25 million MT in 2021 to about 49 million MT in 2035. Power transition applied sciences are anticipated to account for practically half of that demand progress. “The world has by no means produced wherever near this a lot copper in such a short while body,” the agency notes in its report.

China is the world’s largest shopper of the steel, and unsurprisingly its zero-COVID coverage wreaked havoc on its financial system and demand for copper. When China ended that coverage in early 2023, it contributed to the increase seen in copper costs on the time. Nevertheless, repercussions proceed to be seen within the nation, notably in its actual property market.

China’s property sector turmoil is in its third yr, with housing begins down by greater than 60 % in comparison with pre-pandemic ranges, as per the Worldwide Financial Fund. Nevertheless, analysts are beginning to name for a backside as China’s aggressive efforts to energise the sector slowly proper the ship — property funding in China fell by simply 9 % year-on-year within the first two months of 2024, in contrast with a 24 % fall in December 2023, reported Reuters.

Property sector apart, copper demand out of China is more likely to get a lift from the Chinese language authorities’s dedication to investing in its electrical infrastructure and inexperienced vitality financial system.

This push will be seen in ongoing structural reforms supposed to safe the nation’s place as a worldwide financial powerhouse — these embody the Made in China 2025 and China Requirements 2035 initiatives. Part of the nation’s 14th 5 yr plan, these insurance policies goal sectors which might be closely reliant on copper, corresponding to 5G networks, robotics, electrical tools, EVs, industrial web, intercity transportation and rail programs, ultra-high-voltage energy transmission and EV charging stations.

Whereas the subsequent five-year plan remains to be within the works, there are indications that measures to realize carbon neutrality and improve renewable vitality consumption are nonetheless very a lot part of China’s long-term financial targets.

On the EV aspect, S&P International tasks that gross sales in China will attain 11.5 million items in 2024, up 22 % from 2023. The nation’s photovoltaic market can also be anticipated to stay robust in 2024.

The EV market is a rising international supply of demand for copper outdoors China as properly. Because the Copper Alliance has famous, EVs can use three to 4 instances as a lot copper as an inside combustion engine passenger automobile.

Automakers are making massive investments in rising their EV manufacturing capability, with some even seeking to safe copper provide. Final yr, McEwen Copper, a subsidiary of McEwen Mining (TSX:MUX,NYSE:MUX), obtained a US$155 million funding from Stellantis (NYSE:STLA), the fourth largest carmaker on this planet.

Watch the total interview with Rob McEwen and Michael Meding above.

In a latest interview, Rob McEwen and Michael Meding mentioned McEwen Copper’s plans to launch a feasibility research for the corporate’s Argentina-based Los Azules copper venture by the primary quarter of 2025.

Corporations struggling to maintain copper provide coming

In fact, demand is only one aspect of the story for copper costs. For greater than a decade, the world’s largest copper mines have struggled with steadily declining copper grades and an absence of recent copper discoveries.

The alarm bells have been ringing for a couple of years now. In a mid-2020 report, S&P International Market Intelligence metals and mining analyst Kevin Murphy painted a “dismal” image for copper mine provide. He said that out of the 224 copper deposits found between 1990 and 2019, a mere 16 have been found within the final decade. These circumstances have led to questions on whether or not peak copper has arrived.

The COVID-19 pandemic additional exacerbated challenges within the international copper provide chain as each mining and refining actions in a number of high copper-producing international locations have been slowed or halted altogether. The financial uncertainty additionally led miners to delay additional investments in copper exploration and growth — a complicating issue on condition that it might take greater than 15 years to develop a newly found deposit right into a producing mine.

Talking on the Prospectors & Builders Affiliation of Canada (PDAC) conference in March 2024, Murphy mentioned one other issue influencing new copper provide coming to market: inflation. He introduced knowledge highlighting how inflation has hamstrung the mining sector. In 2023, exploration budgets for all metals totaled US$12.8 billion, down 3 % over the earlier yr.

Murphy additionally advised that present financial developments aren’t solely stopping tasks from coming into the pipeline, but in addition sandbagging present tasks.

“Drilling has been in a downtrend as properly, and it’s a bit worse than budgets in 2023, which signifies some inflation has hit the mark,” he said. “It’s a tough business. The usual is about 3 %, (and) in the meanwhile we’re pondering that budgets are most likely down 5 % (in 2024).”

Provide instability out of the world’s largest copper-producing international locations, Chile and Peru, has additionally weighed closely available on the market previously few years. Collectively, they signify a mixed 40 % of worldwide output.

In Chile, a few of the world’s greatest copper miners, together with BHP (ASX:BHP,NYSE:BHP,LSE:BHP) and Anglo American (LSE:AAL,OTCQX:AAUKF), are dealing with royalty charge will increase resulting from a tax reform invoice. The nation can also be coping with water woes as drought intensifies, inflicting rigidity for miners that depend on water to pump copper to the floor, and for the smelting and focus processes.

To the north, in Peru, copper miners have been nervous in regards to the sociopolitical unrest following the impeachment and jailing of former President Pedro Castillo in December 2022, together with protests in opposition to the mining business.

Nevertheless, mining funding remains to be alive and properly in Peru, particularly on the subject of copper, and present President Dina Boluarte helps the business. In keeping with EY, “Of the brand new mining investments, US$38.5 billion is anticipated to be allotted to mining tasks in Peru, with copper tasks accounting for 72 (%) of the whole.”

The provision aspect of the copper market can also be being impacted by manufacturing challenges out of a few of the world’s main producers. Dealing with sociopolitical strain, First Quantum Minerals needed to shut down its Cobre Panama mine in late 2023; it accounted for about 350,000 MT of annual international copper manufacturing.

Moreover, Anglo American revised down its 2024 copper manufacturing goal to a spread of 730,000 to 790,000 MT of copper in comparison with the earlier steering of 1 million MT. This was due largely to manufacturing shortfalls at its Los Bronces copper mine, which is anticipated to proceed into 2025.

Bull marketplace for copper or bust?

So when will copper go up? Collectively, robust demand and tight provide can create the correct market surroundings for greater costs.

Copper’s robust rally lately has inspired the concept that even greater copper costs are forward, which may very well be a golden alternative for junior copper firms within the long-term. At a Vancouver Useful resource Funding Convention copper panel, one speaker defined why this phase of the metals market has piqued his curiosity.

“I’m a copper bull, it’s a long-term performing asset, however ‘high quality’ is what it’s a must to add to the phrase, and I feel copper is important. As all of us see the inhabitants progress, modernization, electrification, it’s going to be a key steel going ahead,” mentioned panelist Ivan Bebek, chairman of Torq Assets (TSXV:TORQ,OTCQX:TRBMF).

“Copper is the brand new oil,” declared Jeff Currie, chief technique officer of Power Pathways at Carlyle, throughout his mid-Might Bloomberg TV interview. The analyst is pointing to the explosion of AI know-how, the vitality transition and navy spending as high drivers of copper demand that would push costs for the crimson steel as much as US$15,000 per MT within the close to future.

The Financial institution of America sees potential for copper costs to succeed in US$12,000 per MT for 2026. As demand is about to extend, the financial institution’s analysts have mentioned the extreme lack of recent copper tasks is “lastly beginning to chew.”

For its half, Citigroup (NYSE:C) can also be projecting a copper worth of US$12,000 by 2026 in its base-case situation on greater demand for the crimson steel from the inexperienced vitality revolution. The agency’s analysts do see a extra bullish case for US$15,000 copper over the following two to a few years within the occasion of a powerful financial restoration.

That is an up to date model of an article first revealed by the Investing Information Community in 2021.

Don’t overlook to comply with us @INN_Resource for real-time information updates!

Securities Disclosure: I, Melissa Pistilli, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.