sanchezarancibia/iStock by way of Getty Photographs

The Q2 Earnings Season is ready to begin later this month for the Gold Miners Index (GDX) and producers in addition to royalty/streaming corporations will get pleasure from their highest gold worth on file at $2,300/oz or increased. Nonetheless, extra vital than any quarterly figures to be launched later this month are useful resource/reserve statements up to date in H1 for many corporations, which give a glimpse into how they’re succeeding relating to changing their mined depletion and the way reserves per share are trending. Kinross Gold (NYSE:KGC) (TSX:Okay:CA) was one of many first corporations to report its outcomes, which we’ll dig into beneath:

Fort Knox Mining Fleet – Firm Web site

All figures are in United States {Dollars} until in any other case famous. G/T = grams per tonne (of gold or silver). GEOs = gold-equivalent ounces. AISC refers to all-in sustaining prices.

Mineral Reserves & Reserves Per Share

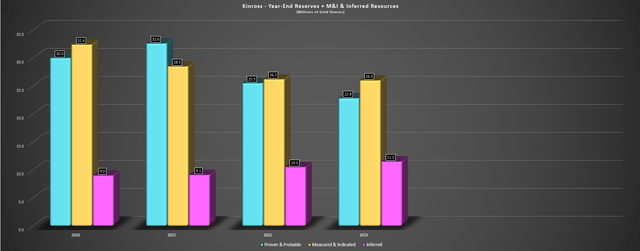

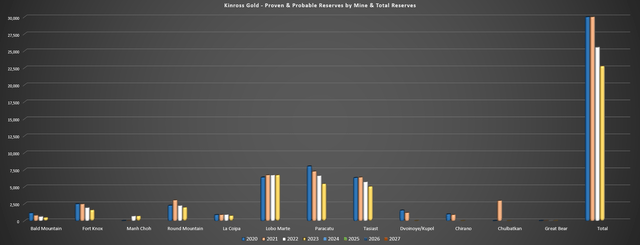

Kinross Gold (“Kinross”) launched its 2023 reserve/useful resource replace earlier this yr, reporting year-end reserves of ~22.8 million ounces of gold at a mean grade of 0.8 G/T of gold. This translated to a ten% decline in reserves year-over-year from ~25.5 million ounces at 0.7 G/T of gold within the year-ago interval. The perpetrator for the decline in reserves was an inferior charge of reserve alternative throughout the portfolio relative to its friends, with continued reserve declines at Paracatu, Tasiast, Spherical Mountain, Fort Knox, Bald Mountain, and La Coipa. The truth is, the one asset which noticed reserve development was Manh Choh (70% owned) the place we noticed a marginal 1.6% enhance in whole ounces (~709,000 ounces vs. ~698,000 ounces), greater than offset by a virtually 3 million ounce mixed dip in reserves at its different property.

Kinross Gold 12 months-Finish Reserves & Sources – Firm Filings, Writer’s Chart

Kinross Gold – Gold Reserves by Asset – Firm Filings, Writer’s Chart

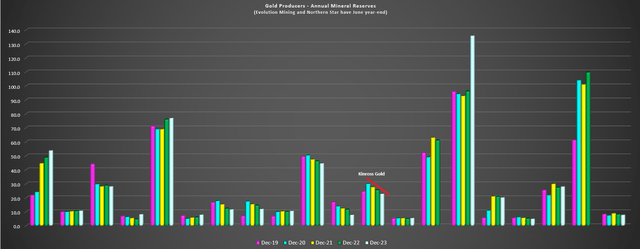

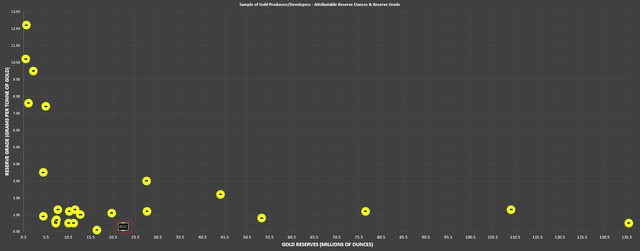

Taking a look at how this stacks up vs. friends, we will see that Kinross continues to have one of many smaller reserve bases on the lowest grade relative to its 2.0+ million ounce producer friends, and has seen a gradual decline in reserves over the previous few years. Sadly, this hasn’t seen a lot of an asset from development in its measured & indicated [M&I] and inferred useful resource classes, with assets up simply ~0.8 million ounces year-over-year and down sharply since 2020 ranges. And based mostly on Kinross’ present enterprise worth, it is buying and selling at practically $550/oz on reserves, a premium to that of Alamos Gold (AGI) which has a much more engaging jurisdictional profile, a a lot increased development charge, and a considerably increased reserve grade (1.5 G/T of gold vs. 0.80 G/T of gold).

Gold Producers Annual Mineral Reserves – Firm Filings, Writer’s Chart

Gold Producers – Reserve Base & Reserve Grade (Hundreds of thousands of Gold Ounces & Grams Per Tonne of Gold) – Firm Filings, Writer’s Chart

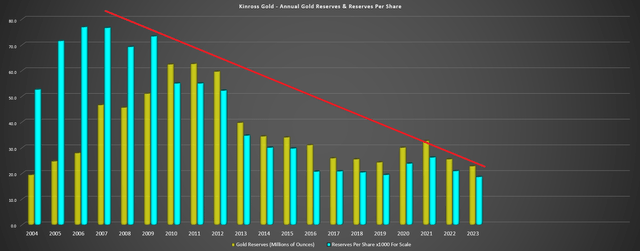

Sadly, whereas gold reserves fell sharply once more year-over-year, reserves per share have continued their steep downtrend over the previous 20 years. It is vital to notice that mining is a depleting enterprise and changing reserves efficiently will not be simple so an investor should not merely write an organization off if it might probably’t efficiently substitute reserves every year. Nonetheless, for my part, there isn’t a use in proudly owning a mining firm as a long-term over the steel until it has been profitable rising reserves per share or one believes there is a path to materially reserving this pattern. And in Kinross’ case, the pattern has not been fairly, and whereas shedding Kupol was out of its management, transactions like dumping Fruta del Norte right into a weak gold market haven’t helped this pattern, with Kinross stating the next on the time:

“We consider it is a win-win transaction for each Kinross shareholders and the way forward for the Fruta del Norte undertaking,” mentioned J. Paul Rollinson, Kinross CEO. “The sale additional strengthens Kinross’ stability sheet because the Firm focuses on its strategic priorities. On the similar time, Kinross’ fairness place in Fortress might present it with a chance to learn from the undertaking’s improvement.”

– Kinross Gold, December 14th, 2014

Though we’ve got seen some win-win transactions over the previous 20 years within the {industry} like Alamos’ current acquisition of Argonaut, I am unsure that I’d name Kinross’ sale of Fruta del Norte a win-win transaction. It is because Fruta del Norte was offered for ~$240 million in money and shares and would have been Kinross’ finest mine at this time with an estimated NPV (5%) of ~$3.8 billion and a ~500,000 ounce manufacturing profile at ~$800/oz AISC, on high of $800+ million in free money stream already generated because it went into manufacturing in 2019.

In the meantime, even when Kinross had taken the money however at the very least held its 26.2 million share place in Lundin Gold (OTCQX:LUGDF) vs. promoting them in 2016 and 2019 for simply ~$140 million, those self same shares would have been value over $420 million at this time. Therefore, irrespective of the way you slice it, this was a large lose-win transaction for Kinross, particularly contemplating that it paid ~$1.0 billion to purchase Aurelian and walked away with lower than one-third of the proceeds after exiting the undertaking even earlier than improvement/drilling bills. Sadly, that is one in all a number of missteps through the years, together with a big fairness elevate close to all-time lows in March 2016 and overpaying for Purple Again Mining, even when Tasiast has been an exceptional asset for the corporate (Chirano since divested).

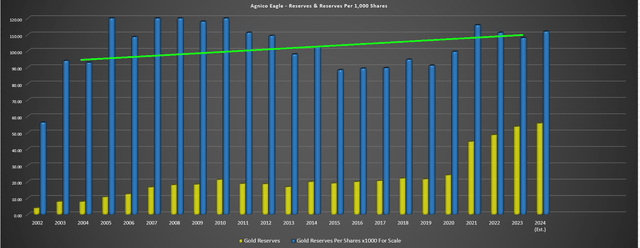

The results of a number of missteps is that Kinross carries the title of getting one of many worst monitor data of reserve per share development amongst its peer group, evidenced by reserves per share down over 60% since 2004. To place this in perspective, Agnico Eagle’s chart of its development in reserves per share is proven straight beneath Kinross’ chart, with reserves per share truly up ~20% in the identical interval. And as I’ve acknowledged in previous updates, the one purpose an investor ought to maintain a core place in a miner is that if it is in a position to persistently develop per share metrics. Therefore, with Kinross failing to develop per share metrics, I see the inventory as extra of a buying and selling car than an funding and an inferior title to personal amongst its million-ounce producer friends, particularly with it now buying and selling at a premium which we’ll talk about later.

Kinross Gold Annual Gold Reserves & Reserves Per Share – Firm Filings, Writer’s Chart

Agnico Eagle Gold Reserves & Reserves Per Share – Firm Filings, Writer’s Chart

Mineral Reserves By Asset

Bald Mountain

Beginning with Bald Mountain, gold reserves ended the yr at ~489,000 ounces at 0.5 G/T of gold or 28.3 million tonnes of ore. This represented a pointy decline from ~625,000 ounces at 0.5 G/T of gold within the year-ago interval and reserves are down over 55% since year-end 2020 (~1.14 million ounces at 0.6 G/T of gold) at decrease grades. Because it stands, this continues to be one in all Kinross’ shortest life property and it famous that it expects to proceed mining till 2026 based mostly on present reserves adopted by residual leaching. That mentioned, the corporate is working to increase the realm of disturbance by 4 acres to ~14.8 acres (proposed allowing motion named the Juniper Challenge), which, if accepted, might lead to a big mine life extension.

Fort Knox

Fort Knox’s reserves ended the yr at ~1.59 million ounces at 0.4 G/T of gold, a pointy decline from ~1.94 million ounces at 0.3 G/T of gold within the year-ago interval. And whereas the mine does have ~940,000 ounces throughout the M&I and inferred useful resource classes backing up reserves, they’re at decrease grades at 0.3 G/T of gold and reserves are down practically 40% since year-end 2020 (2020: ~2.47 million ounces of gold). On a constructive observe, Manh Choh (~709,000 ounces at 7.9 G/T of gold) will considerably raise manufacturing near-term till high-grade reserves are exhausted, with the primary gold pour introduced this week.

Manh Choh Gold Pour – Contago ORE Web site (30% Possession Manh Choh)

Spherical Mountain

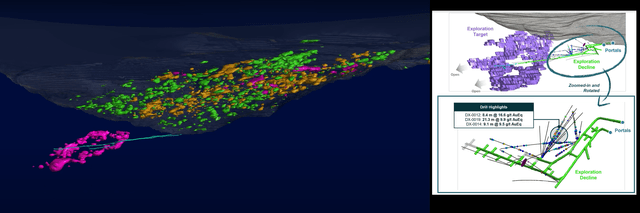

Transferring to Spherical Mountain, gold reserves slid to ~1.98 million ounces at 0.8 G/T of gold, down from ~2.25 million ounces at 0.7 G/T of gold within the year-ago interval. Luckily, Kinross has an honest useful resource base backing up reserves at Spherical Mountain with ~4.9 million ounces within the M&I and inferred classes mixed and with alternatives to increase the mine life. The truth is, the corporate has seen very spectacular drilling outcomes from each Section X and Gold Hill, with the potential for a higher-margin underground mine at Section X. Latest spotlight outcomes from Section X between the open-pit and underground goal hit very spectacular intercepts, together with 8.4 meters at 16.6 G/T gold-equivalent, 21.3 meters at 9.9 G/T gold-equivalent, and 9.1 meters at 9.5 G/T gold-equivalent, with the exploration at Section X practically full (1,800 meters developed to this point).

Section X Mineralization – Firm Web site

La Coipa

Taking a look at La Coipa in Chile, reserves are sitting at simply ~760,000 ounces at 1.8 G/T of gold, down from ~917,000 ounces at 1.7 G/T of gold final yr. This has left the mine with a sub 4-year mine life based mostly on reserves, which is not supreme if it might probably’t efficiently convert assets provided that it’s Kinross’ 2nd lowest-cost asset at present. Because it stands, Kinross has ~1.49 million ounces of assets backing up reserves at La Coipa at a lot increased grades of 1.2 G/T to 1.7 G/T, effectively above its cut-off grade of 0.71 – 0.87 G/T gold-equivalent.

Paracatu

At Kinross’ second-largest mine, Paracatu, reserves fell 18% year-over-year to ~5.45 million ounces at 0.4 G/T of gold, down from ~6.64 million ounces at 0.4 G/T of gold within the year-ago interval. Luckily, the mine is backed up by an honest quantity of assets with ~3.04 million ounces and ~0.1 million ounces within the M&I and inferred classes, respectively, at 0.3 G/T of gold. And like most of Kinross’ different property, Paracatu has had a really tough time changing reserves, with gold reserves down practically 35% since 2020 at this vital asset regardless of a a lot increased gold worth assumption than it used at year-end 2020 ($1,400/oz vs. $1,200/oz).

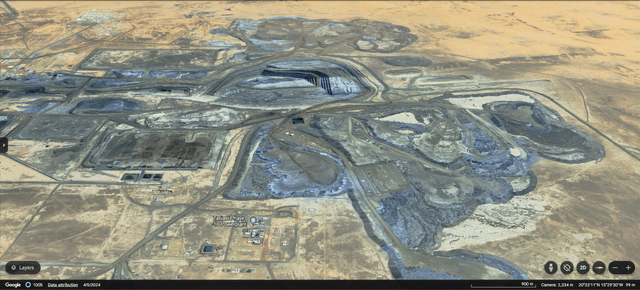

Tasiast

Lastly, Tasiast ended the yr with ~5.06 million ounces of gold reserves at 1.5 G/T of gold, a 12% decline from ~5.74 million ounces at 1.7 G/T of gold within the year-ago interval. This translated to a big decline in grades and whole reserves, and in contrast to another mega mines globally similar to Detour Lake, Tasiast would not have practically as a lot assets backing up reserves. The truth is, whole assets sit at simply ~3.44 million ounces of gold, supporting solely a ~4-year mine life extension assuming 70% conversion charges. Therefore, whereas buyers can stay up for constant low-cost manufacturing till at the very least 2029, we are going to see a cloth drop-off in manufacturing on the finish of the last decade if the mine plan cannot be optimized.

Tasiast Mine – Google Earth

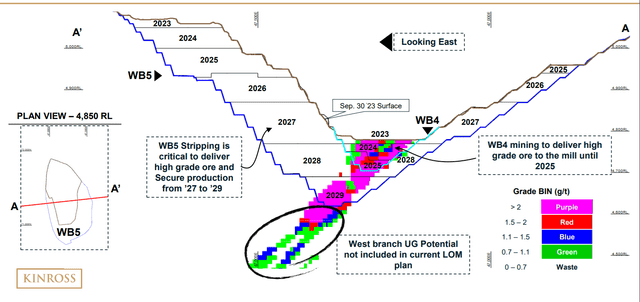

Tasiast West Department Underground Potential – Firm Web site

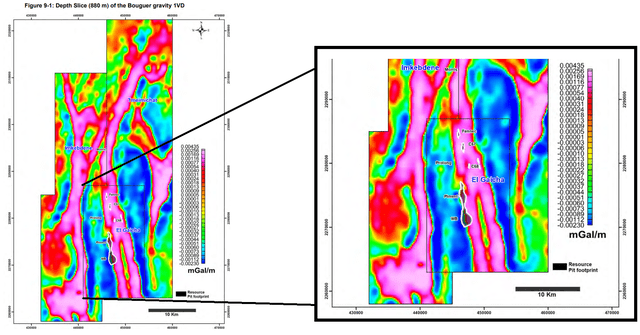

That being mentioned, Kinross has been vocal about testing West Department and Piment at depth to see if there’s the potential for increased grades to justify underground mining. So, with deep drilling anticipated later this yr, any thick high-grade intercepts from Tasiast Deep will surely be a constructive improvement right here. As well as, Kinross has regional potential at Tasiast highlighted beneath with a number of potential targets based mostly on geochemical footprints. Just a few of those embody Kneiffissat, Grindstone, and C23 within the northern extents of the Imkebedene and Tmeimichat licenses. Final, Kinross could possibly uncover new deposits to truck to its Tasiast Mill nearer to Tasiast, together with Fennec, C67 and C68 straight northeast of Piment on its El Ghaicha license.

Tasiast Present Mining Space (Piment, West Department) & Potential Targets – 880 Meter Depth Slice – Tasiast 2019 TR

Mineral Sources

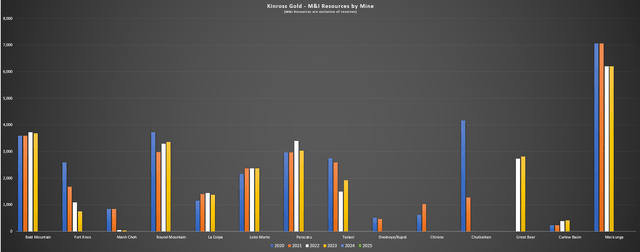

Taking a look at Kinross’ mineral assets, we noticed a tick increased in inferred assets to ~11.5 million ounces at 0.9 G/T of gold, an enchancment from ~10.5 million ounces at 0.7 G/T of gold final yr. This has continued a pattern of development in inferred assets, helped by the acquisition of its Nice Bear Challenge in Purple Lake, Ontario. Sadly, the expansion in inferred assets (27% since 2020 or development of2.5 million ounces) has been greater than overshadowed by vital declines in increased confidence M&I assets that are down ~20% in the identical interval from 32.4 million ounces to 26.0 million ounces or a decline of ~6.4 million ounces of gold. Probably the most vital declines since 2020 have come from Fort Knox and Tasiast, two of its bigger mines, in addition to profitable conversion of assets to reserves that lowered M&I assets at Manh Choh.

Kinross Gold M&I Sources by Mine – Firm Filings, Writer’s Chart

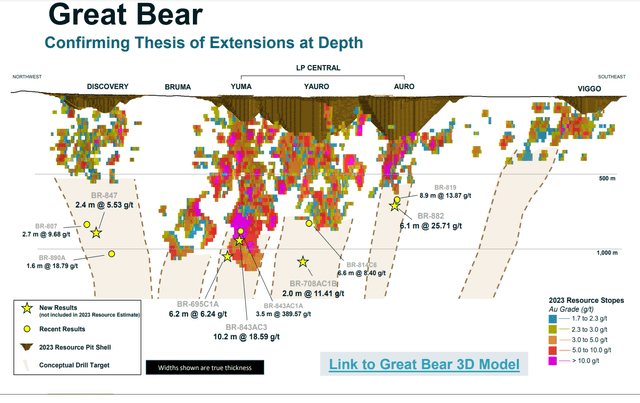

Luckily, there was one main vivid spot with regards to Kinross’ reserves/assets and that is Nice Bear. It is because not solely is the asset sitting on a quickly rising useful resource base ~6.13 million ounces of high-grade and predominantly near-surface gold, however there appears to be a chance to develop assets within the hole areas and at depth. The truth is, Kinross not too long ago hit a monster intercept of three.5 meters (true width) at 389.6 G/T of gold that could possibly be mined from Yuma Underground and there appears to be vital underground potential at depth beneath 500 meter depths. So, whereas I have not been impressed with Kinross’ reserve alternative over the previous few years relative to friends, Nice Bear is actually one main alternative to develop reserves later this decade.

Nice Bear Useful resource, Targets & Drill Highlights – Firm Web site

As for the longer -term potential of this asset, I do not suppose 10.0+ million ounces is that a lot of a stretch from a useful resource standpoint which might help a 17-year mine life beginning in 2030 (topic to permits and approval, and assuming an 80% conversion charge and common manufacturing of ~450,000 ounces/yr). Simply as importantly, a high-grade open-pit would carry industry-leading AISC that is prone to are available beneath $850/oz within the early years of its mine life. Nonetheless, with PEA work underway and vital work left to finish a PFS/DFS, I’d be shocked to see reserves reported at Nice Bear earlier than year-end 2026.

To summarize, whereas is that is actually a really particular asset within the portfolio, it is robust to place an excessive amount of worth on it at this time when it is nonetheless seemingly at least six years away from shifting into business manufacturing, even assuming an accelerated timeline (2031?).

Valuation

Primarily based on ~1,235 million shares and a share worth of US$8.60, Kinross trades at a market cap of ~$10.6 billion and an enterprise worth of ~$12.4 billion. This has left Kinross buying and selling at one of many increased FY2025 EV/FCF multiples amongst its peer group, sitting at over 15x subsequent yr’s free money stream estimates. Clearly, that is nonetheless a far decrease a number of than Agnico Eagle (AEM) which trades above 22x FY2025 EV/FCF estimates, however it’s vital to notice that Agnico Eagle is in a league of its personal by way of jurisdictional danger and per share development, lending to its premium a number of. Conversely, Kinross has one of many worst monitor data of per share development amongst its friends and one of many lowest weighted common mine lives but trades at a premium to a number of different million-ounce producers.

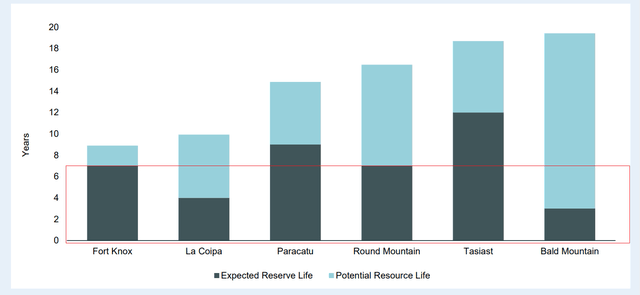

Kinross Anticipated Reserve Life/Useful resource Upside – Firm Web site

Some buyers may argue that Kinross trades at this premium as a result of of its world-class Nice Bear Challenge which isn’t mirrored in 2025 estimates provided that this asset will not head into manufacturing till at the very least 2030. Nonetheless, this designation will not be unique to Kinross alone, with a number of different world-class initiatives within the pipeline of different majors like Reko Diq/Fourmile/Lumwana Enlargement, Hope Bay/Detour Lake Enlargement, Tanda-Iguela. Therefore, even adjusting for the distinctive attribute of proudly owning probably the greatest undeveloped gold initiatives globally, I believe it is robust to justify Kinross’ premium a number of right here and I proceed to see B2Gold (BTG) as a much more engaging alternative at this time from a valuation standpoint at ~7x FY2025 free money stream estimates (KGC: ~15x) whereas providing a ~6.1% dividend yield.

So, what’s a good worth for the inventory?

Utilizing what I consider to be truthful multiples of 1.1x P/NAV and seven.5x FY2025 P/CF estimates and a 65/35 weighting to P/NAV vs. P/CF, I see a good worth for Kinross of US$8.80. This factors to a 4% upside from present ranges, making Kinross one of many least attractively valued producers out there at this time. And whereas this doesn’t suggest that the inventory cannot head increased, I favor to purchase at a deep low cost to truthful worth or move totally. Therefore, with Kinross providing restricted margin of security at present ranges at this time, I do not see any method to justify paying up for the inventory from an funding standpoint.

Abstract

Kinross noticed one of many extra vital year-over-year declines in reserves per share amongst its friends and continues to have one of many worst monitor data of per share development sector-wide. Sadly, this is not anticipated to enhance for a number of years till a big chunk of Nice Bear Challenge ounces make it into reserves. Within the meantime, Kinross has its work lower out for it changing 500,000+ ounces every year at Tasiast/Paracatu which have seen constant declines in reserves over the previous few years.

Working in Kinross’ favor is {that a} rising tide lifts all boats and Kinross has actually been one of many largest beneficiaries of the current gold worth power. Nonetheless, for buyers excited about shopping for deeply discounted companies vs. merely buying and selling momentum, I proceed to see much more engaging bets elsewhere out there at this time. To summarize, I do not see any method to justify paying up for Kinross above US$8.60 and I’d view any rallies above US$9.15 earlier than August as a chance to guide extra income into power.