sommart/iStock by way of Getty Photographs

World markets had been blended over the June quarter, with divergent themes impacting key markets.

Within the U.S., the S&P 500 (SP500, SPX) and Nasdaq continued to maneuver greater. Opposite to final quarter the place there have been indicators of a broadening available in the market rally throughout sectors, U.S. returns this quarter had been concentrated in mega-cap expertise shares – most notably Nvidia (NVDA), Apple (AAPL) and Microsoft (MSFT). The highest 5 holdings within the S&P 500 now make up ~29% of the index, the best focus in 50 years.

European markets had been typically unfavorable, as French elections and their influence on the nation’s future fiscal sustainability weighed on the broader area.

The Australian market was additionally marginally unfavorable (ASX200AI -1.1%) with persevering with indicators of a softening macroeconomic atmosphere. The speed of actual GDP progress has declined additional and decrease family disposable incomes have pushed a protracted benign fee of retail gross sales progress, regardless of document ranges of inbound migration.

Nevertheless, inflation in Australia stays stubbornly excessive. Very excessive ranges of federal and state authorities expenditure, along with latest revenue tax cuts, have elevated the chance that the RBA might improve rates of interest additional with a view to return inflation to its goal vary (2-3%) inside an inexpensive timeframe.

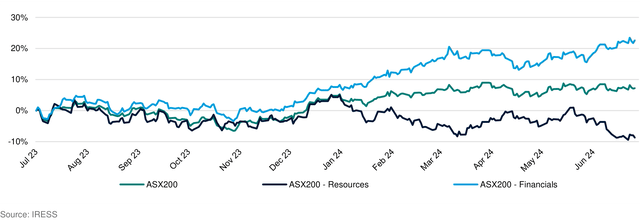

The strongest sectors within the ASX 200 for the June quarter had been Utilities (+13.3%), Financials (+4.0%) and Data Expertise (+2.9%), whereas Vitality (-6.8%), Supplies (-5.9%) and Property (-5.6%) lagged.

Returns (‘internet’) (%)1

|

Catalyst Fund |

S&P/ ASX 200 AI |

Outperformance |

|

|

3 months |

(6.8) |

(1.1) |

(5.7) |

|

6 months |

0.8 |

4.2 |

(3.4) |

|

1 yr |

1.7 |

12.1 |

(10.4) |

|

2 years p.a. |

9.5 |

13.4 |

(3.9) |

|

3 years p.a. |

9.9 |

6.4 |

+3.6 |

|

Since inception p.a. |

9.9 |

6.4 |

+3.6 |

|

Since inception cumulative |

32.8 |

20.3 |

+12.5 |

|

1All efficiency numbers are quoted internet of charges. Figures might not sum precisely resulting from rounding. Inception date: 1 July 2021. Previous efficiency shouldn’t be taken as an indicator of future efficiency. Observe: Fund returns and Australian indices are proven in A$. Returns of U.S. indices are proven in US$. Index returns are on a complete return (accumulation) foundation until in any other case specified. |

The L1 Capital Catalyst Fund continues to seek out worth in low P/E shares with undergeared steadiness sheets, robust money stream technology and realisable near-term catalysts. We stay assured in our portfolio and are targeted on figuring out and enacting catalysts by means of lively engagement with firm administration and Boards.

Portfolio commentary

The efficiency of the Catalyst Fund throughout the June quarter has been disappointing in contrast with its robust efficiency within the three years since inception. In the course of the June quarter, the Fund has deliberately had a comparatively excessive weighting to the Sources sector and no publicity to Australian banks (as will almost all the time be the case). Nevertheless, as proven in Determine 1, this has coincided with a interval of serious underperformance of the ASX 200 Sources sector and relative outperformance of home Financials (particularly the “Large 4” banks).

We always monitor and evaluate the portfolio composition and we stay assured that, specifically, the Sources firms now we have chosen are high-quality commodity producers with long-term structural tailwinds that are actually buying and selling at much more compelling valuations.

This outperformance of Australian Financials over the previous 12 months has been a big headwind for the Catalyst Fund. In our view their valuations have change into extraordinarily tough to justify. For instance, CBA has the best valuation of any financial institution globally (almost double that of J.P. Morgan), regardless of a weak earnings progress outlook (EPS anticipated to be comparatively flat over the following two years), a weakening Australian economic system and dividend yield under the present Australian money fee.

Determine 1: Relative efficiency of ASX 200 Sources and Financials sectors

In the course of the June quarter, the Catalyst Fund’s efficiency relative to the ASX 200 was positively impacted by:

- Improved execution and market recognition: Qantas’ (OTCPK:QABSY) shares carried out nicely after outlining plans to enhance its Loyalty provide to allow simpler entry for Frequent Flyer members to make use of their factors by means of the launch of Basic Plus. This revision had a smaller influence on earnings than the market anticipated and the corporate clearly articulated the robust medium-term advantages of investing in this system. We consider Qantas stays very nicely positioned given it has Australia’s finest loyalty enterprise (anticipated to double earnings over the following 5-7 years), a raft of name new, extra fuel-efficient plane to be delivered over the following few years together with Mission Dawn, which can allow direct flights from Melbourne/Sydney to London and New York from 2026. It additionally has ample steadiness sheet capability to proceed shopping for again shares and to recommence totally franked dividends in FY25. The brand new CEO, Vanessa Hudson, is quickly and methodically addressing buyer ‘ache factors’ which ought to enhance sentiment from each clients and potential traders. Qantas trades on a FY25 P/E of solely 6.3x, regardless of a dominant business place and a excessive progress, capital-light loyalty division that is still extremely underappreciated by the market.

In the course of the June quarter, the Catalyst Fund’s efficiency relative to the ASX 200 was negatively impacted by:

- Weaker commodity costs: Sure commodity costs weakened over the interval, together with lithium spodumene (-15%) which was adversely impacted by vital, quick evolving new provide out of China and Africa. In the course of the June quarter, this negatively impacted the share worth of our holding in Mineral Sources (MALRF, -24%). We proceed to stay constructive on Mineral Sources shifting ahead, noting its valuation stays enticing, being underpinned by the worth of the lengthy life and infrastructure-like Mining Providers division’s earnings, and we see quite a few catalysts over the following 12 months to drive outperformance of the sector. These embrace the profitable ramp-up of the corporate’s Onslow Iron ore undertaking, which can considerably improve its scale and price competitiveness, and de-leveraging following the closing of its A$1.1b (internet proceeds) sale of 49% of the Onslow Haul Highway.

- Enhance in long-term bond yields: Lengthy-term rates of interest moved greater throughout the June quarter following the discharge of persistently excessive inflation knowledge and the deferral of fee minimize expectations. One of many Catalyst Fund’s yield-based portfolio firms was negatively impacted by this improve in long-term bond yields and the broad sentiment that rates of interest might keep greater for longer.

Inventory highlight: QBE Insurance coverage

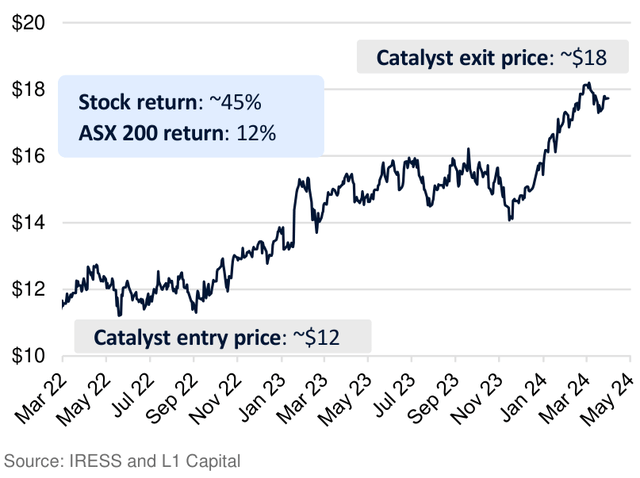

QBE Insurance coverage Group (OTCPK:QBEIF) has been one of many main contributors to the Catalyst Fund over the previous few years. We consider it affords a great case examine on how our contrarian based mostly funding philosophy, medium time period funding horizon and give attention to Worth, High quality and Catalysts can ship robust efficiency.

In our March 2023 Quarterly Report, we outlined why we seen QBE as an undervalued enterprise. Whereas we had been cautious on the corporate for a few years given the business headwinds it was dealing with, our view was that the market underappreciated the advance within the working backdrop and the robust catalysts for the corporate to ship bettering margins, dividends and return on fairness (‘ROE’) going ahead.

Since that point, a number of of the catalysts we recognized have been realised. We subsequently elected to exit the place, attaining a ~45% inventory return over our holding interval vs. 12% for the ASX.

Determine 2: QBE Insurance coverage share worth

We’ve got outlined among the key areas on which we targeted our funding evaluation and the way this will have differed to market expectations on the time of our funding.

1. Stronger underwriting earnings

Throughout 2021 and 2022, our evaluation of QBE’s work to enhance its operational efficiency, along with our work on premium fee traits, led us to conclude that underwriting earnings ought to proceed to enhance forward of market expectations.

We reviewed earlier insurance coverage cycles (early 2000s and 2010s), analysed competitor firm outcomes, spoke to business specialists and studied insurance coverage dealer efficiency.

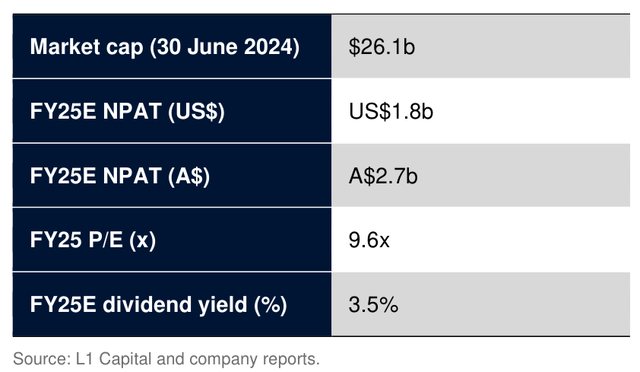

Determine 3: QBE Insurance coverage key ratios

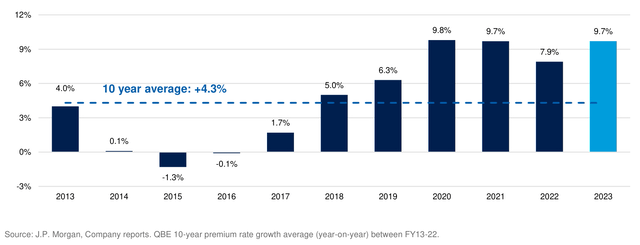

The proof prompt the premium fee cycle on the time can be vital and extended, particularly owing to the distinctive mixture of a number of drivers of premium fee rises (greater pure disaster claims prices, underwriting losses from prior low premium charges, greater reinsurance prices, COVID-19 insurance coverage claims losses, excessive inflation and decrease availability of insurer capital) in comparison with historic cycles which had been sometimes preceded by just a few important elements.

The corporate managed to attain a premium improve of 9.7% in 2023, vs. the ~8.0% anticipated by the market. This supported robust income progress in addition to greater future margin potential as greater charges on new enterprise stream into future earnings. For FY23, these premium will increase, mixed with natural quantity progress and administration actions to scale back threat publicity (mentioned additional under), drove a 30% improve in underwriting earnings.

Determine 4: QBE premium fee actions (year-on-year, %)

2. Larger funding revenue optionality

With rates of interest remaining low for an prolonged interval, we believed the market had discounted QBE’s potential to earn vital funding revenue from its ~US$26b mounted revenue asset portfolio. Given the dangers of inflation remaining extra persistent, we favored the robust working leverage of the corporate to the next rate of interest atmosphere. QBE’s FY23 funding earnings ended up rising ~70%, as its mounted revenue yield elevated from 2.6% in FY22 to 4.4% in FY23.

3. Improved earnings stability

QBE delivered FY23 earnings progress of 100% and demonstrated strong earnings stability by assembly administration steerage. FY24 steerage, which was not too long ago reiterated, additionally factors to additional earnings progress and margin growth. It is a notable achievement in comparison with historical past the place QBE missed steerage on quite a few events. In our view, the advance in consistency was assisted by the next key elements:

- Renewed senior management: Andrew Horton’s appointment as QBE CEO was introduced in Might 2021, after 30 years’ expertise throughout insurance coverage and banking, most not too long ago as CEO of UK insurer Beazley (since 2008). Beneath Andrew’s management, Beazley’s enterprise grew profitably by ~10% p.a.. Throughout our funding due diligence we reviewed the observe document of Mr Horton, spoke to executives who had labored with him, in addition to to fairness analysts within the U.Ok. market, and located he had a constant document of setting conservative targets and outperforming. This elevated our confidence that underneath his management QBE would head in the precise route when it comes to “underneath promising” and “over delivering”.

- Stronger reserves: QBE significantly strengthened its reserving from 2019 to 2022. Our work learning the corporate’s reserve necessities over time supported the view {that a} very conservative set of assumptions had been utilized to the corporate’s forecasts. Given this arrange, we anticipated the corporate to have vital flexibility to ship constant earnings progress going ahead by releasing reserves within the occasion of any softening within the working atmosphere, successfully rising its margin of security to satisfy or beat steerage. On high of this, QBE reinsured giant elements of its portfolio, subsequently eradicating the reserving threat from many risky segments of its portfolio. In FY23, QBE decreased its estimate of longer dated claims (the important thing driver of earlier volatility) reserves for the primary time in a few years, implying reserve energy is now above necessities. To this point in FY24, QBE doesn’t count on any adversarial actions in reserving regarding longer dated claims.

- Lowered publicity to extra risky elements of the enterprise: QBE undertook initiatives to decrease its publicity to giant annual actions in claims from climate occasions. Particularly, administration decreased the dimensions of its property insurance coverage section, the important thing supply of climate claims. QBE additionally elevated the conservatism of its annual climate claims price range (i.e. the anticipated annual climate claims steerage). The danger of unfavorable surprises from precise climate claims being above expectations was thus enormously decreased. This was evidenced earlier this monetary yr the place year-to-date disaster prices tracked inside price range, regardless of giant losses from extreme storms within the U.S. and floods in Dubai.

- U.S. turnaround: We’ve got been encouraging QBE to exit its underperforming U.S. center market section for a few years. The corporate has not too long ago taken the choice to exit this enterprise. It has been structurally challenged for an prolonged interval, and we view administration’s actions right here as key to bettering returns in North America.

In abstract, whereas we consider that QBE stays a high quality enterprise that’s nicely positioned and nicely managed, with a lot of our earlier views now mirrored available in the market outlook, we not too long ago exited the place to fund various funding alternatives.

Editor’s Observe: The abstract bullets for this text had been chosen by In search of Alpha editors.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.