FXQuadro/iStock by way of Getty Photographs

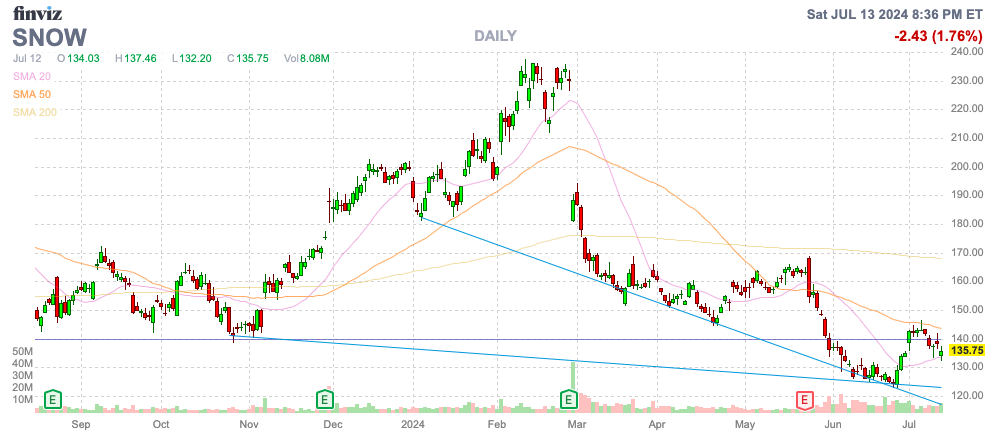

Snowflake, Inc. (NYSE:SNOW) has fallen to yearly lows and the corporate is beginning to present some main cracks within the armor. The info cloud firm is poised to learn from AI, however the transition to include AI options has led to uncertainty in future gross sales whereas prices rise. My funding thesis is Bearish on the inventory, with different cracks forming within the armor because of cybersecurity points and richly valued inventory.

Supply: Finviz

Main Cracks

Snowflake reported weak FQ1’25 outcomes again in late Could, with the corporate lacking EPS targets. The AI knowledge cloud firm is investing aggressively to construct AI options, resulting in the upper prices from elevated GPU-related prices for the AI initiatives, whereas the income advantages aren’t arriving now.

The AI enterprise software program sector has seen quite a few corporations with anticipated advantages from AI not essentially materializing as anticipated. From IBM (IBM) to Palantir Tech. (PLTR) to C3.ai (AI), the shares soared on AI hype, however these corporations have not really seen a lot in the way in which of associated income progress.

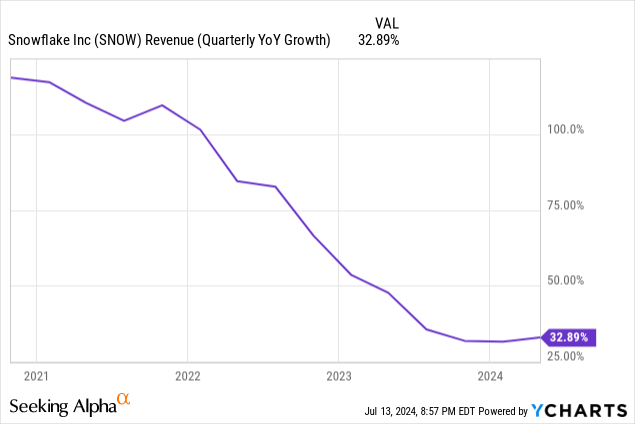

Snowflake seems to be seeing the reverse. The corporate has seen progress charges naturally dip from charges topping 100% again in FY22 to now the forecast for FQ2 gross sales progress to break down all the way in which to 26% from the simply reported strong 34% clip.

The corporate guided to FQ2 product income of $805 to $810 million for under 26% progress. Even worse, the FY25 product income was guided to only $3.3 billion for twenty-four% progress, suggesting further slowdown for the remainder of the yr after a 36% product progress price in FQ1.

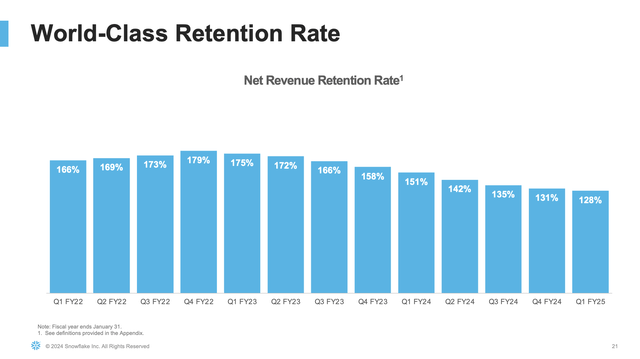

Additionally be aware, Snowflake solely guides to the product income with quick progress, whereas ignoring the extra skilled companies revenues that reduce the whole progress price to barely decrease ranges. The online retention price had already slumped to 128% within the final quarter, in a transparent signal of the deceleration in gross sales progress.

Supply: Snowflake FQ1’25 presentation

Snowflake did not assist buyers with the June Analyst Day the place the corporate once more pumped up AI product improvement, however administration did not present numerous monetary particulars. Analysts protecting the occasion appeared to push off the brand new AI options as not beneficiary to the enterprise till FY26/FY27.

Much more regarding, the report from AT&T (T) of a cyberattack associated to knowledge saved with Snowflake will not assist gross sales throughout this AI pause. The hack seems associated to the beforehand disclosed cyberattack from Snowflake the place prospects from LendingTree (TREE), Advance Auto Elements (AAP) and Ticketmaster operator Reside Nation (LYV) had been beforehand disclosed.

On this case, AT&T had name and textual content data from a 6-month interval in 2022 stolen from knowledge held at Snowflake. In line with studies, the wi-fi large should notify 110 million prospects of the info breach.

Earlier studies have recommended the info hacks had been because of the lack of Snowflake prospects utilizing multi-factor authentication to forestall knowledge breaches. The studies steer away from the info cloud firm having weak programs.

Both approach, cloud companies suppliers with an estimated 165 prospects with knowledge getting stolen is more likely to decelerate gross sales cycles, whether or not the fault of Snowflake or not. As well as, the info cloud firm highlighted key progress alternatives in increasing buyer utilization past the “enterprise analyst” and offering the avenue for patrons to collaborate with their prospects to share knowledge, however this knowledge safety subject probably halts any plans to develop utilization to further utilization.

The corporate reported FQ1 earnings on Could 22 and the info breach was formally reported on Could 30 with subsequent studies from Mandiant in June concerning the scale and scope of the info breach. The problem with AT&T simply got here to gentle final week and the mounting unfavorable safety information all comes following the FQ1 steering with anticipated gross sales slowdowns.

Nonetheless Richly Valued

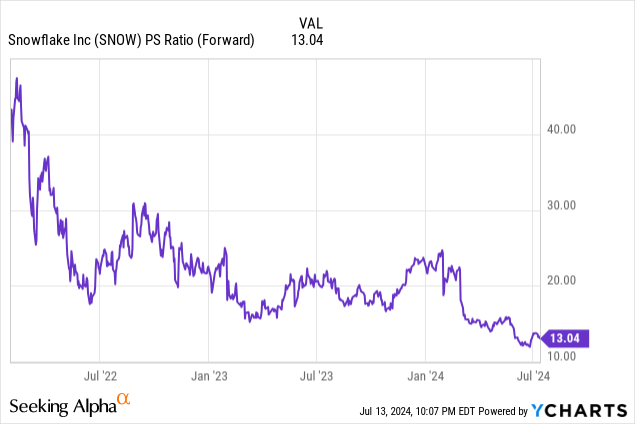

Snowflake hit a inventory worth of $400 again in each 2020 and in direction of the top of 2021, so naturally numerous buyers are going to see the inventory as low-cost at $135. The info cloud firm nonetheless has a large market cap of $49 billion (363 million shares excellent) regardless of the decelerating progress charges and knowledge breaches.

The inventory nonetheless trades at 13x ahead gross sales estimates. Snowflake was already going through gross sales progress dipping to twenty% and these ongoing knowledge leaks on prime of a shift to AI knowledge will solely make prospects rethink processes for storing knowledge on third-party cloud platforms.

Snowflake wants to keep up 30%+ progress with a view to justify a 10x ahead gross sales valuation. To not point out, the revenue image is even worse.

Snowflake nonetheless trades at 215x the FY25 EPS targets of $0.63. The money circulation image is healthier because of numerous prospects prepaying for knowledge consumption companies, however both metric outlines a inventory with a wealthy valuation regardless of troubling cybersecurity considerations from prospects.

Takeaway

The important thing investor takeaway is that Snowflake is an impressive firm with a probable vibrant future in AI, however buyers should pay the precise worth for the inventory. Snowflake trades at very costly valuations, and the main cracks within the armor of slowing progress charges and cybersecurity assaults hitting prospects suggests the inventory is probably going headed decrease. The current failure to reclaim the $140 assist degree is additional proof of much more draw back threat.

Traders ought to anticipate the present hiccups to dissolve earlier than the long-term AI story performs out.