Rua Gold Inc. (CSE: RUA) (OTC: NZAUF) (WKN: A4010V) (“RUA GOLD” or the “Firm”) is happy to announce it has entered right into a definitive share buy settlement (the “Settlement”), pursuant to which the Firm will purchase 100% of the issued and excellent shares of Reefton Sources Pty Restricted (“Reefton”), a 100% owned subsidiary of Siren Gold Ltd. (ASX:SNG) (“Siren”) with tenements situated adjoining to the Firm’s suite of properties in New Zealand’s prolific Reefton Goldfield (the “Transaction”).

Determine 1: Tenement map of the Reefton Goldfield. (CNW Group/Rua Gold Inc.)

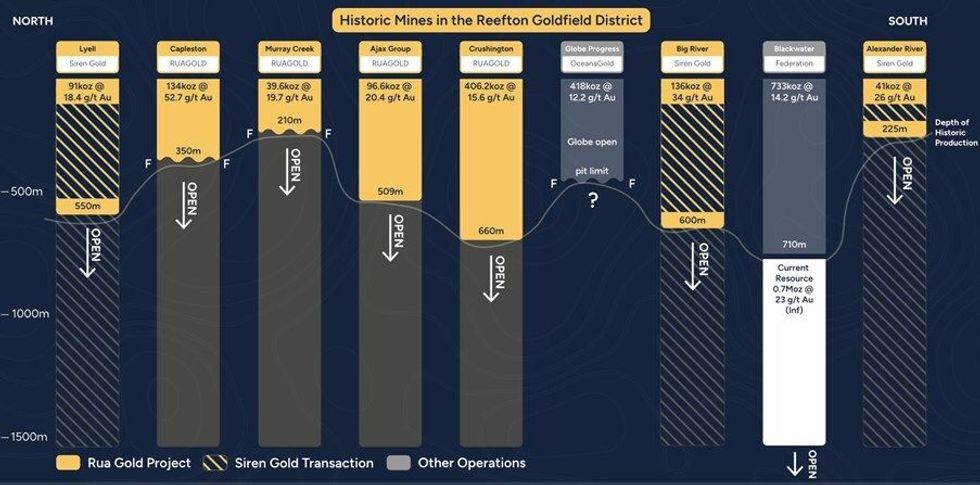

Determine 2: Cross Part of historic underground mines within the Reefton Goldfield. (CNW Group/Rua Gold Inc.)

The Transaction will set up the Firm because the dominant landholder within the Reefton Goldfield on New Zealand’s South Island, with roughly 120,000 hectares (“ha“) of tenements. The district produced over two million ounces at gold grades starting from 9 to 50g/t. The Reefton Goldfield is seeing a resurgence in curiosity, led by the development of Federation Mining’s Blackwater mine, which is anticipated to supply 70koz every year at US$738/oz AISC1.

Actively Advancing a District-Scale Discovery in a Tier 1 Jurisdiction:

- Represents the following chapter in RUA GOLD’s improvement in direction of our objective to be a significant gold producer in New Zealand.

- Newly consolidated challenge represents one of many least explored, high-grade gold districts on the planet.

- Permits, entry, and consents in place for aggressive drilling following a district-wide reassessment of targets and potential on the mixed land package deal.

- The Transaction will enhance regional tenement holdings from ~34k ha to ~120k ha and canopy all recognized previous manufacturing camps outdoors of Blackwater and the Globe Progress mine.

- Potential for decrease total challenge capital expenditures by means of the event of a possible central processing hub.

- The Transaction creates an even bigger participant in New Zealand, permitting better alternative to work alongside a pro-mining Authorities in serving to them draft their Minerals Technique for New Zealand.

- Backed by workforce of mining professionals with +200 years of mixed expertise.

Extra data might be discovered on the Firm’s web site: www.ruagold.com

Following the completion of the Transaction, the Firm will probably be nicely positioned because the preeminent gold explorer in New Zealand with a professional forma market capitalization of ~C$60 million.

Combining properties and exploration actions within the Reefton Goldfield gives many strategic advantages, together with:

- Elevated profile with a really supportive area people that has a protracted historical past and expert work drive in mining.

- Alternative to comprehend important synergies and value financial savings.

- Mixed information units, native work drive and historic information, resulting in increased high quality goal technology with a better scale of alternatives.

- Capacity to develop exploration applications and generate extra constant information circulate.

- Consolidation of allowing actions with an expedited challenge improvement timeline.

Transaction Highlights

- Underneath the phrases of the Settlement, Siren shall obtain:

- A$2 million (C$1.8 million) in money, of which A$1 million has been paid and the remaining A$1 million will probably be paid on the shut of the Transaction; and

- 83,927,383 absolutely paid shares of RUA GOLD representing A$18 million (C$16.6 million2), to be issued on the shut of the Transaction with agreed contractual resale restrictions.

- The full consideration represents:

- an implied worth of A$20 million (C$18.5 million); and

- an acquisition value of ~US$25/oz AuEq primarily based on Reefton’s 0.5 Moz AuEq Resource3.

- Upon completion of the Transaction, Siren will personal ~30% of RUA GOLD, and Siren Chairman, Mr. Brian Rodan, will be a part of the RUA GOLD Board. Mr. Rodan is a Fellow of the Australian Institute of Mining and Metallurgy (FAusIMM) with 48 years’ expertise. Beforehand, Mr. Rodan was the proprietor and managing director of Australian Contract Mining Pty Ltd. (ACM), a contract mining firm finishing $1.5 billion value of labor over a 20-year interval. Mr. Rodan held varied roles with Eltin Restricted over 15 years as Common Supervisor between 1993 and 1996 and Govt Director from 1996 to 1999), being Australia’s largest full service ASX listed contract mining firm with annual turnover of +$850 million. Mr. Rodan was a founding Director of Dacian Gold Ltd. 2013 and Desert Metals Ltd. 2020. Mr. Rodan was the founding director and is at present Chairman of Siren, Iceni Gold Restricted (ICL) and Augustus Minerals (AUG), all listed on the ASX.

- The Transaction is focused to shut in This autumn-2024 (topic to regulatory approvals and satisfaction of all situations beneath the Settlement).

|

_______________________________ |

|

2 Calculated utilizing RUA GOLD’s 30-day VWAP on the CSE as of July 12, 2024 of C$0.1983 at an AUD:CAD alternate charge of 0.9246. |

|

3 Gold equivalency calculated utilizing metals costs of US$2,200/oz Au and US$20,500/t Sb. |

Simon Henderson, COO of RUA GOLD commented: “This Transaction creates a major alternative in an beneath explored orogenic gold district. The Firm has targeted on the Reefton Goldfield and in 4 years mixed speedy geochemical sampling, ultra-detailed geophysical surveying and mapping to focus on the potential of exploring previous workings at depth in addition to a number of new greenfield prospects. It is rather thrilling to mix RUA GOLD and Siren information units, mixed information, and have the entire orogenic district to discover. We will probably be a mix of latest discoveries and scalability of historic high-grade gold mines to develop the following main gold producer within the area.”

Brian Rodan, Chairman of Siren commented: “Having personally been concerned with the Reefton Mission for over 6 years, I firmly consider that the Reefton Goldfield has monumental untapped potential to create a considerable long-term, high-grade gold and antimony mining operation. Antimony being a uncommon vital mineral can even present the chance to create a world class operation that may help the western nations transition to greener economies by means of securing a long-term provide of antimony, which is important to assemble photo voltaic panels, wind generators, electrical autos, energy storage batteries and protection wants. The choices taken by the Boards of each Siren and Rua to take a significant step to consolidate the 40km line of strike of the whole Reefton area is really visionary and can notice important long-term advantages to the Reefton district as a complete. The extra circulate on results created from this consolidation can even convey long run generational development in regional improvement by means of elevated infrastructure spending and elevated employment alternatives which can be created by the “mining multiplier have an effect on”. The numerous enchancment in regional infrastructure and employment alternatives that may observe will probably be transformational for the whole West Coast and New Zealand as a complete.”

The Transaction will ship the next advantages to the Firm’s shareholders:

- Elevated scale and sources by combining tasks and exploration groups.

- Elevated publicity to the extremely potential and under-explored Reefton Goldfield, as the biggest landholder within the district with roughly 120,000 ha of mixed tenements.

- The tenements owned by Reefton host a complete JORC-compliant inferred mineral useful resource estimate (at a 1.5 g/t Au cut-off grade) containing 444koz Au @ 3.81g/t Au and eight.7kt Sb @ 1.5% Sb4 with the superb alternative to outline additional mineralization with aggressive exploration throughout the mixed land package deal.

- Improved investor visibility and positioning amongst friends, with the chance to broaden the Firm’s shareholder base.

- Potential for future operational synergies (i.e., centralized infrastructure and workforce) by realizing economies of scale throughout the entire land package deal.

- Continued publicity to the Firm’s extremely potential asset, Glamorgan on the North Island of New Zealand.

Transaction Particulars

The Transaction will probably be effected by means of a share buy settlement beneath relevant Canadian legal guidelines.

As consideration for the acquisition of Reefton, the Firm will:

- pay an mixture of A$2.0 million (topic to a working capital adjustment) to Siren, of which (i) A$1.0 million was paid by the Firm upon getting into into the Settlement within the type of a forgivable mortgage (repayable solely within the occasion the Settlement is terminated previous to consummation of the Transaction), evidenced by a promissory notice issued by Siren in favor of the Firm and secured by an enforceable safety curiosity in all of Reefton’s current and after-acquired private property; and (ii) A$1.0 million will probably be payable on the completion of the Transaction (the “Closing Date”); and

- on the Closing Date, difficulty 83,927,383 frequent shares within the capital of the Firm to Siren at a deemed value of C$0.1983 per RUA GOLD Share (primarily based on the 30-day volume-weighted common value of the frequent shares on the Canadian Securities Alternate previous to the date of the Settlement), having an mixture worth of A$18.0 million5 (the “Consideration Shares”).

Key situations precedent to the completion of the Transaction embody, amongst others:

- the events acquiring all required company, shareholder and regulatory approvals for the Transaction;

- the events acquiring all required materials third occasion, regulatory and ministerial consents; and

- different situations customary for a public transaction of this nature.

|

____________________________ |

|

5 Calculated utilizing RUA GOLD’s 30-day VWAP on the CSE as of July 12, 2024 of C$0.1983 at an AUD:CAD alternate charge of 0.9246. |

The Settlement in any other case consists of customary representations, warranties, covenants and situations contained in agreements for transactions of this nature.

In reference to the closing of the Transaction, the Firm will enter right into a shareholder rights settlement with Siren pertaining to Siren’s curiosity within the Consideration Shares, which can embody, amongst others, the next phrases:

- Siren shall have the suitable to appoint one member to the board of administrators of the Firm, as long as Siren maintains at the least a ten% fairness curiosity within the Firm’s issued and excellent frequent shares.

- The Consideration Shares shall be topic to the next contractual resale restrictions:

- 22.2% will probably be restricted from buying and selling for a interval of six months from the Closing Date;

- 22.2% will probably be restricted from buying and selling for a interval of 12 months from the Closing Date;

- 22.2% will probably be restricted from buying and selling for a interval of 15 months from the Closing Date;

- 22.2% will probably be restricted from buying and selling for a interval of 18 months from the Closing Date; and

- the remaining Consideration Shares will probably be restricted from buying and selling for a interval of 24 months from the Closing Date.

- The contractual resale restrictions above shall be lifted if, at any time after six months following the Closing Date, RUA GOLD’s market capitalization is 5 occasions better (or extra) than its market capitalization measured as of July 12, 2024 (being the date the Settlement was signed).

- For as long as Siren owns or controls 10% or extra of the issued capital of RUA GOLD, Siren shall comply with vote, or trigger to be voted, all Consideration Shares in the identical method because the board of administrators of RUA GOLD at any basic or particular assembly of shareholders of the Firm.

Convention Name and Presentation

RUA GOLD will host a convention name and presentation on July 15, 2024 at 9:00 a.m. (Toronto time) to debate the Transaction.

Webcast:

Convention Name:

Members could acquire expedited entry to the convention name with the next registration hyperlink. Upon registering, name in particulars will probably be displayed on display screen. Utilizing these name particulars will by-pass the operator and keep away from the decision queue. Registration will stay open till the tip of the stay convention name. Members preferring to dial-in and communicate with a stay operator, can entry the decision by dialing 1-844-763-8274 or +1-647-484-8814. It’s endorsed that you simply name 10 minutes earlier than the scheduled begin time.

Advisors and Authorized Counsel

Cormark Securities Inc. is appearing as monetary advisor to the Firm and its Board of Administrators. McMillan LLP is appearing as Canadian authorized counsel to the Firm and Simpson Grierson is appearing as New Zealand authorized counsel to the Firm.

Crimson Cloud Securities Inc. is appearing as monetary advisor to Siren and its Board of Administrators. Steinepreis Paganin is appearing as Australian authorized counsel to Siren and Cassels Brock & Blackwell LLP is appearing as Canadian authorized counsel to Siren.

Intention to checklist on the TSX Enterprise Alternate

Aligned to executing on the expansion technique, the Firm can be happy to announce that it has utilized to checklist the frequent shares of the Firm on the TSX Enterprise Alternate (“TSX-V”) beneath the image “RUA”. The Firm’s software stays topic to TSX-V approval. In reference to itemizing on the TSX-V, it’s anticipated the Firm’s frequent shares will probably be voluntarily delisted from the Canadian Inventory Alternate (“CSE”).

About RUA GOLD

RUA GOLD (CSE: RUA, OTC: NZAUF, WKN: A4010V) is a brand new entrant to the mining business, specializing in gold exploration and discovery in New Zealand. With permits which have a wealthy historical past relationship again to the gold rush within the late 1800’s, RUA GOLD combines conventional prospecting practices with fashionable applied sciences to uncover and capitalize on useful gold deposits.

The Firm is dedicated to accountable and sustainable exploration, which is obvious in its skilled planning and execution. The Firm goals to attenuate its environmental impression and to execute on its tasks with key stakeholders in thoughts. RUA GOLD has a extremely expert workforce of New Zealand professionals who possess in depth information and expertise in geology, geochemistry, and geophysical exploration expertise.

For additional data, please consult with the Firm’s disclosure report on SEDAR+ at www.sedarplus.ca.

Technical Data

Simon Henderson CP, AUSIMM, a professional particular person beneath Nationwide Instrument 43-101 Requirements of Disclosure for Mineral Tasks, has reviewed and accredited the technical disclosure contained herein.

Web site: www.RUAGOLD.com

This information launch consists of sure statements which may be deemed “forward-looking statements”. All statements on this new launch, apart from statements of historic info, that deal with occasions or developments that the Firm expects to happen, are forward-looking statements. Ahead-looking statements are statements that aren’t historic info and are usually, however not at all times, recognized by the phrases “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “tasks”, “potential” and related expressions, or that occasions or situations “will”, “would”, “could”, “may” or “ought to” happen and particularly embody statements relating to: the Firm’s methods, expectations, deliberate operations or future actions; the strategic advantages of the Transaction; the advantages of the Transaction to shareholders; closing of the Transaction and the satisfaction of the situations thereof, together with however not restricted to the receipt of all company and regulatory approvals and consents; itemizing the Firm’s frequent shares on the TSX-V and the receipt of TSX-V approval therefor; and delisting the frequent shares from the CSE. Though the Firm believes the expectations expressed in such forward-looking statements are primarily based on cheap assumptions, such statements aren’t ensures of future efficiency and precise outcomes could differ materially from these within the forward-looking statements.

Traders are cautioned that any such forward-looking statements aren’t ensures of future efficiency and precise outcomes or developments could differ materially from these projected within the forward-looking statements. Quite a lot of inherent dangers, uncertainties and components, a lot of that are past the Firm’s management, have an effect on the operations, efficiency and outcomes of the Firm and its enterprise, and will trigger precise occasions or outcomes to vary materially from estimated or anticipated occasions or outcomes expressed or implied by ahead wanting statements. A few of these dangers, uncertainties and components embody: basic enterprise, financial, aggressive, political and social uncertainties; dangers associated to the results of the Russia-Ukraine battle; dangers associated to local weather change; operational dangers in exploration, delays or modifications in plans with respect to exploration tasks or capital expenditures; the precise outcomes of present exploration actions; conclusions of financial evaluations; modifications in challenge parameters as plans proceed to be refined; modifications in labour prices and different prices and bills or gear or processes to function as anticipated, accidents, labour disputes and different dangers of the mining business, together with however not restricted to environmental hazards, flooding or unfavourable working situations and losses, rebel or battle, delays in acquiring governmental approvals or financing, and commodity costs. This checklist will not be exhaustive of the components that will have an effect on any of the Firm’s forward-looking statements and reference also needs to be made to the Firm’s annual data type dated April 19, 2024, filed beneath its SEDAR+ profile at www.sedarplus.ca for an outline of further danger components.

Ahead-looking statements are primarily based on the beliefs, estimates and opinions of the Firm’s administration on the date the statements are made. Besides as required by relevant securities legal guidelines, the Firm undertakes no obligation to replace these forward-looking statements within the occasion that administration’s beliefs, estimates or opinions, or different components, ought to change.