PM Photos

I final wrote concerning the Simplify Enhanced Earnings ETF (NYSEARCA:HIGH), which focuses on T-bills with some choices buying and selling, in late 2023. In that article, I argued that HIGH’s robust 9.3% distribution yield, low volatility and drawdowns, made the fund a purchase.

Since then, HIGH’s distributions are barely down, whereas its returns elevated. Share costs had been usually fairly secure, not a small feat for a fund yielding 9.3% specializing in secure property, till the June dividend fee. Nonetheless, developments appear broadly favorable to the fund and its shareholders. HIGH stays a relatively secure, high-yield ETF, and so the fund stays a purchase.

HIGH – Fast Overview

A fast take a look at HIGH earlier than analyzing a few of its newer developments.

HIGH invests most of its portfolio in easy T-bills. At present yields, these generate a major quantity of revenue for the fund. Federal Reserve cuts ought to begin to stress this supply of revenue within the coming months.

HIGH additionally trades possibility spreads, usually on equities. Specifics range, however most possibility spreads are structured in order to generate a modest quantity of premiums / revenue at low danger.

The general efficiency of those spreads is strongly depending on their specifics, and of basic administration competence. Choosing the correct choices ought to generate a pleasant quantity of revenue with out important will increase to danger, volatility, or drawdowns. Choosing the mistaken ones ought to merely lower returns, danger, volatility. and drawdowns. Threat administration additionally issues: spreads have to be rigorously tailor-made to attenuate danger.

The problems above matter for HIGH, not like for a lot of revenue investments or ETFs. Traders in T-bills would not have to choose the correct T-bills to generate revenue, nor should they rigorously assemble their portfolios to attenuate danger. Traders in T-bills merely obtain round 5.25% in revenue per yr. Traders in particular person high-yield bonds might undoubtedly enhance their returns by way of sensible bond choice, however they might additionally simply purchase an index ETF.

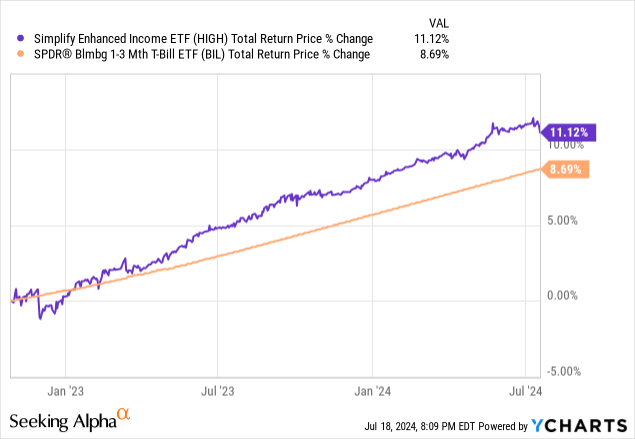

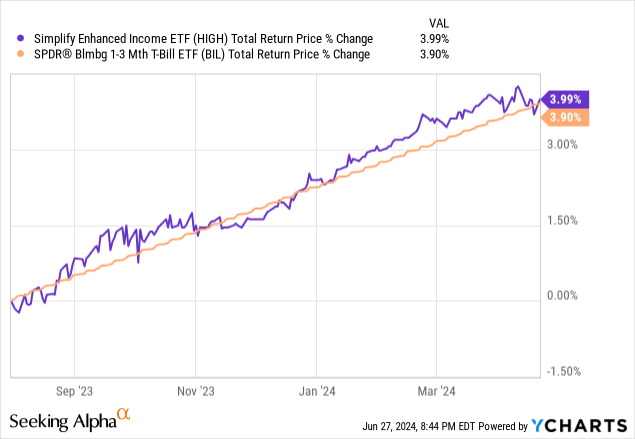

HIGH’s technique has labored total, with the fund outperforming T-bills since inception, by fairly good margins. Drawdowns and volatility each appear fairly low, though it took the fund a few months to search out its bearings.

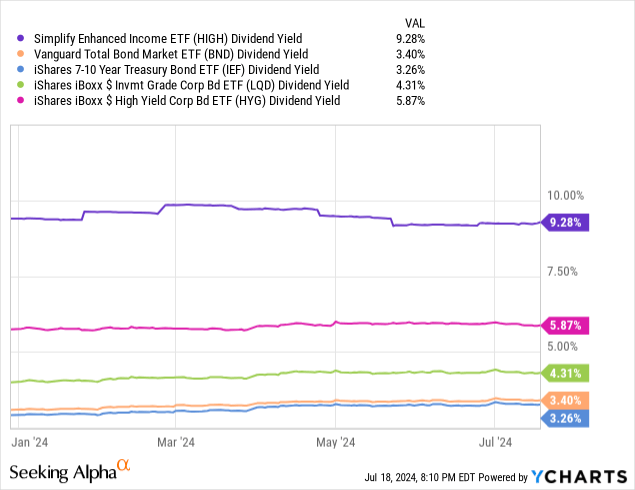

HIGH yields 9.3%, an extremely robust yield on an absolute foundation, and far increased than most bonds and bond sub-asset courses.

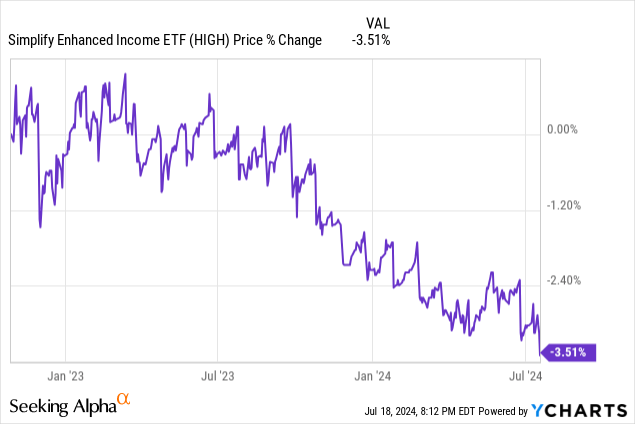

HIGH’s distributions will not be totally coated by underlying technology of revenue or premiums. T-bills at the moment yield round 5.25%, and possibility spreads couldn’t plausibly generate 4.00% in premiums yearly. At the least not the low-risk spreads that HIGH trades, particularly so persistently. HIGH’s share worth has steadily decreased since inception, constant

HIGH’s distributions will solely flip extra unsustainable because the Federal Reserve cuts charges later within the yr. It’s my understanding that rules virtually compel HIGH into having considerably unsustainable distributions. Typically, ETFs should distribute any earnings from choices or derivatives to shareholders. So, if these are worthwhile, beneficial properties are distributed, and share costs stay secure. If these are unprofitable, share costs go down. Underneath these circumstances, share costs can solely go down long-term, though maybe solely very slowly.

Shifting on, HIGH yields 9.3%, however solely appears to generate round 7.0% – 8.0% in revenue yearly.

Excessive – Latest Developments

Decrease Distributions

HIGH’s distributions had been regular at $0.20 monthly for near a yr, from early 2022 to early 2023. Distributions decreased from March to Could however have since returned to $0.20. Distributions are down 5.2% for the whole yr, in comparison with 2023.

HIGH’s distributions might have been reduce for a number of causes, together with aligning these with the fund’s revenue, decrease realized earnings from its possibility trades, and different vagaries of ETF distribution necessities. It’s my understanding that for funds with important possibility investments, distributions will not be essentially reflective of underlying technology of revenue, so distribution cuts will not be essentially a unfavorable.

Larger Returns

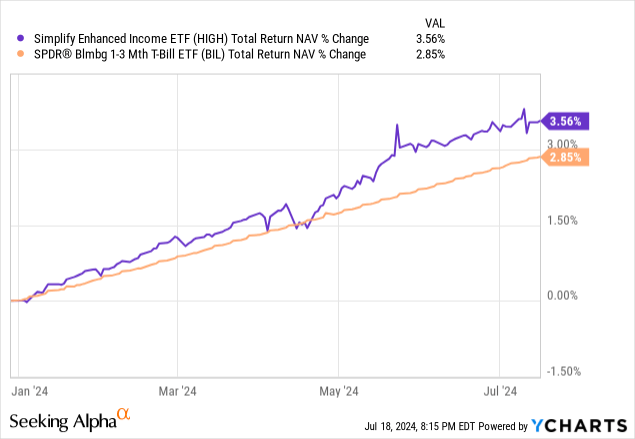

HIGH’s complete returns have been fairly good these previous few months, with the fund outperforming T-bills YTD. Outperformance principally occurred in Could and June, with the fund principally matching T-bills earlier than.

Latest outperformance contrasts with prior efficiency. HIGH had matched the efficiency of T-bills from early August 2023 to late April 2024, a interval of round 9 months.

Knowledge by YCharts

HIGH’s possibility spreads had been producing meager returns for 9 months. Though that’s not a very lengthy period of time, a lot of the fund’s possibility spreads final for lower than a month, so it is an terrible lot of (principally) unsuccessful trades. I feel some buyers had began to waver on the fund earlier than, however the previous couple of months ought to most likely put any considerations to relaxation: HIGH’s technique continues to work fairly properly.

As an apart, I feel a cycle of outperformance and matching the efficiency of the index is about pretty much as good as buyers can count on transferring ahead. Constant outperformance would require constant possibility earnings, and few merchants are that good, and the few which can be do not handle retail merchandise.

Considerably Decreased Capital Losses – With a Caveat

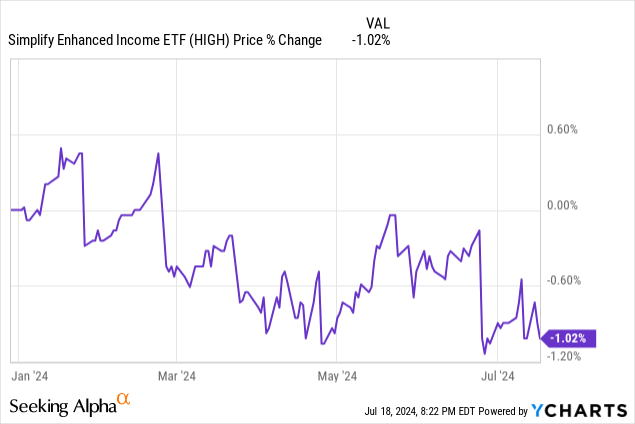

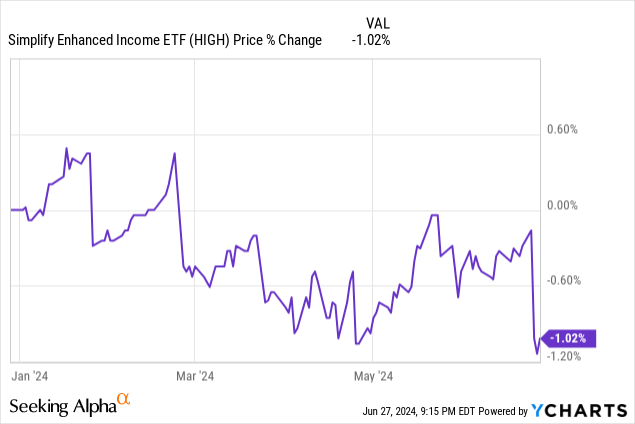

The mixture of decrease distributions and better returns virtually mechanically resulted in considerably extra secure share costs. HIGH’s worth was down solely 0.30% till late June, a really small drop, and one which could have trended down in the direction of 0.0% with a bit extra luck or success.

HIGH then paid a full $0.20 distribution and costs dropped one other 0.70%, for 1.0% in complete.

Knowledge by YCharts

For HIGH, month-to-month $0.20 distributions quantities to a 9.9% yield. Such a yield is plainly unsustainable, resulting in small, however constant, capital losses / decrease share worth, as occurred this final June. Previous to June distributions averaged $0.168, amounting to a 8.3% yield. Stated yield appeared rather more sustainable, resulting in a lot smaller, inconsistent capital losses.

Contemplating the above, I feel yields within the 7.5% – 8.5% vary are rather more sustainable and more healthy for the fund. HIGH should adjust to relevant rules on this space although, and I feel these pull in the direction of (considerably) unsustainable distributions. Proper now the fund yields 9.3%, which ought to end in small, however constant, capital losses and distribution cuts. Whole returns stay greater than satisfactory, nonetheless.

Conclusion

HIGH’s robust 9.3% distribution yield and secure, secure, share worth make the fund a purchase. Earnings and returns are a tad decrease than 9.3%, which ought to end in small, however constant, capital losses and distribution cuts transferring ahead.