Aaron Hawkins

AXT, Inc. (NASDAQ:AXTI), a provider of single aspect and compound wafer substrates to the semiconductor trade, is anticipated to launch its Q2 FY2024 report on August 1 after the market closes. The final time AXTI reported, the inventory soared increased after the Q1 FY2024 report blew previous expectations. Nevertheless, the inventory has not achieved a lot since as a result of lack of a comply with by. Nevertheless, this may very well be a chance, particularly if one is lengthy AXTI. Why will likely be lined subsequent.

Why now could also be an excellent time to get in on AXTI

AXTI has launched two quarterly experiences this yr and the inventory jumped increased after each. The inventory gained 69.3% the day after the discharge of the This autumn FY2023 report on February 23 and the inventory gained 20.8% on Might 3 after the discharge of the Q1 FY2024 report. As a consequence, AXTI has gained 39.6% YTD after closing at $3.35 on July 19.

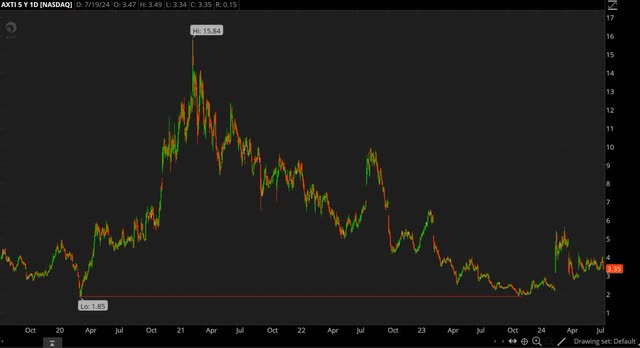

Supply: Thinkorswim app

Nevertheless, it’s value noting that the inventory has not achieved a lot in current months. The inventory reached an intraday excessive of $4.23 and it closed at $3.66 on Might 3 after the final report, however there have been no new highs within the 2.5 months which have handed since. The chart above exhibits how the inventory has basically gone sideways in the previous few months. Be aware the upper lows within the chart.

If all of the current lows are related, an ascending trendline seems. The inventory appears to be respecting the boundaries imposed by this trendline. The trendline thus affords assist to the inventory, which may be seen as a bullish signal. If assist is shifting up as a result of ascending trendline, then this factors within the route of upper inventory costs. The inventory is now at this trendline, which suggests the inventory is at a probably good entry level, assuming assist holds and the inventory stays above the trendline.

Why AXTI might have to beat resistance

Take into account the inventory wants to remain above the trendline for the development to carry. A break beneath may break the development of upper lows. As well as, the prior chart exhibits how the inventory appears to have points getting previous $4 or so. Be aware the variety of occasions the inventory modified course each time it bought to or near the $4 worth level.

|

Date |

Intraday excessive |

Closing worth |

|

5/3/2024 |

$4.23 |

$3.66 |

|

5/6/2024 |

$4.05 |

$3.93 |

|

5/7/2024 |

$4.00 |

$3.86 |

|

5/29/2024 |

$4.00 |

$3.71 |

|

6/10/2024 |

$3.93 |

$3.75 |

|

6/21/2024 |

$3.97 |

$3.69 |

|

7/16/2024 |

$4.03 |

$3.93 |

|

7/17/2024 |

$3.99 |

$3.70 |

It occurred on Might 3 when the inventory bought to $4.23, solely to retreat to shut a lot decrease at $3.66. The desk above exhibits the variety of occasions the inventory had issues getting previous or staying previous $4 or so. That is additionally what occurred on February 23, when the inventory gained 69.3% after the This autumn FY2023 report. The inventory bought as excessive as $4.85, solely to fall again to shut beneath $4 at $3.86.

AXTI was capable of get previous the $4 area the following day and keep there for a couple of weeks, however a 34% drop on April 4 put the inventory again beneath $4. This sample is unlikely to be a coincidence. The probably clarification is that sellers have settled on the $4 or so area, which exhibits up as resistance within the charts. If AXTI is to maneuver increased, it might want to break resistance first.

The place may AXTI be heading?

There’s something else value mentioning. Within the prior chart, the inventory posted a 52-weeks excessive of $5.64 on March 21, though it closed at $5.40 that day. Along with February 27, these two days are the one two occasions the inventory was capable of get above $5 in 2024 after which solely briefly. On each days, the inventory fell again beneath $5 the very subsequent day.

Supply: Thinkorswim app

Thoughts you, the 52-weeks excessive of $5.64 is near the typical worth goal of $5.50 on Wall Road, which can be what triggered the choice to promote. Moreover, it’s value mentioning that the $5 worth level is near a Fibonacci degree. Recall how the inventory bottomed at $1.89 on November 2, 2023. In doing so, the inventory concluded a multi-year decline that began with the February 2021 excessive of $15.84 as proven within the chart above.

Be aware how within the chart the height of $15.84 was preceded by a inventory rally that began with a low of $1.85 in March 2020. That is simply $0.04 beneath the November 2023 low of $1.89. AXTI went from the March 2020 low of $1.85 to the February 2021 excessive of $15.84 after which nearly utterly retraced the prior transfer by going from the February 2021 excessive of $15.84 to the November 2023 low of $1.89.

The inventory could now be retracing the final transfer. It’s thus value mentioning that the 23.6% Fibonacci retracement of $15.84 to $1.89 is $5.18. That is roughly the place the inventory topped out earlier in 2024 as talked about earlier than. If we assume AXTI continues to retrace and makes it previous the 23.6% Fibonacci degree, then the following Fibonacci retracement of $15.84 to $1.89 is 38.2%, which might take the inventory to round $7.22.

Is there cause to be bullish on AXTI?

Nevertheless, earlier than it will get there, AXTI might want to get previous $4, which can take some effort as a result of presence of resistance. If resistance is to be damaged, AXTI will want consumers to step in and bid up the inventory worth. Patrons are extra doubtless to take action if they’ve a cause and it’s subsequently value mentioning that there are a number of causes on the market.

For starters, an argument may be made that AXTI is undervalued at its present worth. AXTI has a market cap of $148.7M with a inventory worth of $3.35 a share. Then again, AXTI’s ebook worth is considerably increased. Tangible ebook worth is $197.5M, which converts to $4.45 a share with the variety of excellent shares at 44.4M. This implies AXTI trades beneath ebook worth with a price-to-book of about 0.75x.

An argument can subsequently be made that AXTI is undervalued because of this. Nevertheless, a counterargument may be made that AXTI deserves to commerce beneath ebook worth since it’s operating at a loss. This can scale back ebook worth. The consensus estimate, as an example, is that AXTI will report a non-GAAP lack of $0.05, or $0.06 by way of GAAP, on income of $26.3M when AXTI releases the Q2 FY2024 report on August 1.

These estimates are considerably worse than the midpoint of steerage from AXTI. From the Q1 FY2024 earnings name:

“In line with our feedback at this time, we anticipate Q2 income to be between $25.5 million and $27.5 million. We anticipate our non-GAAP internet loss will likely be within the vary of $0.03 to $0.05, and GAAP internet loss will likely be within the vary of $0.05 to $0.07.”

Supply: AXTI earnings name

Bulls may argue the bar has been set low, which will increase the probability of a beat because of low expectations. AXTI has in spite of everything soundly beat estimates for each the experiences launched earlier in 2024. Non-GAAP lack of $0.03 per share in Q1 FY2024 was $0.05 higher than anticipated and non-GAAP lack of $0.07 per share in This autumn FY2023 was $0.06 higher than anticipated. This might occur once more when AXTI experiences on August 1, particularly if AXTI lowballed steerage.

As well as, whereas it’s true being within the crimson will scale back ebook worth, bulls can really feel assured in the truth that quarterly outcomes are enhancing as proven within the desk beneath. If we extrapolate the speed of enchancment within the prime and the underside line, AXTI may realistically be out of the crimson as quickly as subsequent yr or FY2025. AXTI has money, money equivalents, restricted money and brief -term investments totaling $41.27M as of Q1 FY2024, offset by complete debt of $51.72M on the stability sheet.

|

(Unit: $1000, aside from EPS) |

|||||

|

(GAAP) |

Q1 FY2024 |

This autumn FY2023 |

Q1 FY2023 |

QoQ |

YoY |

|

Income |

22,688 |

20,429 |

19,405 |

11.06% |

16.92% |

|

Gross margin |

26.9% |

22.6% |

26.3% |

430bps |

60bps |

|

Revenue (loss) from operations |

(3,347) |

(3,560) |

(4,437) |

– |

– |

|

Web revenue (loss) attributable to AXT |

(2,083) |

(3,621) |

(3,348) |

– |

– |

|

EPS |

(0.05) |

(0.09) |

(0.08) |

– |

– |

|

(Non-GAAP) |

|||||

|

Income |

22,688 |

20,429 |

19,405 |

11.06% |

16.92% |

|

Gross margin |

27.3% |

23.2% |

26.9% |

410bps |

40bps |

|

Revenue (loss) from operations |

(2,538) |

(2,738) |

(3,522) |

– |

– |

|

Web revenue (loss) attributable to AXT |

(1,247) |

(2,799) |

(2,433) |

– |

– |

|

EPS |

(0.03) |

(0.07) |

(0.06) |

– |

– |

Supply: AXTI Type 8-Okay

AXTI has misplaced $16.8M or $0.39 per share within the final 12 months, by way of GAAP. As compared, AXTI is valued $48.8M lower than its ebook worth of $197.5M with a market cap of $148.7M. The market has priced in roughly 3 years of TTM losses into the inventory, however this appears to be like extreme if the current enchancment in earnings continues and AXTI finishes FY2025 within the black with a revenue, GAAP or non-GAAP.

What are the potential catalysts for future development at AXTI?

AXTI continues to be coping with comfortable demand in some finish markets, however that may’t be stated of demand for indium phosphide or InP, which has outperformed in current quarters. Indium phosphide is utilized in, amongst different issues, silicon photonic units and lasers for high-speed knowledge transmissions in, for instance, datacenters. As a consequence AXTI stands to learn from rising adoption of AI-powered functions as a result of AI ought to enhance the necessity for extra and sooner bandwidth, and indium phosphide by extension from a provider like AXTI.

It’s additionally value reminding that AXTI continues to work in the direction of a list of its subsidiary Tongmei on the Shanghai Inventory Alternate in China. True, this has been occurring for a few years, however an IPO may function a catalyst to energy the inventory worth of AXTI increased, particularly if inventory consumers subscribe to the argument that AXTI is undervalued.

The IPO software continues to be pending, however even within the absence of 1 AXTI may generate investor curiosity because it holds stakes in ten firms in China producing uncooked supplies which are more likely to see rising demand within the semiconductor trade, together with germanium or Ge and gallium arsenide or GaAs. All this might function an incentive to get in on AXTI, whereas the inventory worth is comparatively low, if not undervalued.

Are there headwinds on the market for AXTI?

AXTI is headquartered within the U.S., together with manufacturing amenities, however it additionally has publicity to China since that’s the place a few of its amenities are positioned as a part of Tongmei. As a consequence, there’s the likelihood a change in U.S. export guidelines and even the federal government itself may lead to a renewed tech/commerce conflict between the U.S. and China, which can have an effect on AXTI.

Nothing has been settled right here, however the mere chance of a renewed commerce conflict may function a headwind for AXTI and its inventory by extension. It’s no coincidence the large decline within the inventory worth the previous few days got here within the wake of current feedback by one of many candidates operating for POTUS. Anybody who intends to be lengthy AXTI should be conscious of the dangers political change may have on AXTI.

Investor takeaways

AXTI has misplaced nearly 15% within the final three buying and selling days, going from $3.93 to $3.35, after feedback made by a presidential candidate triggered a selloff of semiconductor shares as an entire. The truth that the inventory was bumping in opposition to what’s probably resistance round $4 or so doubtless contributed to the decline. AXTI is related to China in a number of methods, which suggests the China subject may function a headwind for the inventory for a while to come back.

Nevertheless, the current decline has introduced the inventory to a trendline that has supplied assist up to now. If assist holds, now could also be an excellent time to get in. And even when assist doesn’t maintain, going lengthy should show to be worthwhile. True, AXTI is presently within the crimson, however an argument can nonetheless be made that AXTI is undervalued at 0.75x ebook worth, particularly if quarterly outcomes proceed to quickly enhance and AXTI turns into worthwhile subsequent yr.

If AXTI returns to being within the black in FY2025, then that might take away the argument AXTI ought to be buying and selling beneath ebook worth because of being within the crimson. E-book worth on the stability sheet ought to enhance as soon as the revenue assertion will get again to posting sustained earnings. As well as, AXTI has stable development prospects to maintain it worthwhile as a provider of substrates which are anticipated to see elevated demand, together with in AI.

AXTI is presently underneath strain as a result of China issue and longs shouldn’t be stunned if the inventory worth will get pushed decrease, however I’m nonetheless bullish on AXTI. There are extra professionals than cons to be discovered. If the inventory worth drops additional, then that might solely additional enhance the prevailing hole between market cap and ebook worth.

Quarterly earnings have are available a lot stronger than anticipated this yr with AI-related demand taking part in a big function and this might occur once more when AXTI experiences on August 1, particularly since expectations are on the low aspect and the inventory having not achieved a lot in months. Nothing is ready in stone, however the circumstances are there for one more post-earnings bounce within the inventory, similar to what occurred the 2 earlier occasions AXTI reported in 2024.

Backside line, there are dangers to regulate, however the bull case for AXTI has sufficient backing it up. The inventory appears to be like mispriced by principally pricing in way more losses than AXTI is more likely to incur. If or when AXTI will get out of the crimson, AXTI will have to be repriced to account for this. Odds are this may occur sooner relatively than later.