The greenback slipped in early Asian buying and selling after Joe Biden ended his reelection marketing campaign and endorsed Vice President Kamala Harris. The area’s shares look set for a combined begin.

Article content material

(Bloomberg) — The greenback slipped in early Asian buying and selling after Joe Biden ended his reelection marketing campaign and endorsed Vice President Kamala Harris. The area’s shares look set for a combined begin.

A Bloomberg gauge of the US foreign money’s energy fell 0.2% on Monday after the US President bowed to stress from the Democrats and pulled out of the November election race, whereas the Mexican peso climbed. US inventory futures rose after the S&P 500 dropped on Friday.

Commercial 2

Article content material

US longer-maturity bond futures rose greater than their shorter-dated equivalents, pointing to a modest reversal of the so-called curve steepener commerce related to a victory for Donald Trump. In Asia, fairness futures level to a combined open after contracts in Australia and Japan fell according to US shares, whereas these for Hong Kong shares have been regular. Australian bonds fell.

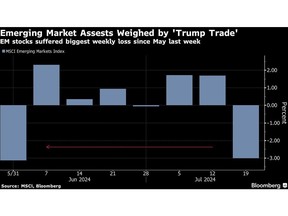

Traders have mulled for weeks a higher prospect Trump will win the November election following Biden’s weak debate efficiency, just for bets on a Trump win to speed up final week following an assassination try on the previous president. The greenback rose for the primary time in three weeks, whereas rising market property suffered amid fears of upper commerce tariffs, elevated US-China tensions and looser US fiscal coverage.

The query for traders is whether or not to stay with such trades now that Biden has dropped his bid for reelection. Markets could also be jumpy as merchants wait to see if Harris secures her get together’s nomination and weigh if she will be able to then collect sufficient momentum to problem Trump’s lead within the polls.

Article content material

Commercial 3

Article content material

“The knee-jerk response could be to say that this destructive for the US greenback, nevertheless it’s too quickly to say,” stated Olga Yangol, head of EM analysis and technique at Credit score Agricole. “Rather a lot will rely upon Harris’s preliminary appearances and selection of a operating mate and the way the swing state polls react.”

In commodities, oil and gold rose in early buying and selling Monday.

The S&P 500 dropped 0.7% on Friday to cap its worst week since April, whereas the Nasdaq 100 slumped about 1%. The Russell 2000 Index of smaller corporations fell 0.6%. Tech shares fell forward of earnings stories this week, whereas CrowdStrike Holdings Inc., the agency behind an enormous IT failure that grounded flights and disrupted firms around the globe, slumped as a lot as 15% earlier than paring losses.

Tesla Inc. and Alphabet Inc. would be the first of the “Magnificent Seven” to report earnings on Tuesday. Analysts will possible press Elon Musk’s electric-vehicle big on the progress of its plans for robotaxis. And traders will delve into the small print of Google’s guardian income increase from synthetic intelligence.

“The S&P 500 has seen a stable flush out of prolonged and concentrated positioning in some extremely well-owned areas of the market,” stated Chris Weston, head of analysis at Pepperstone Group in Melbourne. With volatility anticipated in Tesla, Alphabet and IBM shares over their earnings, “I wouldn’t be stepping in to purchase the S&P 500 or Nasdaq 100 simply but,” he wrote in a observe.

Commercial 4

Article content material

China’s one- and five-year mortgage prime charges are anticipated to stay unchanged later Monday because the nation’s central financial institution shrugs off anemic second-quarter development.

As an alternative, President Xi Jinping on the weekend unveiled sweeping plans to bolster the funds of China’s indebted native governments because the ruling Communist Get together introduced its long-term blueprint for the world’s second-largest economic system. These are centered round shifting extra income from the central to native coffers, reminiscent of by permitting regional governments to obtain a bigger share of consumption tax.

“Like most paperwork of this type, it didn’t say how Chinese language leaders meant to achieve these targets, a lot of which might require insurance policies which might be contradictory in nature,” stated Bob Savage, head of markets technique and insights at BNY Mellon. “The contradiction of China development vs. stability are hanging over APAC markets and flows, nonetheless leaving Chinese language yuan and commodities a key focus.”

Elsewhere this week, merchants will probably be targeted on financial exercise knowledge in Europe, US second quarter development and a slew of company earnings. The Financial institution of Canada will give a charge determination whereas the Federal Reserve’s most popular measure of inflation can be due.

Commercial 5

Article content material

Key occasions this week:

- China mortgage prime charges, Monday

- Hong Kong CPI, Monday

- Taiwan jobless charge, export orders, Monday

- Mexico retail gross sales, Monday

- Israeli Prime Minister Benjamin Netanyahu embarks on go to to Washington, Monday

- EU overseas ministers meet in Brussels, Monday

- Singapore CPI, Tuesday

- Taiwan industrial manufacturing, Tuesday

- India’s price range for fiscal yr via March 2025, Tuesday

- Turkey charge determination, Tuesday

- Eurozone shopper confidence, Tuesday

- Alphabet, Tesla, LVMH earnings, Tuesday

- Malaysia CPI, Wednesday

- South Africa CPI, Wednesday

- Eurozone HCOB PMI, Wednesday

- UK S&P International PMI, Wednesday

- Canada charge determination, Wednesday

- IBM, Deutsche Financial institution earnings, Wednesday

- ECB Vice President Luis de Guindos speaks, Wednesday

- Hong Kong commerce, Thursday

- South Korea GDP, Thursday

- US GDP, preliminary jobless claims, sturdy items, merchandise commerce, Thursday

- G-20 finance ministers and central bankers meet in Rio de Janeiro, Thursday via Friday

- Bitcoin 2024 convention in Nashville, Thursday via July 27

- Japan Tokyo CPI, Friday

- US private revenue, PCE value index, College of Michigan shopper sentiment, Friday

- Mexico commerce, Friday

Commercial 6

Article content material

Among the major strikes in markets:

Shares

- S&P 500 futures rose 0.3% as of 8:22 a.m. Tokyo time

- Hold Seng futures have been little modified

- S&P/ASX 200 futures fell 0.8%

- Nikkei 225 futures fell 1.1%

Currencies

- The Bloomberg Greenback Spot Index fell 0.2%

- The euro rose 0.2% to $1.0900

- The Japanese yen rose 0.1% to 157.26 per greenback

- The offshore yuan was little modified at 7.2799 per greenback

- The Australian greenback rose 0.2% to $0.6698

Cryptocurrencies

- Bitcoin rose 0.4% to $68,042.9

- Ether was little modified at $3,500

Bonds

- Australia’s 10-year yield superior 4 foundation factors to 4.32%

Commodities

- West Texas Intermediate crude rose 0.5% to $80.55 a barrel

- Spot gold rose 0.4% to $2,410.64 an oz.

This story was produced with the help of Bloomberg Automation.

—With help from Joanna Ossinger and Richard Henderson.

Article content material