narvikk

Introduction

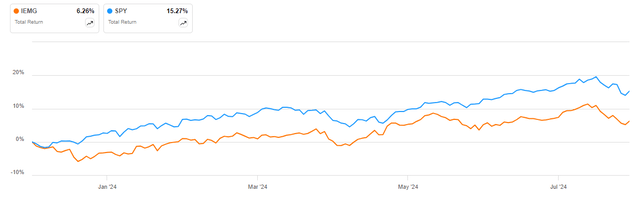

The iShares Core MSCI Rising Markets ETF (NYSEARCA:IEMG) has underperformed the SPDR S&P 500 ETF Belief (SPY) thus far in 2024, delivering a mid-single-digit complete return in opposition to the circa 15% acquire within the benchmark ETF:

IEMG vs SPY in 2024 (Searching for Alpha)

Over a 3-year, 5-year, and 10-year timeframe, the underperformance is much more vital, at round 37%, 76%, and 204%, respectively:

IEMG vs SPY over the previous three years (Searching for Alpha)

Whereas there isn’t a assure the development of the final decade will reverse, I believe there are a number of components that may flip the tide in rising markets’ favor. Firstly, the IEMG affords a better earnings and dividend yield relative to the SPY. Secondly, constituent international locations’ GDP development charges are more likely to exceed these of america, each short-term and over the long run. Final however not least, the underweight place in Info Know-how relative to the SPY is sensible in my view given costly valuations within the sector after current outperformance.

ETF Overview

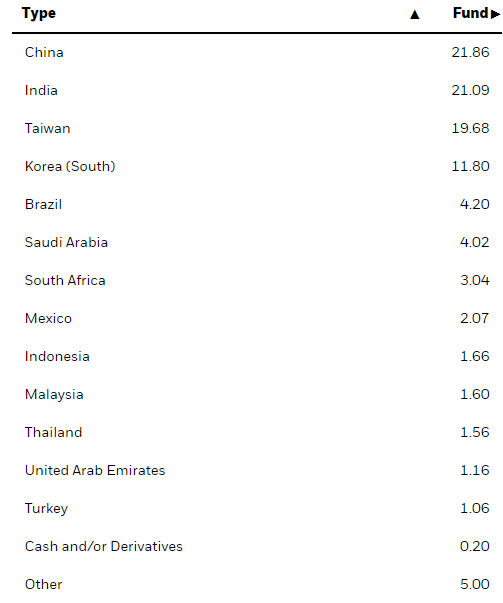

You possibly can entry all related IEMG info on the iShares web site right here. The iShares Core MSCI Rising Markets ETF tracks small, mid, and large-capitalization firms from rising markets. The portfolio is pretty concentrated in just a few main rising market international locations, particularly China (21.86% of internet property), India (21.09%), Taiwan (19.68%), and South Korea (11.80%):

Portfolio breakdown by nation (iShares web site (Accessed July 2024))

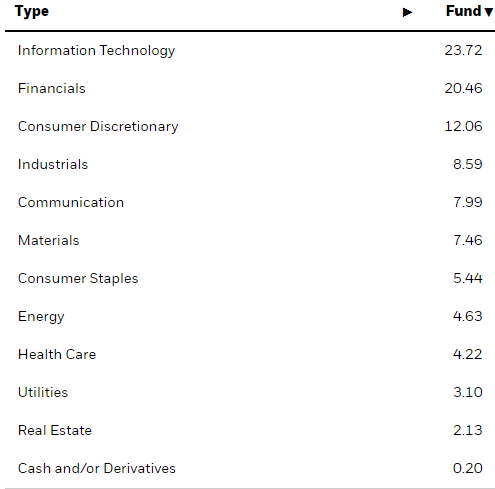

From a sector perspective, the allocation is primarily to Info Know-how (23.72% of internet property), adopted by Financials (20.46%) and Shopper Discretionary (12.06%):

Portfolio breakdown by sector (iShares web site (Accessed July 2024))

Diversification, bills, and distributions

The overall variety of IEMG holdings is 2 943, with the complete listing out there right here. The highest ten positions account for 22.04% of internet property, which is arguably higher diversification than the 34.26% focus within the high ten holdings within the SPY. However, we should always point out the outsized single-stock publicity to Taiwan Semiconductor Manufacturing Firm (TSM) which accounts for 8.35% of IEMG’s internet property.

The expense ratio stands at 0.09%, which is a really engaging stage, in step with SPY’s 0.0945% stage. The IEMG ETF makes distributions twice a yr versus quarterly funds at SPY.

Sector allocation comparability

Within the desk under, I’ll now consider how the IEMG compares to the SPY from a sector perspective:

| Sector/ETF allocation % | IEMG | SPY | Distinction |

| Info Know-how | 23.72 | 31.34 | -7.62 |

| Financials | 20.46 | 13.05 | +7.41 |

| Shopper Discretionary | 12.06 | 9.85 | +2.21 |

| Industrials | 8.59 | 8.37 | 0.22 |

| Communication Companies | 7.99 | 8.77 | -0.87 |

| Supplies | 7.46 | 2.24 | 5.22 |

| Shopper Staples | 5.44 | 5.93 | -0.49 |

| Power | 4.63 | 3.73 | 0.9 |

| Well being Care | 4.22 | 12.10 | -7.88 |

| Utilities | 3.10 | 2.35 | 0.75 |

| Actual Property | 2.13 | 2.27 | -0.14 |

Supply: Creator calculations based mostly on iShares and State Road disclosures

Wanting on the knowledge above, we observe IEMG is closely underweight Info Know-how (by 7.62%) and Well being Care (7.88%). Given elevated valuations within the Info Know-how house, I believe it is sensible to underweight the sector. The Well being Care underweight doesn’t appear prudent given the defensive nature of the sector and long-term development prospects. However, should you have a look at the iShares International Healthcare ETF (IXJ), we discover that it affords an incomes yield of three.26% and a dividend yield of simply 1.29% which appears overvalued, so maybe the great long-term prospects are already priced in.

Turning to the sectors, IEMG is chubby, we observe that Financials (7.41%) and Supplies (5.22%) are the 2 largest variations. Financials is historically a worth sector, however I’d argue that given the present prospect for rate of interest cuts, you would need to be selective when allocating capital for the sector. Therefore, the chubby place is probably not prudent. The Supplies chubby place arguably makes extra sense, because the sector ought to profit from the electrification development, which is unlikely to cease any time quickly. Moreover, the iShares International Supplies ETF (MXI) affords an earnings yield of 5.29% and a dividend yield of two.68%, which is cheap.

Going over the variations within the remaining sectors, they’re total not that vital, with a slightly increased allocation to Shopper Discretionary (2.21%) giving IEMG a considerably extra cyclical tilt, which is already evident from the bigger Financials/Supplies allocation, respectively the Well being Care underweight place.

Valuation and development prospects

IEMG at the moment boasts an earnings yield of 6.30% and a dividend yield of two.79%, fairly increased than SPY’s 4.45% ahead earnings yield and its present dividend yield of 1.26%. In consequence, S&P 500 earnings must develop some 1.85% quicker than IEMG earnings for the SPY ETF to make up for the valuation distinction, one thing I do not assume is sustainable long run.

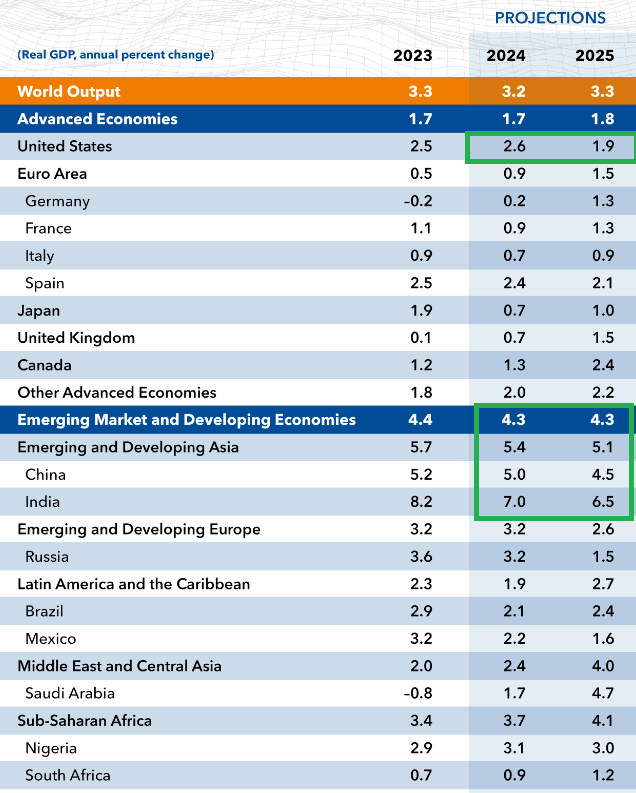

In actual fact, rising markets are forecast to outpace US development in 2024-2025, as evident from the Worldwide Financial Fund’s July 2024 World Financial Outlook Replace:

GDP development projections (IMG World Financial Outlook – July 2024)

We observe america is forecast to develop 2.6% and 1.9% in 2024 and 2025 respectively, a lot slower relative to a circa 5% development for the most important IEMG elements India and China. Whereas it’s true that GDP development is not going to essentially translate into earnings development, it’s generally accepted that rising markets will develop quicker than high-income economies as a consequence of pure catch-up development.

Dangers

Investing in rising markets brings quite a lot of idiosyncratic dangers. One threat that got here to the eye of buyers not too long ago is the danger of capital controls as those imposed by Russia following its 2022 invasion of Ukraine. Therefore, there isn’t a assure buyers will be capable to get a good worth for his or her property in such an occasion.

Institutional safety is arguably additionally much less developed as in comparison with established capital markets, with quite a few examples of questionable courtroom choices, outright fraud, or poor investor safety.

Forex threat can be entrance and heart when allocating capital to rising markets, with every nation having its personal set of financial coverage concerns. Given the engaging valuations, chances are you’ll nicely make an inexpensive revenue in native forex phrases, however when calculated in laborious forex such because the US greenback, chances are you’ll find yourself worse than a easy SPY funding.

Conclusion

The iShares Core MSCI Rising Markets ETF has underperformed the SPDR S&P 500 ETF Belief in actually each time-frame prior to now ten years. As issues stand, I believe rising markets might outperform going ahead, thanks largely to a extra engaging valuation from an earnings yield perspective, higher GDP development prospects relative to high-income markets corresponding to america, and maybe helped by an underweight place in Info Know-how sector in comparison with the S&P 500.

Whereas there have been many false dawns for rising market shares prior to now and these markets include quite a few dangers, I nonetheless assume it is sensible to extend allocations to ETFs such because the IEMG which is able to profit from rising markets outperformance. Towards the backdrop of a looming presidential election, which is able to create some uncertainty in US inventory markets within the months forward, I like to recommend going lengthy the IEMG ETF.

Thanks for studying.