Marc Bruxelle

This yr has been fruitful when it comes to new cryptocurrency ETFs. Nevertheless, there’s nonetheless a distinct segment that is still free: exchange-traded funds representing a diversified mixture of cryptocurrencies. Bitwise 10 Crypto Index Fund ETF (OTC:BITW), incepted means again in 2017, is an try to handle the dearth of such funds.

I just like the idea of the fund, although there are critical caveats which will have an effect on an investor’s determination to purchase the fund’s shares. For those who’re snug with the fund’s options, dangers, and limitations, then it is a first rate funding automobile to personal with sturdy YTD efficiency. I give the BITW fund a “Maintain” ranking.

BITW Fund Overview

In line with the fund’s description, the BITW fund seeks to trace an index comprised of the ten most extremely valued cryptocurrencies, screened and monitored for sure dangers, weighted by market capitalization, and rebalanced month-to-month.

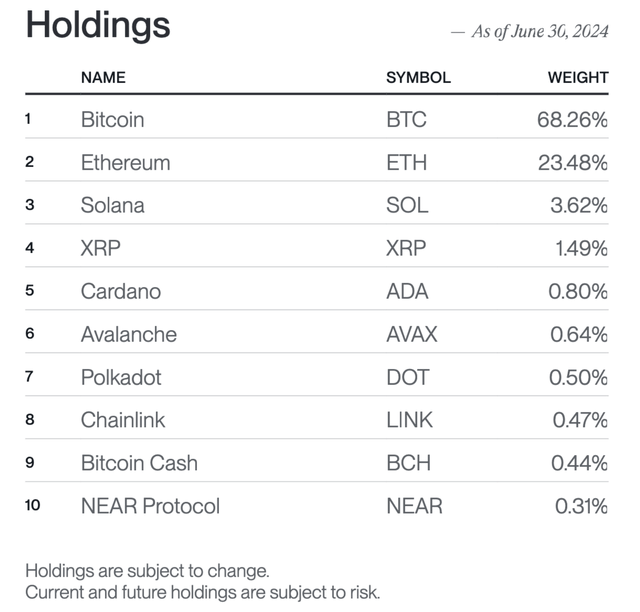

Such an idea sounds superior, but when we have a look at the fund’s holdings, the primary caveat turns into apparent: unbalanced sizing of the fund’s crypto positions.

Bitwise

As you possibly can see from the image above, 91% (!) of the fund consists of Bitcoin and Ethereum. The remainder eight cryptocurrencies share a negligible 9% of the fund’s holdings. Given the overwhelmingly dominant weight of the fund’s efficiency with Bitcoin and Ethereum, these are the one cryptocurrencies which might be value discussing within the context of the BITW fund.

With the present crypto ETFs, you possibly can simply replicate 91% of the BITW fund by shopping for iShares Bitcoin Belief ETF (IBIT) and Bitwise Ethereum ETF (ETHW), which offer you liquid publicity to Bitcoin and Ethereum accordingly. With a presumably upcoming Solana ETF, you’ll replicate 95.36% of the BITW holdings.

And right here comes the subsequent purple flag: bills. In 2017, when the fund was incepted, crypto was nonetheless an oddity for tech geeks, and an expense ratio of two.5% appeared justified for another asset. It is no secret that new BTC-ETFs and ETH-ETFs have charges round 0-0.25%, making the BITW look utterly uncompetitive.

Nonetheless, there’s one thing else we have to think about: the NAV low cost.

Worth To Seize Or A Worth Lure?

There is a particular characteristic of the BITW fund that pulls buyers: an enormous low cost of the fund’s share value to the worth of belongings it’s presently holding. The fund states that the fund’s web asset worth (NAV) stands at $51.87, whereas the share value of the BITW is $35.96. Merely put, BITW’s share value is roughly 30% decrease than the online worth of its belongings.

In my view, decrease liquidity, excessive expense ratio, and fading exclusivity of the fund amid new crypto ETF issuances in a technique or one other might contribute to the NAV low cost we observe in the present day. Another excuse for a reduction could also be the truth that the BITW fund would not have a correct itemizing on a inventory alternate, buying and selling solely within the OTC market.

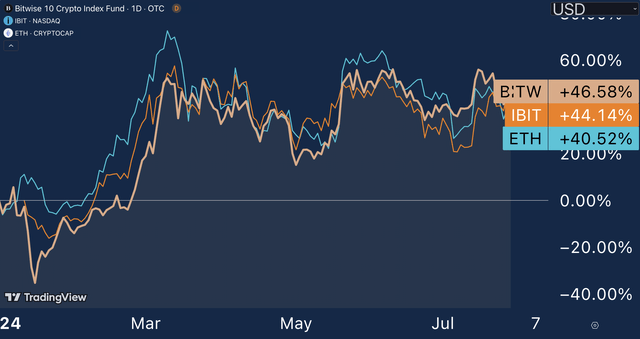

Thus far, the BITW fund performs barely higher than the most well-liked BTC ETF, IBIT.

TradingView

Nevertheless, I do not see catalysts that would drive the BITW a lot nearer to its precise NAV. Thus, for my part, it is a daring assumption to anticipate that the NAV low cost can shut anytime quickly, if ever.

To conclude, holding the BITW shares offers principally the identical efficiency as a mixture of BTC and ETH ETFs, and also you pay a better expense ratio for an opportunity that in some unspecified time in the future sooner or later, the NAV low cost can be eradicated.

The Backside Line

Whereas the BITW appears like an apparent purchase contemplating the fund’s valuation low cost to its NAV, I might argue that this low cost shouldn’t be solely unfounded. Once more, crypto is all about hype, and “legacy” funds just like the BITW that fail to supply low-cost, liquid, and handy publicity to crypto might finally lag behind.

With an equal-weight strategy to structuring the fund’s holdings, the BITW fund might supply a singular proposition of a very diversified strategy to get into crypto. Sadly sufficient, this isn’t what the BITW represents in the intervening time.