franckreporter/iStock through Getty Pictures

Introduction

Following the instance of Warren Buffett, who has been promoting his main fairness shares, akin to Apple (AAPL) and Financial institution of America (BAC), and elevating money to a file degree, it’s the time for me to think about rising the fastened revenue portion of my funding portfolio. My present favourite alternative in that class is lengthy authorities bonds, for a lot of causes to be mentioned on this article. Vanguard Lengthy-Time period Treasury Index Fund ETF Shares (NASDAQ:VGLT) is likely one of the greatest ETFs centered on long-term authorities money owed. The ETF has a giant hole between the present value degree and the earlier excessive. There are a number of tailwinds which were developed in latest weeks. These tailwinds, when absolutely established, may assist VGLT recoup the value loss considerably within the coming months. I’ve a purchase ranking on VGLT and count on the ETF to perform an amazing complete return in the remainder of 2024.

VGLT ETF Spotlight

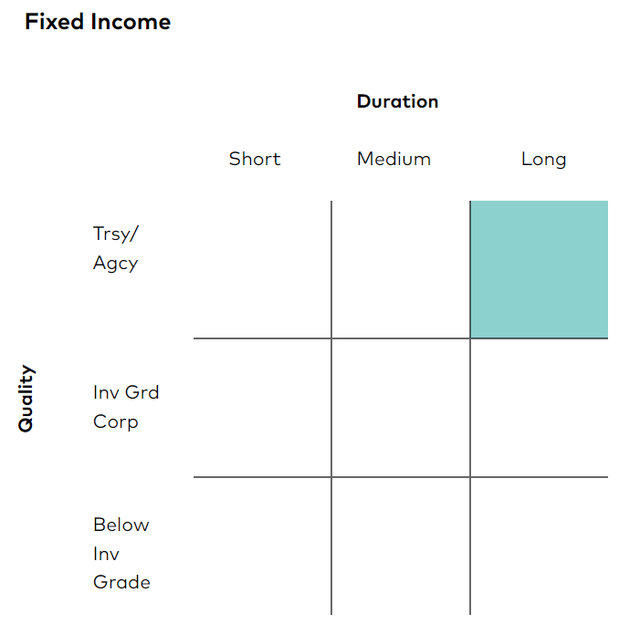

VGLT is a set revenue ETF managed by Vanguard. The ETF is targeted on lengthy period US treasury bonds. As proven by the next map supplied by Vanguard, VGLT falls into the lengthy period and fine quality classes within the Mounted Revenue map.

VGLT Mounted Revenue Class – from Vanguard

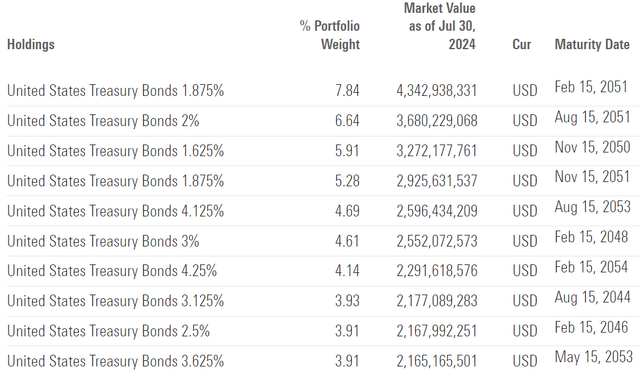

The variety of bond holdings is 84. The next exhibits the highest 10 holdings.

VGLT High 10 holdings – from Morningstar.com

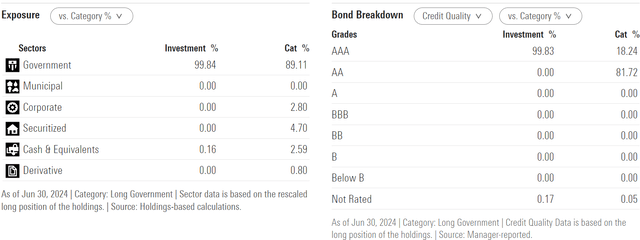

The bond grade is on the high AAA, rated on 99.8% of the holdings with 99.84% allotted to Authorities sector, as proven under.

VGLT Sectors and Credit score Grades – from Monrningstar.com

The next summarizes the ETF market traits, with transient feedback evaluating it to TLT, which is the most important ETF of the identical kind.

- Whole Bonds: 84. TLT has 47 complete holdings.

- Credit score (A or larger): 99.83% AAA.

- Yield (FWD): 3.68%.

- Whole Property (AUM): $17.46B. That is the second largest. TLT AUM is $60.01B.

- Quantity (final day): 3,399,439.

- Expense Ratio: 0.04%. It’s a tremendous low expense ratio in comparison with TLT’s 0.15%.

- Danger Rating(Morningstar): 50. It’s thought of aggressive however lower than TLT’s 56.

Warren Buffett doesn’t dump his long-term conviction and market MVP for no cause.

What we simply realized is that Berkshire Hathaway’s “money hits file $276.94B” and that Warren Buffett has been dumping his main fairness holdings Apple (reported $76 billion) and Financial institution of America (reported $2.3 billion).

However we could not know the place Buffett is parking the money as we speak and, extra importantly, what his technique is to handle the massive money pile sooner or later. It was reported that he invested in short-term authorities debt again in 2023 for a excessive curiosity of above 5% yield. What’s going to occur to the holdings of the short-term bonds if the inverted yield is reverted?

It’s fairly doable that Buffett is searching for the subsequent generational, lengthy performs within the fairness market, like he has often executed previously. However I do not see a greater fairness than AAPL as the present MVP out there, with its market cap of $3.4T. Needless to say we’ve got not seen the massive offers from Buffett for a number of years together with his excessive money pile. His holdings of (short-term) Treasury payments turn out to be extra noticeable today.

The place to speculate the money pile?

My funding technique is an fascinating one based mostly on two telnets, 1) an general conservative portfolio construction with a “50-50” allocation, following the legendary John Bogle’s favourite strategy and a pair of) aggressive and swift fairness positions, together with deploying choices and extremely leveraged ETFs. There may be one other 50-50 break up between lengthy convictions (sometimes a handful) and short-term performs.

About two months in the past, I began to boost my bond portion to the present 60%. It was extra of a profiting-taking strategy and preparation for sector rotations. Nonetheless, the latest macro situations have been quickly altering, so I plan to proceed rising my bond holdings to 70% with extra long-duration alternate options till maybe after the US election.

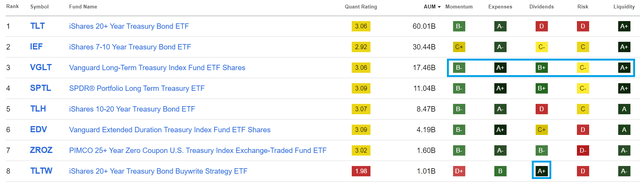

The next illustrates my choice course of with the long-term treasury ETFs:

- The bottom checklist is SA’s Lengthy Authorities ETFs, with a present complete of 21 ETFs.

- Choose AUM that’s over $1B as a result of I favor massive dimension ETFs. This step will give me the 8 ETFs proven under.

- The subsequent three standards are: (1) good dividends, (2) greatest value momentums, and (3) the bottom expense. This choice step narrows the checklist all the way down to the ultimate two: VGLT and SPTL.

- The ultimate alternative is VGLT, because it presents a 3.68%, which has a slight edge over SPTL’s 3.51%.

Lengthy Authorities ETFs Comparability – from SA

Discover that TLT is the most important ETF with complete property over $60B, whereas TLTW has the most effective dividend distribution (yield over 15%) on this group. They each are good performs relying on investing choice and technique. readers can take a look at my latest article on TLTW for extra particulars.

Promising fee reduce in September is propelling a value escape for the lengthy treasury ETFs

There may be rising concern a couple of potential onerous touchdown given the slowing economic system knowledge, proven by unemployment, which is “ticking as much as 4.3%“. The highest graded treasury bonds are recognized to be anti-inflationary in nature.

The next chart exhibits the value conduct for the final 5 years, together with through the preliminary phases of the COVID-19 pandemic in 2020. It may be seen that the lengthy treasury bond was going up through the fallout of the fairness market in March 2020. This transfer was largely triggered by the FED fee reduce, dropping the rate of interest to zero.

VGLT Value Evaluation -from Creator utilizing SA Charting Knowledge

I count on the speed reduce this September will create an analogous catalyst for VGLT to go up in value.

Dangers & Caveats

The largest danger to investing in lengthy authorities bonds is the massive authorities debt, which is topping $35 trillion these days. The latest rolling to brief time period to maintain the lengthy regular will certainly be short-lived. The issues may go larger quickly. This may be very destructive for the lengthy authorities bonds. The newest recognized downgrade got here from Moody’s in November 2023, in response to this Credit score Ranking. We may see one other downgrade, relying on what the federal government will probably be doing with its big debt.

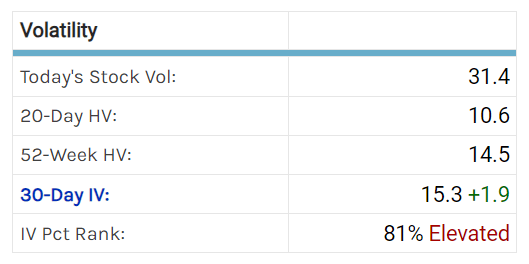

This is likely one of the key the explanation why VGLT may have a really risky inventory value. As proven under, at some point’s studying of 31.4 on Volatility is taken into account very excessive.

VGLT Volatility data from marketchameleon.com

Volatility is a measure of danger. Traders ought to concentrate on the potential value drop that could possibly be very substantial when favorable situations (akin to cooling inflations) usually are not in place.

Conclusion

The latest selloff within the fairness market could trigger the cash to start out flowing into the lengthy period fastened revenue class. The speed-cut in September is sort of sure given the latest weak economic system knowledge. The reduce itself may begin the speed declining cycle, which is able to make the lengthy period treasury a giant winner. Provided that the lengthy bond can be an anti-recessionary and defensive asset class, a high quality ETF like VGLT represents an amazing candidate for a protracted core holding in a single’s funding portfolio. Additionally it is a sexy purchase for a doable exceptional complete return within the a number of months to come back, because the macro situations may flip more and more extra favorable.