(Bloomberg) — Shares in Asia climbed for a second session as markets shifted focus to key US knowledge prints this week for additional perception into the well being of the world’s largest financial system.

Most Learn from Bloomberg

A gauge of shares for the area rose Monday, following on from Friday’s 1.5% achieve as benchmarks in Australia, Taiwan and South Korea edged greater. Shares in Hong Kong fluctuated whereas these on the mainland have been little modified. Japanese markets have been closed for a vacation.

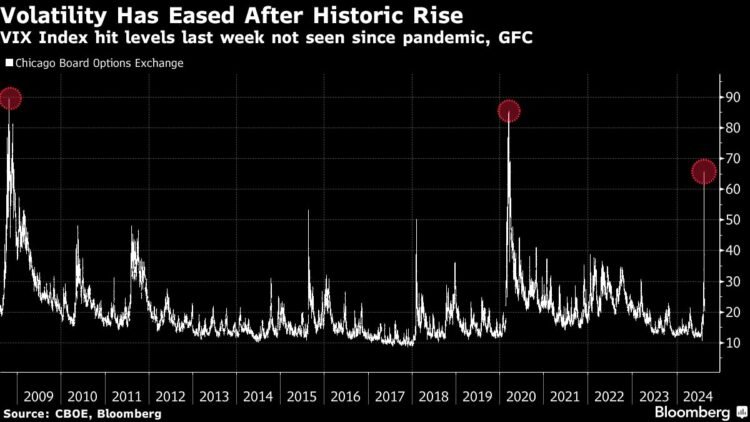

A semblance of calm returned after markets have been ravaged early final week from fears the Federal Reserve is ready too lengthy to chop rates of interest. The Cboe Volatility Index – Wall Avenue’s worry gauge – has reversed off its highest because the early days of the Covid-19 pandemic. The yen was barely weaker towards the buck on Monday.

“The skies should not totally clear but, however there are a number of causes that counsel to us that some comparatively calmer seas are forward of us,” analysts at Nomura Holdings Inc. mentioned in a word, citing a lessening of fears a couple of US recession and decrease probabilities of a really hawkish Financial institution of Japan as among the many grounds for optimism.

The yen surged final week as merchants slashed bearish bets following the BOJ’s fee hike, forcing a detrimental suggestions loop as traders dumped carry trades that ricocheted throughout markets, earlier than ending final week little modified.

The BOJ and Fed are the largest variables to drive buying and selling, mentioned Taosha Wang, a portfolio supervisor at Fil Asia Holdings Pte Ltd. For the US, “I don’t assume the market has agreed — both a recession, which we predict is extreme, or a gentle touchdown,” she advised Bloomberg Tv’s Yvonne Man and David Ingles on Monday.

Elsewhere in Asia, merchants might be targeted on China’s retail gross sales and industrial manufacturing knowledge this week to gauge whether or not the nation’s financial system is discovering traction.

China continues to be battling bond market speculators, with state banks promoting debt to buoy yields. Sovereign yields rebounded final week after authorities intensified their combat towards bond bulls. The financial system wants extra stimulus as the most recent main indicators level to a lack of restoration momentum round mid-year, in response to Bloomberg Economics.

New Zealand’s central financial institution will even determine on coverage this week, with the financial system displaying indicators of coming into its third recession in lower than two years. Australian and New Zealand authorities bonds have been little modified on Monday. Treasuries money buying and selling was shut in Asia as a result of vacation in Tokyo.

Financial Downturn

A tumultuous week for world bond markets headed towards calm on Friday as angst over the potential US financial downturn — which spurred a Treasury rally and temporary market meltdown — light.

The US client value index on Wednesday is anticipated to have risen 0.2% from June for each the headline determine and the so-called core gauge that excludes meals and power. The modest strikes, nonetheless, will not be sufficient to derail the Fed from a broadly anticipated interest-rate reduce subsequent month.

On the weekend, Fed Governor Michelle Bowman mentioned she nonetheless sees upside dangers for inflation and continued energy within the labor market, signaling she will not be able to assist an interest-rate lower when US central bankers subsequent meet in September. Cash markets have totally priced a fee reduce in September and about 100 foundation factors of easing for the yr, in response to swaps knowledge compiled by Bloomberg.

In commodities, oil edged greater on Monday following a 4.5% achieve final week. Among the prime US oil refiners are throttling again operations at their amenities this quarter, including to issues {that a} world glut of crude is forming. Gold was decrease.

Some key occasions this week:

-

RBA Deputy Governor Andrew Hauser speaks, Monday

-

India CPI, industrial manufacturing, Monday

-

Australia client confidence, Tuesday

-

Japan PPI, Tuesday

-

South Africa unemployment, Tuesday

-

UK jobless claims, unemployment, Tuesday

-

Residence Depot earnings, Tuesday

-

US PPI, Tuesday

-

Atlanta Fed President Raphael Bostic speaks, Tuesday

-

Eurozone GDP, industrial manufacturing, Wednesday

-

New Zealand fee resolution, Wednesday

-

South Korea jobless fee, Wednesday

-

Poland CPI, Wednesday

-

UK CPI, Wednesday

-

US CPI, Wednesday

-

Australia unemployment, Thursday

-

Japan GDP, industrial manufacturing, Thursday

-

Philippines fee resolution, Thursday

-

China house costs, retail gross sales, industrial manufacturing, Thursday

-

Norway fee resolution, Thursday

-

UK industrial manufacturing, GDP, Thursday

-

US preliminary jobless claims, retail gross sales, industrial manufacturing, Thursday

-

St. Louis Fed President Alberto Musalem, Philadelphia Fed President Patrick Harker converse, Thursday

-

Alibaba Group, Walmart earnings, Thursday

-

Hong Kong jobless fee, GDP, Friday

-

Taiwan GDP, Friday

-

US housing begins, College of Michigan client sentiment, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

Among the major strikes in markets:

Shares

-

S&P 500 futures have been little modified as of 11:05 a.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 0.7%

-

Australia’s S&P/ASX 200 rose 0.5%

-

Hong Kong’s Grasp Seng fell 0.3%

-

The Shanghai Composite was little modified

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0920

-

The Japanese yen fell 0.2% to 146.96 per greenback

-

The offshore yuan was little modified at 7.1759 per greenback

-

The Australian greenback was little modified at $0.6584

Cryptocurrencies

-

Bitcoin fell 0.1% to $58,455.91

-

Ether fell 0.6% to $2,541.87

Bonds

Commodities

-

West Texas Intermediate crude rose 0.3% to $77.07 a barrel

-

Spot gold fell 0.3% to $2,424.86 an oz

This story was produced with the help of Bloomberg Automation.

–With help from Richard Henderson.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.