Market watchers count on volatility to stay elevated within the close to time period with a number of key occasions in thoughts

Article content material

After one of many wildest weeks in latest market historical past — the S&P 500 index posted each its greatest one-day stoop and greatest rebound since 2022 — merchants may very well be forgiven for not wanting to leap again totally into shares. Some at the moment are wanting into choices.

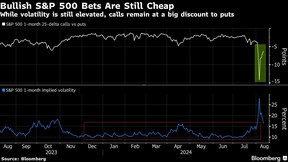

Threat reversals and name spreads, methods that contain shopping for a contract whereas promoting one other, are recognized for offering a less expensive strategy to wager on market course. Now, they’re particularly interesting for bullish views. In latest days, calls on the S&P 500 index have been at their most cost-effective in years relative to places, information compiled by Bloomberg exhibits.

Commercial 2

Article content material

Choices costs spiked final week, with the CBOE volatility index (VIX) hitting an nearly four-year excessive as shares tanked on considerations over weak financial information. Whereas implied volatility has since given up a few of its good points, it’s nonetheless holding up properly above the vary from the previous 16 months, with hedging demand pushing up put prices extra, making it extra engaging to promote them to fund rally bets.

Article content material

Merchants who see the potential for extra inventory losses however are scared of lacking out in case these don’t materialize may use choices, in line with Christopher Jacobson, co-head of spinoff technique at Susquehanna Worldwide Group LLP.

“That’s when the danger reversal may make sense,” he mentioned. “By the identical token, we’ve checked out name spreads in addition to a a lot lower-risk strategy to get publicity to a rebound with out taking up that draw back danger.”

In a bullish danger reversal, traders purchase a name and promote a put, whereas a name unfold entails buying and selling simply calls. Although these provide restricted reward, their value is smaller and so they guarantee traders received’t have to purchase shares or get uncovered to a much bigger loss if costs drop. Ratio spreads — when one facet of the commerce includes extra contracts than the opposite — are even cheaper, however they lower the reward additional and danger a loss if costs spike.

Commercial 3

Article content material

Some merchants mix each methods. On Thursday, an investor within the VanEck semiconductor exchange-traded fund purchased December US$255/US$290 name spreads whereas promoting US$160 places. In a Sunday word, Citigroup Inc. talked about name spreads on the fund worth properly for these desirous to play a bounce in synthetic intelligence shares.

U.S. inventory volatility has elevated after months of calm took the VIX to its lowest common studying since 2017 within the first half of the 12 months. In July, unusually excessive costs for bullish choices on some megacap tech shares provided alternatives for traders to hedge by shopping for longer-dated places and promoting calls.

Now, market watchers count on volatility to stay elevated within the close to time period, with a number of occasions in thoughts: a key U.S. inflation report on Aug. 14, U.S. Federal Reserve chair Jerome Powell’s speech on the Jackson Gap symposium on Aug. 23 and Nvidia Corp. earnings after the market shut on Aug. 28.

Beneficial from Editorial

“Two- to three-week name choices may very well be a protected strategy to get some publicity to a rebound,” Rocky Fishman, founding father of derivatives analytical agency Asym 500 LLC, mentioned. “Promoting places to purchase calls additionally traces up properly.”

Article content material