JHVEPhoto

Funding thesis

My preliminary bullish thesis about Medtronic (NYSE:MDT) aged considerably good because the inventory delivered a complete 1.9% return since mid-February. As I underlined in my preliminary thesis, MDT is an efficient possibility for buyers in search of low-volatility inventory with stable dividend progress.

The corporate experiences its fiscal Q1 earnings quickly, on August 20. At this time I need to replace my thesis and clarify why I consider there are sturdy causes to stay reasonably bullish about MDT. Furthermore, the valuation nonetheless appears to be like good. All in all, I reiterate my “Purchase” score for MDT.

MDT FQ1 earnings preview

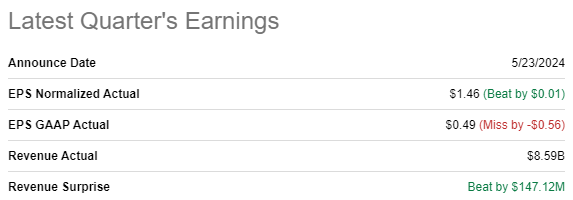

MDT launched its newest quarterly earnings on Might 23, surpassing income and adjusted EPS consensus estimates. Alternatively, there was a giant miss towards consensus from the attitude of GAAP EPS. Income was virtually flat YoY with a shallow 0.5% progress.

Searching for Alpha

The upcoming quarter’s earnings are scheduled subsequent week, for August 20. Wall Avenue analysts count on FQ1 income to be $7.90 billion, round 2.5% greater on a YoY foundation. The adjusted EPS is anticipated to be flat YoY at $1.2. Sentiment of Wall Avenue analysts across the upcoming earnings launch is kind of bearish with 17 downgrade EPS revisions over the past 90 days.

Searching for Alpha

MDT has a stable earnings shock report and several other earlier quarters there have been solely optimistic income and adjusted EPS surprises. What can also be vital is that the inventory isn’t a giant mover after earnings releases, in accordance with historic share value actions.

Current developments are largely optimistic for MDT buyers. The corporate declared a $0.70 quarterly dividend on August 16, consistent with the earlier one. Furthermore, MDT bought upgraded from “Promote” to “Maintain” by UBS analysts, with optimism across the skill to drive progress within the firm’s diabetes phase. The optimism appears to be like sound for the reason that trade is anticipated to show stable progress. In accordance with Statista, diabetes care gadgets trade is anticipated to ship a 12.2% CAGR between 2024 and 2029, which is a stable tailwind for MDT’s diabetes enterprise. Furthermore, Medtronic has lately received an FDA approval for its Simplera steady glucose monitor [CGM].

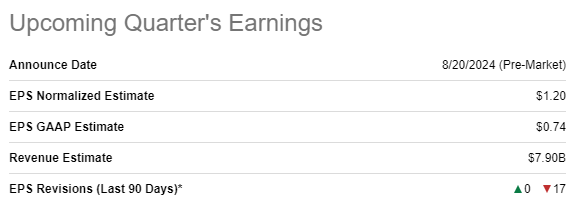

Parkinson’s Basis

Current info additionally means that Medtronic obtained one other vital FDA approval for its asleep deep mind stimulation [DBS] surgical procedure. Medtronic claims that it has grow to be the primary and solely firm getting an FDA approval to conduct DBS surgical procedures. The DBS surgical procedure answer is for folks with Parkinson’s illness and with important tremor. That is additionally an important optimistic improvement for MDT as Parkinson’s illness can also be a giant downside within the U.S. In accordance with Parkinson’s Basis, almost 90,000 folks within the U.S. are identified with this illness annually and the mixed direct and oblique value of Parkinson’s is estimated to be almost $52 billion per yr within the U.S. alone.

All these developments are essential for the corporate’s long-term income prospects. The nice half is that the administration shouldn’t be additionally centered on driving income progress, but in addition increase worth for shareholders. The corporate restructured its amenities, which allowed it to optimize the headcount in 2023. In accordance with information as of mid-June 2024, the corporate continues shedding workers.

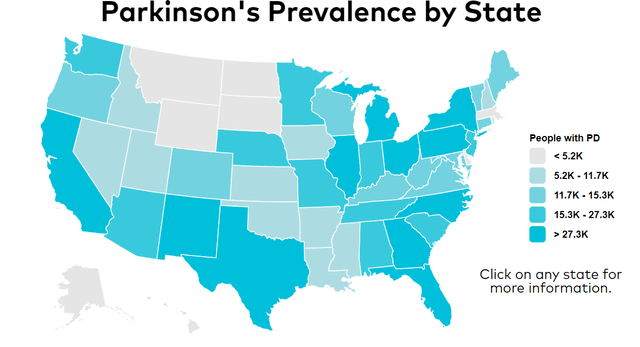

Valuation replace

MDT demonstrated a modest 3.7% share value enhance over the past twelve months, and the 52-week vary diverse between $69 and $89. The inventory’s efficiency has lagged behind the broader U.S. market and the Well being Care sector (XLV) over the past 12 months. Searching for Alpha Quant assigns MDT a low “D” valuation grade primarily as a result of huge ahead PEG ratio, however different ratios look enticing. What’s essential is that a lot of the valuation ratios are notably decrease than MDT’s historic averages.

Searching for Alpha

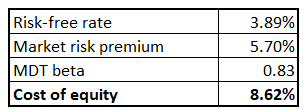

Since MDT is a mixture of a progress and worth inventory, for my part, simulating each the dividend low cost mannequin [DDM] and discounted money stream [DCF] approaches shall be sound for my valuation evaluation. I’ll use an 8.62% low cost fee for each fashions, which was found out utilizing the CAPM strategy under.

Creator’s calculations

MDT has an distinctive dividend consistency, which provides me excessive conviction that consensus dividend estimates are dependable to include into my DDM. That stated, I exploit an FY 2025 $2.74 projection. MDT additionally has a stable dividend progress report, however to be on the secure aspect, I exploit the final three-years’ dividend CAGR of 5.34%. In accordance with my DDM evaluation, the inventory’s honest value is $83.5. That is very near the present share value, which means that MDT is roughly pretty valued.

Creator’s calculations

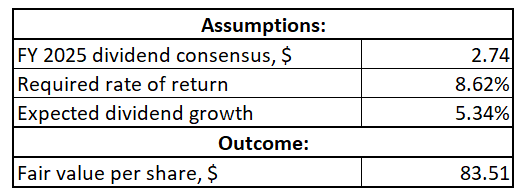

Now I’ll proceed with the DCF simulation. I exploit a 54% income CAGR for the subsequent decade, which appears to be like like a good deceleration in comparison with the final decade’s 7% fee. Furthermore, my projected income progress fee is roughly consistent with the income consensus estimates. I exploit a flat 16.87% FCF margin, which is the TTM stage. To be conservative, I may even deduct from my honest worth calculation the present $18.01 billion internet debt place.

Creator’s calculations

In accordance with my DCF simulation, the enterprise’s honest worth is round $118 billion. That is 10% greater than the present market cap, which means that DCF which means that MDT is attractively valued from the attitude of future money flows.

Dangers replace

The inventory value declined by 17.8% over the past 5 years, which means it was not a sensible choice for buyers who have been in search of capital good points aside from the stable dividend progress. Potential buyers, particularly these focusing on progress, needs to be prepared for “boring” share value dynamics. Alternatively, contemplating the size of the timeframe under, we are able to see that the inventory has been buying and selling in a comparatively slender hall and is presently a lot nearer to the decrease fringe of the vary, which will increase the chance of a rebound to greater ranges within the brief time period.

Searching for Alpha

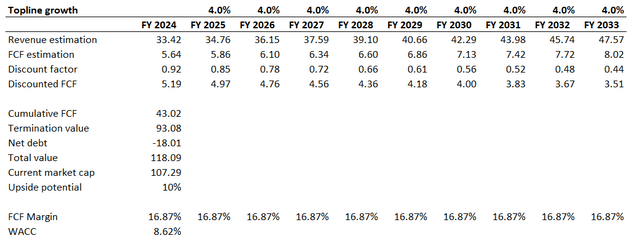

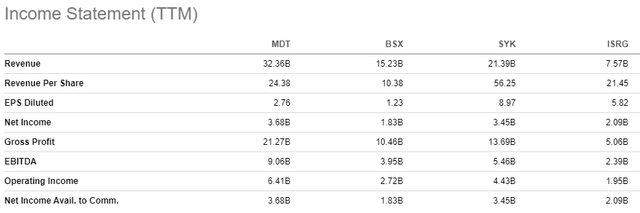

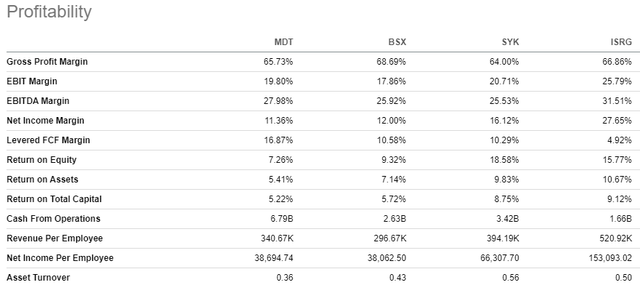

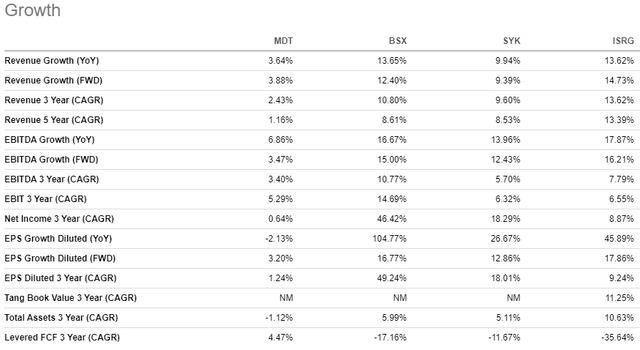

The main enterprise danger that I see is the fierce competitors. There are quite a few rivals within the Well being Care Tools trade, that are roughly of the identical market cap as MDT, which incorporates Boston Scientific Company (BSX), Stryker Company (SYK), and Intuitive Surgical (ISRG). I cannot dig deep into comparisons of choices of every firm as a result of the atmosphere and applied sciences are quickly evolving, and I’d higher look from the attitude of monetary metrics and their dynamics.

Searching for Alpha

Although the market caps of all these corporations will not be very removed from MDT’s, we are able to see that Medtronic is much bigger from the attitude of income. Such an inconsistency between the variations in market cap and income extremely doubtless implies that buyers understand MDT as weaker than friends. Certainly, from the attitude of profitability ratios, I can’t name MDT an undisputed chief because it lags behind rivals throughout some metrics.

Searching for Alpha

Furthermore, MDT demonstrates a way more modest income progress than its friends. Whereas buyers apparently extremely worth progress dynamics and prospects, I don’t suppose it’s a large crimson flag for MDT. First, the corporate remains to be by far the biggest from the attitude of revenues and working money flows generated, which means that MDT generates extra assets to reinvest into enterprise in absolute phrases. Second, the administration’s efficiencies initiatives are working, which we’ve got seen within the monetary evaluation, which implies that MDT will shut the hole when it comes to profitability metrics in comparison with the competitors.

Searching for Alpha

Backside line

To conclude, I consider that MDT remains to be a “Purchase”. Current developments are fairly optimistic and historic share value actions recommend that purchasing this inventory earlier than earnings shouldn’t be very dangerous. Furthermore, the valuation remains to be enticing.