During the last couple of years, the pharmaceutical business has been taken over by glucagon-like peptide-1 (GLP-1) agonists. Even in the event you aren’t conversant in that terminology, I would wager that you simply’re effectively conscious of diabetes and weight problems medicines corresponding to Ozempic, Wegovy, and Mounjaro — that are all GLP-1 medication.

For now, Denmark-based Novo Nordisk (NYSE: NVO) dominates the GLP-1 market, due to its deep roster of remedies together with Ozempic, Wegovy, Rybelsus, and Saxenda. Nevertheless, Novo Nordisk’s chief rival within the weight reduction house should not be slept on.

Eli Lilly (NYSE: LLY), the developer of Mounjaro, has confirmed that it could compete with Novo Nordisk at a excessive stage. Furthermore, the corporate’s sibling therapy to Mounjaro — Zepbound — has gotten off to a scorching begin since its approval final November to help weight reduction. With greater than $1.2 billion in gross sales within the three months resulted in June, Zepbound has already gained the “blockbuster drug” standing given to medicines promoting greater than $1 billion in a yr.

It is nearly sufficient to make one “overlook” about Mounjaro.

Let’s break down how Zepbound helps remodel Lilly and assess what the long-term image may maintain.

Zepbound appears to be like unstoppable

Many instances, when a brand new drug receives approval from the Meals and Drug Administration (FDA), the approval is granted for therapy of just one situation.

For instance, Ozempic is technically solely accredited to deal with diabetes. Nevertheless, losing a few pounds is commonly a byproduct of taking diabetes medicines. However since Ozempic will not be formally accredited for persistent weight administration, Novo Nordisk launched a separate drug referred to as Wegovy aimed particularly at weight problems care. It is essential to notice that Ozempic and Wegovy share the identical main compound, semaglutide.

Eli Lilly has adopted an identical template to that of Novo Nordisk. Mounjaro is Lilly’s response to Ozempic, and is utilized in treating diabetes.

Final yr was Mounjaro’s first full calendar yr in the marketplace. The diabetes treatment introduced in $5.2 billion in annual gross sales for Lilly in 2023, making it the corporate’s second-largest supply of income.

Whereas Mounjaro has little doubt been a monumental success, Lilly was additionally engaged on one thing else within the background. As Novo Nordisk did, Lilly developed another model of its diabetes drug — Zepbound — which is geared toward treating weight problems and likewise shares its important ingredient, tirzepatide, with Mounjaro.

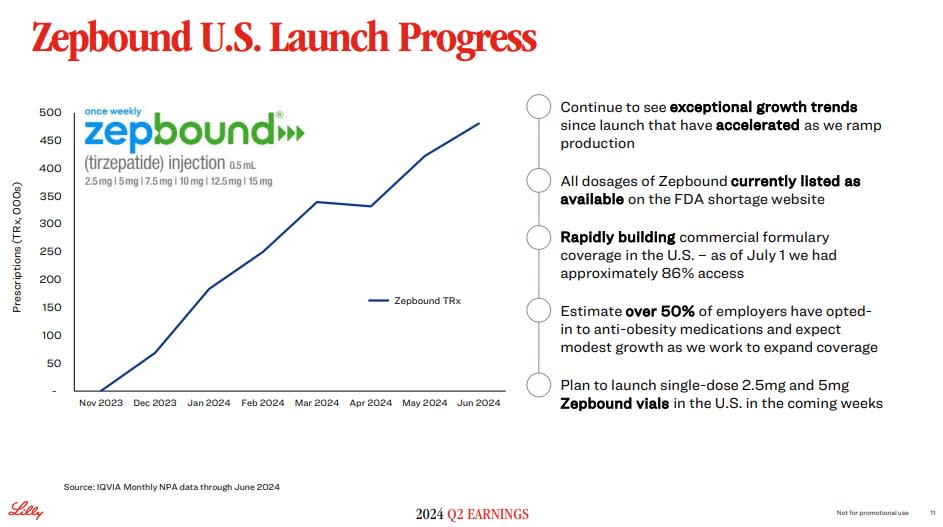

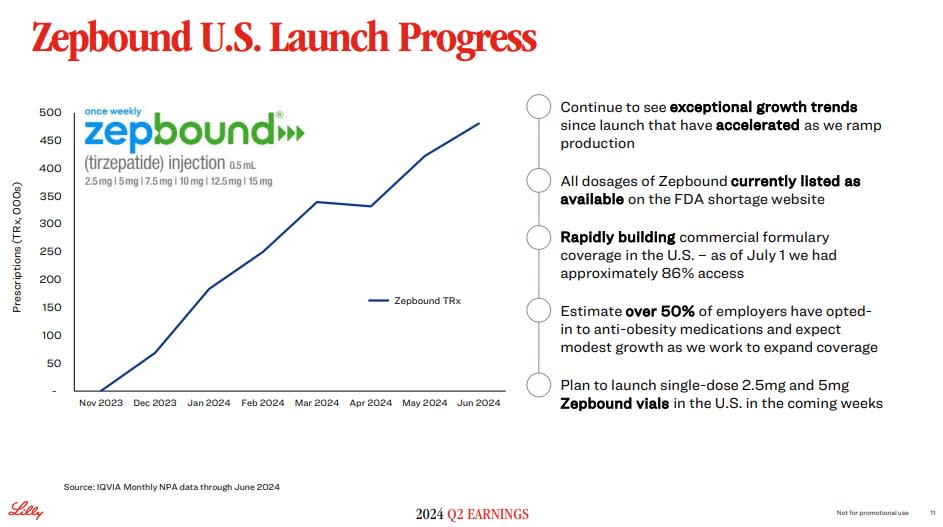

Zepbound obtained FDA approval in November 2023 and has been nothing in need of a smash since its launch:

Throughout the first quarter of 2024, Zepbound generated $517 million in gross sales, placing it at an annual run fee of about $2 billion. However in response to Lilly’s second-quarter earnings report, Zepbound has already demolished its run-rate forecast.

For the quarter ended June 30, Zepbound reported gross sales of $1.2 billion — making it a blockbuster drug with lower than one yr in the marketplace.

The perfect half? The journey appears to be simply getting began.

The journey is simply starting

In keeping with analysis printed by Goldman Sachs, the whole addressable marketplace for weight problems care medicines may attain $100 billion by 2030. As a result of the World Well being Group (WHO) estimates that greater than 1 billion individuals globally reside with weight problems, I am inclined to suppose that estimate could also be conservative.

Contemplating the weight problems care market is fragmented — with Novo Nordisk and Eli Lilly being the 2 main gamers — Lilly’s progress prospects over the subsequent a number of years seem sturdy.

Moreover, Lilly’s administration has made some essential strikes to make sure that provide and demand dynamics do not produce any hiccups. Specifically, Lilly acquired a producing facility from Nexus Prescription drugs earlier this yr to fight any shortages of its weight reduction medication. I believe this was a clever determination and positions Lilly effectively for the longer term.

Is Eli Lilly inventory a purchase?

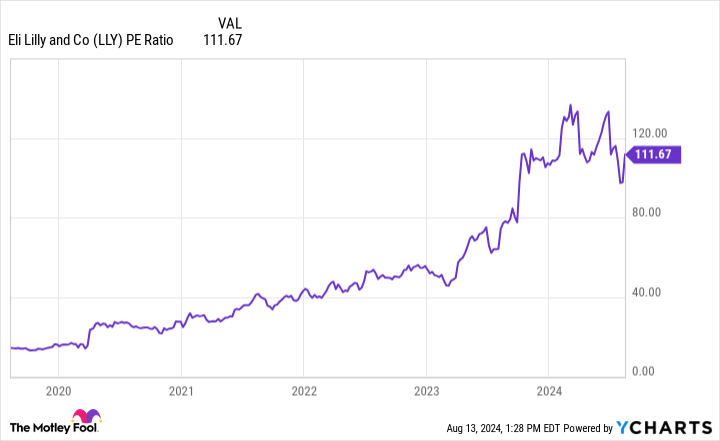

The chart beneath illustrates Lilly’s price-to-earnings (P/E) ratio during the last a number of years. Clearly, Lilly has skilled fairly a little bit of valuation growth, particularly during the last 18 months.

Whereas this may increasingly counsel that Lilly inventory is overvalued, I believe there’s extra to the story. Needless to say the S&P 500 is up over 40% since January 2023. Though Lilly has demonstrated constantly spectacular monetary efficiency, I believe the inventory has doubtless skilled some melt-up exercise due to broader market situations.

On high of that, Lilly just lately obtained approval for a brand new Alzheimer’s illness therapy referred to as donanemab, and it is believable that among the anticipation about donanemab’s approval grew to become priced into the inventory.

Regardless of its dear valuation, I nonetheless see Eli Lilly as a particularly compelling alternative for long-term traders. Each Mounjaro and Zepbound are already blockbuster medication. And with an estimated market dimension of at the least $100 billion and little in the best way of competitors, it is onerous to see Lilly experiencing vital draw back within the weight reduction realm.

Because the diabetes and weight problems care markets proceed to evolve, I believe it could behoove traders with a long-term horizon to think about a place in Eli Lilly.

Must you make investments $1,000 in Eli Lilly proper now?

Before you purchase inventory in Eli Lilly, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Eli Lilly wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Adam Spatacco has positions in Eli Lilly and Novo Nordisk. The Motley Idiot has positions in and recommends Goldman Sachs Group. The Motley Idiot recommends Novo Nordisk. The Motley Idiot has a disclosure coverage.

Overlook Mounjaro: Eli Lilly’s Subsequent Huge Blockbuster Has Arrived was initially printed by The Motley Idiot