Suphanat Khumsap

Introduction

Cheniere Power (NYSE:LNG) has confirmed itself to be a cornerstone of the worldwide power market. As the most important producer of Liquefied Pure Gasoline (“LNG”) in america, and a dominant participant globally, Cheniere is in a robust place to capitalize on the rising demand for LNG.

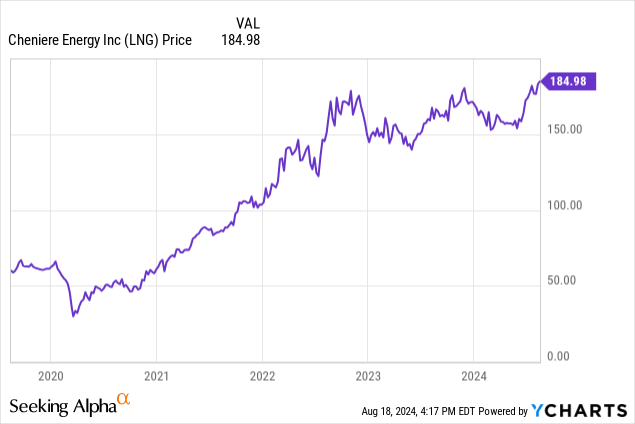

In my earlier article final August, I coated Cheniere’s progress technique to fulfill the rising demand for LNG. Since then, the corporate has continued to ship, with shareholders being rewarded with a 14.15% rise within the share value, contributing to the 208% acquire seen over the previous 5 years.

On this article, I’ll present an replace on Cheniere’s newest developments, analyze its current outcomes, and clarify why I proceed to view it as a robust purchase. Let’s discover the components that make Cheniere Power a lovely funding alternative for the years forward.

International LNG Demand Surge and Cheniere Power’s Strategic Positioning

Demand for LNG is rising internationally. Seen as a transition gas, bridging the divide between coal and renewables, pure fuel demand is about to develop considerably heading into the long run. Nonetheless, pure fuel just isn’t at all times current the place it’s wanted, therefore the necessity for its transportation in pipelines, or in its liquefied type, LNG, on ships. With Russian pipeline imports suspended, Europe noticed LNG imports develop 60% in 2022.

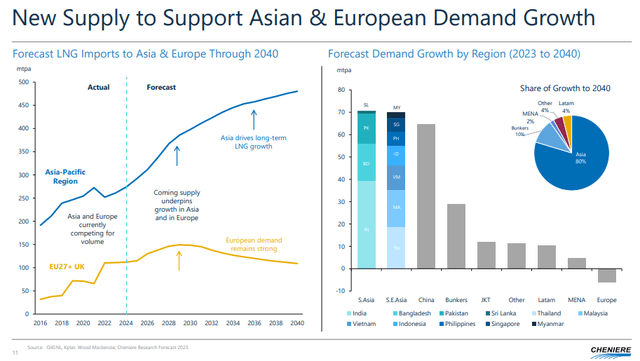

Cheniere Power Q2 2024 Outcomes Presentation

Globally, the demand for LNG is about to virtually double by 2040. Progress although just isn’t coming from Europe because it continues its change to renewables and reduces demand for pure fuel by way of deindustrialization. As a substitute, demand is about to soar throughout Asia because it undertakes its improvement drive, rising industrial manufacturing, and boosting dwelling requirements. Certainly, we will see above that 80% of progress in LNG demand within the interval to 2040 is about to return from Asia. As such, Cheniere Power is well-placed to search out patrons for the LNG it produces, enabling the pure fuel to be transported internationally.

To have the ability to harness LNG, you don’t simply want an exporter like Cheniere Power to have the ability to ship it to you, you additionally want specialist regasification import terminals. I coated this in my earlier article, the place I highlighted:

From 2022 to 2024, the variety of markets with LNG import capability is projected to rise from 46 to 55. This growth entails the event of over 380 megatons of regasification capability internationally.

These new amenities will considerably broaden the worldwide attain of LNG, opening up new markets and growing the demand for Cheniere’s exports.

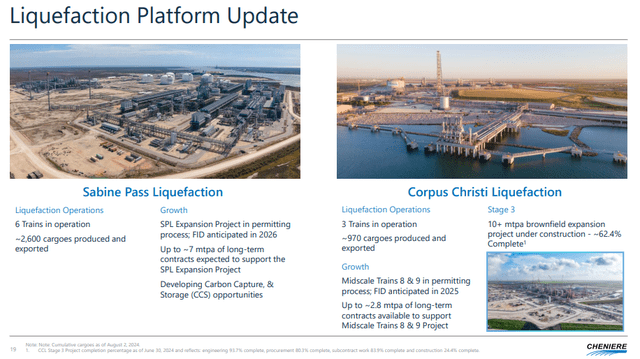

With demand for LNG set to develop, it appears Cheniere Power is in a robust place to fulfill this progress. With the prices of constructing an LNG export terminal extraordinarily excessive, Cheniere’s Corpus Christie challenge value an estimated $15 billion for the primary two levels, limitations to entry are excessive. To fulfill this demand progress, Cheniere Power has growth initiatives at varied levels of improvement throughout its Sabine Cross and Corpus Christi Liquefaction amenities. Throughout these two amenities, the corporate has round 55 mtpa LNG manufacturing capability.

Cheniere Power Q2 2024 Outcomes Presentation

A ten mtpa growth of the Corpus Christi facility is presently underway, with an additional growth within the allowing course of. Additional growth is deliberate at Sabine Cross, pending allowing and a remaining funding resolution.

Underpinning Cheniere’s enterprise mannequin are long-term contracts, offering a secure income base and mitigating publicity to, what could be, unstable spot markets. These long-term contracts usually span a number of a long time, and assist guarantee constant money move and assist derisk potential growth initiatives. Most of those contracts embrace pricing preparations that hyperlink the sale value of LNG to a worldwide fuel benchmark plus a liquefaction charge. The fastened liquefaction charge for the contracted quantity usually must be paid even when the client cancels or suspends supply.

Such is the recognition of those long-term contracts, Cheniere Power is nearly totally booked. Highlighting the significance of those contracts was the CFO of Cheniere Power within the Q2 2024 earnings name:

if we wished to be – we could possibly be 100% contracted even with the mid-scale growth of 8 to 9 and debottlenecking. That is what number of contracts we have now. So we’re in a extremely great spot the place – now with the EA at Corpus for midscale 8 and 9 concentrating on FID subsequent yr as soon as we have now the permits and we will make that totally contracted. And with the contract at Galp and every thing else that we have signed tied to Practice 7 or Practice 8, we have now greater than sufficient to even FID in a few years or so, a primary section of a Sabine growth.

With sturdy demand, long-term contracts, and ongoing growth initiatives, Cheniere Power is in a robust place to proceed capitalizing on the burgeoning demand for LNG.

Q2 Outcomes

On August 8th, Cheniere Power launched its outcomes for the second quarter of 2024. Revenues got here in at $3.25 billion, lacking expectations by $300 million, and down 20.7% year-on-year. This lower was extensively anticipated, with weaker pricing for LNG in the course of the quarter. Whole EBITDA got here in at $1.32 billion, down from $1.86 billion a yr earlier, reflecting the weaker marketplace for LNG. This lower in income and earnings was additionally mirrored in distributable free money move that fell 48% to $700 million

These falls in earnings had been resulting from a mixture of decrease LNG costs and fewer high-margin cargoes bought at spot costs in comparison with final yr. The corporate’s LNG export volumes had been barely larger at 553 TBtu, up from 536 TBtu in Q2 2023, indicating secure operational efficiency regardless of market headwinds.

Regardless of the difficult quarter, Cheniere raised its full-year 2024 steerage for Consolidated Adjusted EBITDA to a variety of $5.7 billion to $6.1 billion, up from the earlier $5.5 billion to $6.0 billion. This displays improved manufacturing forecasts for the second half of the yr, in addition to profitable portfolio optimization actions. The corporate additionally adjusted its DCF steerage upward to a variety of $3.1 billion to $3.5 billion, demonstrating confidence in its capacity to generate sturdy money move regardless of the weaker marketplace for LNG.

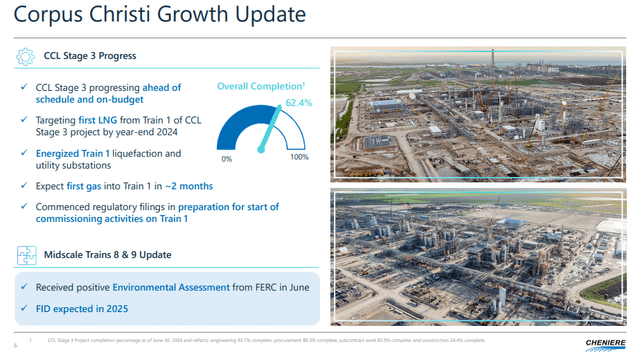

Cheniere continues to make progress on its progress initiatives, with the Corpus Christi Stage 3 growth reaching 62.4% completion as of June 30, 2024. That is forward of schedule and administration highlighted the challenge was on-budget. The primary LNG from Practice 1 of this growth is anticipated by year-end. When full, it will add over 10 mtpa to its manufacturing capability, serving to to fulfill the forecast progress in demand for LNG.

Cheniere Power Q2 2024 Outcomes Presentation

Administration additionally highlighted their plans to proceed returning capital to shareholders, with a rise within the share repurchase authority by $4 billion by means of 2027, with a goal to scale back the share rely from 227 million to 200 million shares. In addition they plan to lift the Q3 2024 dividend by 15% to $2.00 per share annualized.

General, this was one other stable quarter for Cheniere Power. Though outcomes had been weaker than final yr, this was anticipated resulting from weaker LNG costs. The corporate’s long-term prospects stay optimistic, with progress initiatives on observe. With a lift to the dividend and share buybacks, these outcomes underlined Cheniere’s dedication to shareholder returns.

Valuation

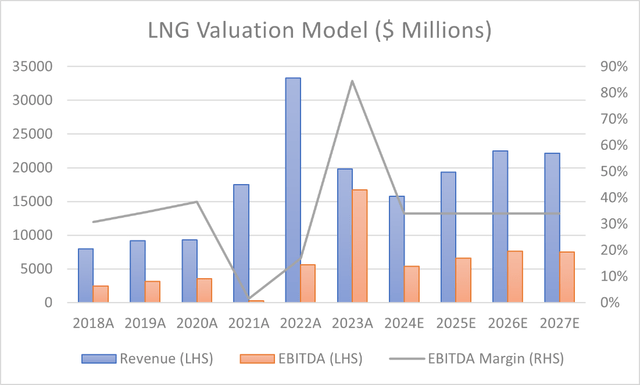

To worth Cheniere Power, I employed an EV/EBITDA valuation methodology for the interval to 2027. For future income, I used analyst estimates on Searching for Alpha, given their complete business perception and information of market traits. I assumed Cheniere Power would proceed to scale back its debt load by $1.25 billion yearly, to succeed in $22.7 billion on the finish of 2027. For functions of simplicity, I assumed money ranges would stay fixed.

Based mostly on the corporate’s EBITDA margin over the previous six years, I predict it to stay secure at round 34%.

Created and calculated by the writer primarily based on Cheniere’s Monetary Knowledge discovered on Searching for Alpha and the writer’s projections

To find out an exit a number of, I made a decision to make use of the corporate’s five-year common EV/EBITDA a number of of 10.21. This was chosen because it considers historic valuation traits, and by counting on a multi-year common, this a number of accounts for fluctuations in market sentiment and avoids the potential distortions of short-term volatility or outlier years.

I assume the corporate reduces its share rely from its present 227 million to 200 million in 2027. That is in keeping with the corporate’s goal highlighted at its 2024 capital allocation presentation, and the graduation of an extra $4 billion buyback within the interval to 2027.

Performing the calculations signifies a market cap of $56.6 billion on the finish of 2027. With an estimated 200 million shares excellent, this interprets to a goal value of $283 a share, an upside of 53% from the present share value, for a CAGR of 13.7% over the following 40 months.

Dangers

As with every firm, Cheniere Power has a number of dangers which will affect its future efficiency. I coated what I believed to be the important thing dangers in my earlier article, however I consider you will need to revisit the important thing factors and broaden on different dangers the corporate might face.

Given Cheniere’s operations are on the coast, its operations stay weak to climate disruptions, particularly hurricanes coming off the Gulf Coast. Giant hurricanes threat a shutdown and will doubtlessly result in harm to the LNG export facility, elevating vital prices for the corporate.

Secondly, though Cheniere advantages from long-term contracts that assist present income stability, its earnings from spot market gross sales could be affected by value swings, which may affect profitability. With demand progress into the long run wanting optimistic, within the short-term there’s a threat of potential oversupply as a number of giant LNG amenities come on-line globally, doubtlessly saturating the market and decreasing costs. This threat is partly mitigated by long-term contracts, however at renewal this may occasionally end in decrease costs, and in addition cut back potential income from Cheniere’s new amenities.

Lastly, geopolitical threat. With LNG traded globally, its outlook is deeply intertwined with world geopolitics. Whether or not this be commerce insurance policies, sanctions, or battle, these might all affect Cheniere’s operations and the value of LNG. Geopolitical threat is not only a problem in far-off jurisdictions. Within the US, the Biden administration tried to pause the issuance of recent export licenses for LNG terminals. This has now been blocked by a federal choose.

Conclusion

Cheniere Power presents a compelling long-term funding alternative. With over 90% of Cheniere’s manufacturing coated by long-term contractual agreements extending years into the long run, the corporate advantages from a safe and predictable income stream, serving to guarantee constant profitability. With demand for LNG solely set to rise, Cheniere is properly positioned as a key participant to capitalize on this rising market, driving income and revenue progress.

With sturdy earnings potential and strong free money move driving shareholder returns by means of share buybacks and dividends, Cheniere is well-positioned to proceed delivering sturdy returns properly into the long run, making it a robust purchase.