PM Photographs

Written by Nick Ackerman, co-produced by Stanford Chemist.

abrdn International Infrastructure Revenue Fund (NYSE:ASGI) has been persevering with to carry out fairly nicely since our final replace. The low cost narrowing primarily based on a brand new managed distribution coverage, which noticed the payout improve, is among the predominant catalysts to drive that low cost narrower. Nevertheless, a rotation extra into defensive sectors has additionally meant the underlying portfolio efficiency of this closed-end fund (“CEF”) has additionally been working nicely.

Immediately, the fund stays buying and selling at a gorgeous low cost—even when it is not fairly as extensive because it was beforehand. It is a non-leveraged fund as nicely, so this is usually a comparatively extra conservative funding selection general in comparison with a few of its CEF infrastructure friends.

Saba Capital Administration, a closed-end fund activist, owns an ~11.5% stake on this fund. That would have prodded the fund to extend its distribution, or could lead to some potential different actions sooner or later.

ASGI Fundamentals

- 1-12 months Z-score: 1.68

- Low cost/Premium: -8.31%

- Distribution Yield: 12.95%

- Expense Ratio: 2.05%

- Leverage: N/A

- Managed Property: $509.425 million

- Construction: Time period (anticipated liquidation date round July 28, 2035).

ASGI’s funding goal is “to hunt to offer a excessive stage of complete return with an emphasis on present earnings.”

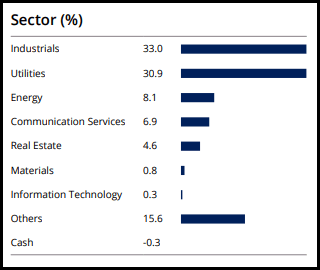

To realize this goal, the funding technique is primary. They may “spend money on a portfolio of income-producing private and non-private infrastructure fairness investments from around the globe.” The biggest publicity for this fund stays industrials, because it has tended to be for fairly some time with this fund. Alternatively, utilities nonetheless make up a significant portion of this fund’s portfolio as nicely.

The fund is not essentially the most important fund by way of complete managed belongings, but it surely ought to, in some unspecified time in the future, get a bit bigger. That would assist present higher day by day buying and selling quantity to extend the liquidity of the fund. This might come from Macquarie/First Belief International Infrastructure/Utilities Dividend & Revenue Fund (MFD) being merged into ASGI. That may assist herald roughly $75 million in web belongings as of this writing.

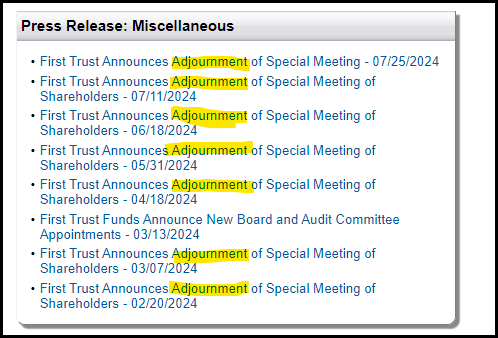

Nevertheless, that is proving tough to finish as MFD is a somewhat tiny fund, and it may be difficult to get shareholders to vote and approve these types of offers—that’s, even when the shareholders could be higher off being merged into ASGI. They’ve needed to adjourn the assembly a complete of seven occasions to this point to permit for extra time to get sufficient shareholders to vote for its approval.

MFD Press Releases (First Belief)

Low cost Narrows With One other Managed Distribution Coverage Change

We final lined ASGI in early April, together with the BlackRock Utilities, Infrastructure & Energy Alternatives Belief (BUI). I consider that each of those funds have been enticing decisions to contemplate as we entered into an surroundings the place we have been more likely to see price cuts. That mentioned, these are each non-leveraged funds, so that they may very well be thought of comparatively conservative in comparison with their leveraged infrastructure CEF friends. They could not take part in as a lot upside and have that double tailwind of decrease borrowing prices, however ought to issues go sideways, they need to additionally have the ability to maintain up comparatively higher as nicely.

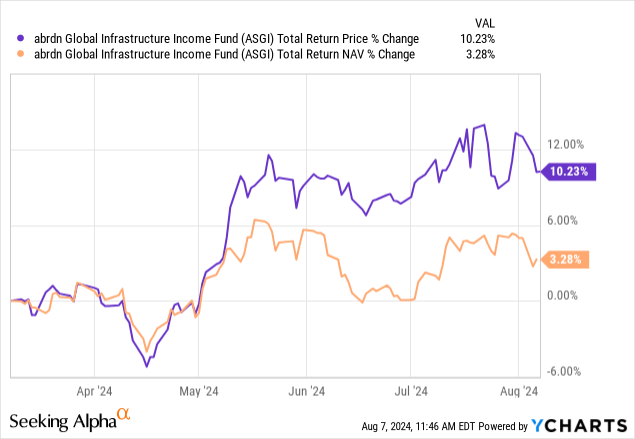

With all that being mentioned, since that final replace, ASGI has carried out extremely nicely. Nevertheless, it took some time because the fund moved largely sideways within the first quarter of the 12 months earlier than seeing a greater efficiency via the second half.

Ycharts

One of many predominant causes was the elevated distribution price that the fund was paying. That acquired income-focused buyers excited and pushed that low cost to slim. So it wasn’t solely the underlying portfolio efficiency, but it surely was helped out by that low cost closing as nicely.

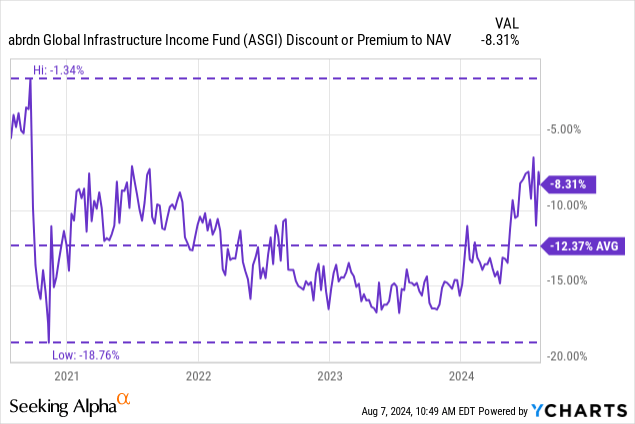

Ycharts

Immediately, the fund’s low cost continues to be interesting although it’s buying and selling increased than its longer-term common due to the change within the distribution coverage. With the next managed distribution coverage, buyers are more likely to proceed to bid shares to round at the least these ranges, for my part.

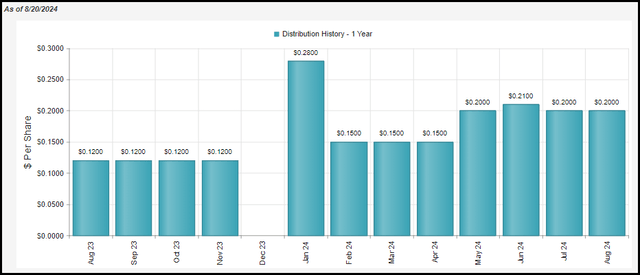

The managed distribution coverage was bumped up in the beginning of the 12 months to a rolling 9% of NAV payout. This was then elevated to a 12% stage with an announcement in Might. This coverage makes it in order that the payout can range from month to month, however so long as this coverage is in place, it ensures a comparatively excessive distribution will probably be paid to buyers. At present, due to a nonetheless sizeable low cost, the fund’s distribution price involves 12.95%.

ASGI 1-12 months Distribution Historical past (CEFConnect)

After all, simply because a fund will pay what it’d like doesn’t imply it’s truly being earned. I consider that it will be tough for them to realize the 9% distribution coverage beforehand over the long run, and meaning a 12% coverage I might be much more skeptical about.

Keep in mind, it is not solely the 12% they need to earn but additionally the fund’s complete working bills of two.05% (1.65% excluding deferred tax bills) on high of that. To be extra particular, the entire working bills would truly be 2.10% and not using a waiver at the moment. That payment waiver got here as the results of a previous merger with one other Macquarie infrastructure fund, however is just in place for twelve months following the closing of the reorganization. That closed on March 10, 2023, which was simply in time for this newest semi-annual report to finish on March 31, 2024. So, we must always anticipate that the entire expense ratio will now be increased.

Anyway, I consider infrastructure is a really enticing place to contemplate placing capital to work in the present day; the speed of return required would possibly even be hit over the subsequent 12 months or two as charges ease.

Nevertheless, it’s in the long term that I consider, with out an adjustment, the place they might discover themselves having a tough time hitting that 13%+ return year-after-year—which is the extent required to not see NAV erosion or a gradual downward development of the month-to-month distribution.

Alternatively, since it’s adjusted every month, the NAV erosion will be restricted. They could additionally change the coverage sooner or later at any time.

Additionally it is vital to contemplate, although, that even when they can not assist these forms of returns or want to regulate the distribution decrease, I nonetheless consider that the longer-term efficiency might nonetheless be greater than cheap. As an instance they’ll return 8-10% complete returns over the long term; that might imply, technically, they don’t seem to be hitting their present managed distribution coverage stage however nonetheless offering respectable outcomes.

To cowl the distribution, the fund would require important capital good points. Nevertheless, that is not not like too many different equity-focused closed-end funds in the marketplace—even in comparison with fairness infrastructure CEF friends, all of them require important capital good points to fund their payouts.

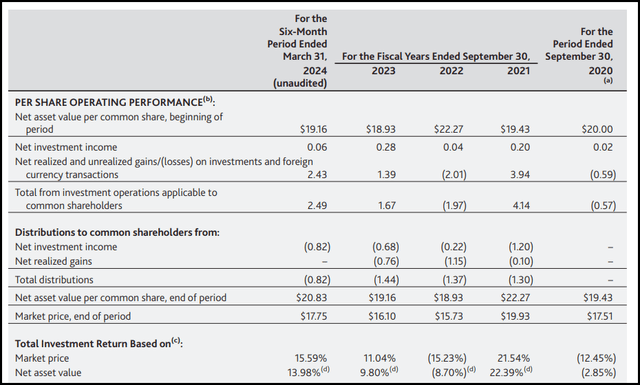

ASGI Monetary Metrics (abrdn)

As of their final semi-annual report, web funding earnings protection primarily based on what was a decrease distribution coverage got here to only 7.3%. With a now increased distribution coverage, we will see that the fund has been paying out ~$0.20 per 30 days, which $0.06 earned in a six-month interval would not even cowl barely 1 / 4 of 1 month-to-month distribution.

ASGI’s Portfolio

ASGI is an infrastructure CEF, for my part, but it surely does include a extra distinctive tilt of overweighting industrial publicity. This has been the case for the reason that fund launched, and I started following it. In actual fact, we have seen a little bit of a rise within the industrial allocation since our earlier replace, the place industrial was at 30.9% weighting, and utilities have been at 32.1%. So we have seen industrials now simply edge out utilities for the highest spot.

ASGI Sector Weightings (abrdn)

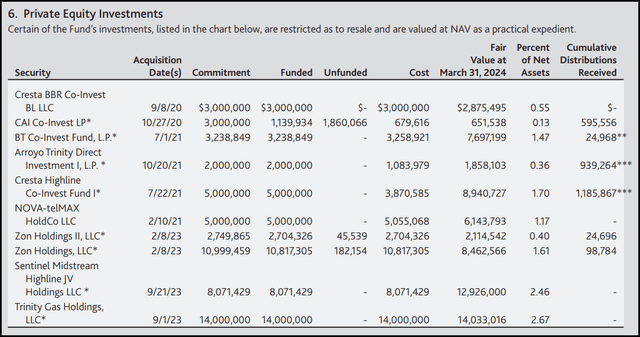

That weighting offsets it from its friends a bit, however this fund additionally comes with a reasonably sizeable allocation to personal investments as nicely. This accounted for 15.5% of the fund’s belongings as of their final semi-annual report.

ASGI Non-public Investments (abrdn)

Generally, non-public investments can add a little bit of uncertainty to the low cost {that a} fund is buying and selling at. It’s because the precise underlying honest worth may very well be suspect as these aren’t securities that commerce on an trade, the place honest worth will be discovered instantly and precisely (i.e., one thing is price and will be offered for what it’s at the moment buying and selling on an trade for.) With non-public investments, it takes a little bit of guesswork.

That mentioned, ASGI appears to be one of many higher funds that will get up to date info pretty recurrently. At the very least from a 12 months in the past, the honest worth of all these investments has shifted—which makes me consider that the low cost on this fund is a little more dependable. I’ve seen one other fund sponsor on one in every of their funds go nicely over a 12 months and not using a change in what that they had honest values listed at (although they appeared to appropriate that with their more moderen reporting materials.)

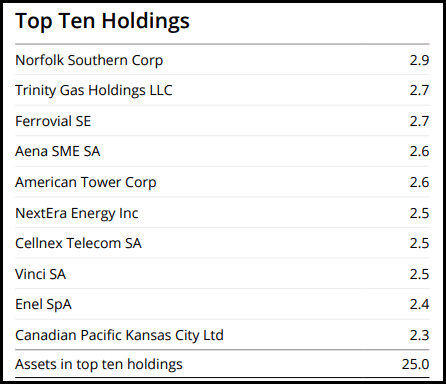

One among their newer non-public investments is Trinity Fuel Holdings, which truly makes its means on the record of its high ten holdings within the newest reality sheet.

ASGI Prime Ten Holdings (abrdn)

The biggest holding within the fund, Norfolk Southern Company (NSC), was a portfolio place beforehand, but it surely has seen its weight climb increased to take the highest spot. Beforehand, it was Vinci SA (OTCPK:VCISY) that took that place, which stays a high place, but it surely has slipped by way of proportion weighting.

Conclusion

ASGI has seen its low cost slim meaningfully since our final replace, which helped present a strong complete share value return. Nevertheless, its underlying portfolio has additionally been performing nicely, in order that wasn’t the only real driver of the efficiency. The fund nonetheless trades at a sizeable low cost, and I consider, mixed with a robust outlook for infrastructure to proceed to carry out nicely, this makes ASGI an inexpensive place to place some capital to work.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.