Jonathan Kitchen/DigitalVision through Getty Photographs

Funding Thesis

Cybersecurity firm SentinelOne, Inc. (NYSE:S) is slated to announce their Q2 FY25 earnings subsequent week on Tuesday, August twenty seventh, after markets shut.

The corporate’s outcomes will come a day earlier than its bigger peer, CrowdStrike Holdings, Inc. (CRWD), studies essentially the most anticipated earnings report of this earnings season on August twenty eighth, the place trade watchers and markets will intently comply with updates & commentary from CrowdStrike’s administration following their international outage final month.

SentinelOne’s Q2 earnings report will probably be crucial for the corporate to show if the Mountain View, CA-headquartered firm has grabbed the chance from CrowdStrike’s outage and received a few of its clients over.

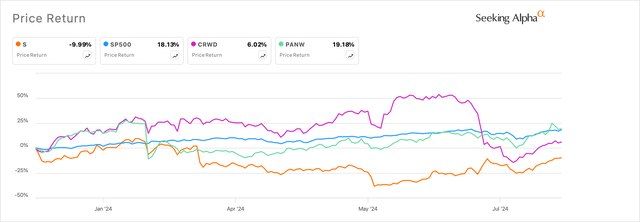

This will probably be essential for SentinelOne inventory, which nonetheless lags the market and a few of its friends for the 12 months.

Exhibit A: SentinelOne lags behind the market and a few of its friends for the 12 months. (In search of Alpha)

I imagine SentinelOne trades discounted to its friends and to the market because it heads into earnings subsequent week, main me to reiterate my Purchase score on the corporate.

Q2 Preview: Watch the tape on SentinelOne’s ARR

I have lined SentinelOne a few occasions this 12 months already, the place I beneficial shopping for the inventory because of its sturdy progress momentum regardless of peer pressures.

SentinelOne operates in two main end-user markets, XDR (Prolonged Detection & Response) in addition to SIEM (Safety Data and Occasion Administration), which can be utilized by enterprise SOCs (Safety Operations Facilities). Each of those end-user markets are extremely aggressive, with giant gamers akin to CrowdStrike, Palo Alto Networks, Inc. (PANW), Microsoft Company (MSFT), and many others. competing for a share of the markets. However SentinelOne considers CrowdStrike its largest and most formidable competitor because of the giant overlap within the XDR market.

Actually, SentinelOne’s administration used the current CrowdStrike outage as a chance to elucidate how SentinelOne differentiates from CrowdStrike when it comes to the structure of its product platform in addition to the broad-based options its whole cybersecurity product platform gives. The corporate has been pushing its Singularity platform, which encompasses cybersecurity choices throughout endpoint safety and CNAPP (Cloud-Native Software Safety Platform), an rising cybersecurity end-user market.

The expansion from SentinelOne’s Singularity platform is vital for long-term progress. That is very true since I had famous in my earlier protection that the general XDR market, whereas nonetheless necessary, is maturing and cybersecurity distributors are rising areas akin to SIEM and CNAPP for future progress.

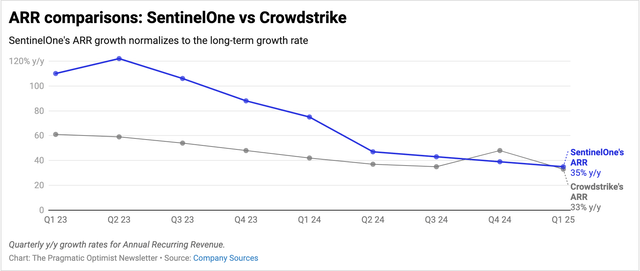

In SentinelOne’s case, progress could be seen in its ARR, which is rising at a decent 35% y/y based mostly on its final earnings report. Alternatively, its peer CrowdStrike can also be reporting a progress tempo that’s normalizing to 33% y/y progress after a small blip of sequential progress it noticed within the earlier quarter.

Exhibit B: SentinelOne’s ARR is normalizing its tempo of progress however rising quicker than its peer CrowdStrike. (Firm filings)

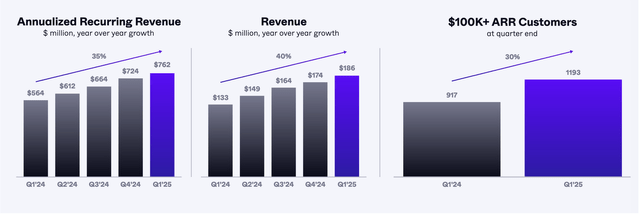

The million-dollar query for administration to reply is: Can SentinelOne proceed to report sturdy double-digit progress of their ARR, particularly if the tempo of that progress outpaces CrowdStrike? The ARR progress tempo will even assist markets consider SentinelOne’s income tempo and its market penetration within the three end-user cybersecurity markets I discussed earlier. At present, SentinelOne is clocking a ~40% progress tempo in its whole gross sales.

Exhibit C: SentinelOne’s progress metrics per the Q1 FY25 Shareholder letter. (Firm sources)

Throughout the previous quarter, the corporate has deepened its rising relationship with Alphabet Inc.’s (GOOG) Mandiant, with SentinelOne now turning into the “strategic endpoint vendor” of Mandiant’s cybersecurity companies. That is after SentinelOne partnered with Mandiant to offer Risk Intelligence capabilities to Mandiant’s clients. As a part of the partnership, Mandiant’s clients get entry to SentinelOne’s Singularity Platform.

Plus, SentinelOne is including extra capabilities to its Singularity Platform by including Managed Detection response, along with the CNAPP capabilities, its autonomous SOC AI agent, PurpleAI, and Knowledge Safety companies which can be already accessible on the Singularity Platform. The geographic availability of Singularity in Europe must also be a lift to SentinelOne’s progress.

Whereas watching the ARR and income progress, what can also be of paramount significance is monitoring the corporate’s NRR (dollar-based Internet Retention Price) which stays in an expansionary state as present clients spend incremental safety price range {dollars} on SentinelOne’s merchandise. Thus far, the corporate says their NRR is “north of 110%” based mostly on their feedback from the final earnings name.

Can SentinelOne Put up a Shock EPS Shock?

Whereas SentinelOne has been rising at a sturdy tempo, I imagine markets would count on administration to show extra working leverage by the again half of the 12 months. That may be seen in market expectations of the corporate’s EPS, the place consensus estimates peg the corporate to breakeven this quarter whereas guiding for its first cent of EPS within the Q3 FY25 quarter.

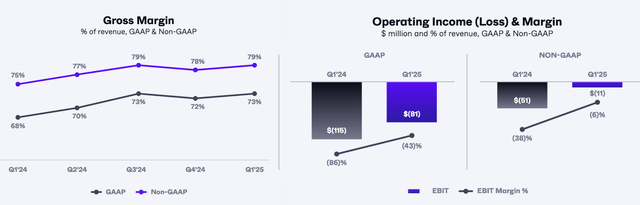

The corporate has demonstrated good progress on reaching breakeven in some unspecified time in the future this 12 months, with working margins contracting by far much less on an adjusted foundation, as famous in Exhibit D beneath.

Exhibit D: SentinelOne’s margin profile per its Q1 FY25 report (Firm sources)

The corporate remains to be guiding its working margins to remain within the adverse territory of -6% in Q2 whereas being between -6% and -2% for the complete 12 months. If the corporate’s progress prospects drastically enhance on the upside, there’s scope for the corporate is being conservative, and SentinelOne breaks even between Q2 and This fall this 12 months.

Valuation Reveals SentinelOne Trades Discounted Earlier than Earnings

Markets count on SentinelOne to develop its revenues at a 30% CAGR between 2023 and 2025, or FY24 and FY26. That’s marginally increased than the 27% CAGR that CrowdStrike is projected to develop at. Word that the market’s expectations of SentinelOne are largely consistent with my prior expectations of midterm progress that I had estimated in my earlier analysis of the corporate. This means markets should not but pricing in any potential upside from the CrowdStrike outage.

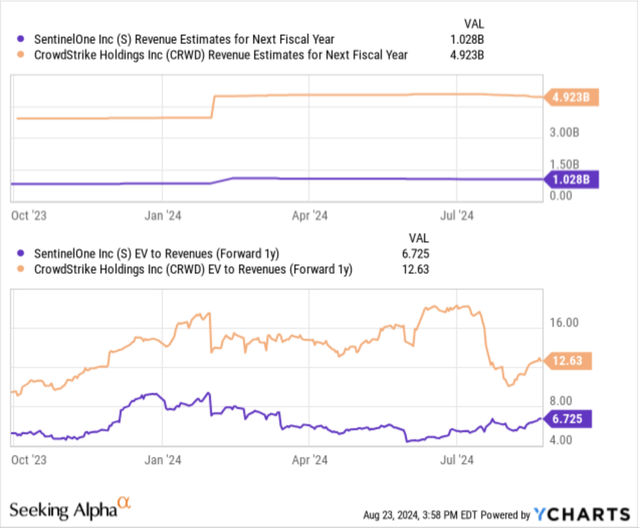

Exhibit E: SentinelOne versus CrowdStrike EV/revenues valuation (YCharts)

Nevertheless, when evaluating the EV/revenues ahead for FY26, I see that SentinelOne is valued at half the premium that CrowdStrike is valued at, with SentinelOne’s ahead EV/revenues at 6.7x versus CrowdStrike’s ahead EV/revenues of 12.6x. This means that there’s large upside in SentinelOne, however I believe some melancholy in premiums because of the extremely aggressive atmosphere of SentinelOne’s goal market and, extra importantly, the power of SentinelOne to show working leverage.

One other method to fairly consider SentinelOne is to match its ~30% progress tempo by subsequent 12 months with the ~5.5% progress tempo projected for the S&P 500 over the identical interval. This means a ahead gross sales a number of of 10-11x for SentinelOne, which, per my estimates, values SentinelOne at ~$32 per share, implying a 25-30% upside from present ranges.

3 Issues To Look For In SentinelOne’s Q2 Earnings

Q2 Estimates: Markets will probably be anticipating SentinelOne to interrupt even on its earnings on a per-share foundation. Revenues are anticipated to decelerate sequentially to 32% progress, with whole gross sales value $197-198 million in Q2, barely above administration’s personal Q2 steering of $197 million.

Q3 and FY24 Steering: Consensus estimates put SentinelOne to information its first quarterly EPS revenue of 1 cent per share for Q3 on revenues totaling ~$210 million, rising ~28% y/y. For the 12 months, markets count on SentinelOne to information its first full 12 months of constructive earnings per share progress of 4 cents per share on revenues of $814 million, rising 31% y/y. The market’s income expectations are marginally elevated, provided that administration was nonetheless guiding a couple of 4% working loss on an adjusted foundation on revenues value $808-815 million for the complete 12 months. This means markets are optimistic about administration elevating its full-year steering, particularly on the earnings entrance, so buyers ought to brace for volatility if administration’s steering disappoints markets.

Commentary on aggressive pressures: Since SentinelOne operates in a extremely aggressive market with outstanding friends akin to CrowdStrike, Microsoft, and many others., as I discussed earlier, I will probably be curious to see if SentinelOne’s current product positioning in direction of their Singularity platform is boosting the corporate’s progress prospects. This can turn into particularly necessary to see, in my view, since CrowdStrike’s outage might present some aid from theoretical peer stress. Any hints from SentinelOne’s administration about the advantages of the outage will propel the inventory ahead.

As well as, buyers should look ahead to CrowdStrike’s earnings report the day after SentinelOne studies on August twenty seventh subsequent week.

Takeaway

I imagine SentinelOne is priced at a beautiful valuation earlier than its earnings. Markets look like impartial in direction of any potential upside SentinelOne might have had following CrowdStrike’s outage occasion final month. Any indication from SentinelOne’s administration about aggressive advantages will enhance the outlook for SentinelOne, with markets viewing this identify as a winner from the outage fiasco.

SentinelOne trades at a compelling gross sales a number of earlier than earnings, and I reiterate my Purchase score on this identify.