marchmeena29

Annaly Capital Administration, Inc. (NYSE:NLY) is a mortgage actual property funding belief (“mREIT”) that primarily invests in company mortgage-backed securities, and different mortgage-related paper. Given the present financial surroundings, and the growing chance that the Federal Reserve will quickly provoke a collection of rate of interest cuts, Annaly’s leveraged company MBS portfolio ought to be anticipated to carry out nicely in coming quarters. Whereas definitely a riskier funding than holding company MBSs or Treasuries with out the usage of leverage, Annaly ought to comply with their efficiency. I consider Annaly is prone to transfer larger because the Federal Reserve initiates its price lower cycle, which is prone to start subsequent month.

Annaly Capital’s major enterprise mannequin is to accumulate mortgage-backed securities to both maintain them till maturity, or when referred to as by the issuer. Annaly additionally intends to seize an rate of interest unfold, or margin, between the payout on these securities and their borrowing prices. The efficiency of mREITs is very correlated to rate of interest fluctuations, in addition to there being an affordable rate of interest unfold off of which to revenue. When rates of interest rise, the worth of current mortgage-backed securities will usually decline, and when rates of interest decline, the worth of those securities ought to enhance.

Annaly gives a excessive dividend yield by holding a leveraged portfolio of mortgage-backed securities. This has usually made Annaly a lovely funding to income-oriented traders. This attraction was possible lessened over the previous few years, as its portfolio’s worth declined together with most bond valuations, and extra compelling yields got here to market.

Now, it seems more and more possible that rates of interest will start to say no once more, and doubtlessly at an accelerated tempo. That is dependent upon many elements, together with broad market efficiency, the state of the economic system and geopolitical danger, however the most definitely driving pressure seems to be a possible discount of borrowing charges by the Federal Reserve. If this occurs, the worth of Annaly Capital’s mortgage-backed securities ought to enhance.

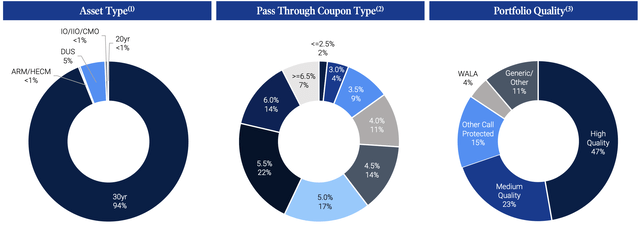

On the finish of the second quarter of 2024, Annaly’s company portfolio consisted of $66 billion in belongings. In Annaly’s Q2 2024 investor presentation, it famous that the corporate “continued to rotate the portfolio into larger coupon high-quality specified swimming pools,” and that “60% of the portfolio was in 5.0% coupons and better, barely larger than the prior quarter[.]” Annaly additionally maintained a conservative period place with a 98% hedge ratio that was targeted on changing maturing swaps with Treasury futures.

Annaly’s Company Portfolio Statistics (NLY’s Q2 2024 Investor Presentation)

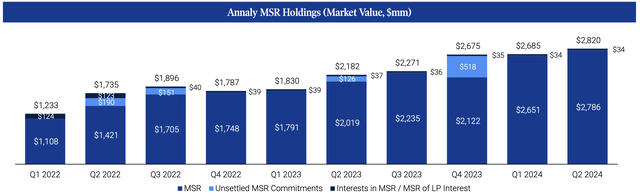

Annaly additionally has a residential credit score portfolio that was price about $5.9 billion on the finish of Q2, 2024. This was a lower of about 4 p.c in comparison with Q1 2024. Annaly’s mortgage servicing rights (or MSR) portfolio was price about $2.8 billion on the finish of Q2 2024, which was a rise of about 5 p.c in comparison with Q1 2024 and about 29% year-over-year. These enterprise segments are additionally prone to profit from decrease rates of interest, as a discount in charges is prone to enhance market exercise and help current mortgage paper valuations together with the worth of the underlying actual property.

Annaly’s MSR holdings information (NLY’s Q2 2024 Investor Presentation)

Annaly’s Q2 2024 earnings press launch included commentary that:

“Regardless of modest widening in Company MBS spreads, Annaly produced a constructive financial return within the second quarter, supported by our diversified capital allocation, balanced hedge portfolio and accountable leverage place. Notably, Annaly generated a 5.7% financial return year-to-date, demonstrating the energy of our housing finance mannequin,” remarked David Finkelstein, Annaly’s Chief Govt Officer and Chief Funding Officer. “Through the quarter, we opportunistically added to our Company MBS portfolio given enticing unfold ranges, whereas we proceed to increase our complementary Residential Credit score and MSR platforms.

“We’re inspired by current inflation information and signaling from the Federal Reserve, which counsel a near-term price lower is more and more possible. As rate of interest volatility seems poised to reasonable and extra dovish financial coverage is on the horizon, we stay well- positioned for additional development given our substantial liquidity, prudent leverage and nimble capital construction.”

Technical Evaluation

Annaly’s shares have been in a reasonably tight buying and selling vary for many of 2024. They have been additionally at roughly the identical valuation all through the primary three quarters of 2023, and seem to have reached a capitulatory backside together with bonds within the fourth quarter of final 12 months.

Annaly weekly candlestick chart (Finviz.com with crimson strains by Zvi Bar)

Within the more moderen weeks, NLY shares have remained pretty rangebound even if yields have been constantly declining. These declining yields ought to lead to larger valuations upon Annaly’s portfolio. The tight vary inside which NLY shares have remained caught signifies a fairly sturdy potential for shares to understand within the subsequent few weeks, and particularly if a price lower cycle begins in September.

NLY shares have really been slowly trending larger because the spring, and making a collection of barely larger highs, in addition to larger lows, however each inside a reasonably tight vary. Shares at the moment are principally in the midst of NLY’s tight buying and selling vary, and likewise sitting simply above the inventory’s 50-day easy shifting common. From right here, it seems possible that shares will quickly take a look at the highest of this buying and selling vary and doubtlessly break larger upon the beginning of a price lower cycle.

Annaly each day candlestick chart (Finviz.com)

On condition that the Federal Reserve basically acknowledged that the speed lower cycle is prone to start in September, it’s moderately possible that NLY shares will admire upfront of the formal announcement that’s anticipated to happen on September 18th. Additional, it’s possible that analysts will start to boost their value estimates for Annaly after that prevalence.

Annaly’s leveraged holdings are prone to considerably profit from the speed cuts, and never solely from portfolio appreciation, but in addition as a result of decreased price of borrowing that ought to happen. A big establishment like Annaly has the capability to borrow at among the many lowest charges obtainable out there, and a price lower cycle is probably going to offer them with larger margins by lowering their prices. Additional, an elevated likelihood of extra forthcoming price cuts ought to decrease the danger related to the leverage utilized by Annaly. These decrease charges also needs to make Annaly’s comparatively larger yield extra compelling as an funding.

Dangers

Will increase to rates of interest would negatively affect Annaly’s portfolio valuation, in addition to its dividend payout. The clearest danger to Annaly’s portfolio is that of spiking rates of interest. Rising charges have a damaging impact upon the worth of mortgage-backed securities, and hedging in opposition to accelerated adjustments to rates of interest is commonly tough.

There may be additionally a danger of default on Annaly’s underlying mortgage loans. This danger is primarily borne by the a part of its portfolio with out an company backing, in addition to the servicing enterprise generally. Nonetheless, the danger might prolong to company MBSs in occasions of political uncertainty and grandstanding. In spite of everything, company paper has an implied assure, however not an specific assure as is the case with Treasuries.

It’s also possible that a few of the firm’s company debt holdings shall be referred to as by the federal government companies that issued it. In contrast to Treasuries, company debt could also be referred to as again for early redemption, and better yielding debt is extra prone to get referred to as as charges decline. If such debt have been acquired under 100, it could lead to a capital achieve, however any such debt acquired above issuing worth would lead to a capital loss upon prepayment.

Annaly has an extended historical past of issuing secondary choices. This can be a widespread monetary maneuver for mREITs in an effort to boost capital. Such a secondary providing is mostly dilutive and prone to trigger a lower in share valuation to or under the providing value.

Conclusion

Annaly’s core enterprise of holding a leveraged portfolio of company mortgage-backed securities is prone to profit from a price chopping cycle. Annaly’s ancillary enterprise strains ought to equally profit from decreased charges, and the help they would offer to actual property and mortgage associated companies. Additional, a discount to the risk-free price supplied by Treasuries ought to present a profit to revenue options like Annaly. On condition that the Federal Reserve simply indicated that the time has come for it to start chopping charges, it seems of accelerating chance that Annaly ought to reprice larger as its portfolio beneficial properties worth, and its dividend turns into extra enticing to traders.