alengo

It is no secret the business Micron (NASDAQ:MU) operates in, and its inventory would not at all times line up. In actual fact, I’ve outlined intimately earlier than how the inventory peaks prematurely of the enterprise fundamentals and bottoms forward of the reminiscence atmosphere bottoming. Each the inventory and the business require fixed evaluation as a result of this business strikes shortly. One quarter to the subsequent can be a shock when it comes to steerage and the state of the DRAM and NAND business. And so, with the enterprise clearly now trending in the suitable route, how does one make sense of Micron’s “lagging” chart? Effectively, the readability I get by analyzing the enterprise whereas concurrently analyzing its chart could put some items of the puzzle collectively for you.

Lots of you’ve adopted me through the years understanding I cowl all issues tech, however now I’ve a delicate spot for semiconductors, notably Micron. I’ve referred to as the turns in Micron’s enterprise and chart through the years, with this previous backside in late 2022 my most correct. You would possibly marvel how – was it a fluke, or had been there indicators each essentially and chart-wise? The reply is sure, it is each, and it isn’t one with out the opposite, however the chart aspect has introduced me an edge. With Micron hitting new highs over the previous couple of months and since pulling again almost 45% on the depth of the selloff in early August, it makes one ponder whether the chart’s peak is already in, even when the basics have but to even take off.

This text solutions that query.

A Examine On The Fundamentals

I will begin by reviewing the enterprise and reminiscence market fundamentals, as any weak spot right here can result in hesitant traders. Nobody needs to be caught using the reminiscence cycle down on the backend.

The All Necessary Bits Shipped

On this regard, not a lot has modified within the final two quarters. Nonetheless, there’s been a slight shift within the outlook for near-term bit shipments. In the event you’ve learn me for any size of time, you may know bit shipments are one of many greatest keys to understanding the reminiscence cycle – the place it bottoms, the place it tops, and the way it progresses. So after I hear a change in steerage for bit shipments, my ears perk up.

What I anticipated to be a low-key, hum-drum analyst convention earlier this month offered a slight shift in steerage relating to bit shipments.

The underside line is, administration guided for a “strengthening” of bit shipments for the November quarter on the FQ3 name just a few months in the past.

We forecast cargo progress to strengthen modestly within the November quarter.

– Mark Murphy, CFO, Micron’s FQ3 ’24 Earnings Name

Nonetheless, on the KeyBanc analyst convention the place Micron offered about three weeks in the past, the tune modified barely from modestly strengthening to flat for the FQ1 November quarter. That additionally follows steerage for FQ4 to be flat. So, as an alternative of 1 flat quarter, it is now two flat quarters lined up.

We forecast bit shipments to be flat sequential within the November quarter, for each DRAM and NAND.

– Mark Murphy, CFO, KeyBanc Capital Markets Know-how Management Discussion board (minute 4:39)

The KeyBanc analyst adopted up as a result of it caught his consideration. The CFO’s reply to his query revolved round pricing and the way it’s nonetheless transferring up, so the corporate is strolling away from offers. After all, no deal means no bits shipped. Certainly, this is not the one scenario, and Micron is making many good-priced offers this fiscal yr, because the earnings report can attest to. Nonetheless, the lingering snub of consumers unwilling to just accept greater costs says one thing in regards to the finish market they’re part of.

Now, that is each not vital and vital on the identical time.

It is not vital as a result of guiding two quarters out on bit shipments has a lot much less visibility. Subsequently, I do not maintain them to one thing six months out with a information like that. There is a margin of error for utilizing “modestly,” as used on this explicit information.

However why is it vital nonetheless?

One thing administration wasn’t anticipating modified in that very same visibility, sufficient to shift the information to one thing decrease whereas nonetheless being within the quarter earlier than it. It is also vital as a result of the choice is in administration’s palms to take or depart the value negotiated now, because it has taken pricing management again from prospects at this a part of the cycle as a result of power and trajectory of reminiscence pricing. Subsequently, strolling away from offers permits for it to have stock to promote later at higher pricing.

Nonetheless, pricing higher maintain up for an additional quarter or two past these walkaways to get the value it is in search of – in any other case, this can be a vital threat (I will get to cost shortly). If pricing would not, it did not promote what it may have, and now it owns that stock at doubtless greater manufacturing prices.

So, is one thing like this sufficient to sway the cycle?

No, not precisely.

If it is a one-off information remoted to 1 / 4, there’s nothing to be involved about apart from minor changes to income estimates for FQ1. Nonetheless, if the flat bit shipments proceed, the implications are the market is weaker than administration has let on. Even then, although, flat shouldn’t be horrible. As pricing continues to climb, the flat bits every quarter are making extra per bit, so income and gross margins proceed to climb.

However, like I mentioned at the start of this text, bit shipments inform the story, and pricing, because it does, lags the market’s true colours. I am not saying the reminiscence market has peaked, nor has administration, however you do not need to hear a string of flat bit shipped quarters, higher pricing or not, at this stage of the cycle. So, an FQ2 information (February quarter) of flat bits would make me uneasy.

Pricing Holding Up Its Finish Of The Deal

Exterior of quantity (bits shipped), the value per bit is the opposite vital issue driving the financials. This space hasn’t had a lot let up since pricing started firming in FQ1 ’24. As excessive bandwidth reminiscence – HBM – has taken over the scene, many legacy fab strains have been transformed to dedicating a little bit of provide to HBM3e.

As a result of complexity concerned, it takes 3 times as many bits to provide the equal HBM as mainstream DRAM. This results in structurally much less provide in different finish markets akin to PC, cell, and industrial. Thus, as an alternative of bit progress by way of node transitions, as has been the case during the last a number of years, provide is reducing total. Now, whilst indicators of PC and cell apparently present weakening, in line with one analyst home, these aren’t as impactful as provide is shrinking as quick or quicker to maintain the provision demand stability in Micron’s favor.

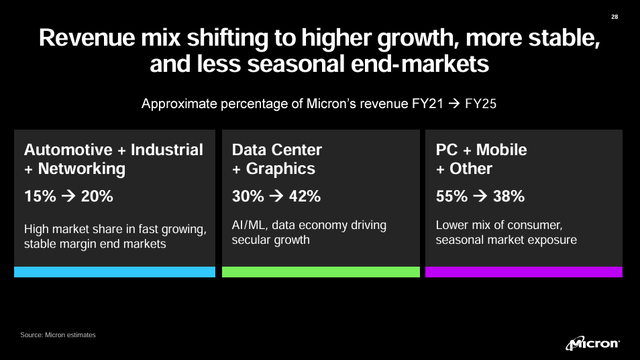

However greater than that, even when there’s momentary weakening in some areas like shopper and enterprise PC and cell, not solely is the content material in every growing, however its impact on the DRAM enterprise as a complete has considerably decreased through the years. In 2022, the corporate anticipated PC, cell, and “different” to turn out to be lower than 38% of total income (together with NAND).

Micron’s Investor Day 2022 Presentation

Contemplating the speedy onset of AI in late 2022 and early 2023, HBM and its investments had been pulled in and sure reached these income targets forward of the FY25 goal. I anticipate PC and cell to make up lower than 38% at this level and thus haven’t got the identical affect as maybe implied by analyst headlines. In actual fact, the results of no matter weakening is going on in these finish markets is probably going the slight shift in a little bit of steerage I outlined earlier. If that is all of the impact this sector weak spot has on it, I would say there’s loads of buffer within the income combine to offset it. Furthermore, pricing is anticipated to proceed climbing into 2025, in line with Micron’s administration and outdoors analyst homes like Trendforce.

Total, whereas there are ebbs and flows in particular finish markets, the general outlook stays fairly sturdy. Nonetheless, it may very well be stronger if not for strolling away from offers (as in, if prospects had been amenable to Micron’s greater pricing). The danger is these offers by no means come again round as a result of the reminiscence provide and worth atmosphere deteriorate earlier than getting there. In that case, the corporate is caught with the next value of products stock and no consumers.

However we’re not there but to be contemplating that. It is only a tail threat for now.

Total, there’s nonetheless sufficient pricing strain and resiliency in high-growth markets like servers and AI to beat perceived weak spot in different areas, already identified to be lagging behind the remainder of the reminiscence market.

Matching It To The Chart

Now, let’s take a look at how the reminiscence cycle is aligning with the inventory’s cycle.

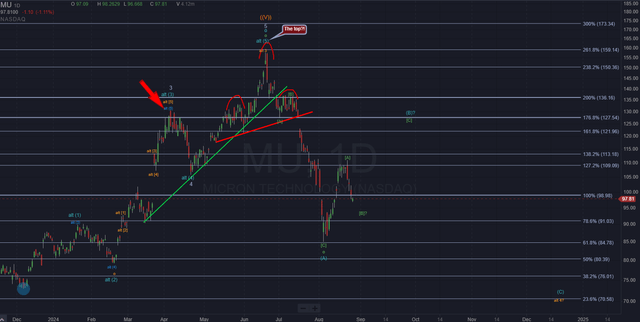

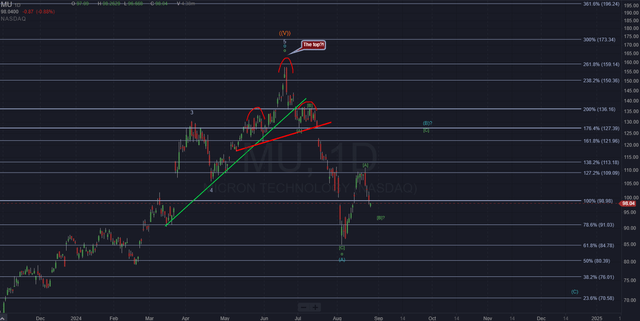

A number of months again, I used to be monitoring what I anticipated to be a high in a 3rd wave on Micron’s chart. I used to be anticipating a pullback much like the one we’re seeing now earlier than one closing rally into all-time highs. Nonetheless, as this decline continued deeper, I needed to shift my evaluation to contemplate the highest was already in at $157.

Permit me to provide the high-level view.

In April (pink arrow), I initially thought of this the tip of wave alt [5] of alt (3) of alt 3. Subsequently, I used to be anticipating waves alt (4) and alt (5) of alt 3 to result in a high close to $155. From there, a comparatively shallow retrace in alt 4 would give method to the next excessive close to $170 in alt 5.

Writer’s chart

Nonetheless, that is not the way it performed out. And truthfully, it was pretty clear it wasn’t going again then (judging in hindsight). And that is due to the Fib ranges.

See, the Fib ranges of this complete rally from December 2022 (proper the place I referred to as the underside) level to wave 3 topping at simply over the 176.4% stage, a typical extension for third waves. It is at this level when the chart was saying, “That is all of the wave 3 you are going to get.” Then, as soon as the corrective construction of wave 4 developed and reached slightly below the 127.2% extension (usually, I see it go to the 100% extension), it was apparent it was preparing for wave 5. And so it did, reaching above the everyday 200% extension and placing in extra time for nearly the 261.8% extension.

Here is a cleaner model of the chart displaying simply that:

Writer’s chart

Subsequently, that prime is almost definitely the highest for this cycle (sure, I hear you).

This brings us to this very deep selloff and bounce we’re experiencing now.

As a result of depth of this selloff, this seems to be a correction of a better diploma, and subsequently, I am anticipating nonetheless decrease lows to come back. Presently, the inventory is working wave (B) of this correction. Ought to we get a typical wave C inside wave (B), I anticipate a bounce to round $125- $128 over the subsequent few weeks. However from there, wave (C) is lurking, which may simply carry the inventory to $70 over the weeks and months following the completion of (B). Sure, whilst the basics look fairly good. The timing seems suspiciously aligned with an earnings report catalyst for that wave (C) drop, so maybe there’s some worse information than I’ve already analyzed on this article.

This implies I will trim my MU holdings extra as this wave (B) approaches its goal. After it completes, there is a threat of almost 45% draw back.

Reconciling The Two

So that you would possibly marvel how on earth Micron might be $70 when its EPS progress is thru the roof. Effectively, fundamentals and sentiment (what chart evaluation susses out) do not should align at occasions. And when that (C) wave completes, it could simply be finishing a bigger A wave. Which means a B wave rally may ensue for all of 2025, giving the impression it is rallying alongside the monetary progress and fundamentals. Now, B waves do not usually exceed the prior excessive, however they’ll. So we may see a typical retracement again to the $125-$140 space or perhaps a poke above the prior $157 highs earlier than a big C wave takes over, and we see even additional lows than what I’ve outlined right this moment.

Micron traders, lend me your ears: Do not be married to the inventory, and do not be caught (once more, for many people) up using the downcycle. The reminiscence business’s downcycle would not align with the chart; it by no means has. Simply because it seems to be tremendous early this time would not change that reality. I am taking off extra threat as this bounce completes, and can doubtless hedge the remainder of the place with places as soon as the C wave begins someday within the coming months.