Erik Isakson

The Thesis

As anticipated earlier in my final article, Vertiv Holdings (NYSE: NYSE:VRT) topline continued its sturdy development into the second quarter of 2024 as order development stays sturdy. I’m anticipating this to proceed additional in 2024 because of a wholesome demand setting throughout the all of the areas in each the commercial and industrial finish markets and powerful elevated backlog ranges. The corporate can also be well-positioned to profit from a tailwind within the information heart finish market and its vital publicity in it, which together with its numerous product portfolio and capability enlargement initiative to cope with rising demand for cooling applied sciences ought to drive the corporate’s gross sales development within the coming years. Margins additionally look good with quantity development sooner or later, which together with continued concentrate on operational enhancements ought to drive margin development additional past 2024. The inventory is presently buying and selling at a premium to its historic ranges, however the outlook stays sturdy making me stick to a purchase score on the present ranges.

Final Quarter Efficiency

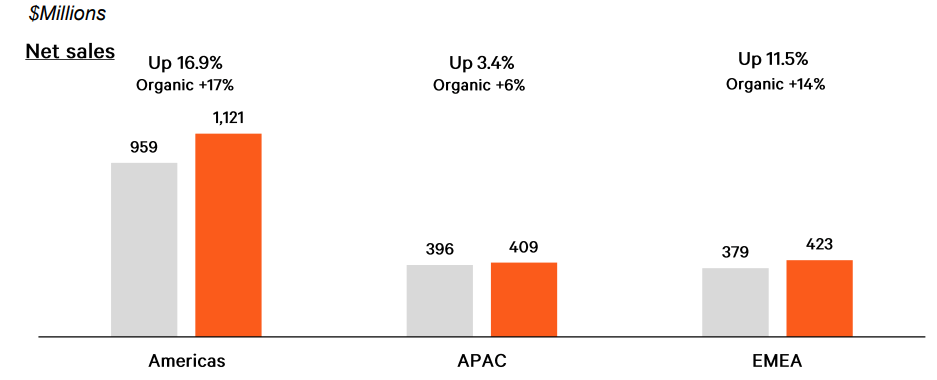

VRT exited the primary half of 2024 with one other sturdy quarter, reporting roughly 14% natural topline line development versus the prior 12 months’s second quarter. This continued development was primarily a results of constant sturdy efficiency within the Americas area, which grew 17% over the past quarter as order development stays sturdy adopted by continued AI scaling, notably on this area. APAC area additionally continued its mid-single-digit development after a nasty 2023, because it grew 6% organically in the course of the quarter regardless of a slowdown in China, because of sturdy development in India and the remainder of Asia. Speaking in regards to the EMEA area, it delivered double-digit topline development for the second consecutive quarter because of wholesome development within the firm’s modular options within the area.

VRT Q2 2024 information (Firm presentation)

Sturdy topline efficiency can also be mirrored within the firm’s margin efficiency as VRT’s adjusted working margin jumped by 510 bps 12 months on 12 months to a file 19.6% in the course of the second quarter of 2024, simply 40 bps in need of its long-term goal. This was primarily pushed by larger quantity and advantages from value value and productiveness good points in the course of the quarter. Whereas America’s margin climbed probably the most, by 540 bps to 25.4%, EMEA reported the very best margin at 25.9% in the course of the quarter with the assistance of sturdy quantity development and operational advantages. The Backside-line efficiency was additionally good with a year-on-year improve in adjusted EPS to $0.67, beating the consensus estimates by $0.10 in the course of the quarter.

Outlook

VRT began 2024 at a slower tempo with topline development in mid-single digits within the first quarter, nevertheless, the second quarter was sturdy because of a major leap within the Americas gross sales over the past quarter. In my final bullish article on VRT, I anticipated the corporate to report its topline development within the excessive single-digit regardless of sturdy order development and backlog, because of more durable comparisons from the 2023 quarter. Nonetheless, VRT exceeded my expectations because of sturdy efficiency primarily in America. I stay optimistic in regards to the firm’s prime line because the market exercise stays wholesome throughout all of the areas in each industrial and industrial finish markets. The Americas area is benefiting from continued sturdy momentum within the hyper-scale (giant Knowledge Facilities operated by large tech corporations)and co-location market (renting house in these giant Knowledge Facilities to small corporations), whereas, the EMEA area is growing the usage of modular options amongst its prospects to speed up information heart capability enlargement. In my view, these tailwinds together with file backlog ranges and elevated pipeline velocity ought to drive the corporate’s gross sales additional in 2024.

VRT is seeing a continued acceleration of infrastructure constructed out in hyper-scale and colo markets because of growing demand for AI-driven applied sciences like high-density and liquid-cooled chips. This development is seen within the Americas, EMEA, and Asia together with favorable indicators in co-location and cloud sectors in China. Infrastructure spending can also be taking place throughout the area indicating a wholesome market setting primarily for information facilities. The great factor is that roughly 75% of VRT finish market publicity consists of knowledge facilities, which ought to profit the corporate’s enterprise within the coming years. Along with this, In my opinion, the corporate’s vital publicity within the information heart market ought to act as a aggressive benefit because of VRT’s full options starting from energy and funky to service information facilities.

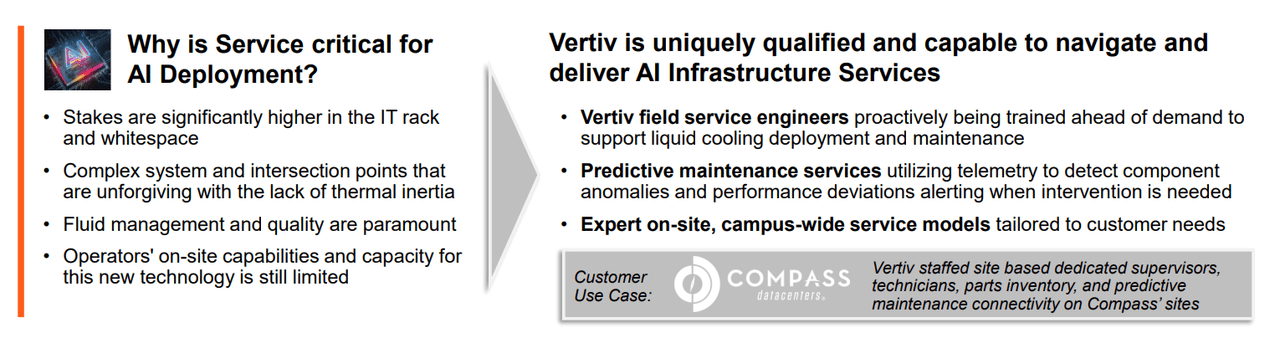

Whereas the corporate’s focus is especially on the liquid cooling a part of the market, it additionally has a complete portfolio other than cooling tech, which incorporates, direct-to-chip, immersion, in-row-CDUs, and in-rack CDUs. The corporate additionally has a whole portfolio of know-how options prepared for deployment with a powerful community of regionally accessible area service engineers globally, which must also profit the corporate’s gross sales via enhanced buyer expertise in the long term.

VRT service capabilities (Firm presentation)

Vertiv can also be considerably increasing its manufacturing capability primarily for its modular, liquid cooling, and thermal administration applied sciences and is on monitor to realize 45x development within the liquid cooling manufacturing capability by the tip of 2024 versus the prior 12 months. As AI is scaling in North America, the necessity for liquid cooling is rising for next-generation chips and is anticipated to proceed rising additional. This aggressive enlargement aligns with the corporate’s demand projections, which together with the capital expenditure forecast of $175 million to $200 million ought to assist the corporate meet the anticipated rise in demand sooner or later, benefiting the corporate’s gross sales within the coming years.

General, I stay assured in regards to the firm demand outlook in 2024 because the demand setting stays wholesome throughout all of the areas leading to sturdy order development. The long term alternatively ought to profit from scaling AI and the rising want for AI infrastructure primarily within the Americas area, which together with VRT’s sturdy market place and a complete product portfolio ought to drive the corporate’s top-line development within the coming years.

Valuation

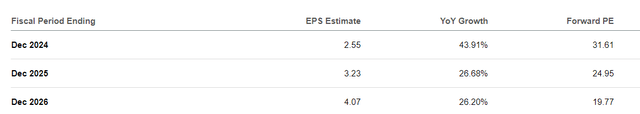

Since my final bullish article on VRT in July, the inventory is down roughly 9% and reaching $79.92, nevertheless, continues to be up over 70% YTD. At present, the corporate’s inventory is buying and selling at a Non-GAAP ahead P/E ratio of 31.61 primarily based on FY2024 EPS estimates of $2.55. Whereas in contrast with its five-year common P/E ratio of twenty-two.9, the inventory nonetheless appears at a premium, nevertheless, the latest inventory correction has cooled down the inventory valuation a bit making the valuation higher, contemplating the sturdy development prospects within the coming quarters.

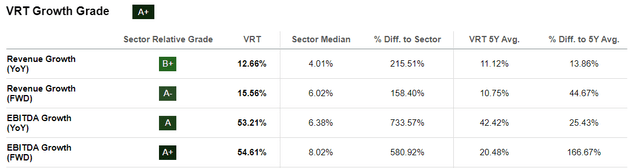

VRT Development Grade (Searching for Alpha)

I’m anticipating the corporate’s prime line to proceed its constant development additional in 2024 because the order exercise stays wholesome and pipeline velocity will increase. Backlog ranges additionally stay sturdy which ought to drive quantity development within the coming quarter resulting in top-line development in 2024. The quantity improve ought to assist the corporate’s margin, which together with the corporate’s concentrate on operational execution and advantages from productiveness good points ought to drive the corporate’s margin in 2024.

Consensus EPS estimates (Searching for Alpha)

As we will see within the VRT development desk above, its EBITDA has grown at a mean of roughly 42% prior to now 5 years, versus the common income development of 10.75%. This has resulted in a major leap within the firm’s margin in the previous few quarters reaching a file excessive of 19.6% over the past quarter from simply 5.9% in the identical quarter two years in the past. This has helped within the valuation enchancment of the corporate as the underside line expanded with elevated profitability. As we mentioned, the corporate’s margin ought to proceed to develop sooner or later, the underside line must also proceed to develop because the market can also be anticipating, additional resulting in valuation enhancement within the quarters forward.

Threat

Much like my final article on VRT, the inventory premium valuation is justified provided that it continues to ship sturdy topline and margin development going ahead to make the valuation higher. Nonetheless, if the corporate could not maintain its margin development within the coming quarters, its backside line is perhaps impacted probably resulting in deteriorated valuation and poor inventory efficiency sooner or later.

Conclusion

As mentioned above, the corporate’s inventory is down 9% since my final article, and presently buying and selling larger than its historic common. VRT topline is anticipated to proceed its sturdy momentum going forward within the close to time period as the tip market demand stays good. This could ship sturdy quantity development, which together with the corporate’s continued concentrate on operational enhancements ought to drive margin development in 2024. Whereas the inventory nonetheless seems to be at a better valuation, promising longer-term prospects nonetheless make it a good BUY.