As a local Texan, I by no means thought that I might declare Oklahoma the winner over us in virtually something. However that point has lastly come. New short-term rental traders want to listen to about this market, and it breaks my coronary heart that it’s simply north of the Texas border.

Discovering the perfect marketplace for new short-term rental traders has confirmed extra daunting in recent times. Rates of interest and insurance coverage premiums are rising, and competitors is rising because of the sheer provide within the short-term market. There was even a rumor of an Airbnb bust, however that will have simply been for the hosts considering Grandma’s previous home was the proper short-term rental.

Everyone knows the heavy hitters for STR markets: The Smokies, Joshua Tree, Whitefish, and so on. These markets additionally include heavy value tags that push out most new traders. What if I advised you there are nonetheless areas that may usher in practically as a lot revenue for half of the start-up prices?

The Market Finder

I prefer to make the most of just a few instruments when researching these new markets which can be much less standard however might hit my potential “purchase field”: The BiggerPockets Market Finder and using particular STR knowledge (e.g., AirDNA, Pricelabs).

These markets will not be in your yard (not obligatory however useful for newbies), however when run correctly, you may see vital returns in your funding. Brief-term leases sometimes have the greatest money stream however require extra work for good motive: Extra money, extra issues.

Your techniques, groups, and tech stacks have to be in place to succeed even with only one rental. The core workforce (agent, lender, cleaner, handyperson, inspector, and so on.) shall be invaluable in your funding areas. Programs to assist automate your leases, similar to cleansing and operations (e.g., Turno, Breezeway), property administration software program (e.g., Hospitable), advertising and marketing, and extra, will enable your STR to thrive with out being on name 24/7. All of us dread the considered two company displaying up concurrently since you double-booked your rental.

I’ve been looking the southern area of the U.S. (sorry, Northeast; I am not constructed for the chilly) for my subsequent funding, and I’ve been backwards and forwards between Oklahoma and Arkansas. Anytime I enter a possible market to construct distinctive experiences, I like to make use of my 60/30/10 rule as one a part of my determination (amongst many elements):

- 60 minutes from a significant metropolis (no less than 500,000 residents)

- half-hour from a nationwide, regional, or state attraction

- 10 minutes from some sort of civilization (fuel station at a minimal, however hoping for a Greenback Normal as a place to begin)

How Did I Nominate Lawton?

Whereas Lawton might not have the best appreciation fee or be close to some main nationwide parks that others worth extremely, it has some incredible metrics that may work for traders at a decrease entry value level:

- You’re close to main, rising feeder cities (Dallas/Fort Value and Oklahoma Metropolis).

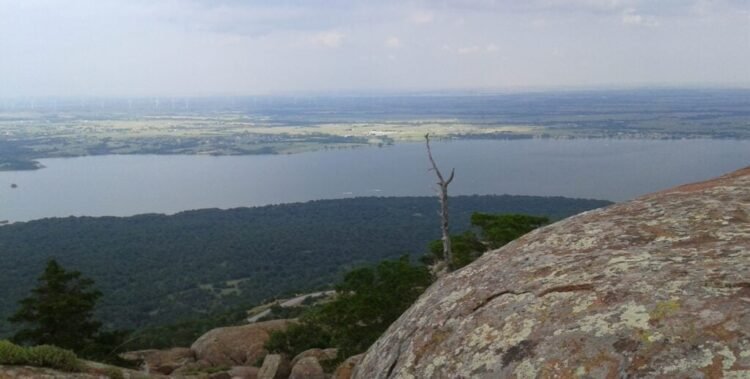

- You’re close to main regional points of interest (three state parks, Mt. Scott, casinos, and extra).

- The median value is $135,069. Sure, you learn that accurately.

- You could have an amazing backup plan for mid- and long-term rental (Fort Sill Military facility, Goodyear Tires, and Oklahoma Nationwide Guard close by).

| Median house value | $135,609 |

| Median rental revenue | $1,081 |

| YoY house progress worth | 4.11% |

| YoY lease progress | 3.80% |

| Lease-to-price ratio | 0.80% |

| Inhabitants | 127,314 |

Once I began my analysis, I used to be not even conscious of Lawton exactly, and I’m certain most of you weren’t, both. Market Finder lists 25 expertly curated areas displaying lots of the vital metrics traders search.

After crunching some numbers and consuming an excessive amount of espresso, I went by way of completely different ZIP codes I used to be focusing on for short-term leases and realized one thing: Nothing in comparison with Lawton.

As a short-term rental investor, I take this info and pinpoint what would deliver company to the market. The sheer variety of feeder cities, regional points of interest, and lack of properties that dominate the market have my gears spinning.

AirDNA listed the Greatest Trip Rental Markets within the Subsequent 5 Years, and their winners are primarily based on the inhabitants and revenue progress of main cities close by. Additionally they combed by way of critiques on Airbnb to see what cities had been talked about probably the most as locations individuals traveled from (I don’t know how they did that, however I’m impressed).

Lawton is a major candidate to profit from these main feeder cities’ inhabitants progress over the following 5 years.

| Feeder Metropolis | Inhabitants 2023 | Inhabitants Progress Over 5 Years | Distance |

|---|---|---|---|

| Better Dallas/Fort Value | 7.76 million | 7.3% | 166 miles |

| Better Houston | 7.36 million | 8% | 427 miles |

| Better Austin | 2.72 million | 10.1% | 354 miles |

| Better Oklahoma Metropolis | 1.41 million | 5.1% | 86 miles |

Damaged Bow vs. Lawton

Damaged Bow, Oklahoma, has been one of many hottest STR markets for the previous two to 3 years, however these two have some main obtrusive variations.

In response to Realtor.com, the median itemizing house value for Damaged Bow is a staggering $695,000, whereas Lawton’s sat at $165,000. This means a Lawton mortgage with in the present day’s rates of interest may price you round $1,278, and Damaged Bow may very well be $4,669. Chances are you’ll not have $100,000+ prepared for a down cost, however $15,000+ is one thing possible for the newer investor to try for.

Let’s evaluate knowledge on related 3-4 bed room and 2-3 toilet leases in these markets.

| Class | Lawton | Damaged Bow |

|---|---|---|

| Common income potential | $46.1K | $107.2K |

| Common nightly fee | $224.1 | $530.2 |

| Occupancy fee | 55% | 41% |

| Occupancy fee progress | 11% | -5% |

| RevPAR | $89.8 | $190.3 |

| RevPAR progress | 4% | -2% |

If something in regards to the Damaged Bow market, the occupancy fee is astonishing. Some prime single performers are hitting 90% constantly on their charges, so how can it’s solely 41%?

Each markets have elevated by 23% for energetic listings over the past three years. The distinction is that Lawton has 473 energetic listings, and Damaged Bow has 4,600 energetic listings. Briefly scrolling by way of Airbnb listings in these markets, you’ll rapidly see the place skilled hosts have dominated the market and the place the chance actually lies. Every place may have laws to verify for in particular areas, and as all the time, by no means belief a HOA.

I knew I had hit the jackpot when the highest 5 performing properties available in the market didn’t even make the most of skilled images (for those who don’t take anything away from this, please spend the $200-$1,000 for skilled photos). The highest performers common round a 68% (highest 83%) occupancy fee, with a transparent alternative to offer an genuine expertise to company.

I’m certain many individuals are waving their fists and screaming on the display after listening to me announce Lawton as the perfect short-term rental marketplace for new traders. The important thing phrase right here is “new.” Lawton is a protected marketplace for new short-term rental traders as they search to see in the event that they even get pleasure from operating the enterprise facet of it. The mid-term, long-term, or flipping exit methods are worthwhile for the worth vary and will depart traders feeling OK…lahoma (I’ll see myself out on that one).

Dive into the Market Finder in the present day and see what short-term rental markets may change into a long-term success for you.

Discover the Hottest Markets of 2024!

Effortlessly uncover your subsequent funding hotspot with the model new BiggerPockets Market Finder, that includes detailed metrics and insights for all U.S. markets.

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially characterize the opinions of BiggerPockets.