Shopping for Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) inventory is never a nasty concept.

Think about choosing up $1,000 of Alphabet inventory on Feb. 25, 2014. That turned out to be the worst day of that yr to get into the know-how big’s shares. The day’s peak, with a file worth of $30.50 per split-adjusted share, was adopted by an 18% plunge over the following 10 months. The bear bait stacked up as European regulators thought-about breaking apart the corporate, Android telephone gross sales struggled, high executives left, and new product concepts like Google Glass and Waymo self-driving vehicles weren’t catching on.

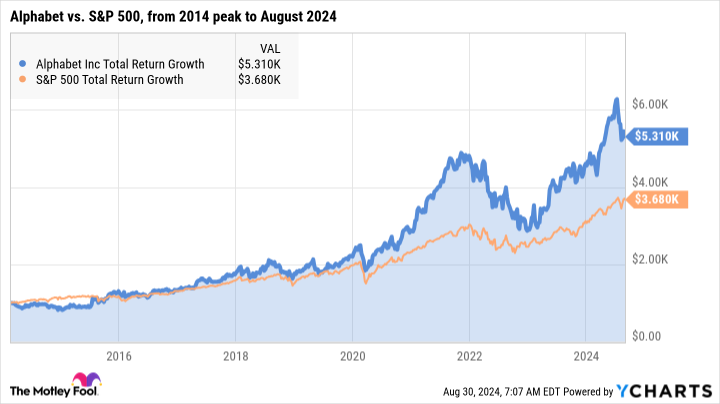

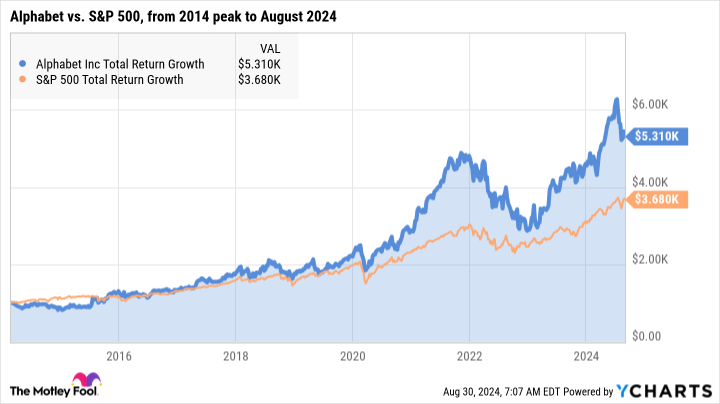

That is all proper, although. In the event you had held on to that $1,000 funding by way of thick and skinny, you’d have a market-beating $5,310 in your pocket roughly 10 years later.

Alphabet’s inventory has stumbled earlier than — and are available again swinging

You’ll after all have finished even higher in case you invested in Alphabet on some other day of that yr, however the firm overcame its points and stomped the broader market even from the worst attainable start line of 2014. I count on future generations to say comparable issues about shopping for Alphabet inventory in 2024 — that funding ought to beat the marketplace for a few years and even a long time to return, regardless of how poorly you’ll have timed the acquisition.

Time available in the market beats timing the market, . And this firm was constructed to final for a really very long time.

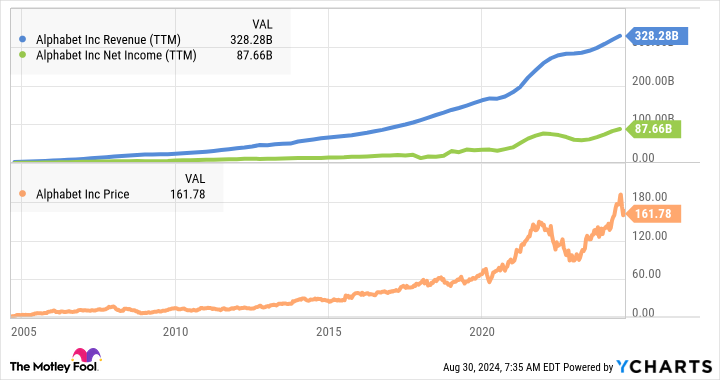

I am unable to consider any single firm extra doubtless than Alphabet to ship strong returns in 2040, 2050, and past. That horrible worth drop in 2014 is a barely detectable chart squiggle by now. And Alphabet’s enterprise outcomes simply continued to develop:

Alphabet’s inventory is a discount proper now

Wait — it nonetheless will get higher. On high of Alphabet’s tank-like endurance, the inventory occurs to be unusually inexpensive proper now.

After reaching one other all-time file of $191.40 per share in July, Alphabet shares have retreated 15% to roughly $162 per share. As I write this, they commerce at 23.4 occasions trailing earnings with a price-to-earnings-to-growth (PEG) ratio of 1.1. These are probably the most inexpensive earnings-based valuation ratios among the many “Magnificent Seven” of tech giants.

Furthermore, Alphabet has taken a number one position within the synthetic intelligence (AI) increase. Google Cloud is a well-liked cloud computing platform the place different corporations can prepare and run their very own AI platforms. The Google Gemini chatbot competes straight with OpenAI’s ChatGPT in language understanding and technology. The corporate is poised to profit from generative AI as a long-term progress catalyst.

I may go on, however you get my level. Alphabet’s inventory was a fantastic funding earlier than the current sell-off, and it is an excellent higher purchase immediately. Market sell-offs could be your good friend once you’re trying to spend money on an important firm like Alphabet.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Alphabet wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $731,449!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 26, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Alphabet and Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Alphabet and Vanguard S&P 500 ETF. The Motley Idiot has a disclosure coverage.

The Current Tech Promote-Off Made This Synthetic Intelligence (AI) Inventory an Even Higher Purchase was initially printed by The Motley Idiot