By Saqib Iqbal Ahmed and Suzanne McGee

NEW YORK (Reuters) – Wall Road remained on edge as a intently watched debate between Republican Donald Trump and Democratic Vice President Kamala Harris late Tuesday gave buyers little readability on key coverage points, whilst betting markets swung in Harris’ favor after the occasion.

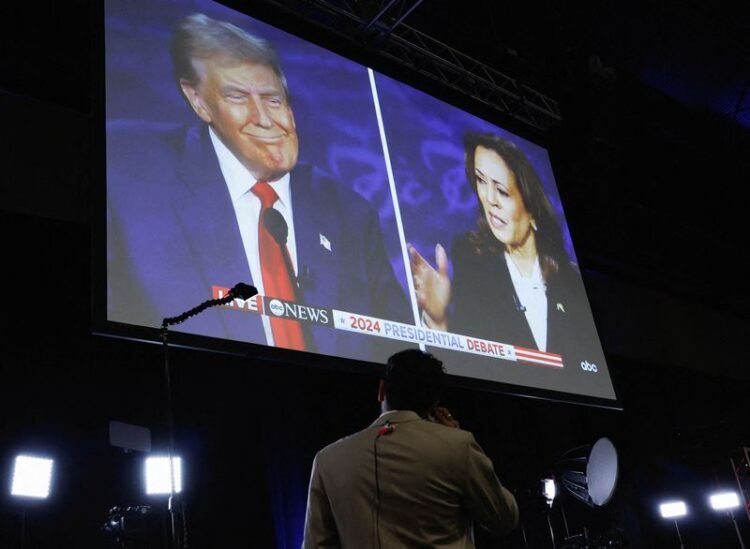

In a combative debate, Trump and Harris clashed over every part from the economic system to immigration and Trump’s authorized woes, as every sought a campaign-altering second in what has been a closely-fought race.

Their exchanges left buyers with few new particulars on points that might sway markets, together with tariffs, taxes and regulation. Some observers, nonetheless, stated Harris carried out higher than anticipated and that it might proceed to sway costs for some belongings in coming days ought to buyers determine it improved her possibilities at gaining the White Home.

“Neither certainly one of them made sturdy financial factors, however total Harris got here out of this higher than Trump,” stated Eric Beyrich, portfolio supervisor, Sound Revenue Methods, in Westchester, New York. “Markets actually don’t need strident statements; they need readability.”

On-line prediction market PredictIt’s 2024 presidential normal election market confirmed Harris’ odds enhancing to 56% from 53% earlier than the controversy, whereas Trump’s odds slipped to 48% from 52%.

Response in asset costs was muted. Inventory futures eased as the controversy progressed, with the S&P 500 E-minis down 0.5% early Wednesday in Asia and Nasdaq 100 E-minis off 0.6%.

The greenback index, which measures the U.S. forex’s power in opposition to six main friends, slipped 0.2%.

“I believe the controversy is just not going to alter many minds, as voters stay intently divided,” stated Sonu Varghese, international macro strategist on the Carson Group. “The one indication is that Harris moved forward in prediction markets however that also retains the race very shut.”

Nonetheless, some buyers consider even a small shift in perceptions of the candidates may show important in a contest that might come right down to tens of 1000’s of votes in a handful of states. The 2 candidates are successfully tied within the seven battleground states prone to determine the election, in line with polling averages compiled by the New York Instances.

The controversy “doesn’t appear to be having a serious influence on markets up to now, which aligns with the comparatively low volatility expectations heading into the occasion,” stated Shier Lee Lim, Lead FX and Macro Strategist for APAC at Convera. “That stated, the controversy may nonetheless show to be a big catalyst for shifting election chances.”

Whereas the presidential race could be very a lot on buyers’ minds, political considerations have these days coalesced with extra instant market catalysts, together with worries over a doubtlessly softening U.S. economic system and uncertainty over how deeply the Fed might want to lower rates of interest, buyers stated. The S&P 500 notched its worst weekly share loss since March 2023 final week after a second-straight underwhelming jobs report, although the index continues to be up almost 15% this yr.

TAXES AND TARIFFS

Trump has promised decrease company taxes and a harder stance on commerce and tariffs. He has additionally stated a robust greenback hurts the U.S., although some analysts consider his insurance policies may spur inflation and finally buoy the forex.

Harris final month outlined plans to boost the company tax fee to twenty-eight% from 21%, a proposal that some on Wall Road consider may damage company earnings.

On Tuesday night time, Harris attacked Trump’s intention to impose excessive tariffs on international items – a proposal she has likened to a gross sales tax on the center class – whereas touting her plan to supply tax advantages to households and small companies.

Trump defended his tariffs proposal and stated they might not result in greater costs for Individuals.

The Chinese language yuan, which had come underneath strain within the U.S.-China commerce battle throughout Trump’s time period, edged up in opposition to the greenback.

“Kamala Harris succeeded in shifting prediction market odds in her favor, supporting a light, however broad-based enchancment in danger urge for food throughout forex markets,” stated Karl Schamotta, chief market strategist, at Corpay in Toronto.

Trump additionally criticized Harris for the persistent inflation throughout the Biden administration’s time period. Inflation, he stated, “has been a catastrophe for individuals, for the center class, for each class.”

Nevertheless, financial insurance policies could possibly be up within the air for some time longer.

“There wasn’t a lot substantive dialogue of coverage,” Carson Group’s Varghese stated. “Neither candidate advocated for vastly totally different financial insurance policies than presently in place. Finally, quite a lot of financial insurance policies that we see applied subsequent yr will rely on the make-up of the Senate and the Home.”

(Reporting by Saqib Iqbal Ahmed and Suzanne McGee; Further reporting by Rae Wee in Singpaore; Modifying by Ira Iosebashvili, Megan Davies and Shri Navaratnam)