The 2024 Baselane Actual Property Investor Survey reveals optimism amongst traders regardless of rising prices. Key takeaways embrace:

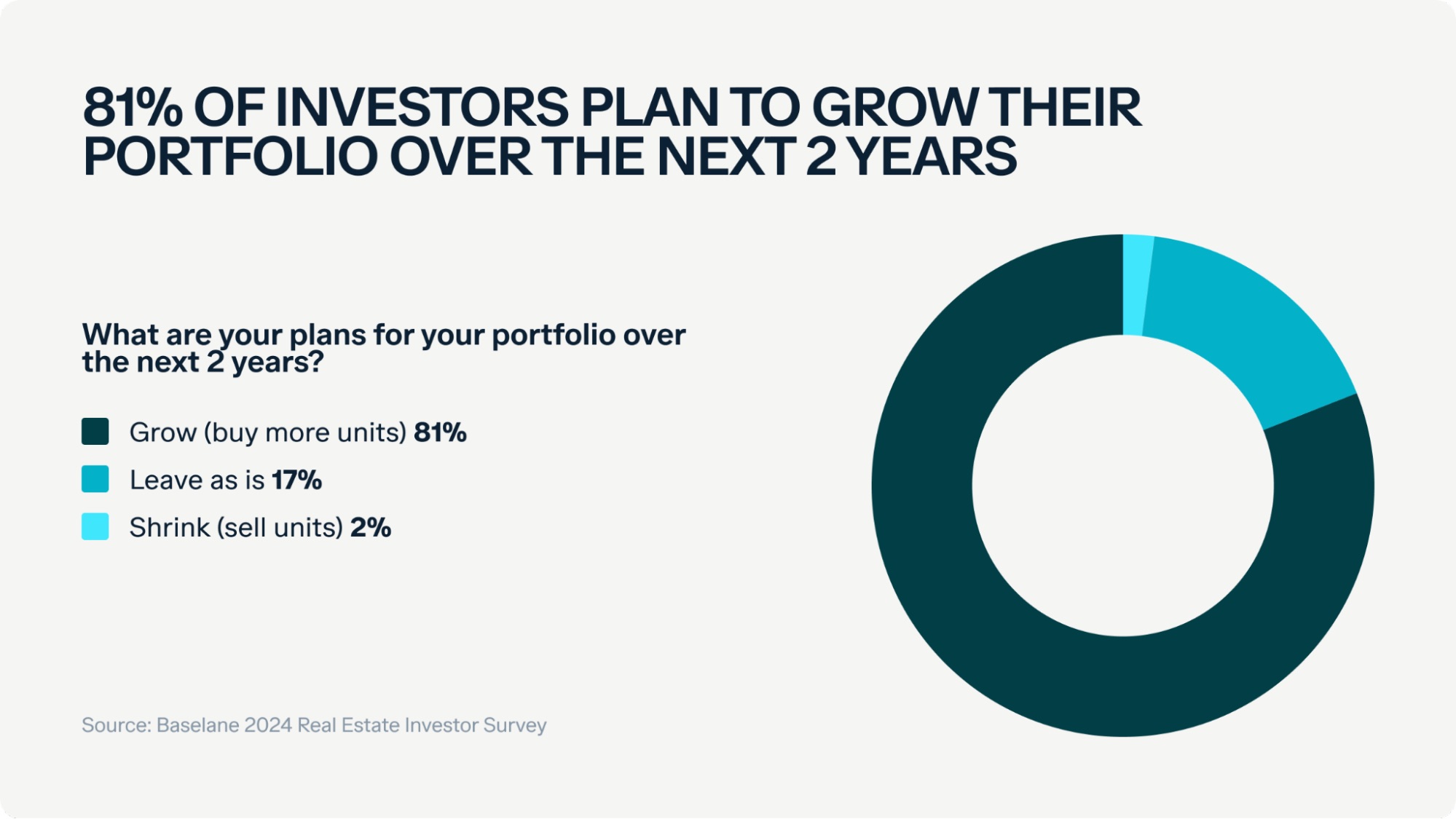

- 81% of traders plan to develop their portfolios inside two years.

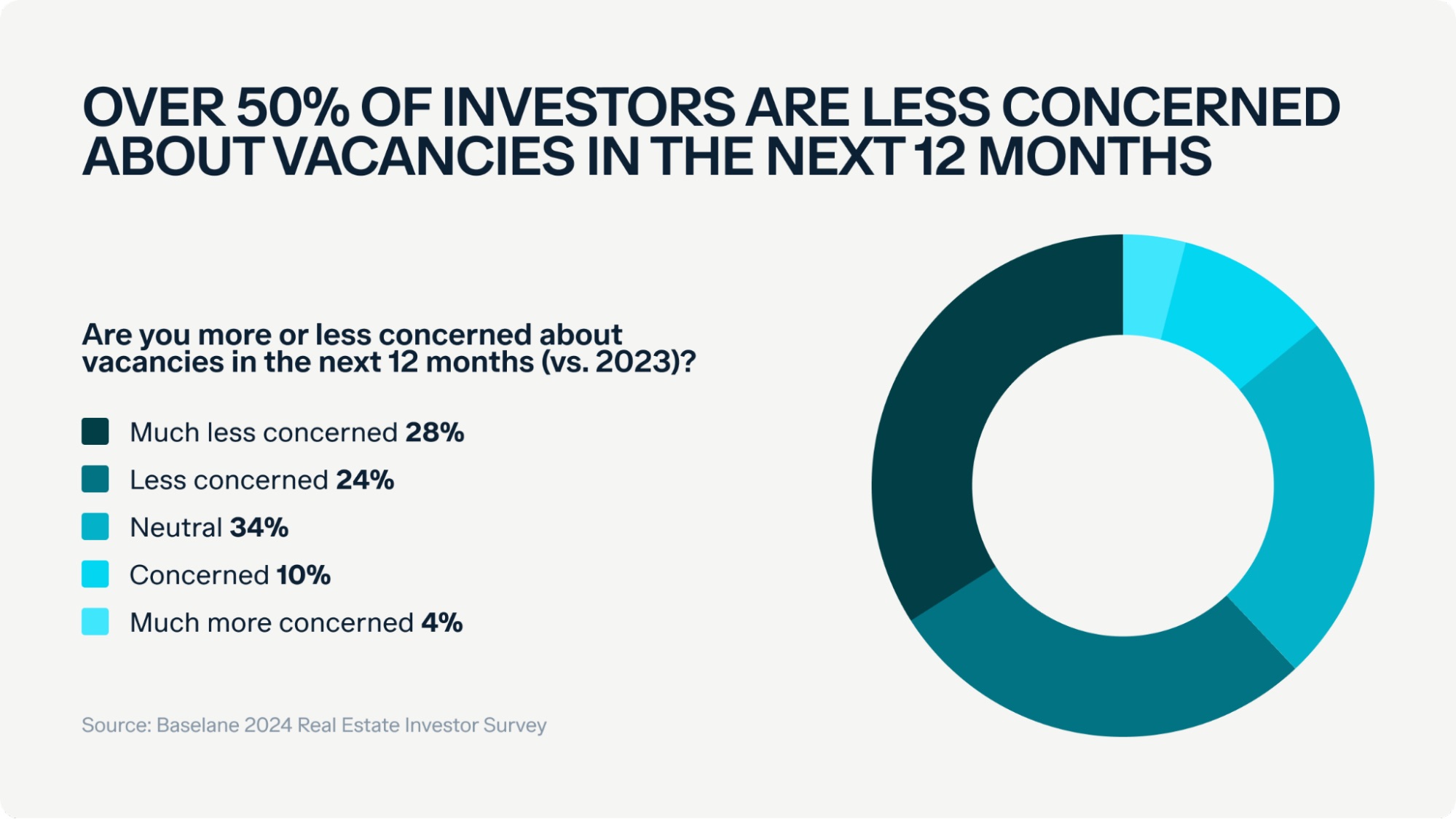

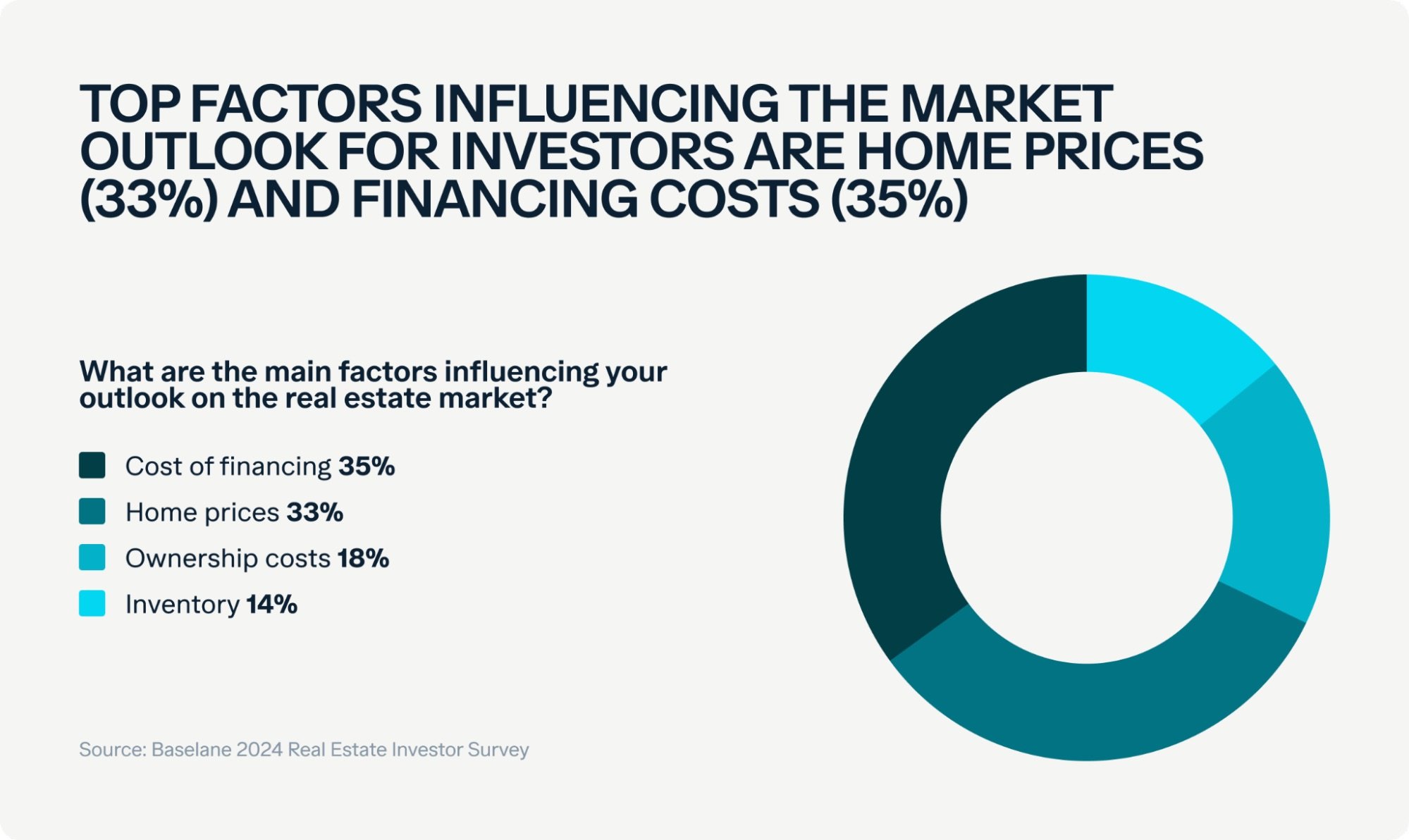

- Traders are much less frightened about vacancies, specializing in financing prices (35%) and residential costs (33%).

- 22% confronted rental insurance coverage hikes of 11% or extra, and 50% noticed property tax will increase of over 6%.

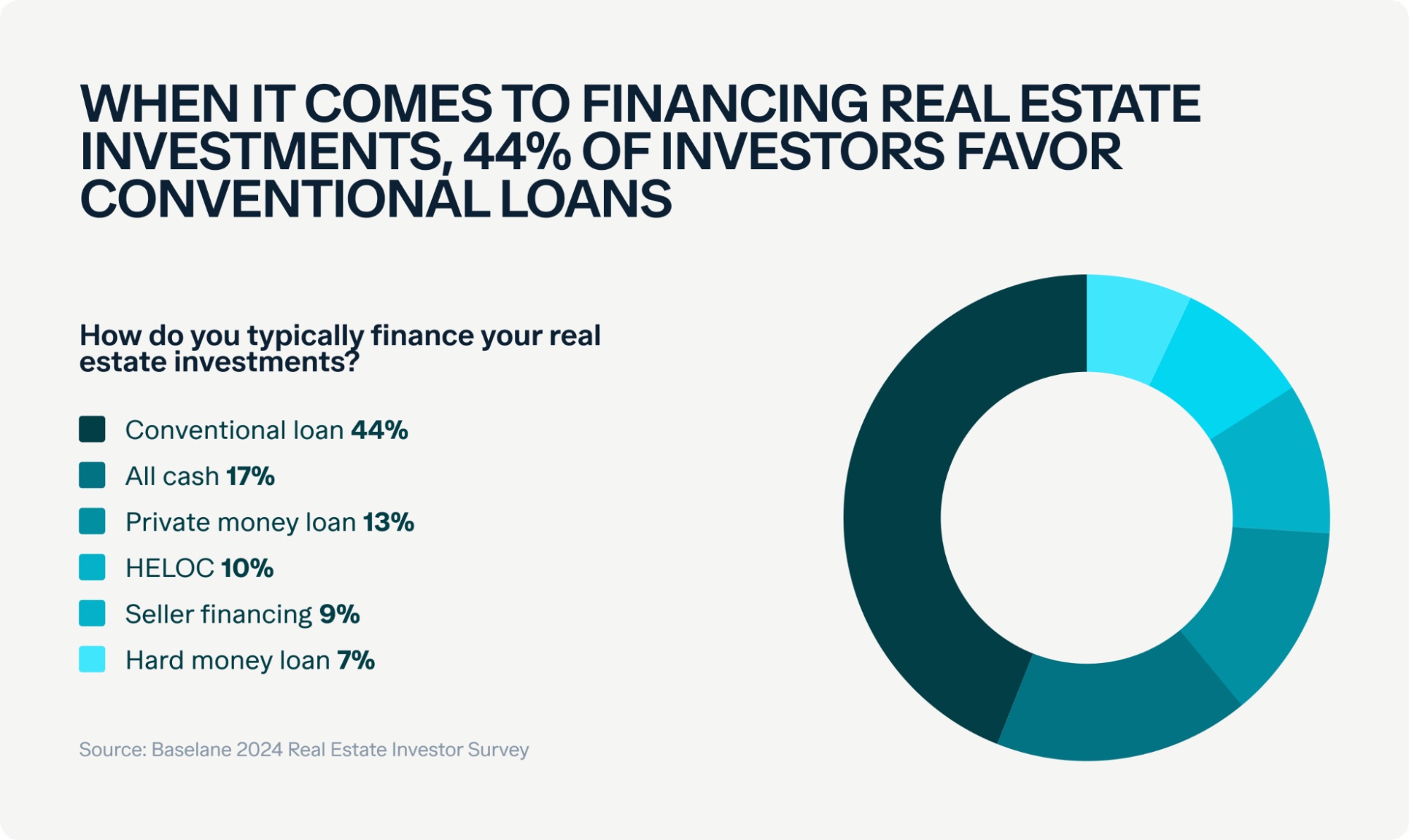

- Typical loans stay the highest financing choice (44%).

Traders Are Rising Portfolios However Skeptical

No, the sky is just not falling on actual property traders, and they don’t seem to be waving the white flag. I agree that transactions could also be down, however that doesn’t imply that investor sentiment is altering. Over 81% of traders are intending to develop their portfolio over the subsequent two years, in accordance with a current investor survey by Baselane.

After studying via the survey, it turned clear that traders are optimistic however cautious when underwriting offers. Certainly, 17% of traders felt snug with their portfolio and didn’t really feel the necessity to broaden anytime quickly.

As rental demand stays regular, emptiness considerations have dwindled, as over 52% of traders are much less or a lot much less involved about them than in 2023.

Affordability Is on the Forefront

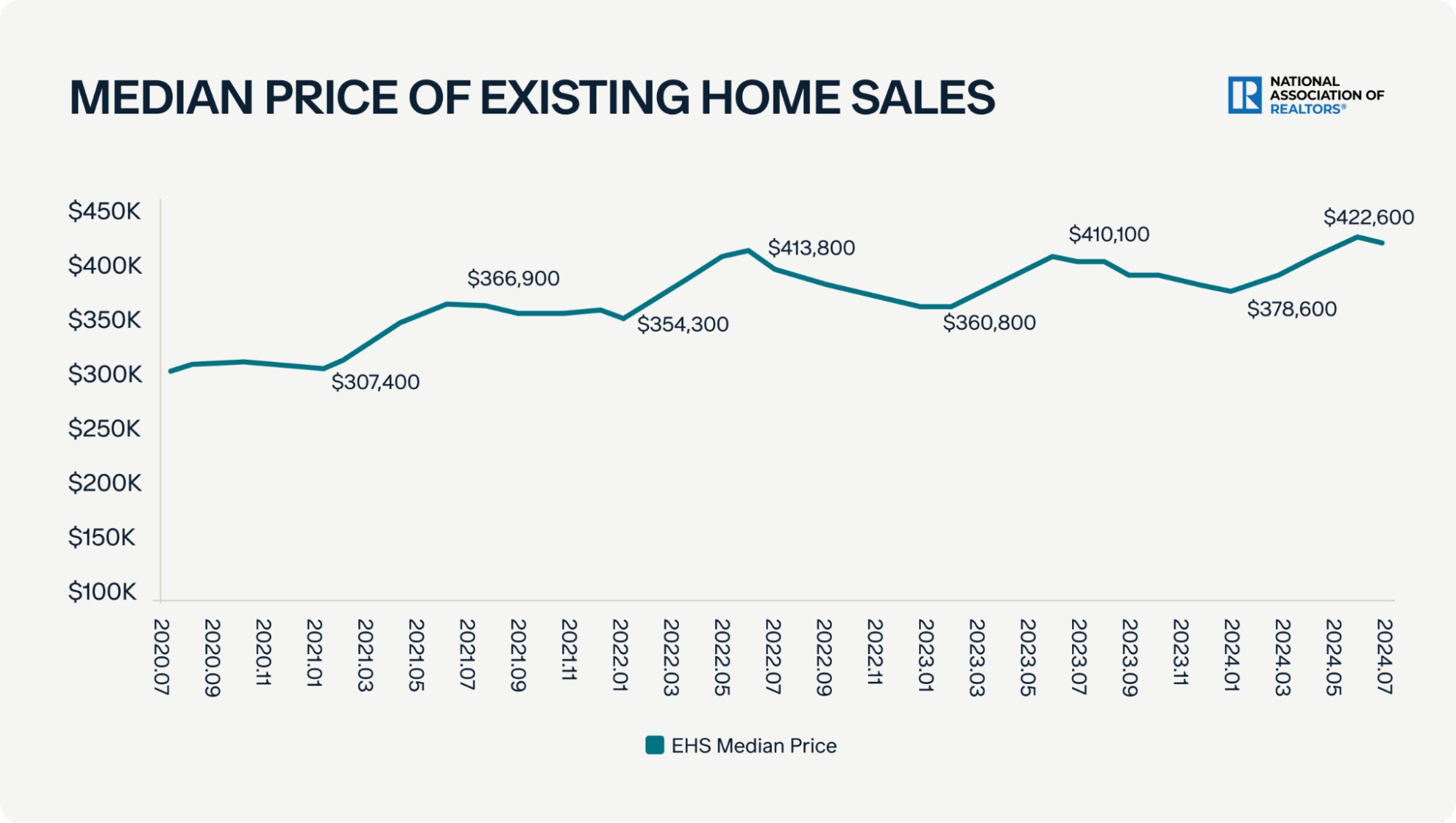

Getting tenants in doesn’t appear to be the problem, however financing and rising house costs that rental charges can’t sustain with are. In line with the Nationwide Affiliation of Realtors (NAR), the median house value for July 2024 has risen 4.2% 12 months over 12 months (YoY) to a whopping $422,600. The explosion during the last 4 years is sort of staggering when you think about most gross sales throughout that point had been made with rates of interest under 3%.

Potential sellers’ mortgages are at their pandemic rates of interest, and so they’re locked in and never letting go, understandably. That very same motive leaves consumers on the sidelines ready, hopefully, for charges to drop.

Knowledge from the U.S. Census Bureau and the U.S. Division of Housing and City Improvement exhibits that as of August, housing begins for privately owned houses have decreased by 6.8% since June and 16% in comparison with July 2023.

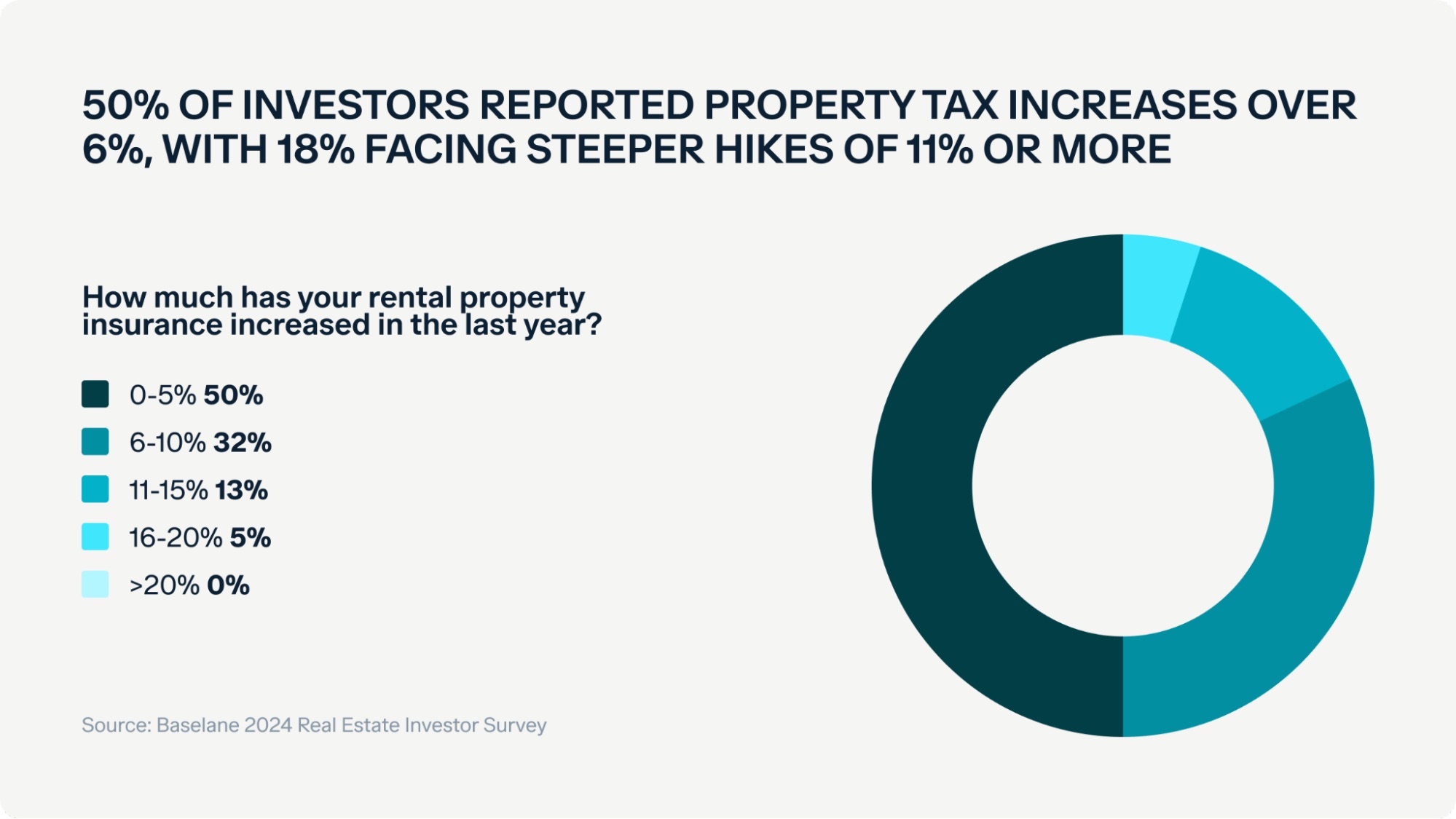

Insurance coverage, Taxes Are Considerations

When you have owned a home over the previous couple of years, you most likely have seen insurance coverage prices going via the roof (pun meant) and taxes pacing the rising house costs. Practically 1 / 4 (22%) of these surveyed noticed rental property insurance coverage hikes of 11% or extra, and 13% skilled will increase over 20%.

Taxes are going greater than the Smoky Mountains, with 50% of traders seeing will increase over 6%, and 18% dealing with rises of 11% or extra.

Typical Financing Is Nonetheless King

As for financing actual property investments, 44% of traders stick to standard loans, like they’re the comfortable sweatpants of the actual property world—dependable and acquainted. This alternative blows different choices out of the water, similar to all-cash purchases (for many who’ve discovered a hidden treasure chest), personal cash loans, HELOCs, vendor financing, and exhausting cash. Clearly, most traders wish to hold issues easy with the outdated devoted of property shopping for.

Charges have lastly seen some aid, with a present fee of 6.2%, the bottom since February 2023. It is a dramatic swing from the highs of seven.79% in 2023, with traders hoping to maneuver farther from that quantity.

Financing, House Costs High Priorities

With mortgage charges seemingly staying round 6% subsequent 12 months and the housing market not balancing provide and demand till 2025 (or past), it’s no shock that financing (35%) and residential costs (33%) are main considerations for traders.

Including to traders’ worries is the rising presence of institutional traders—these snapping up 1,000 properties a 12 months. Their large-scale shopping for can drive up costs in sure areas, making it difficult for native traders to compete. This pattern was evident in Q1 2024, with 18.7% of U.S. houses offered to institutional traders—the very best share in nearly two years. These houses had been flipped for a median hefty 55.2% revenue, up from 46.3% the earlier 12 months.

Then again, restricted housing provide and skyrocketing house costs are boosting rental demand. At present, renting is 27% cheaper than shopping for in all 50 largest metro areas. As extra folks get priced out of homeownership, they flip to renting, creating a possibility for impartial traders to faucet into this demand and enhance portfolio returns.

Closing Outcomes

Though the rising prices of shopping for and sustaining rental properties might be difficult for some, in addition they mirror the energy and stability of the actual property market. As one investor mentioned, “Actual property is at all times a strong funding—you simply want to search out the proper property.”

Analysis Methodology

Baselane performed a web-based survey of U.S. landlords and actual property traders inside our community from June 18-26, 2024. We surveyed roughly 2,116 traders and continued gathering responses till reaching a response fee of over 10%, guaranteeing a statistically vital pattern measurement.

This landlord survey aimed to collect crucial insights into funding methods, financing preferences, property possession prices, and expectations for the way forward for the actual property market. To take care of the accuracy and relevance of the info, we used impartial, non-leading questions and utilized branching logic to show or disguise questions based mostly on earlier responses. The sentiment was measured utilizing a 1-5 scale, starting from “Strongly Disagree” to “Strongly Agree.”

Discover the Hottest Offers of 2024!

Uncover prime offers in at present’s market with the model new Deal Finder created only for traders such as you! Snag nice offers FAST with customized purchase containers, complete property insights, and property projections.

Word By BiggerPockets: These are opinions written by the writer and don’t essentially characterize the opinions of BiggerPockets.